|

市場調查報告書

商品編碼

1740763

工業縫紉機市場機會、成長動力、產業趨勢分析及2025-2034年預測Industrial Sewing Machine Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

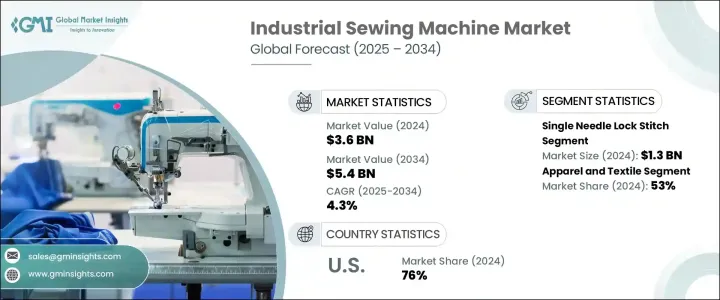

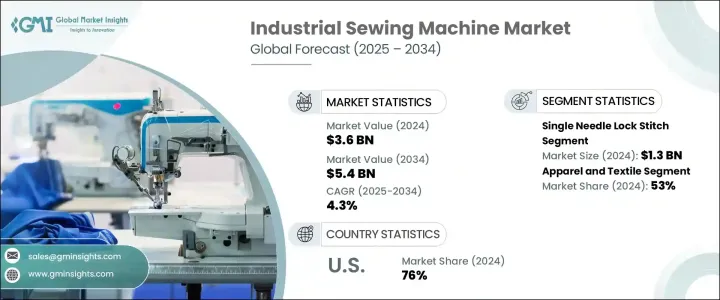

2024年,全球工業縫紉機市場規模達36億美元,預計到2034年將以4.3%的複合年成長率成長,達到54億美元。這一成長主要源於全球對服裝和紡織品日益成長的需求,而人口成長、城鎮化和消費者偏好的不斷變化又推動了這一需求。工業縫紉機在支援大批量紡織服裝生產方面發揮關鍵作用,對於追求速度、精確度和效率的製造商而言,它至關重要。機器人、物聯網連接和自動化等先進技術的整合顯著提高了營運產出,減少了對勞動力的依賴,並改善了製造環境中的品質控制。隨著新興經濟體企業持續工業化,對更先進縫紉系統的需求也日益成長。時尚潮流的快速變化、快時尚的興起以及對可擴展生產的需求,進一步加劇了對先進縫紉設備的需求。如今,工業縫紉機已超越了基本功能,並配備了智慧系統,有助於簡化生產流程、減少停機時間並提高縫紉一致性,最終提升全球製造商的獲利能力。

市場上的機器類型多種多樣,以滿足不同的應用需求。主要類別包括雙針鎖式線跡、鋸齒形線跡、單針鎖式線跡、包縫、平縫以及其他專用系統。其中,單針鎖式線跡細分市場在2024年佔據主導地位,貢獻了超過13億美元的收入。預測顯示,到2034年,該細分市場的複合年成長率將達到4.8%左右。這類機器在服裝製造業中尤其受到重視,因為它在輕質和標準布料上進行直線縫紉時,可靠性和簡便性都很高。目前,該細分市場的創新包括自動穿線、先進的馬達功能和數位張力控制等功能,這些功能簡化了操作,減輕了操作員的疲勞,同時確保了線蹟的均勻性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 36億美元 |

| 預測值 | 54億美元 |

| 複合年成長率 | 4.3% |

從產業應用角度來看,市場分為服裝和紡織品、汽車、家具和室內裝潢、皮革製品以及其他工業領域。服裝和紡織品類別在2024年佔據主導地位,佔總市場佔有率的53%以上。隨著對能夠快速、精確地執行多種功能的高輸出機器的需求不斷成長,這一細分市場將繼續成長。自動剪線、可編程針跡圖案和基於感測器的調整等增強功能擴大被應用於服務於該行業的機器中,從而提高了生產效率並降低了誤差幅度。

就銷售通路而言,市場分為直接銷售和間接銷售。 2024年,由於對客製化解決方案和全面售後服務的需求日益成長,直接銷售將引領分銷格局。製造商青睞這一管道,因為它有助於建立長期的業務關係,確保重複訂單,並更深入地了解客戶需求。透過直接接觸,公司還可以提供培訓、維護和安裝支援——這些對大型工業客戶至關重要。

儘管如此,間接銷售管道對於市場擴張仍然至關重要,尤其是在觸達中小型企業方面。經銷商在提供完整的產品系列、庫存解決方案和本地化技術支援方面發揮關鍵作用。線上平台也已成為分銷組合的重要組成部分,提供便利的服務、價格競爭力以及更豐富的機器選擇。這種轉變顯著影響了尋求靈活、經濟實惠方案的小型企業的採購決策。

從區域來看,北美在全球市場格局中扮演著重要角色。 2024年,美國佔據該地區約76%的市場佔有率,創造了近7.6億美元的收入。強大的技術基礎設施、蓬勃發展的電商活動以及汽車和家具行業日益成長的生產需求等因素共同促成了北美的主導地位。美國紡織業也正在經歷復甦,這得益於其對生產回流和永續生產方式的重視。這些發展趨勢正在推動對先進工業縫紉解決方案的投資。

市場競爭仍維持中等集中度,領導企業合計市佔率介於15%至20%之間。這些關鍵企業持續透過策略性收購、合作和設施升級進行擴張,以豐富產品線,拓展新的客戶群,並保持競爭優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素。

- 利潤率分析。

- 中斷

- 未來展望

- 製成品

- 經銷商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 供應商格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 服裝和紡織品需求不斷成長

- 新興經濟體的工業成長

- 產業陷阱與挑戰

- 初始成本高

- 來自低成本製造商的激烈競爭

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按機器類型,2021 - 2034 年

- 主要趨勢

- 單針鎖式線跡

- 雙針鎖式線跡

- 鋸齒形縫線

- 包包縫紉

- 平縫紉

- 其他(套結機、臂式送料機等)

第6章:市場估計與預測:依營運模式,2021 年至 2034 年

- 主要趨勢

- 手動的

- 半自動

- 全自動

第7章:市場估計與預測:按速度,2021 - 2034 年

- 主要趨勢

- 高達 1000 spm

- 1000 至 2000 spm

- 2000 至 4000 spm

- 4000 spm以上

第8章:市場估計與預測:按線軸類型,2021 - 2034 年

- 主要趨勢

- 大線軸

- 小線軸

第9章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 服飾

- 非服裝

- 鞋

- 包包

- 室內裝潢

- 其他(繃帶、敷料等)

第 10 章:市場估計與預測:按最終用途產業,2021 年至 2034 年

- 主要趨勢

- 服裝和紡織品

- 汽車

- 室內裝潢和家具

- 皮革製品

- 其他(製鞋業、包裝業等)

第 11 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷

- 間接銷售

第 12 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第13章:公司簡介

- AMF Reece

- Brother

- Consew

- Dohle

- Jack

- Juki

- Kansai Special

- Merrow

- Miller Weldmaster

- Pegasus

- Seiko Industries

- Singer

- Usha International

- Vetron Typical

- Yamato

The Global Industrial Sewing Machine Market was valued at USD 3.6 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 5.4 billion by 2034. This expansion is largely driven by increasing global demand for apparel and textiles, propelled by population growth, urbanization, and evolving consumer preferences. Industrial sewing machines play a critical role in supporting high-volume textile and garment production, making them essential for manufacturers aiming for speed, precision, and efficiency. The integration of advanced technologies like robotics, IoT connectivity, and automation has significantly enhanced operational output, reduced labor dependency, and improved quality control in manufacturing environments. As businesses across emerging economies continue to industrialize, the demand for more sophisticated sewing systems continues to grow. Rapid shifts in fashion trends, the rise of fast fashion, and the need for scalable production have further intensified the need for advanced sewing equipment. Industrial sewing machines now go beyond basic functions and are developed to include intelligent systems that help streamline production, reduce downtime, and improve stitching consistency, ultimately boosting profitability for manufacturers globally.

Within the market, machine types vary to serve diverse applications. Key categories include double needle lock stitch, zigzag stitching, single needle lock stitch, overlock sewing, flatlock sewing, and other specialized systems. Among these, the single needle lock stitch segment led the category in 2024, contributing over USD 1.3 billion in revenue. Forecasts suggest this segment will witness a CAGR of around 4.8% through 2034. This machine type is particularly valued in garment manufacturing for its reliability and simplicity in performing straight-line stitching on lightweight and standard fabrics. Innovations in this segment now include features like automatic threading, advanced motor functions, and digital tension control, which simplify tasks and reduce fatigue for operators while ensuring stitch uniformity.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $5.4 Billion |

| CAGR | 4.3% |

From an industry application perspective, the market is divided into apparel and textiles, automotive, furniture and upholstery, leather goods, and other industrial sectors. The apparel and textile category held the dominant position in 2024, accounting for more than 53% of the total market share. This segment continues to grow as demand rises for high-output machines that can perform multiple functions with speed and precision. Enhanced features such as automatic thread trimming, programmable stitch patterns, and sensor-based adjustments are increasingly incorporated into machines serving this industry, leading to higher productivity and lower error margins.

Regarding sales channels, the market is split into direct and indirect sales. In 2024, direct sales led the distribution landscape, fueled by the growing need for tailor-made solutions and comprehensive after-sales services. Manufacturers prefer this channel as it helps in forging long-lasting business relationships, ensuring repeat orders, and enabling a deeper understanding of client requirements. Through direct engagement, companies can also offer training, maintenance, and installation support-factors critical for large-scale industrial clients.

Nevertheless, indirect sales channels remain crucial for market expansion, particularly in reaching small to mid-sized enterprises. Distributors play a key role in delivering complete product ranges, inventory solutions, and localized technical assistance. Online platforms have also become an important part of the distribution mix, offering convenience, price competitiveness, and easy access to a wider selection of machines. This shift has notably impacted purchasing decisions for small businesses seeking flexible, budget-friendly options.

Regionally, North America plays a prominent role in global market dynamics, with the United States commanding approximately 76% of the region's market in 2024 and generating close to USD 760 million in revenue. Factors such as strong technological infrastructure, rising e-commerce activities, and growing production needs in the automotive and furniture sectors have contributed to this dominance. The U.S. textile industry is also witnessing a revival driven by a focus on reshoring production and adopting sustainable practices. These developments are fueling investments in advanced industrial sewing solutions.

Market competition remains moderately concentrated, with leading companies collectively holding a market share between 15% and 20%. These key players continue to expand through strategic acquisitions, collaborations, and facility upgrades to diversify their offerings, access new customer segments, and maintain competitive advantage.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations.

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain.

- 3.1.2 Profit margin analysis.

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-side impact (selling price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Rising demand for apparel and textiles

- 3.6.1.2 Industrial growth in emerging economies

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High initial costs

- 3.6.2.2 Intense competition from low-cost manufacturers

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Machine Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Single needle lock stitch

- 5.3 Double needle lock stitch

- 5.4 Zigzag stitching

- 5.5 Overlock sewing

- 5.6 Flatlock sewing

- 5.7 Others (bartack machine, feed off the arm etc.)

Chapter 6 Market Estimates & Forecast, By Mode of Operation, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Manual

- 6.3 Semi-automatic

- 6.4 Fully automatic

Chapter 7 Market Estimates & Forecast, By Speed, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 Up to 1000 spm

- 7.3 1000 to 2000 spm

- 7.4 2000 to 4000 spm

- 7.5 Above 4000 spm

Chapter 8 Market Estimates & Forecast, By Bobbin Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Large bobbin

- 8.3 Small bobbin

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 Apparel

- 9.3 Non-apparel

- 9.3.1 Shoes

- 9.3.2 Bags

- 9.3.3 Upholstery

- 9.3.4 Others (bandages and dressings etc.)

Chapter 10 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Apparel and textile

- 10.3 Automotive

- 10.4 Upholstery and furniture

- 10.5 Leather goods

- 10.6 Others (footwear industry, packaging etc.)

Chapter 11 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 Direct sales

- 11.3 Indirect sales

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 UK

- 12.3.2 Germany

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 South Korea

- 12.4.5 Australia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.6 MEA

- 12.6.1 UAE

- 12.6.2 Saudi Arabia

- 12.6.3 South Africa

Chapter 13 Company Profiles

- 13.1 AMF Reece

- 13.2 Brother

- 13.3 Consew

- 13.4 Dohle

- 13.5 Jack

- 13.6 Juki

- 13.7 Kansai Special

- 13.8 Merrow

- 13.9 Miller Weldmaster

- 13.10 Pegasus

- 13.11 Seiko Industries

- 13.12 Singer

- 13.13 Usha International

- 13.14 Vetron Typical

- 13.15 Yamato