|

市場調查報告書

商品編碼

1740785

水溶性豆莢及膠囊包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Water-Soluble Pods and Capsules Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

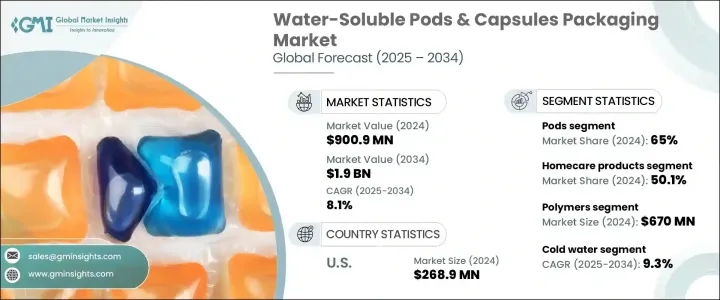

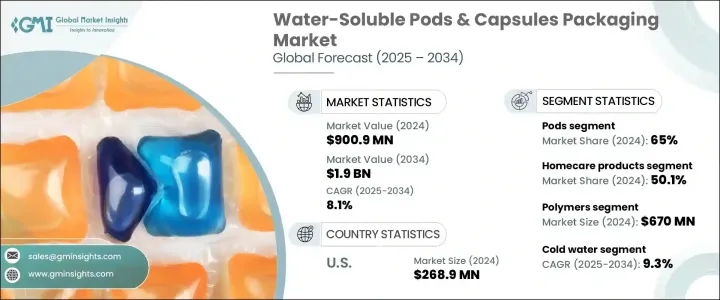

2024年,全球水溶性膠囊和豆莢包裝市場價值達9.009億美元,預計2034年將以8.1%的複合年成長率成長,達到19億美元。這得益於一次性定量消費品的日益普及以及改進型水溶性薄膜技術的不斷發展。對便利、環保和高效包裝形式的需求正在塑造該市場的未來。從居家照護到醫藥,各行各業的消費者都在積極尋求能夠消除塑膠垃圾、減少產品過度使用並提升使用者體驗的解決方案。這種偏好的轉變正推動品牌和製造商採用先進的包裝解決方案來重新構想產品交付,這些解決方案不僅簡化了使用,還有助於環境保護。此外,城市生活的興起、衛生意識的增強以及對永續替代品的日益接受,正在推動水溶性膠囊和豆莢的快速普及。隨著消費者越來越青睞更智慧、更乾淨、更安全的日用產品,市場對緊湊型可溶包裝的需求激增,這種包裝兼具永續性、高性能和便利性。從洗衣液到農業製劑,這種包裝形式正日益受到青睞,成為那些致力於兼顧功能與責任的品牌的首選解決方案。

技術進步,尤其是水溶性薄膜成分的進步,是推動這一成長的關鍵力量。聚合物科學領域的創新,尤其是聚乙烯醇 (PVA) 領域的創新,正在徹底改變水溶性包裝在不同產品類別中的表現。這些尖端薄膜如今擁有卓越的溶解性、更高的拉伸強度和更強的防潮性能。這意味著,無論您包裝的是粉末還是液體,都能延長保存期限、更安全的產品處理和更可靠的性能。這些改進使其能夠廣泛應用於農業化學品、藥品和化妝品等領域。多功能性已成為此類包裝的顯著特徵,吸引了各行各業的製造商。然而,市場也並非一帆風順。貿易法規帶來了許多複雜性,最顯著的是美國對中國進口的聚合物和特種化學品等重要原料徵收關稅。這些關稅擾亂了供應鏈,推高了生產成本,促使企業重新思考採購策略,並探索區域替代方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 9.009億美元 |

| 預測值 | 19億美元 |

| 複合年成長率 | 8.1% |

從產品細分來看,水溶性洗衣凝珠在2024年佔了65%的市佔率。它們的受歡迎程度很大程度上得益於其在家庭應用中的強大功能,尤其是在洗衣和洗碗方面。凝珠提供精準的用量,避免了傳統包裝帶來的混亂和猜測。其方便用戶使用的設計和完全溶解的特性,為現代家庭帶來了更多便利。隨著人們追求更清潔、更永續的生活方式,這些凝珠正迅速成為家庭必需品。它們結構緊湊,能夠完全溶解且無殘留,不僅減少了浪費,也迎合了當今快節奏的消費習慣,便利性是其關鍵所在。

在應用方面,2024年家庭護理產品佔了50.1%的市場。這主要是因為消費者在日常清潔中越來越注重便利性和永續性。水溶性包裝有助於品牌兼顧這兩點。它能夠創造出高效率、減少浪費的解決方案,同時又不犧牲清潔力。隨著城市擴張,城市消費者尋求更快、更環保的居家清潔方式,對此類產品的需求也日益成長。為此,各公司紛紛增加研發投入,打造更智慧的膠囊,採用可生物分解的薄膜、更安全的配方和更強大的輸送系統。這項持續的創新使消費者比以往任何時候都更容易養成永續的清潔習慣,同時又不影響產品的有效性。

2024年,美國水溶性豆莢和膠囊包裝市場規模達2.689億美元,這得益於先進的製造基礎設施和消費者對永續生活的高度認知。美國消費者對兼具性能和環境安全性的包裝提出了更高的要求。家庭護理和製藥行業引領著這一潮流,這得益於人們對零浪費和衛生解決方案日益成長的興趣。隨著塑膠垃圾持續成為主要關注點,水溶性包裝因其能夠提供符合消費者價值的清潔環保替代品而備受關注。

三菱化學集團株式會社、Aicello Corporation、積水化學工業株式會社和ConstantiaFlexibles等公司正積極塑造競爭格局。他們專注於與家庭護理和製藥領域的製造商建立合作夥伴關係,豐富產品組合以滿足新的需求,並改進聚合物技術以提高性能。許多公司也加大對永續材料的投資,並拓展新興市場,以增強其全球影響力並贏得消費者信任。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響

- 主要原物料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 衝擊力

- 成長動力

- 一次性、預裝消費品的成長

- 可溶性薄膜材料的技術進步

- 跨產業應用多樣化

- 對永續和環保包裝的需求不斷成長

- 嚴格的環境和包裝法規

- 產業陷阱與挑戰

- 水溶性薄膜成本高

- 阻隔性能有限且保存期限受限

- 成長動力

- 成長潛力分析

- 科技與創新格局

- 專利分析

- 重要新聞和舉措

- 未來市場趨勢

- 波特的分析

- PESTEL分析

- 監管格局

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 豆莢

- 膠囊

第6章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 聚合物

- 界面活性劑

- 纖維

第7章:市場估計與預測:依溶解度類型,2021 - 2034

- 主要趨勢

- 冷水

- 熱水

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 居家護理產品

- 個人護理和化妝品

- 農業化學品

- 食品和飲料

- 製藥

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Aicello Corporation

- Arrow GreenTech Ltd.

- Constantia Flexibles

- Foshan Polyva Materials Co., Ltd

- Guangdong Proudly New Material Technology Corp.

- Jiangmen Proudly Water-soluble Plastic Co., Ltd.

- Mattpak Inc.

- Medanos Claros HK Limited

- Mitsubishi Chemical Group Corporation

- NOBLE INDUSTRIES

- Sekisui Chemical Co., Ltd.

- Solupak

The Global Water-Soluble Pods and Capsules Packaging Market was valued at USD 900.9 million in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 1.9 billion by 2034, driven by the growing popularity of single-use, pre-measured consumer goods and the development of improved soluble film technologies. The demand for convenient, eco-conscious, and efficient packaging formats is shaping the future of this market. Consumers across sectors-from homecare to pharmaceuticals-are actively seeking out solutions that eliminate plastic waste, reduce product overuse, and enhance user experience. This shift in preference is pushing brands and manufacturers to reimagine product delivery with advanced packaging solutions that not only simplify usage but also contribute to environmental preservation. What's more, the rise of urban living, growing hygiene awareness, and increased acceptance of sustainable alternatives are driving rapid adoption of water-soluble pods and capsules. As consumers gravitate toward smarter, cleaner, and safer daily-use products, the market is witnessing a surge in demand for compact, dissolvable packaging that ticks all the boxes for sustainability, performance, and convenience. From laundry detergents to agricultural formulations, this packaging format is gaining traction as the go-to solution for brands aiming to combine function with responsibility.

Technological advances, especially in water-soluble film composition, are a key force behind this growth. Innovations in polymer science-particularly around polyvinyl alcohol (PVA)-are transforming how water-soluble packaging performs across diverse product categories. These cutting-edge films now offer superior solubility, improved tensile strength, and enhanced moisture barrier properties. That means better shelf life, safer product handling, and more reliable performance, whether you're packaging powders or liquids. These improvements have made it possible to scale usage across segments like agrochemicals, pharmaceuticals, and cosmetics. Versatility has become a defining trait of this packaging type, attracting manufacturers from a broad range of industries. However, the market isn't without challenges. Trade regulations have introduced complexities-most notably, US-imposed tariffs on Chinese imports of essential raw materials like polymers and specialty chemicals. These tariffs have disrupted supply chains and pushed up production costs, prompting companies to rethink sourcing strategies and explore regional alternatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $900.9 Million |

| Forecast Value | $1.9 Billion |

| CAGR | 8.1% |

In terms of product segmentation, water-soluble pods commanded a 65% market share in 2024. Their popularity is driven largely by their high functionality in household applications, especially laundry and dishwashing. Pods offer precise dosing, eliminating the mess and guesswork of traditional packaging. Their user-friendly design and complete solubility add a layer of convenience that modern households value. With the push for cleaner, more sustainable lifestyles, these pods are quickly becoming a household staple. Their compact nature and ability to dissolve completely without residue not only reduce waste but also cater to today's fast-paced consumer behavior where ease of use is key.

On the application side, homecare products held a 50.1% market share in 2024. That's largely because consumers are increasingly focused on convenience and sustainability in their everyday cleaning routines. Water-soluble packaging helps brands deliver on both counts. It allows for the creation of efficient, waste-reducing solutions that don't sacrifice cleaning power. As cities expand and urban consumers look for quicker, greener ways to maintain their homes, the demand for such products is only rising. Companies are responding by investing heavily in RandD to create smarter pods with biodegradable films, safer formulations, and enhanced delivery systems. This ongoing innovation is making it easier than ever for consumers to adopt sustainable habits without compromising on product effectiveness.

The United States Water-Soluble Pods and Capsules Packaging Market generated USD 268.9 million in 2024, driven by advanced manufacturing infrastructure and high awareness around sustainable living. American consumers are demanding packaging that delivers both performance and environmental safety. The home care and pharmaceutical sectors are leading the charge, fueled by a rising interest in zero-waste and hygienic solutions. As plastic waste continues to be a major concern, water-soluble packaging is gaining attention for its ability to provide a clean, eco-friendly alternative that aligns with consumer values.

Companies like Mitsubishi Chemical Group Corporation, Aicello Corporation, SEKISUI CHEMICAL CO., LTD., and Constantia Flexibles are actively shaping the competitive landscape. They are focusing on forging partnerships with manufacturers in home care and pharma, diversifying product portfolios to meet new demands, and refining polymer technologies for higher performance. Many of these players are also ramping up investments in sustainable materials and expanding into emerging markets to strengthen their global footprint and build consumer trust.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key raw material

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 key companies impacted

- 3.2.4 strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growth of single-use, pre-dosed consumer products

- 3.3.1.2 Technological advancements in soluble film materials

- 3.3.1.3 Application diversification across industries

- 3.3.1.4 Rising demand for sustainable and eco-friendly packaging

- 3.3.1.5 Stringent environmental and packaging regulations

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 High cost of water-soluble films

- 3.3.2.2 Limited barrier properties and shelf-life constraints

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Technological & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news and initiatives

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Regulatory landscape

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 (USD Million & Kilo Tons)

- 5.1 Key trends

- 5.2 Pods

- 5.3 Capsules

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Million & Kilo Tons)

- 6.1 Key trends

- 6.2 Polymers

- 6.3 Surfactants

- 6.4 Fibers

Chapter 7 Market Estimates & Forecast, By Solubility Type, 2021 - 2034 (USD Million & Kilo Tons)

- 7.1 Key trends

- 7.2 Cold water

- 7.3 Hot water

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million & Kilo Tons)

- 8.1 Key trends

- 8.2 Homecare products

- 8.3 Personal care & cosmetics

- 8.4 Agrochemicals

- 8.5 Food & beverage

- 8.6 Pharmaceuticals

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Aicello Corporation

- 10.2 Arrow GreenTech Ltd.

- 10.3 Constantia Flexibles

- 10.4 Foshan Polyva Materials Co., Ltd

- 10.5 Guangdong Proudly New Material Technology Corp.

- 10.6 Jiangmen Proudly Water-soluble Plastic Co., Ltd.

- 10.7 Mattpak Inc.

- 10.8 Medanos Claros HK Limited

- 10.9 Mitsubishi Chemical Group Corporation

- 10.10 NOBLE INDUSTRIES

- 10.11 Sekisui Chemical Co., Ltd.

- 10.12 Solupak