|

市場調查報告書

商品編碼

1740744

雙懸窗市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Double Hung Windows Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

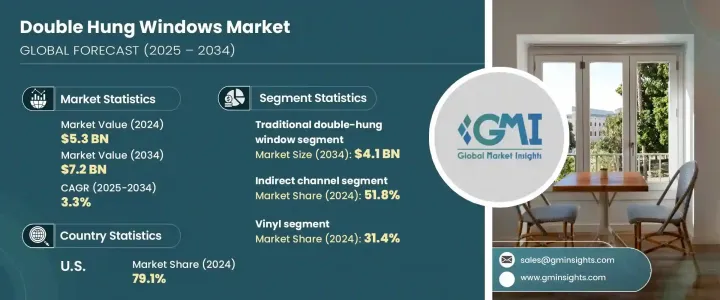

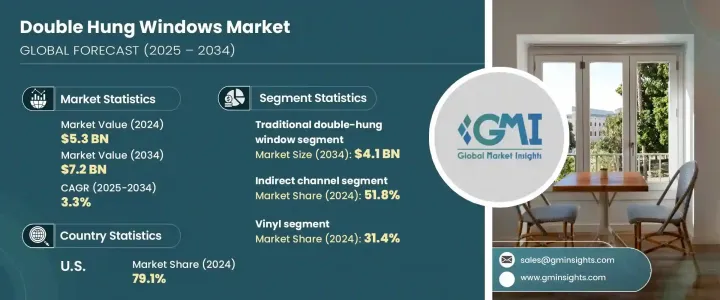

2024 年全球雙懸窗市場價值為 53 億美元,預計到 2034 年將以 3.3% 的複合年成長率成長至 72 億美元。住宅和商業建築日益轉向節能解決方案是該市場的重要驅動力。消費者擴大選擇隔熱性能更好、有助於降低暖氣和冷氣成本的窗戶。雙懸窗融合了傳統美學和現代節能功能,正成為首選。這些窗戶通常包含 Low-E 塗層、雙層玻璃和充氣玻璃等元素,可最大限度地減少熱傳遞並最大限度地提高隔熱效果,從而降低水電費並創造更舒適的生活環境。它們還以改善室內通風和保持恆定的室內溫度而聞名,使其成為新建和翻新項目的熱門解決方案。

除了美觀節能之外,環保意識的日益普及也促使屋主和建築商選擇永續的窗戶系統。雙懸窗因其功能多樣、能夠與各種建築風格相得益彰而備受推崇。此外,其易於操作和極低的維護需求使其在當今快節奏、追求便利的社會中尤為引人注目。政府推行的節能升級措施也推動了市場發展,進一步鼓勵消費者投資高性能窗戶。除了經濟誘因外,能源成本的上漲和大眾對減少碳足跡意識的不斷增強,也持續激發了人們對先進窗戶技術的興趣。節能、成本節約和經典設計的結合,使雙懸窗成為住宅建造和改造的首選。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 53億美元 |

| 預測值 | 72億美元 |

| 複合年成長率 | 3.3% |

市場依類型分為傳統雙懸窗和內傾雙懸窗。 2024年,傳統雙懸窗市場規模為28億美元,預計2034年將達到41億美元。這類窗型因其經典的外觀和可靠的性能而廣受青睞。然而,內傾式雙懸窗因其易於清潔和方便用戶使用的設計,正日益受到青睞,尤其是在現代住宅開發項目中。雖然傳統風格仍佔據主導地位,但內傾式窗型的日益普及反映了家裝產品追求便利性和實用性的普遍趨勢。

按配銷通路分類,市場分為直接銷售和間接銷售。間接通路在2024年佔據領先地位,佔據51.8%的市場佔有率,預計到2034年將達到39億美元。該通路透過批發商、零售商和承包商等中介機構將製造商與廣泛的客戶群聯繫起來,從而蓬勃發展。間接分銷透過大量交易提供更優惠的價格,並透過線上和線下集中地點提供多種產品選擇來提升客戶便利性。這些中介機構還透過管理庫存、配送和客戶服務來簡化物流流程,使製造商能夠專注於產品創新和生產。

就材料而言,市場包括木材、玻璃纖維、乙烯基和其他類別。乙烯基在2024年佔據了該細分市場的主導地位,佔據了31.4%的市場。其日益成長的受歡迎程度與其卓越的隔熱性能、經濟實惠的價格以及防潮、防蟲和防褪色等特性有關。乙烯基窗戶幾乎無需維護,並且可以輕鬆自訂以適應各種設計偏好,使其成為預算型住宅和高階住宅專案的有力競爭者。其耐用性和適應性也使其適用於各種氣候條件和建築風格,這將繼續推動其在多個地區的普及。

從地區來看,美國已成為北美地區領先的市場,2024 年佔據該地區 79.1% 的佔有率。預計 2025 年至 2034 年間,美國市場的複合年成長率將達到 4.1%。這一成長主要源於對永續住房解決方案日益成長的需求、能源成本的上升以及住宅建設和翻新工程的激增。財政激勵措施和屋主對環保生活方式日益成長的興趣進一步推動了節能產品的普及。隨著越來越多的人開始 DIY 家居項目並尋求個性化的生活空間,對時尚、低維護且節能的窗戶的需求持續成長。

該市場的主要公司正在投資先進技術和材料,以滿足消費者對可自訂高性能窗戶解決方案的期望。這些公司還透過完善的分銷網路擴大覆蓋範圍,並提供種類繁多的產品線,以滿足多樣化的市場需求。在不斷發展的雙懸窗市場中,對品質、永續性和創新的關注仍然是保持競爭力的關鍵。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 川普政府關稅分析

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供應方影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(銷售價格)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 衝擊力

- 成長動力

- 節能窗戶需求不斷成長

- 住宅建設熱潮

- 美觀且多功能

- 產業陷阱與挑戰

- 安裝和維護成本高

- 來自低成本和DIY窗戶產品的競爭

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:雙懸窗市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 傳統雙懸窗

- 內傾式雙懸窗

第6章:雙懸窗市場估計與預測:按窗戶材料,2021 - 2034 年

- 主要趨勢

- 木頭

- 玻璃纖維

- 乙烯基塑膠

- 其他

第7章:雙懸窗市場估計與預測:按框架材料,2021 - 2034 年

- 主要趨勢

- 硬質聚氯乙烯

- 玻璃

- 鋁

- 其他

第8章:雙懸窗市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 住宅

- 商業的

- 工業的

第9章:雙懸窗市場估計與預測:依最終用途分類 2021 - 2034 年

- 主要趨勢

- 新建築

- 翻新和更換

第 10 章:雙懸窗市場估計與預測:按配銷通路2021 - 2034 年

- 主要趨勢

- 直接的

- 間接

第 11 章:雙懸窗市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第12章:公司簡介

- American Craftsman

- Andersen

- Blair Window and Door

- Champion Windows

- Harvey Building Products

- Jeld-Wen

- Kolbe Windows and Doors

- Marvin Windows and Doors

- Milgard Windows and Doors

- Pella

- Simonton Windows and Doors

- Therma-Tru Doors

- Vinylmax

- Weather Shield Windows and Doors

- Window World

The Global Double Hung Windows Market was valued at USD 5.3 billion in 2024 and is estimated to grow at a CAGR of 3.3% to reach USD 7.2 billion by 2034. The growing shift toward energy-saving solutions in residential and commercial construction has been a significant driver for this market. Consumers are increasingly opting for window options that offer better insulation and help lower heating and cooling costs. Double-hung windows are becoming a preferred choice due to their blend of traditional aesthetics and modern energy-efficiency features. These windows often include elements such as Low-E coatings, double glazing, and gas-filled panes that minimize thermal transfer and maximize insulation, leading to reduced utility expenses and more comfortable living environments. They are also known for improving indoor ventilation and maintaining consistent interior temperatures, making them a popular solution for both new construction and renovation projects.

Beyond aesthetics and energy savings, the rising adoption of environmentally conscious practices has pushed homeowners and builders to select sustainable window systems. Double-hung windows are well-regarded for their functional versatility and ability to complement various architectural styles. Additionally, their easy operability and minimal maintenance needs make them particularly appealing in today's fast-paced, convenience-driven society. The market is also benefiting from government initiatives promoting energy-efficient upgrades, which are further encouraging consumers to invest in high-performance windows. In addition to financial incentives, the increasing cost of energy and growing public awareness about reducing carbon footprints continue to fuel interest in advanced window technologies. The combination of energy efficiency, cost savings, and timeless design is positioning double-hung windows as a top choice in residential construction and remodeling.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.3 Billion |

| Forecast Value | $7.2 Billion |

| CAGR | 3.3% |

The market is categorized by type into traditional double-hung windows and tilt-in double-hung windows. In 2024, the traditional segment accounted for USD 2.8 billion and is anticipated to reach USD 4.1 billion by 2034. This type remains widely favored for its classic appearance and reliable performance. However, tilt-in double-hung windows are gaining traction, particularly in modern housing developments, due to their ease of cleaning and user-friendly design. While the traditional style maintains dominance, the rising popularity of tilt-in models reflects a broader trend toward convenience and practicality in home improvement products.

By distribution channel, the market is split into direct and indirect sales. The indirect channel held the leading position in 2024, representing 51.8% of the market, and is projected to be valued at USD 3.9 billion by 2034. This channel thrives by connecting manufacturers with a broad customer base through intermediaries like wholesalers, retailers, and contractors. Indirect distribution supports better pricing through bulk transactions and enhances customer convenience by providing multiple product options in centralized locations, both online and offline. These intermediaries also streamline logistics by managing inventory, delivery, and customer service, allowing manufacturers to focus on product innovation and production.

In terms of material, the market includes wood, fiberglass, vinyl, and other categories. Vinyl dominated the segment in 2024, capturing a 31.4% share. Its growing preference is linked to its superior insulation properties, affordability, and resistance to moisture, pests, and fading. Vinyl windows require little to no upkeep and can be easily tailored to fit various design preferences, making them a strong competitor in both budget-conscious and premium home projects. Their durability and adaptability also make them suitable for a wide range of climates and building styles, which continues to drive adoption across multiple regions.

Regionally, the United States emerged as the leading market within North America, accounting for 79.1% of the regional share in 2024. The market in the U.S. is forecasted to grow at a 4.1% CAGR between 2025 and 2034. This growth is being driven by increasing demand for sustainable housing solutions, rising energy costs, and a surge in residential construction and renovation. The adoption of energy-efficient products is further supported by financial incentives and growing homeowner interest in eco-friendly living. As more people take on do-it-yourself home projects and seek personalized living spaces, demand for stylish, low-maintenance, and energy-efficient windows continues to grow.

Key companies in this market are investing in advanced technology and materials to meet consumer expectations for customizable, high-performance window solutions. These players are also enhancing their reach through well-established distribution networks and offering a wide variety of product lines to cater to diverse market needs. The focus on quality, sustainability, and innovation remains central to staying competitive in the evolving double-hung window landscape.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research Approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-Side impact (Raw Materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.5 Demand-Side impact (Selling Price)

- 3.2.2.6 Price transmission to end markets

- 3.2.2.7 Market share dynamics

- 3.2.2.8 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for energy-efficient windows

- 3.3.1.2 Residential construction boom

- 3.3.1.3 Aesthetic appeal and versatility

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 High installation and maintenance costs

- 3.3.2.2 Competition from Low-Cost and DIY window products

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Double Hung Windows Market Estimates & Forecast, By Type, 2021 - 2034 (USD Billion) (Thousand Units)

- 5.1 Key trends

- 5.2 Traditional double-hung window

- 5.3 Tilt-in double-hung window

Chapter 6 Double Hung Windows Market Estimates & Forecast, By Window Material, 2021 - 2034 (USD Billion) (Thousand Units)

- 6.1 Key trends

- 6.2 Wood

- 6.3 Fiberglass

- 6.4 Vinyl

- 6.5 Others

Chapter 7 Double Hung Windows Market Estimates & Forecast, By Frame Material, 2021 - 2034 (USD Billion) (Thousand Units)

- 7.1 Key trends

- 7.2 UPVC

- 7.3 Glass

- 7.4 Aluminium

- 7.5 Others

Chapter 8 Double Hung Windows Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.4 Industrial

Chapter 9 Double Hung Windows Market Estimates & Forecast, By End Use 2021 - 2034 (USD Billion) (Thousand Units)

- 9.1 Key trends

- 9.2 New construction

- 9.3 Renovation and replacement

Chapter 10 Double Hung Windows Market Estimates & Forecast, By Distribution Channel 2021 - 2034 (USD Billion) (Thousand Units)

- 10.1 Key trends

- 10.2 Direct

- 10.3 Indirect

Chapter 11 Double Hung Windows Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 United States

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 United kingdom

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 Middle East & Africa

- 11.6.1 South Africa

- 11.6.2 Saudi Arabia

- 11.6.3 United Arab Emirates

Chapter 12 Company Profiles

- 12.1 American Craftsman

- 12.2 Andersen

- 12.3 Blair Window and Door

- 12.4 Champion Windows

- 12.5 Harvey Building Products

- 12.6 Jeld-Wen

- 12.7 Kolbe Windows and Doors

- 12.8 Marvin Windows and Doors

- 12.9 Milgard Windows and Doors

- 12.10 Pella

- 12.11 Simonton Windows and Doors

- 12.12 Therma-Tru Doors

- 12.13 Vinylmax

- 12.14 Weather Shield Windows and Doors

- 12.15 Window World