|

市場調查報告書

商品編碼

1721626

家具市場機會、成長動力、產業趨勢分析及2025-2034年預測Furniture Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

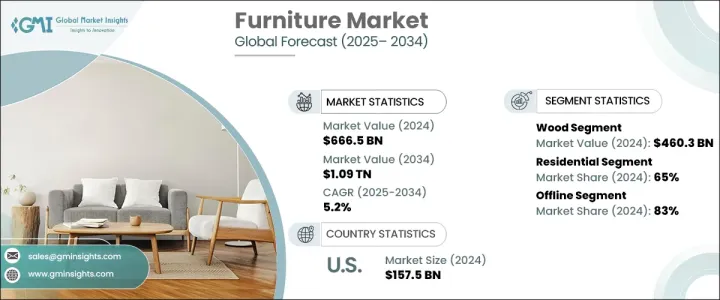

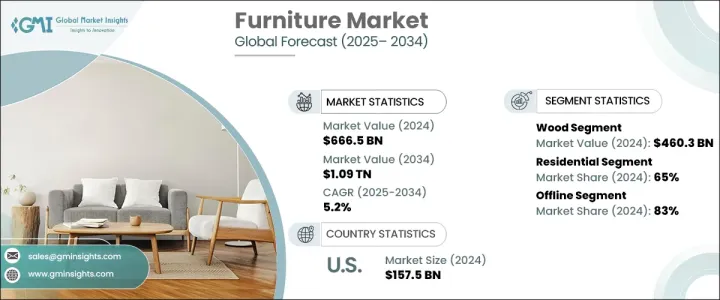

2024 年全球家具市場價值為 6,665 億美元,預計到 2034 年將以 5.2% 的複合年成長率成長,達到 1.09 兆美元。這一穩定成長反映了可支配收入增加、城市化快速發展、基礎設施擴張以及全球建築活動增加的強大影響。消費者生活方式的轉變、對室內美學的關注度提高以及對永續生活的意識不斷增強,進一步推動了市場需求。隨著全球人口擴大投資於實用而時尚的生活空間,家具已成為住宅和商業設計的關鍵方面。此外,對多功能家具的需求,尤其是在緊湊的城市環境中,正在改變人們選擇和使用家具的方式。數位零售通路為顧客獲取各種家具系列開闢了新途徑,使市場比以往任何時候都更具競爭力和以消費者為中心。家具製造商正在推出更多樣化的設計、模組化的產品和環保的選擇,以滿足當今買家不斷變化的需求。

歐洲擁有超過2.3億個家庭,是人均家具消費水準最高的地區之一,佔全球家具市場的四分之一以上。該地區在影響生產價值、塑造國際貿易模式和定義全球設計趨勢方面發揮關鍵作用。強勁的國內需求加上高出口活動使歐洲成為全球格局的主導力量。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6665億美元 |

| 預測值 | 1.09兆美元 |

| 複合年成長率 | 5.2% |

2024 年木材產業的產值達到 4,603 億美元。隨著消費者越來越青睞木製家具的永恆魅力、耐用性以及在不同室內風格的多功能性,木製家具的受歡迎程度也持續上升。手工製作和工匠製作的木製作品越來越受到那些重視精湛工藝、道德採購和耐用性的買家的青睞。無論是鄉村風格還是現代風格,木製家具仍然是住宅和商業室內裝潢的首選。

根據最終用戶,家具市場分為住宅和商業類別。 2024 年,住宅領域將佔據 65% 的市場佔有率,這主要歸功於藝術木製家具的吸引力不斷上升。家居裝修項目支出的增加以及室內外社交的趨勢推動了對餐具、長凳和椅子組合、沙發和多功能戶外家具的需求。屋主們也正在投資戶外廚房、酒吧區和用餐區,進一步增加了對時尚、耐用和耐候家具的需求。

光是美國家具市場在 2024 年就創造了 1,575 億美元的產值,佔該地區佔有率的 80%。美國的成長主要受到裝修趨勢、對高檔家具的偏好增加以及對木質內飾不斷成長的需求的支持。紐約、邁阿密、洛杉磯和舊金山等城市正在興起高階住宅項目,需要訂製家具來提升豪華居住空間。

全球家具產業的主要參與者包括 Artek、Roche Bobois、Restoration Hardware、Ashley Furniture、La-Z-Boy、Boca do Lobo、Bernhardt Furniture、Hartmann Mobelwerke、Herman Miller、Haworth、HNI Corporation、Steelcase、Kimball International、The Senator Group 和 Vitra。這些公司正在擴大產品線,投資創新設計研發,擁抱數位零售平台,並與設計師和建築師合作提供個人化的家具解決方案。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製成品

- 經銷商

- 供應商格局

- 技術格局

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 都市化和基礎設施發展

- 裝潢和改造趨勢

- 產業陷阱與挑戰

- 原料成本和可用性

- 消費者偏好的轉變

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021-2034

- 主要趨勢

- 座椅家具

- 椅子

- 沙發和長沙發

- 腳凳和腳凳

- 長椅

- 凳子

- 其他(躺椅等)

- 儲物家具

- 櫥櫃

- 貨架

- 寶箱

- 書櫃

- 其他(腳凳等)

- 餐廳家具

- 餐桌

- 餐椅

- 餐椅

- 自助餐檯和餐櫃

- 其他(酒吧推車等)

- 娛樂家具

- 電視櫃和媒體控制台

- 家庭劇院座位

- 揚聲器支架和安裝座

- 酒櫃和家用酒吧

- 其他(遊戲椅等)

- 其他(睡眠家具等)

第6章:市場估計與預測:按類型,2021-2034

- 主要趨勢

- 室內家具

- 戶外家具

第7章:市場估計與預測:依材料,2021-2034

- 主要趨勢

- 塑膠

- 木頭

- 金屬

- 其他

第8章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 住宅

- 商業的

- 商業/辦公

- 教育機構

- 衛生保健

- 飯店業

- 其他

第9章:市場估計與預測:依價格區間,2021-2034

- 主要趨勢

- 低的

- 中等的

- 高級/豪華

第 10 章:市場估計與預測:按配銷通路,2021-2034 年

- 主要趨勢

- 線上

- 離線

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第12章:公司簡介

- Artek

- Ashley Furniture

- Bernhardt Furniture

- Boca do Lobo

- Hartmann Mobelwerke

- Haworth

- Herman Miller

- HNI Corporation

- Kimball International

- La-Z-Boy

- Restoration Hardware

- Roche Bobois

- Steelcase

- The Senator Group

- Vitra

The Global Furniture Market was valued at USD 666.5 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 1.09 trillion by 2034. This steady growth reflects the strong influence of rising disposable incomes, rapid urbanization, expanding infrastructure, and an uptick in construction activities worldwide. The shift in consumer lifestyle, a heightened focus on interior aesthetics, and growing awareness of sustainable living are further driving market demand. With the global population increasingly investing in functional yet stylish living spaces, furniture has become a key aspect of both residential and commercial design. Moreover, the demand for multifunctional furniture, especially in compact urban settings, is transforming how people choose and use furniture pieces. Digital retail channels have opened new avenues for customers to access a broad variety of furniture collections, making the market more competitive and consumer-centric than ever. Furniture makers are responding with more versatile designs, modular products, and eco-friendly options to meet the evolving needs of today's buyers.

Europe, home to over 230 million households and boasting one of the highest per capita consumption levels, accounts for more than a quarter of the global furniture market. The region plays a key role in influencing production values, shaping international trade patterns, and defining global design trends. Its strong domestic demand, coupled with high export activity, positions Europe as a dominant force in the global landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $666.5 Billion |

| Forecast Value | $1.09 Trillion |

| CAGR | 5.2% |

The wood segment generated USD 460.3 billion in 2024. The preference for wooden furniture continues to rise as consumers gravitate toward its timeless appeal, durability, and versatility across different interior styles. Handcrafted and artisan-made wooden pieces are gaining traction among buyers who value intricate craftsmanship, ethical sourcing, and longevity. Whether it's rustic or contemporary, wooden furniture remains a top choice for both residential and commercial interiors.

Based on end users, the furniture market is segmented into residential and commercial categories. In 2024, the residential segment captured a 65% market share, largely due to the rising appeal of artistic wooden furniture. Increased spending on home improvement projects and the trend of indoor and outdoor socializing have driven demand for dining sets, bench and chair combos, sofas, and multifunctional outdoor furniture. Homeowners are also investing in outdoor kitchens, bar areas, and dining spaces, further boosting the need for stylish, durable, and weather-resistant furniture.

The United States Furniture Market alone generated USD 157.5 billion in 2024, accounting for 80% of the regional share. Growth in the U.S. is largely supported by renovation trends, increasing preferences for premium furniture, and a growing demand for wooden interiors. Cities like New York, Miami, Los Angeles, and San Francisco are seeing high-end residential projects demanding bespoke furniture that enhances luxurious living spaces.

Key players in the global furniture industry include Artek, Roche Bobois, Restoration Hardware, Ashley Furniture, La-Z-Boy, Boca do Lobo, Bernhardt Furniture, Hartmann Mobelwerke, Herman Miller, Haworth, HNI Corporation, Steelcase, Kimball International, The Senator Group, and Vitra. These companies are expanding their product lines, investing in R&D for innovative design, embracing digital retail platforms, and collaborating with designers and architects to deliver personalized furniture solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufactures

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Technological landscape

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Urbanization and infrastructure development

- 3.6.1.2 Renovation and remodeling trends

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Raw material costs and availability

- 3.6.2.2 Shifting consumer preferences

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Seating furniture

- 5.2.1 Chairs

- 5.2.2 Sofas and couches

- 5.2.3 Ottomans and footstools

- 5.2.4 Benches

- 5.2.5 Stools

- 5.2.6 Others (chaise lounges etc.)

- 5.3 Storage furniture

- 5.3.1 Cabinets

- 5.3.2 Shelves

- 5.3.3 Chests

- 5.3.4 Bookcases

- 5.3.5 Others (ottomans etc.)

- 5.4 Dining furniture

- 5.4.1 Dining tables

- 5.4.2 Dining chairs

- 5.4.3 Dining benches

- 5.4.4 Buffets and sideboards

- 5.4.5 Others (bar carts etc.)

- 5.5 Entertainment furniture

- 5.5.1 TV stands and media consoles

- 5.5.2 Home theater seating

- 5.5.3 Speaker stands and mounts

- 5.5.4 Bar cabinets and home bars

- 5.5.5 Others (gaming chairs etc.)

- 5.6 Others (sleeping furniture etc.)

Chapter 6 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Indoor furniture

- 6.3 Outdoor furniture

Chapter 7 Market Estimates & Forecast, By Material, 2021-2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Plastic

- 7.3 Wood

- 7.4 Metal

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Business/office

- 8.3.2 Educational institute

- 8.3.3 Healthcare

- 8.3.4 Hospitality

- 8.3.5 Others

Chapter 9 Market Estimates & Forecast, By Price Range, 2021-2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Low

- 9.3 Medium

- 9.4 High/luxury

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Online

- 10.3 Offline

Chapter 11 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 Australia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 Saudi Arabia

- 11.6.3 South Africa

Chapter 12 Company Profiles

- 12.1 Artek

- 12.2 Ashley Furniture

- 12.3 Bernhardt Furniture

- 12.4 Boca do Lobo

- 12.5 Hartmann Mobelwerke

- 12.6 Haworth

- 12.7 Herman Miller

- 12.8 HNI Corporation

- 12.9 Kimball International

- 12.10 La-Z-Boy

- 12.11 Restoration Hardware

- 12.12 Roche Bobois

- 12.13 Steelcase

- 12.14 The Senator Group

- 12.15 Vitra