|

市場調查報告書

商品編碼

1740777

汽車控制電纜市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Control Cables Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

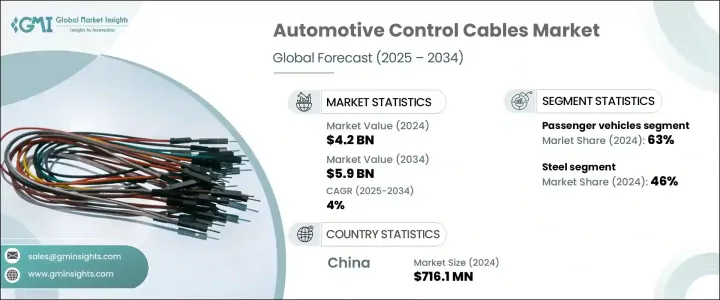

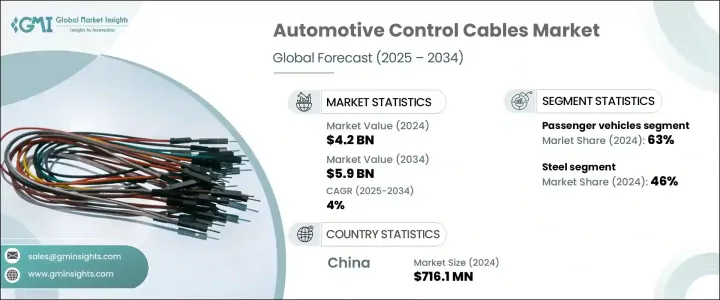

2024年,全球汽車控制拉索市場規模達42億美元,預計到2034年將以4%的複合年成長率成長,達到59億美元,這主要得益於汽車產量的成長,尤其是在亞太和拉丁美洲的新興經濟體。汽車控制拉索是車輛性能的重要組成部分,可確保離合器接合、煞車、換檔和油門控制的精確度。隨著汽車產業的發展,對車輛效率、耐用性和使用者體驗的高度重視持續推動拉索技術的創新。全球汽車產量正在迅速成長,尤其是在發展中地區,這些地區的經濟狀況改善和城市化進程推動了汽車銷售的成長。同時,原始設備製造商正致力於透過先進的拉索系統來提高機械可靠性和反應能力。消費者對車輛安全性和性能的期望值不斷提高,進一步刺激了對高品質控制拉索的需求。此外,全球日益嚴格的排放法規也促使汽車製造商最佳化車輛系統,包括控制拉索等機械零件,以提高能源效率。

產業向電動和混合動力汽車轉型正在重塑控制電纜的應用。電動車 (EV) 雖然淘汰了內燃機中使用的一些傳統機械部件,但也為控制電纜帶來了全新且關鍵的應用。隨著電動車設計日益複雜,控制電纜也需要進行調整以支援各種功能,例如暖通空調 (HVAC) 系統中的擋板控制和氣流分配、電池倉通道裝置、座椅移動以及充電介面控制。這些不斷發展的應用案例為製造商帶來了新的創新機遇,使其能夠滿足新一代汽車的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 42億美元 |

| 預測值 | 59億美元 |

| 複合年成長率 | 4% |

在材料類型中,鋼材繼續主導汽車控制拉索市場,2024 年的市場佔有率為 46%。其卓越的耐用性、抗張強度、成本效益和易於製造的特性使其成為離合器、煞車和油門應用的首選。即使業內人士正在探索鋁或複合材料等更輕的材料以提高燃油經濟性,鋼材仍然因其在嚴苛條件下的韌性而不可或缺,尤其是在高性能和大眾市場車型中。原始設備製造商和售後市場供應商青睞鋼材,因為其價格實惠且供應廣泛,確保了穩定的需求。

按車型分類,乘用車在市場中佔據主導地位,2024 年佔據 63% 的市場佔有率,並保持穩定成長趨勢。這一領先地位反映了全球範圍內緊湊型、中型和豪華汽車的高產量和消費者日益成長的需求。快速的城市化進程、不斷成長的中產階級收入以及印度和東南亞等國家汽車普及率的提高,是推動這一成長的主要因素。控制線在這些車輛中至關重要,它支援手動和自動功能,提升整體駕駛體驗和安全性。

中國汽車控制電纜市場在2024年創造了7.161億美元的市場規模,並有望在2034年佔據39%的市場佔有率。中國強大的製造業基礎、飆升的國內需求以及積極的電動車發展,正在鞏固其領先地位。有利的政府政策和不斷擴大的出口網路正在進一步推動汽車電纜系統的創新,鞏固中國作為全球汽車控制電纜生產中心的地位。

全球汽車控制電纜市場的主要公司——Hi-Lex、矢崎、安波福、特瑞堡、Cablecraft Motion Controls、康斯伯格汽車、李爾、DURA Automotive Systems、泰科電子和古河電工——正更加重視拓展全球供應鏈,與原始設備製造商建立更深層的合作夥伴關係,投資於量化材料自動化。各公司也正在加強研發力度,以打造專為電動車和自動駕駛汽車系統量身訂製的先進電纜解決方案。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 零件製造商

- 控制電纜組裝商/製造商

- 一級汽車供應商

- 原始設備製造商 (OEM) 和售後市場分銷商

- 利潤率分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 其他國家的報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 全球乘用車和商用車產量不斷增加

- 向電動車和混合動力車的轉變

- 控制電纜定期維護和更換的必要性

- 電纜設計和材料的不斷創新

- 產業陷阱與挑戰

- 擴大轉向線控驅動技術

- 嚴格且不斷發展的環境法規

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按電纜,2021 - 2034 年

- 主要趨勢

- 離合器線

- 加速器電纜

- 煞車線

- 變速線

- 手煞車線

- 油門線

- 其他

第6章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 鋼

- PVC(聚氯乙烯)

- 尼龍

- 橡膠塗層

- 其他

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 二輪車

- 商用車

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 引擎控制

- 傳動控制

- 煞車系統

- 暖通空調系統

- 其他

第9章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Aptiv

- Bergen Cable Technology

- Cablecraft Motion Controls

- Conwire

- DURA Automotive Systems

- Furukawa Electric

- Hi-Lex

- Kongsberg Automotive

- Kuster Holding

- Lear

- Lexco Cable

- Orscheln Products

- Sila Group

- Sumitomo Electric Industries

- Suprajit Engineering

- TE Connectivity

- Trelleborg

- Triumph Group

- Venus Industrial

- Yazaki

The Global Automotive Control Cables Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 4% to reach USD 5.9 billion by 2034, driven by rising vehicle production, particularly across emerging economies in Asia-Pacific and Latin America. Automotive control cables form a vital part of vehicular performance, ensuring precision in clutch engagement, braking, gear shifting, and throttle control. As the automotive sector evolves, a strong emphasis on vehicle efficiency, durability, and user experience continues to fuel innovation in cable technologies. Global automotive production is scaling up rapidly, especially in developing regions where improving economic conditions and urbanization drive automobile sales. Meanwhile, OEMs are focusing on enhancing mechanical reliability and responsiveness through advanced cable systems. Increasing consumer expectations around vehicle safety and performance further boosts demand for high-quality control cables. Additionally, stricter emissions regulations globally are pushing automakers to optimize vehicle systems, including mechanical components like control cables, to achieve better energy efficiency.

The industry's pivot to electric and hybrid vehicles is reshaping control cable applications. While electric vehicles (EVs) eliminate some traditional mechanical parts used in internal combustion engines, they introduce new and critical applications for control cables. As EV designs grow more complex, control cables are adapted to support various functions, such as flap control and air distribution in HVAC systems, battery compartment access mechanisms, seat movement, and charging interface controls. These evolving use cases are unlocking fresh opportunities for manufacturers to innovate and meet the demands of a new generation of vehicles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $5.9 Billion |

| CAGR | 4% |

Among material types, steel continues to dominate the automotive control cables market, accounting for a 46% share in 2024. Its exceptional durability, tensile strength, cost-efficiency, and manufacturing ease make it the preferred choice for clutch, brake, and throttle applications. Even as industry players explore lighter materials like aluminum or composites to boost fuel economy, steel remains indispensable for its resilience under demanding conditions, especially in high-performance and mass-market models. OEMs and aftermarket suppliers favor steel for its affordability and widespread availability, ensuring a steady demand.

Passenger vehicles lead the market by vehicle type, securing a 63% share in 2024 and maintaining a steady growth trend. This leadership reflects high production volumes and a surging consumer appetite for compact, mid-size, and luxury vehicles worldwide. Rapid urbanization, expanding middle-class income, and better automotive access in countries like India and throughout Southeast Asia are major factors fueling this growth. Control cables are essential across these vehicles for supporting both manual and automated functions, enhancing the overall driving experience and safety.

China Automotive Control Cables Market generated USD 716.1 million in 2024 and captured a commanding 39% share through 2034. The country's strong manufacturing base, soaring domestic demand, and aggressive EV push are strengthening its leadership. Favorable government policies and an expanding export network are further propelling innovation in automotive cable systems, solidifying China's role as a global hub for automotive control cable production.

Key companies operating in the Global Automotive Control Cables Market-Hi-Lex, Yazaki, Aptiv, Trelleborg, Cablecraft Motion Controls, Kongsberg Automotive, Lear, DURA Automotive Systems, TE Connectivity, and Furukawa Electric-are sharpening their focus on expanding global supply chains, forging deeper partnerships with OEMs, investing in lightweight material technologies, and automating manufacturing processes. Companies are also ramping up R&D efforts to engineer advanced cable solutions tailored for EVs and autonomous vehicle systems.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Control cable assemblers/manufacturers

- 3.2.4 Tier 1 automotive suppliers

- 3.2.5 Original equipment manufacturers (OEMs) & aftermarket distributors

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing global production of passenger and commercial vehicles

- 3.9.1.2 The shift toward EVs and hybrid vehicles

- 3.9.1.3 The need for regular maintenance and replacement of control cables

- 3.9.1.4 Continuous innovation in cable design and materials

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Increasing shift towards drive-by-wire technology

- 3.9.2.2 Stringent and evolving environmental regulations

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Cable, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Clutch cables

- 5.3 Accelerator cables

- 5.4 Brake cables

- 5.5 Gear shift cables

- 5.6 Handbrake cables

- 5.7 Throttle cables

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Steel

- 6.3 PVC (Polyvinyl Chloride)

- 6.4 Nylon

- 6.5 Rubber coated

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Two-wheelers

- 7.4 Commercial vehicles

- 7.4.1 Light Commercial Vehicles (LCV)

- 7.4.2 Medium Commercial Vehicles (MCV)

- 7.4.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Engine control

- 8.3 Transmission control

- 8.4 Braking system

- 8.5 HVAC system

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aptiv

- 11.2 Bergen Cable Technology

- 11.3 Cablecraft Motion Controls

- 11.4 Conwire

- 11.5 DURA Automotive Systems

- 11.6 Furukawa Electric

- 11.7 Hi-Lex

- 11.8 Kongsberg Automotive

- 11.9 Kuster Holding

- 11.10 Lear

- 11.11 Lexco Cable

- 11.12 Orscheln Products

- 11.13 Sila Group

- 11.14 Sumitomo Electric Industries

- 11.15 Suprajit Engineering

- 11.16 TE Connectivity

- 11.17 Trelleborg

- 11.18 Triumph Group

- 11.19 Venus Industrial

- 11.20 Yazaki