|

市場調查報告書

商品編碼

1740766

汽車無線模組市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Wireless Module Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

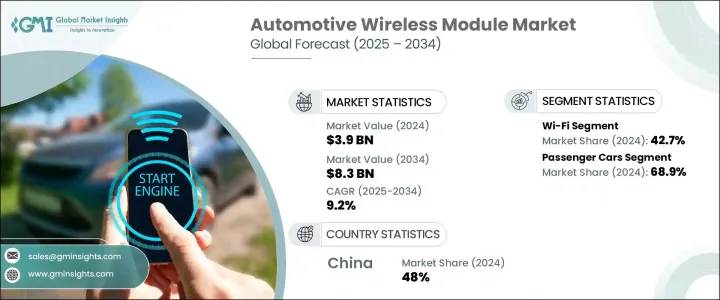

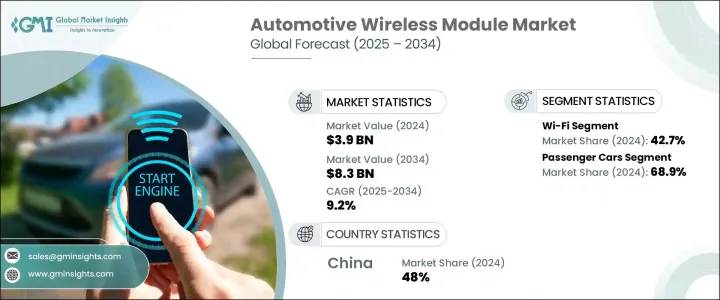

2024年,全球汽車無線模組市場規模達39億美元,預計2034年將以9.2%的複合年成長率成長,達到83億美元。這得歸功於消費者對連網汽車日益成長的需求,以及5G和V2X通訊等下一代無線技術的快速部署。隨著汽車產業向數位轉型邁進,無線模組正成為提供更智慧、更安全、更互聯駕駛體驗的關鍵組件。從支援無縫資訊娛樂系統到支援預測性維護和遠端診斷,這些模組正在重塑汽車與環境和使用者的互動方式。

汽車製造商正加倍重視無線連接功能,以提升便利性、安全性和效能。現今的消費者不僅追求先進的引擎或時尚的設計,他們還期望車輛能夠提供與智慧型手機同等水平的連接性。高速無線技術的整合正在改變駕駛和乘客與車輛的互動方式,為汽車製造商創造新的價值主張。人們對自動駕駛、電氣化和互聯服務的日益關注,推動了對高頻寬、低延遲通訊系統的需求。無線模組如今被視為智慧交通系統的支柱,支援即時導航、車隊追蹤、遠端軟體更新和智慧城市整合等功能。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 39億美元 |

| 預測值 | 83億美元 |

| 複合年成長率 | 9.2% |

向始終互聯汽車的轉變正在重新定義整個汽車行業的期望。如今,購車者的需求已超越傳統的遠端資訊處理,他們希望獲得即時交通資料、基於行動應用程式的車輛控制、串流媒體娛樂和即時車輛健康更新。這些功能依賴強大的無線通訊模組,以確保車輛、雲端和其他互聯基礎設施之間的不間斷互動。 5G 和 V2X(車對萬物)通訊的日益普及進一步加劇了對先進無線解決方案的需求。這些技術預計將在車輛、基礎設施、行人和更廣泛的移動生態系統之間建立超可靠、低延遲的連接。隨著安全法規的演變和自動化水準的提高,對一致、高速資料傳輸的需求只會成長,這迫使汽車製造商優先考慮在每款車型中整合無線模組。

在眾多可用的連接選項中,Wi-Fi 繼續引領汽車無線模組市場,到 2024 年將佔據 42.7% 的市場佔有率。預計這一主導地位將持續下去,並在整個預測期內保持兩位數的強勁成長潛力。 Wi-Fi 仍然是資料密集型應用的首選技術,例如無線 (OTA) 更新、視訊串流、導航和車載連線。汽車製造商正在使用 Wi-Fi 模組進行即時診斷並提供軟體增強功能,而無需親自前往服務中心。在電動和混合動力汽車中,支援 Wi-Fi 的系統還可以幫助監控電池使用情況、最佳化性能並實現與充電站的無縫通訊。隨著人們對更聰明、更環保的汽車的需求不斷成長,Wi-Fi 在管理和分析能源系統中的作用變得越來越重要。

乘用車佔據汽車無線模組市場主導地位,2024 年佔 68.9%。由於從高階轎車到緊湊型掀背車等所有車型互聯功能的快速發展和標準化,該細分市場佔據了市場領先地位。如今,消費者已經習慣將基於雲端的資訊娛樂系統、基於應用程式的控制、預測性診斷和語音輔助功能融入駕駛體驗。汽車製造商正在將無線模組嵌入到車輛架構中,以更有效地提供這些功能並提升整體客戶滿意度。隨著競爭加劇,即使是入門車型也配備了先進的互聯解決方案,這提高了人們對車載技術的基本期望。

2024年,中國汽車無線模組市場規模達7.786億美元,佔全球市場佔有率的48%。中國市場佔據主導地位,源自於其積極推動互聯互通和自動駕駛出行,並依賴全球最大的汽車製造生態系統。中國對高技術電動車的需求不斷成長,加上政府的慷慨激勵措施和5G基礎設施的快速部署,正推動V2X和無線通訊模組的廣泛應用。國內汽車製造商正藉此良機,整合智慧功能,拓展在國內外市場的影響力。中國對汽車電子的持續投入及其對數位轉型的重視,預計將進一步鞏固其在汽車無線連接領域的全球領先地位。

高通技術、Mobileye、法雷奧、英偉達、愛信精機、電裝、羅伯特·博世、大陸集團、博格華納和採埃孚等領先企業正透過專注於創新和策略合作來加速其市場佈局。這些企業正在增強其無線平台以支援 5G 和 V2X 應用,整合人工智慧功能,並為電動車和自動駕駛汽車推出可擴展、高效的模組。透過在地化生產和擴展基於雲端的服務,他們力求在互聯互通、自動化和即時資料交換驅動的快速變化的市場格局中保持領先地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 製造商

- 原物料供應商

- 汽車OEM

- 配銷通路

- 最終用途

- 川普政府關稅的影響

- 貿易影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(客戶成本)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 貿易影響

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 定價分析

- 推進系統

- 地區

- 對部隊的影響

- 成長動力

- 連網汽車需求不斷成長

- 5G 和 V2X 通訊的採用率不斷提高

- 物聯網和智慧移動的進步

- 消費者對車載功能的需求增加

- 產業陷阱與挑戰

- 先進無線模組成本高

- 網路安全和資料隱私問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依連結性,2021 - 2034 年

- 主要趨勢

- 無線上網

- 藍牙

- 蜂巢

- 其他

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 轎車

- 掀背車

- 越野車

- 商用車

- 輕型

- 中型

- 重負

第7章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 汽油

- 柴油引擎

- 電的

- 插電式混合動力

- 油電混合車

- 燃料電池電動車

第8章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 導航

- 遠端資訊處理

- 資訊娛樂

- 車輛安全和緊急服務

- 其他

第9章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第 11 章:公司簡介

- Aisin Seiki

- Autotalks

- BorgWarner

- Continental

- Delphi Technologies

- Denso

- Harman International

- Huawei Technologies

- Infineon Technologies

- Magna International

- Mobileye

- NVIDIA

- NXP Semiconductors

- Panasonic

- Qualcomm Technologies

- Renesas Electronics

- Robert Bosch

- Skyworks Solutions

- VALEO

- ZF Friedrichshafen

The Global Automotive Wireless Module Market was valued at USD 3.9 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 8.3 billion by 2034, driven by increasing consumer demand for connected vehicles and the rapid deployment of next-generation wireless technologies like 5G and V2X communication. As the automotive industry experiences a major shift toward digital transformation, wireless modules are becoming essential components in delivering smarter, safer, and more connected driving experiences. From enabling seamless infotainment systems to supporting predictive maintenance and remote diagnostics, these modules are reshaping how vehicles interact with their environment and users.

Automakers are doubling down on wireless connectivity features to enhance convenience, safety, and performance. Today's consumers are not just looking for advanced engines or sleek designs-they expect their vehicles to offer the same level of connectivity as their smartphones. The integration of high-speed wireless technologies is transforming the way drivers and passengers interact with their vehicles, creating new value propositions for automakers. The increasing focus on autonomous driving, electrification, and connected services is fueling the demand for high-bandwidth, low-latency communication systems. Wireless modules are now seen as the backbone of intelligent transportation systems, enabling features like real-time navigation, fleet tracking, remote software updates, and smart city integration.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.9 Billion |

| Forecast Value | $8.3 Billion |

| CAGR | 9.2% |

The shift toward always-connected vehicles is redefining expectations across the automotive landscape. Car buyers today demand more than traditional telematics-they want access to live traffic data, mobile app-based vehicle control, streaming entertainment, and real-time vehicle health updates. These capabilities rely on robust wireless communication modules that ensure uninterrupted interaction between the vehicle, cloud, and other connected infrastructure. The growing rollout of 5G and V2X (vehicle-to-everything) communication is further intensifying the need for advanced wireless solutions. These technologies promise ultra-reliable, low-latency connections between vehicles, infrastructure, pedestrians, and the broader mobility ecosystem. As safety regulations evolve and automation levels rise, the need for consistent, high-speed data transmission will only grow-pushing automakers to prioritize wireless module integration in every model.

Among the many connectivity options available, Wi-Fi continues to lead the automotive wireless module market, commanding a 42.7% share in 2024. This dominance is expected to continue, with strong potential for double-digit growth throughout the forecast period. Wi-Fi remains the go-to technology for data-heavy applications like over-the-air (OTA) updates, video streaming, navigation, and in-vehicle connectivity. Automakers are using Wi-Fi modules to perform real-time diagnostics and deliver software enhancements without requiring physical visits to service centers. In electric and hybrid vehicles, Wi-Fi-enabled systems also help monitor battery usage, optimize performance, and enable seamless communication with charging stations. As the push for smarter, greener vehicles gains momentum, the role of Wi-Fi in managing and analyzing energy systems is becoming increasingly critical.

Passenger vehicles dominate the automotive wireless module market, representing a 68.9% share in 2024. This segment leads the market thanks to the rapid evolution and standardization of connected features across all vehicle classes-from premium sedans to compact hatchbacks. Consumers are now accustomed to having cloud-based infotainment systems, app-based controls, predictive diagnostics, and voice-assisted functions as part of their driving experience. Automakers are embedding wireless modules into vehicle architecture to deliver these features more effectively and boost overall customer satisfaction. As competition intensifies, even entry-level models are being equipped with advanced connectivity solutions, raising the baseline expectations for in-car technology.

The China Automotive Wireless Module Market generated USD 778.6 million in 2024, capturing a 48% share globally. China's dominance stems from its aggressive push toward connected and autonomous mobility, supported by the world's largest automotive manufacturing ecosystem. The country's rising demand for tech-savvy electric vehicles, coupled with generous government incentives and rapid 5G infrastructure rollout, is fueling high adoption of V2X and wireless communication modules. Domestic automakers are leveraging this momentum to integrate smart features and expand their presence in both domestic and international markets. China's continued investment in automotive electronics and its emphasis on digital transformation are expected to further cement its position as a global leader in wireless vehicle connectivity.

Leading companies such as Qualcomm Technologies, Mobileye, VALEO, NVIDIA, Aisin Seiki, Denso, Robert Bosch, Continental, BorgWarner, and ZF Friedrichshafen are accelerating their market presence by focusing on innovation and strategic partnerships. These players are enhancing their wireless platforms to support 5G and V2X applications, integrating AI capabilities, and rolling out scalable, power-efficient modules for EVs and autonomous vehicles. By localizing production and expanding cloud-based service offerings, they aim to stay ahead in a fast-changing market landscape driven by connectivity, automation, and real-time data exchange.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Manufacturers

- 3.2.2 Raw material suppliers

- 3.2.3 Automotive OEM

- 3.2.4 Distribution channel

- 3.2.5 End Use

- 3.3 Impact of Trump administration tariffs

- 3.3.1 Trade impact

- 3.3.1.1 Trade volume disruptions

- 3.3.1.2 Retaliatory measures

- 3.3.2 Impact on industry

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.2.1.1 Price volatility in key materials

- 3.3.2.1.2 Supply chain restructuring

- 3.3.2.1.3 Production cost implications

- 3.3.2.2 Demand-side impact (Cost to customers)

- 3.3.2.2.1 Price transmission to end markets

- 3.3.2.2.2 Market share dynamics

- 3.3.2.2.3 Consumer response patterns

- 3.3.2.1 Supply-side impact (raw materials)

- 3.3.3 Key companies impacted

- 3.3.4 Strategic industry responses

- 3.3.4.1 Supply chain reconfiguration

- 3.3.4.2 Pricing and product strategies

- 3.3.4.3 Policy engagement

- 3.3.5 Outlook & future considerations

- 3.3.1 Trade impact

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Pricing analysis

- 3.9.1 Propulsion

- 3.9.2 Region

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising demand for connected vehicles

- 3.10.1.2 Rising adoption of 5G and V2X communication

- 3.10.1.3 Advancements in IoT and smart mobility

- 3.10.1.4 Increased consumer demand for in-car features

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High cost of advanced wireless modules

- 3.10.2.2 Cybersecurity and data privacy concerns

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Connectivity, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Wi-Fi

- 5.3 Bluetooth

- 5.4 Cellular

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedans

- 6.2.2 Hatchback

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light duty

- 6.3.2 Medium duty

- 6.3.3 Heavy duty

Chapter 7 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

- 7.4 Electric

- 7.4.1 PHEV

- 7.4.2 HEV

- 7.4.3 FCEV

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Navigation

- 8.3 Telematics

- 8.4 Infotainment

- 8.5 Vehicle safety and emergency services

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 Aisin Seiki

- 11.2 Autotalks

- 11.3 BorgWarner

- 11.4 Continental

- 11.5 Delphi Technologies

- 11.6 Denso

- 11.7 Harman International

- 11.8 Huawei Technologies

- 11.9 Infineon Technologies

- 11.10 Magna International

- 11.11 Mobileye

- 11.12 NVIDIA

- 11.13 NXP Semiconductors

- 11.14 Panasonic

- 11.15 Qualcomm Technologies

- 11.16 Renesas Electronics

- 11.17 Robert Bosch

- 11.18 Skyworks Solutions

- 11.19 VALEO

- 11.20 ZF Friedrichshafen