|

市場調查報告書

商品編碼

1721632

瓦斯工業熱水鍋爐市場機會、成長動力、產業趨勢分析及2025-2034年預測Gas Fired Industrial Hot Water Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

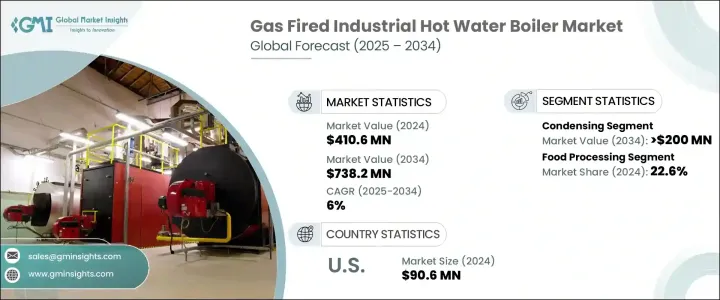

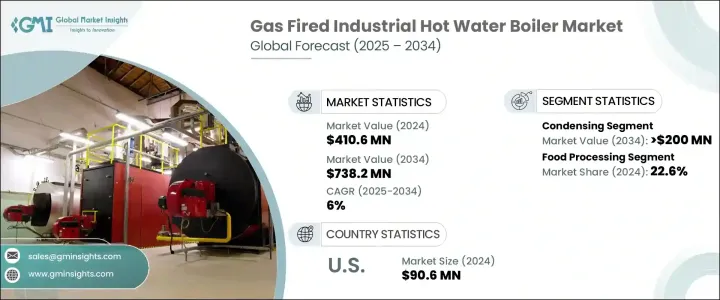

2024 年全球燃氣工業熱水鍋爐市場價值為 4.106 億美元,預計到 2034 年將以 6% 的複合年成長率成長,達到 7.382 億美元。隨著全球工業設施轉向永續、節能的供熱技術以滿足不斷變化的監管標準,市場正在穩步擴張。要求減少溫室氣體排放和提高能源利用率的更嚴格的環境法規正在推動各個行業採用燃氣熱水鍋爐。工業營運商優先考慮減少碳足跡同時保持高性能的系統,從而對技術先進的鍋爐解決方案產生持續的需求。隨著食品加工、區域供熱和紡織製造等行業致力於降低營運成本並提高效率,現代熱水鍋爐已成為其基礎設施的重要組成部分。

預測性維護、即時監控和增強型營運自動化等智慧技術的整合進一步推動了市場的成長。這些功能不僅提高了系統可靠性,還減少了停機時間和能源浪費,幫助公司實現顯著的成本節約。隨著製造商推出旨在順應全球脫碳趨勢的節能系統,持續的創新正在重塑格局。冷凝技術因其能夠回收廢氣中的潛熱、提高熱效率並降低燃料消耗而迅速普及。對於尋求經濟高效且合規的供暖解決方案的買家來說,這項技術正成為一項關鍵賣點。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 4.106億美元 |

| 預測值 | 7.382億美元 |

| 複合年成長率 | 6% |

市場依技術分為冷凝鍋爐和非冷凝鍋爐。預計到 2034 年冷凝鍋爐的產值將達到 2 億美元,反映出各行各業對冷凝鍋爐的應用日益廣泛,以達到最佳性能並符合綠色標準。這些系統透過改善熱回收和降低整體能源費用提供了切實的優勢,使其成為製造商有吸引力的投資。

化學工業在支持市場成長方面發揮關鍵作用,因為該領域的公司正在不斷升級遺留系統以滿足嚴格的排放法規並提高流程效率。該行業正在進行的現代化努力是全球先進鍋爐部署的重要推動力。

2022 年美國燃氣工業熱水鍋爐市場價值為 7,990 萬美元,預計到 2034 年將達到 1.5 億美元。美國各產業數位轉型力度的加大正在加速智慧高效鍋爐的採用。這些系統配備了支援自動診斷、預測性維護和最佳化熱管理的功能,這些功能有助於實現卓越營運並降低成本。

全球市場的主要參與者包括 Bosch Industriekessel、Cleaver-Brooks、Viessmann、Johnston Boiler、Hurst Boiler & Welding、Babcock Wanson、Cochran、Thermodyne Boilers、Fulton、Hoval、Thermon、Ecotherm Austria、Miura America、Danstoker、Califora、Califor率。這些公司正在大力投資研發,以推出具有遠端監控、即時分析和增強性能功能的先進產品。策略併購對於擴大產品線和進入新興市場仍然是核心。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依產能,2021 - 2034 年

- 主要趨勢

- < 10 百萬英熱單位/小時

- 10 - 25 百萬英熱單位/小時

- 25 - 50 百萬英熱單位/小時

- 50 - 75 百萬英熱單位/小時

- > 75 百萬英熱單位/小時

第6章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 食品加工

- 紙漿和造紙

- 化學

- 煉油廠

- 原生金屬

- 其他

第7章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 冷凝

- 無凝結

第8章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 火管

- 水管

第9章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第10章:公司簡介

- Babcock Wanson

- Bosch Industriekessel

- California Boiler

- Cleaver-Brooks

- Cochran

- Danstoker

- Ecotherm Austria

- Fulton

- HKB

- Hoval

- Hurst Boiler & Welding

- Indeck Power Equipment

- Johnston Boiler

- Miura America

- Thermax

- Thermodyne Boilers

- Thermon

- Viessmann

The Global Gas Fired Industrial Hot Water Boiler Market was valued at USD 410.6 million in 2024 and is estimated to grow at a CAGR of 6% to reach USD 738.2 million by 2034. The market is witnessing steady expansion as industrial facilities worldwide shift toward sustainable, energy-efficient heating technologies to meet evolving regulatory standards. Stricter environmental mandates requiring the reduction of greenhouse gas emissions and improved energy usage are driving the adoption of gas-fired hot water boilers across diverse sectors. Industrial operators are prioritizing systems that reduce carbon footprints while maintaining high performance, thereby creating consistent demand for technologically advanced boiler solutions. As industries such as food processing, district heating, and textile manufacturing aim to cut operating costs and boost efficiency, modern hot water boilers have become essential components in their infrastructure.

Market growth is further fueled by the integration of smart technologies like predictive maintenance, real-time monitoring, and enhanced operational automation. These features not only increase system reliability but also reduce downtime and energy waste, helping companies achieve significant cost savings. Continuous innovation is reshaping the landscape as manufacturers introduce energy-efficient systems designed to align with the global shift toward decarbonization. Condensing technology is rapidly gaining popularity due to its ability to recover latent heat from exhaust gases, increasing thermal efficiency and reducing fuel consumption. This technology is becoming a key selling point for buyers seeking cost-effective and compliant heating solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $410.6 Million |

| Forecast Value | $738.2 Million |

| CAGR | 6% |

The market is segmented by technology into condensing and non-condensing boilers. Condensing boilers are projected to generate USD 200 million by 2034, reflecting their rising adoption across industries aiming for optimal performance and compliance with green standards. These systems offer a tangible advantage by improving heat recovery and lowering overall energy expenses, making them an attractive investment for manufacturers.

The chemical sector plays a critical role in supporting market growth, as companies in this space are increasingly upgrading legacy systems to meet stringent emission regulations and improve process efficiency. This sector's ongoing modernization efforts are a significant driver of advanced boiler deployments worldwide.

The U.S. Gas Fired Industrial Hot Water Boiler Market was valued at USD 79.9 million in 2022 and is forecast to reach USD 150 million by 2034. A surge in digital transformation efforts across U.S. industries is accelerating the adoption of smart, high-efficiency boilers. These systems are equipped with features that support automated diagnostics, predictive maintenance, and optimized heat management-factors that contribute to operational excellence and cost reduction.

Major players in the global market include Bosch Industriekessel, Cleaver-Brooks, Viessmann, Johnston Boiler, Hurst Boiler & Welding, Babcock Wanson, Cochran, Thermodyne Boilers, Fulton, Hoval, Thermon, Ecotherm Austria, Miura America, Danstoker, California Boiler, Indeck Power Equipment, and HKB. These companies are investing heavily in R&D to launch advanced products with remote monitoring, real-time analytics, and enhanced performance capabilities. Strategic mergers and acquisitions remain central to expanding their product lines and tapping into emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's Analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 5.1 Key trends

- 5.2 < 10 MMBTU/hr

- 5.3 10 - 25 MMBTU/hr

- 5.4 25 - 50 MMBTU/hr

- 5.5 50 - 75 MMBTU/hr

- 5.6 > 75 MMBTU/hr

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 6.1 Key trends

- 6.2 Food processing

- 6.3 Pulp & paper

- 6.4 Chemical

- 6.5 Refinery

- 6.6 Primary metal

- 6.7 Others

Chapter 7 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 7.1 Key trends

- 7.2 Condensing

- 7.3 Non-condensing

Chapter 8 Market Size and Forecast, By Product, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 8.1 Key trends

- 8.2 Fire-tube

- 8.3 Water-tube

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, MMBTU/hr & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 France

- 9.3.3 Germany

- 9.3.4 Italy

- 9.3.5 Russia

- 9.3.6 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Australia

- 9.4.3 India

- 9.4.4 Japan

- 9.4.5 South Korea

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 Turkey

- 9.5.4 South Africa

- 9.5.5 Egypt

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 Babcock Wanson

- 10.2 Bosch Industriekessel

- 10.3 California Boiler

- 10.4 Cleaver-Brooks

- 10.5 Cochran

- 10.6 Danstoker

- 10.7 Ecotherm Austria

- 10.8 Fulton

- 10.9 HKB

- 10.10 Hoval

- 10.11 Hurst Boiler & Welding

- 10.12 Indeck Power Equipment

- 10.13 Johnston Boiler

- 10.14 Miura America

- 10.15 Thermax

- 10.16 Thermodyne Boilers

- 10.17 Thermon

- 10.18 Viessmann