|

市場調查報告書

商品編碼

1740749

電動車減速機市場機會、成長動力、產業趨勢分析及2025-2034年預測Electric Vehicle Reducer Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

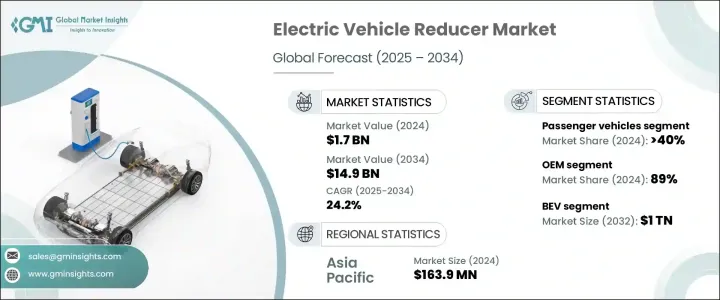

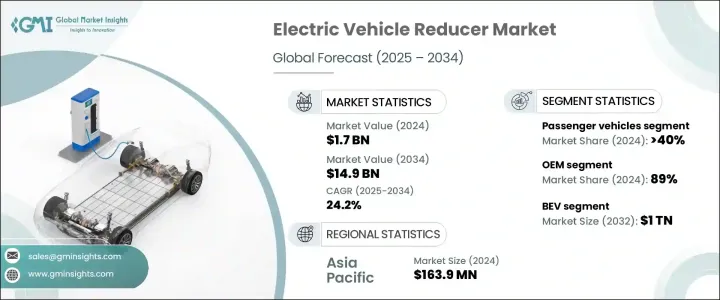

2024年,全球電動車減速機市場規模達17億美元,預計到2034年將以24.2%的複合年成長率成長,達到149億美元。這一爆炸性成長的動力源自於全球向電動車轉型的加速,消費者和企業都越來越重視永續交通。隨著全球各國政府推出更嚴格的排放法規,並為電動車普及提供誘人的激勵措施,汽車製造商正在迅速擴大其電動車產品線,以滿足日益成長的需求。這種轉變不僅重塑了傳統汽車製造業,也為整個電動車零件生態系統創造了前所未有的機會。

其中,電動汽車減速器的需求激增,因為這些關鍵部件透過將高速馬達輸出轉換為車輪可控的扭矩,在最佳化傳動系統性能方面發揮著至關重要的作用。隨著電動車產量從小型乘用車擴大到重型商用車隊,對可靠、高效的減速器的需求變得比以往任何時候都更加重要。原始設備製造商和一級供應商如今面臨著巨大的壓力,需要提供符合不斷發展的電動車架構和性能預期的下一代減速器解決方案。這種不斷成長的勢頭使減速器市場成為更廣泛的電氣化領域的關鍵推動者。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 17億美元 |

| 預測值 | 149億美元 |

| 複合年成長率 | 24.2% |

全球電動車需求的不斷成長直接推動了對電動車減速器的需求,減速器對於將電動馬達的高轉速轉換為驅動車輪的可用扭矩至關重要。隨著電動車普及率的提高,電動乘用車、商用車和車隊系統的產量顯著成長,導致減速機的消耗量也隨之增加。為了滿足這項需求,製造商正在最佳化減速器的性能、耐用性和能源效率。尤其是在商業和物流應用中,先進的多級減速器因其能夠處理連續運行並最大限度地減少能量損失而備受青睞。車隊營運商擴大尋求高扭矩、低維護的解決方案,以降低總擁有成本並提高傳動系統的可靠性,這進一步凸顯了高效減速器系統的重要性。

電動車在最後一哩配送、叫車服務和公共運輸領域取得了長足進展,擴大了電動車減速機市場的規模。供應商面臨越來越大的創新壓力,他們致力於生產緊湊、高扭矩密度的減速器設計,以便無縫整合到輕型和重型電動車平台。人們對性能的期望不斷提高,對可擴展、模組化解決方案的需求也日益成長,以滿足不同車型的需求。因此,主要供應商正在大力投資研發,以提高能源效率並減少減速器系統的機械損耗,鞏固其在電動車價值鏈中的地位。

就車輛類型而言,市場細分為乘用車、商用車、非公路用車以及兩輪和三輪車。 2024年,乘用車以7億美元的收入領先市場,佔40%的市場。這種主導地位主要歸功於電動車銷售的快速成長,尤其是在城市地區,清潔能源車在減排、節油和降低維護成本方面具有顯著優勢。汽車製造商正在將減速器嵌入專用電動車平台,以提高駕駛性能和效率。

電動車減速器市場也按銷售管道分類,包括原始設備製造商 (OEM) 和售後市場。 OEM 在 2024 年佔據主導地位,佔總銷售額的 89%。由於減速器是通常在車輛組裝過程中安裝的核心傳動系統零件,因此 OEM 在市場擴張中發揮關鍵作用。特斯拉、比亞迪和大眾等全球電動車製造商正在推動對符合嚴格性能基準的客製化減速器的需求,從而推動所有地區由OEM主導的成長。

2024年,中國電動車減速機市場貢獻了1.639億美元的產值,反映了中國在電動車生產領域的領先地位。中國憑藉垂直整合的供應鏈、強大的生產能力和極具競爭力的價格,成為包括減速器在內的電動車零件製造的全球樞紐。快速且有效率地完成大批量訂單的能力,使中國在全球市場中佔據主導地位。

全球電動車減速機市場的主要參與者包括採埃孚、博格華納、羅伯特·博世、舍弗勒股份公司、吉凱恩汽車、麥格納國際和日本電產株式會社。這些公司高度重視技術創新,致力於開發性能更佳、使用壽命更長、整合靈活性更高的新一代減速器。與汽車製造商的策略合作使他們能夠為特定的電動車平台客製化減速器系統,從而進一步鞏固其市場地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 零件製造商

- 系統整合商和技術提供商

- 最終用戶

- 利潤率分析

- 川普政府關稅的影響

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 技術與創新格局

- 專利分析

- 價格分析

- 按地區

- 按電動車

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 電動車銷量快速成長

- 商用車和車隊的電氣化

- 電動車傳動系統技術的進步

- 政府法規和激勵措施

- 產業陷阱與挑戰

- 材料供應限制

- 電動車傳動系統零件的初始成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 單級減速器

- 多級減速器

第6章:市場估計與預測:依企業價值,2021 - 2034 年

- 主要趨勢

- 純電動車

- 插電式混合動力

- 燃料電池電動車

- 油電混合車

第7章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第8章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 轎車

- 越野車

- 掀背車

- 商用車

- 輕型商用車

- 平均血紅素 (MCV)

- 丙型肝炎病毒

- 越野車

- 二輪車和三輪車

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- Aichi Machine Industry

- BorgWarner

- GKN Automotive

- Hyundai Transys

- Jatco

- JTEKT

- Magna International

- Nidec Corporation

- Punch Powertrain

- Ricardo plc

- Robert Bosch

- RSB Global

- Schaeffler

- TATA Autocamp

- Valeo

- Vitesco Technologies

- ZF Friedrichshafen

- Zhejiang Wanliyang

The Global Electric Vehicle Reducer Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 24.2% to reach USD 14.9 billion by 2034. This explosive growth is driven by the accelerating global transition toward electric mobility, as both consumers and corporations increasingly prioritize sustainable transportation. As governments across the globe roll out stricter emission regulations and offer attractive incentives for EV adoption, automakers are rapidly expanding their electric vehicle lineups to meet this rising demand. The shift is not only reshaping traditional vehicle manufacturing but also creating unprecedented opportunities across the EV component ecosystem.

Among these, the demand for EV reducers has surged, as these critical components play a vital role in optimizing drivetrain performance by converting high-speed motor output into manageable torque for the wheels. As electric vehicle production scales up-from compact passenger cars to heavy-duty commercial fleets-the need for reliable, high-efficiency reducers is becoming more crucial than ever. Original equipment manufacturers and tier-1 suppliers are now under intense pressure to deliver next-generation reducer solutions that align with evolving EV architectures and performance expectations. This rising momentum positions the reducer market as a key enabler in the broader electrification landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 Billion |

| Forecast Value | $14.9 Billion |

| CAGR | 24.2% |

The rising global demand for electric vehicles has directly boosted the need for EV reducers, which are essential in converting the high rotational speed of electric motors to usable torque for driving wheels. As adoption rates grow, the production of electric passenger cars, commercial vehicles, and fleet systems is increasing significantly, leading to higher consumption of reducers. Manufacturers are responding to this demand by optimizing reducers for performance, durability, and energy efficiency. Particularly in commercial and logistics applications, advanced multi-stage reducers are in high demand due to their ability to handle continuous operations while minimizing energy losses. Fleet operators are increasingly seeking high-torque, low-maintenance solutions that reduce the total cost of ownership and enhance drivetrain reliability, which further underscores the importance of efficient reducer systems.

Electric vehicles are making substantial inroads in last-mile delivery, ride-hailing services, and public transportation, expanding the scope of the EV reducer market. Suppliers are under growing pressure to innovate, producing compact, high-torque-density reducer designs that seamlessly integrate into both light-duty and heavy-duty EV platforms. The performance expectations are rising, and so is the need for scalable, modular solutions that meet the demands of various vehicle classes. As a result, major suppliers are heavily investing in R&D to improve energy efficiency and reduce mechanical losses in reducer systems, reinforcing their role in the EV value chain.

In terms of vehicle type, the market is segmented into passenger cars, commercial vehicles, off-highway vehicles, and two- and three-wheelers. In 2024, passenger vehicles led the market with USD 700 million in revenue, capturing a 40% market share. This dominance is largely due to the rapid expansion of electric car sales, especially in urban areas where clean energy vehicles offer substantial benefits in terms of emissions reduction, fuel savings, and lower maintenance costs. Automakers are embedding reducers into purpose-built EV platforms to enhance driving performance and efficiency.

The EV reducer market is also categorized by sales channels, including original equipment manufacturers (OEMs) and the aftermarket. OEMs dominated in 2024, accounting for 89% of total sales. Because reducers are core drivetrain components typically installed during vehicle assembly, OEMs play a pivotal role in market expansion. Global EV manufacturers such as Tesla, BYD, and Volkswagen are driving demand for custom-engineered reducers that meet strict performance benchmarks, fueling OEM-led growth across all regions.

The China Electric Vehicle Reducer Market contributed USD 163.9 million in 2024, reflecting the country's leadership in EV production. China's vertically integrated supply chain, massive production capabilities, and competitive pricing make it a global hub for EV component manufacturing, including reducers. The ability to fulfill high-volume orders quickly and cost-effectively positions China as a dominant player in the global market.

Key players in the global EV reducer market include ZF Friedrichshafen, BorgWarner Inc., Robert Bosch, Schaeffler AG, GKN Automotive, Magna International, and Nidec Corporation. These companies are heavily focused on technological innovation, developing next-generation reducers that deliver improved performance, longevity, and integration flexibility. Strategic collaborations with automakers allow them to tailor reducer systems for specific EV platforms, further solidifying their market position.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 System integrators and technology providers

- 3.2.4 End-users

- 3.3 Profit margin analysis

- 3.4 Impact of Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures

- 3.4.2 Impact on industry

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.2.1.1 Price volatility in key materials

- 3.4.2.1.2 Supply chain restructuring

- 3.4.2.1.3 Production cost implications

- 3.4.2.2 Demand-side impact (selling price)

- 3.4.2.2.1 Price transmission to end markets

- 3.4.2.2.2 Market share dynamics

- 3.4.2.2.3 Consumer response patterns

- 3.4.2.1 Supply-side impact (raw materials)

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.4.3 Policy engagement

- 3.4.5 Outlook & future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Price analysis

- 3.7.1 By region

- 3.7.2 By EV

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rapid growth in electric vehicle sales

- 3.10.1.2 Electrification of commercial and fleet vehicles

- 3.10.1.3 Advancements in EV drivetrain technology

- 3.10.1.4 Government regulations & incentives

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Material supply constraints

- 3.10.2.2 High initial costs of EV drivetrain components

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Single-stage reducers

- 5.3 Multi-stage reducers

Chapter 6 Market Estimates & Forecast, By EV, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 BEV

- 6.3 PHEV

- 6.4 FCEV

- 6.5 HEV

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Sedan

- 8.2.2 SUV

- 8.2.3 Hatchback

- 8.3 Commercial vehicle

- 8.3.1 LCV

- 8.3.2 MCV

- 8.3.3 HCV

- 8.4 Off highway vehicle

- 8.5 Two and three wheelers

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Aichi Machine Industry

- 10.2 BorgWarner

- 10.3 GKN Automotive

- 10.4 Hyundai Transys

- 10.5 Jatco

- 10.6 JTEKT

- 10.7 Magna International

- 10.8 Nidec Corporation

- 10.9 Punch Powertrain

- 10.10 Ricardo plc

- 10.11 Robert Bosch

- 10.12 RSB Global

- 10.13 Schaeffler

- 10.14 TATA Autocamp

- 10.15 Valeo

- 10.16 Vitesco Technologies

- 10.17 ZF Friedrichshafen

- 10.18 Zhejiang Wanliyang