|

市場調查報告書

商品編碼

1740756

汽車主動側傾控制系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Active Roll Control System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

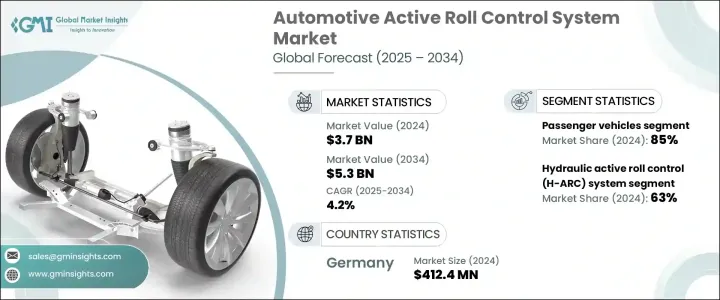

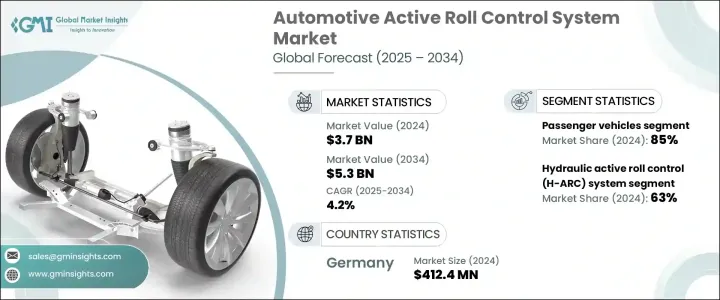

2024年,全球汽車主動側傾控制系統市場規模達37億美元,預計年複合成長率將達4.2%,2034年將達到53億美元。這主要得益於消費者對車輛穩定性、安全性和駕駛舒適性日益成長的需求,尤其是在日益壯大的SUV和豪華車領域。隨著越來越多的消費者重視駕駛體驗和道路安全,主動側傾控制系統等先進懸吊技術的採用也持續加速。這些系統在轉彎或在崎嶇地形上行駛時,能夠有效減少車身側傾,顯著提高操控精度和整體安全性。越來越多的汽車製造商致力於在兼顧舒適性的同時,提供精緻、性能導向的駕駛體驗,主動側傾控制系統如今已成為現代汽車設計的關鍵。

由於SUV和跨界車銷量激增,該市場正經歷成長勢頭。這兩款車型的重心較高,需要更出色的動態控制才能確保平穩安全的駕駛體驗。消費者也越來越關注車輛在實際駕駛條件下的表現,尤其是在城市和郊區路面狀況難以預測且高速轉彎日益常見的環境下。如今,汽車製造商不僅在高階車型中整合主動側傾控制系統,也在中階車型中整合該系統,以滿足客戶期望並提升品牌價值。同時,電動車和混合動力車的車身尺寸不斷增大(由於電池系統的存在,它們通常會增加重量),這需要專門的懸吊和穩定系統,這進一步刺激了對主動側傾控制技術的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 37億美元 |

| 預測值 | 53億美元 |

| 複合年成長率 | 4.2% |

歐洲和北美等主要地區的安全法規在推動汽車製造商投資尖端技術方面發揮著重要作用。隨著各國政府對車輛安全和性能的合規規範日益嚴格,製造商面臨提升車輛安全性的壓力。主動側傾控制系統有助於滿足這些法規要求,同時提供卓越的駕駛體驗,對於希望確保產品線面向未來的原始設備製造商而言,這無疑是一項明智的投資。

汽車主動側傾控制系統市場主要分為兩大技術:液壓主動側傾控制 (H-ARC) 和機電主動側傾控制 (eARC)。截至 2024 年,液壓系統佔據主導地位,市佔率接近 63%。 H-ARC 系統以其高驅動力、高可靠性和快速響應時間而聞名,廣泛應用於對穩定性和性能要求極高的 SUV 和豪華車。這些系統尤其適用於重型車輛,並將繼續成為注重強勁性能的製造商的首選解決方案。

另一方面,機電式主動側傾控制系統正逐漸受到青睞,尤其是在汽車製造商探索更節能、更緊湊、更電子化控制的解決方案之際。儘管eARC的市場佔有率仍然較小,但其與下一代電動車和混合動力車的整合預計將在未來十年推動其穩步普及。向電氣化和軟體定義汽車的轉變與eARC系統的功能高度契合,該系統能夠提供更精確的控制並與車輛電子設備整合。

乘用車是主導的汽車類別,到2024年將佔據全球約85%的市場。這個細分市場的領先地位源於人們對擁有高階駕駛體驗和頂級安全配置的汽車日益成長的偏好。隨著汽車製造商加大電動車和混合動力車的產量,對能夠適應獨特設計和重量分配挑戰的創新懸吊系統的需求也日益成長。主動側傾控制系統完美契合了這個需求,它在不犧牲能源效率的情況下,提供了更佳的控制力和舒適性。

德國是其中的佼佼者,2024年佔據全球汽車主動側傾控制系統市場29%的佔有率。憑藉其強勁的汽車產業——匯聚了眾多全球頂級豪華和高性能汽車製造商——德國在尖端汽車技術的採用方面持續領先。強大的研發投入、成熟的供應商基礎以及嚴格的監管框架,幫助德國在各類車型先進穩定系統的部署方面保持領先地位。

該市場的主要參與者包括採埃孚、蒂森克虜伯、現代摩比斯、電裝、舍弗勒、羅伯特·博世、海拉有限公司、麥格納國際和大陸集團。這些公司正加倍投入研發,致力於開發更智慧、更具成本效益的側傾控制解決方案。與全球汽車製造商的合作正在擴大其業務範圍,尤其是在將這些系統整合到電動車和混合動力車型方面。高度重視法規合規性、技術進步以及在新興經濟體的佈局,使這些公司能夠保持競爭力,同時滿足日益成長的安全性、舒適性和高性能駕駛需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 零件供應商

- 一級供應商

- 汽車製造商(OEM)

- 軟體和技術供應商

- 研發機構

- 利潤率分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 其他國家的報復措施

- 對產業的影響

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 價格趨勢

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 對增強車輛穩定性和操控性的需求不斷增加

- SUV 和豪華車銷售成長

- 嚴格的政府法規強制要求安全功能

- 與高級駕駛輔助系統 (ADAS) 和自動駕駛技術的整合

- 懸吊技術的進步

- 產業陷阱與挑戰

- 初始成本高

- 整合和校準的複雜性

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 執行器

- 電子控制單元(ECU)

- 感應器

- 連桿和支架

第6章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 液壓主動側傾控制(H-ARC)系統

- 機電主動側傾控制(eARC)系統

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

第8章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM(原始設備製造商)

- 售後市場

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Benteler

- BWI Group

- Continental

- Denso

- Eibach

- HELLA GmbH

- Hitachi Astemo

- Hyundai Mobis

- Infineon Technologies

- JTEKT Corporation

- KYB Corporation

- Magna International

- Mando Corporation

- Robert Bosch

- Schaeffler

- Tenneco

- ThyssenKrupp

- TRW Automotive

- WABCO

- ZF Friedrichshafen

The Global Automotive Active Roll Control System Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 4.2% to reach USD 5.3 billion by 2034, driven by the rising need for enhanced vehicle stability, safety, and ride comfort-especially in the growing SUV and luxury vehicle segments. As more consumers prioritize driving experience and on-road safety, the adoption of advanced suspension technologies like active roll control systems continues to accelerate. These systems play a vital role in reducing body roll when cornering or driving on uneven terrain, significantly improving handling precision and overall safety. With more automakers aiming to deliver a refined, performance-oriented ride without compromising comfort, active roll control systems are now seen as critical to modern vehicle design.

This market is witnessing increased momentum thanks to the surge in SUV and crossover vehicle sales, both of which have a higher center of gravity and require better dynamic control to ensure a smooth and safe ride. Consumers are also becoming more conscious of how vehicles perform in real-world driving conditions, especially with unpredictable road surfaces and high-speed cornering becoming more common in urban and suburban environments. Automakers are now integrating active roll control systems not only in premium vehicles but also in mid-range models to meet customer expectations and boost brand value. At the same time, the growing footprint of electric and hybrid vehicles-which often carry additional weight due to battery systems-calls for specialized suspension and stability systems, further fueling demand for active roll control technologies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 4.2% |

Safety regulations across key regions like Europe and North America are playing a major role in pushing automakers to invest in cutting-edge technologies. As governments impose stricter compliance norms around vehicle safety and performance, manufacturers are under pressure to enhance the safety profiles of their vehicles. Active roll control systems help meet these regulatory demands while simultaneously offering a superior driving experience, making them a smart investment for OEMs looking to future-proof their product lines.

The automotive active roll control system market is segmented into two primary technologies: hydraulic active roll control (H-ARC) and electromechanical active roll control (eARC). As of 2024, hydraulic systems dominate the space, accounting for nearly 63% of the market share. Known for their high actuation force, reliability, and fast response times, H-ARC systems are widely used in SUVs and luxury vehicles where superior stability and performance are non-negotiable. These systems are particularly suited for heavier vehicles and continue to be the go-to solution for manufacturers prioritizing robust performance.

On the other hand, electromechanical active roll control systems are gradually gaining traction, especially as automakers explore more energy-efficient, compact, and electronically controlled solutions. While eARC still holds a smaller portion of the market, its integration into next-gen EVs and hybrids is expected to drive steady adoption over the next decade. The shift toward electrification and software-defined vehicles aligns well with the capabilities of eARC systems, which offer more precise control and integration with vehicle electronics.

Passenger cars represent the dominant vehicle category, capturing around 85% of the global market share in 2024. This segment's lead stems from the growing preference for cars that offer a premium driving experience coupled with top-tier safety features. As automakers ramp up the production of electric and hybrid cars, there is an increasing need for innovative suspension systems that can adapt to unique design and weight distribution challenges. Active roll control systems fit perfectly into this equation, offering enhanced control and comfort without sacrificing energy efficiency.

Germany stands out as a major player, holding a 29% share of the global automotive active roll control system market in 2024. With its robust automotive sector-home to some of the world's top luxury and performance car manufacturers-Germany continues to lead in the adoption of cutting-edge vehicle technologies. Strong R&D investment, a mature supplier base, and stringent regulatory frameworks have helped the country maintain a leadership position in deploying advanced stability systems across vehicle categories.

Key players in this market include ZF Friedrichshafen, ThyssenKrupp, Hyundai Mobis, Denso, Schaeffler, Robert Bosch, HELLA GmbH, Magna International, and Continental. These companies are doubling down on innovation by investing heavily in R&D to develop smarter, more cost-effective roll control solutions. Collaborations with global automakers are expanding their reach, especially in integrating these systems into EVs and hybrid models. A strong focus on regulatory alignment, technology advancement, and presence in emerging economies is allowing these companies to stay competitive while meeting rising demand for safety, comfort, and high-performance driving.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Tier 1 suppliers

- 3.2.3 Automotive manufacturers (OEMs)

- 3.2.4 Software and technology providers

- 3.2.5 Research and development institutions

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.7 Patent analysis

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing demand for enhanced vehicle stability and handling

- 3.10.1.2 Increasing sales of SUVs and luxury vehicles

- 3.10.1.3 Stringent government regulations mandating safety features

- 3.10.1.4 Integration with advanced driver-assistance systems (ADAS) and autonomous driving technologies

- 3.10.1.5 Advancements in suspension technologies

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High initial cost

- 3.10.2.2 Complexity of integration and calibration

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Actuators

- 5.3 Electronic Control Units (ECUs)

- 5.4 Sensors

- 5.5 Linkages and mounts

Chapter 6 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Hydraulic active roll control (H-ARC) system

- 6.3 Electromechanical active roll control (eARC) system

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Passenger vehicles

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial vehicles

- 7.3.1 Light Commercial Vehicles (LCV)

- 7.3.2 Medium Commercial Vehicles (MCV)

- 7.3.3 Heavy Commercial Vehicles (HCV)

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 OEMs (Original Equipment Manufacturers)

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Benteler

- 10.2 BWI Group

- 10.3 Continental

- 10.4 Denso

- 10.5 Eibach

- 10.6 HELLA GmbH

- 10.7 Hitachi Astemo

- 10.8 Hyundai Mobis

- 10.9 Infineon Technologies

- 10.10 JTEKT Corporation

- 10.11 KYB Corporation

- 10.12 Magna International

- 10.13 Mando Corporation

- 10.14 Robert Bosch

- 10.15 Schaeffler

- 10.16 Tenneco

- 10.17 ThyssenKrupp

- 10.18 TRW Automotive

- 10.19 WABCO

- 10.20 ZF Friedrichshafen