|

市場調查報告書

商品編碼

1721615

唇部和臉部油市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Lip and Face Oil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

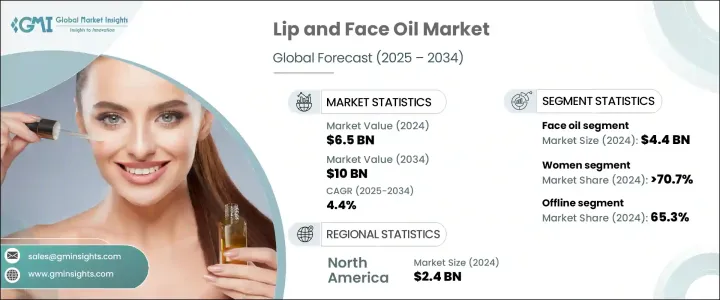

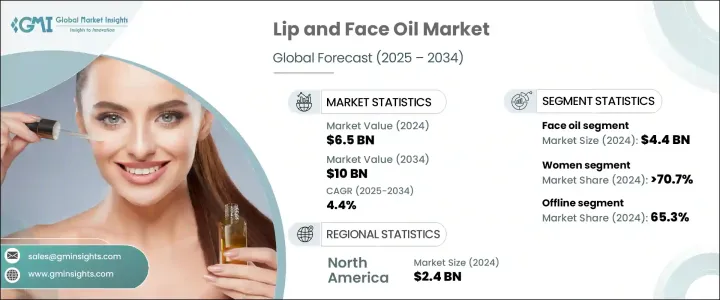

2024 年全球唇部和臉部油市場價值為 65 億美元,預計到 2034 年將以 4.4% 的複合年成長率成長,達到 100 億美元。受對優先考慮健康、永續性和透明度的清潔美容解決方案的需求激增的推動,該市場在全球範圍內越來越受歡迎。隨著消費者越來越關注皮膚上塗抹的產品,他們明顯轉向使用天然、植物性和符合道德標準的成分的產品。護膚程序正在演變成健康儀式,促使購物者尋找具有保濕、滋養和保護功能的多功能油。隨著消費者意識到唇油和臉部油能夠帶來明顯的、長期的皮膚益處,它們正成為美容護理中不可或缺的一部分。社群媒體影響力的增強、對皮膚敏感性的認知以及對無殘忍和純素認證產品的日益成長的傾向正在強化這種轉變。除了監管支持和擴大有機認證之外,這些因素還在繼續重塑美容行業格局,為品牌在全球範圍內創新和擴張創造了肥沃的土壤。隨著美容習慣變得更加有目的性和整體性,唇部和臉部油領域預計將吸引更大的消費者群體。

臉部精油在 2024 年創造了 44 億美元的市場價值,預計到 2034 年將以 4.5% 的複合年成長率成長。臉部精油越來越受歡迎,是因為它們能夠靈活地解決常見的皮膚護理問題,例如乾燥、暗沉、細紋和發炎。如今,消費者更青睞臉部油而非傳統保濕霜,因為它們含有植物成分、不致粉刺的質地以及更深層的保濕能力。這些油由輕質、富含活性成分的成分配製而成,可完美融入現代多步驟護膚程序。它們不僅可以改善膚質和光澤,還可以修復皮膚屏障並提供抗衰老功效,因此非常適合各種皮膚類型。與主要提供水分和光澤的唇油不同,臉部油具有針對性的護膚功能,這提升了它們在不斷成長的清潔美容市場中的價值。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 65億美元 |

| 預測值 | 100億美元 |

| 複合年成長率 | 4.4% |

隨著女性對自我照顧和護膚意識的日益重視,到 2024 年,女性保養品的市佔率將達到 70.7%。現代女性消費者積極尋求能夠體現她們價值觀的美容產品——青睞清潔、自然和透明的配方。有影響力的行銷和皮膚病學代言增強了產品的可信度,鼓勵追求明亮、水潤肌膚的女性採用該產品。對健康美容的追求繼續引起年輕消費者的共鳴,尤其是 Z 世代和千禧世代,他們要求產品功效的同時又不損害成分的完整性。

北美唇部和臉部油市場佔 37.2% 的佔有率,2024 年產值達 24 億美元。該地區擁有知識淵博、精通護膚的受眾,他們重視成分透明度和功效。強大的品牌影響力、快速的產品創新以及成熟、清潔的美容生態系統推動持續的需求。美國和加拿大的消費者都將植物油作為日常生活的一部分,鞏固了該地區在全球市場的領先地位。

市場的主要參與者包括 Kiehl's、Tata Harper Skincare、Clorox、Amorepacific、Johnson and Johnson、Clarins、The Body Shop、Beiersdorf、Herbivore Botanicals、Coty、Estee Lauder、聯合利華、寶潔、資生堂和歐萊雅。這些公司正在對混合油進行創新,將美容效果與臨床功效融為一體。研發工作重點在於為敏感肌膚打造輕盈、不致粉刺的配方,同時品牌也優先考慮環保包裝,並利用數位故事和影響力合作來提升其市場影響力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 定價分析

- 技術與創新格局

- 重要新聞和舉措

- 監管格局

- 製造商

- 經銷商

- 零售商

- 對部隊的影響

- 成長動力

- 消費者可支配所得不斷增加

- 人們對眼睛健康的認知不斷提高

- 消費者偏好的改變

- 產業陷阱與挑戰

- 仿冒品

- 消費者偏好的改變

- 成長動力

- 成長潛力分析

- 消費者行為分析

- 人口趨勢

- 影響購買決策的因素

- 產品偏好

- 首選價格範圍

- 首選配銷通路

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品類型,2021 - 2034 年(十億美元)

- 主要趨勢

- 唇油

- 有色唇油

- 透明唇油

- 豐唇油

- 臉部油

- 保濕臉部油

- 抗衰老臉部油

- 亮膚顏面精油

- 其他(平衡臉部油、鎮靜臉部油)

第6章:市場估計與預測:按價格區間,2021 年至 2034 年(十億美元)

- 主要趨勢

- 低的

- 中等的

- 高的

第7章:市場估計與預測:按消費者群體分類,2021 年至 2034 年(十億美元)

- 主要趨勢

- 男士

- 女性

- 孩子們

第8章:市場估計與預測:按包裝,2021 - 2034 年(十億美元)

- 主要趨勢

- 滴管瓶

- 泵浦瓶

- 滾珠瓶

- 擠壓管

- 貼上容器

- 其他(真空幫浦瓶等)

第9章:市場估計與預測:按配銷通路,2021 - 2034 年(十億美元)

- 主要趨勢

- 線上

- 電子商務

- 公司網站

- 離線

- 超市和大賣場

- 專賣店

- 其他零售店

第10章:市場估計與預測:按地區,2021 - 2034 年(十億美元)

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Amorepacific

- Beiersdorf

- Clarins

- Clorox

- Coty

- Estee Lauder

- Herbivore Botanicals

- Johnson and Johnson

- Kiehl's

- L'Oreal

- Procter and Gamble

- Shiseido

- Tata Harper Skincare

- The Body Shop

- Unilever

The Global Lip and Face Oil Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 10 billion by 2034. This market is gaining traction worldwide, propelled by a surge in demand for clean beauty solutions that prioritize health, sustainability, and transparency. As consumers become increasingly mindful of what they apply to their skin, there is a marked shift toward products that offer natural, plant-based, and ethically sourced ingredients. Skincare routines are evolving into wellness rituals, prompting shoppers to seek out multifunctional oils that hydrate, nourish, and protect. Lip and face oils are becoming staples in beauty regimens as consumers recognize their ability to deliver visible, long-term skin benefits. The rise of social media influence, awareness around skin sensitivity, and growing inclination toward cruelty-free and vegan-certified products are reinforcing this shift. Alongside regulatory support and expanding organic certifications, these factors continue to reshape the beauty landscape, creating fertile ground for brands to innovate and scale globally. As beauty routines become more intentional and holistic, the lip and face oil segment is expected to capture an even larger consumer base.

Face oils generated USD 4.4 billion in 2024 and are projected to grow at a CAGR of 4.5% through 2034. Their rising popularity stems from their versatility in addressing common skincare issues such as dryness, dullness, fine lines, and inflammation. Consumers now favor face oils over traditional moisturizers due to their botanical compositions, non-comedogenic textures, and deeper hydration capabilities. These oils are formulated with lightweight, active-rich ingredients that seamlessly fit into modern multi-step skincare routines. They not only improve texture and radiance but also support skin barrier repair and offer anti-aging benefits, making them highly desirable for a broad range of skin types. Unlike lip oils, which primarily deliver moisture and shine, face oils offer targeted skincare functions, which enhances their value in a growing clean beauty market.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $10 Billion |

| CAGR | 4.4% |

The women segment accounted for 70.7% share in 2024, driven by an increased emphasis on self-care and skincare awareness. Modern female consumers are proactively seeking beauty products that reflect their values-favoring clean, natural, and transparent formulations. Influencer marketing and dermatological endorsements have amplified product credibility, encouraging adoption among women seeking luminous, hydrated skin. The pursuit of wellness-driven beauty continues to resonate with younger consumers, particularly Gen Z and Millennials, who demand efficacy without compromising ingredient integrity.

The North America Lip and Face Oil Market held a 37.2% share, generating USD 2.4 billion in 2024. The region is home to an informed, skincare-savvy audience that values ingredient transparency and efficacy. Strong brand presence, rapid product innovation, and a mature, clean beauty ecosystem drive sustained demand. Consumers across the US and Canada are embracing botanical-based oils as part of their daily regimens, reinforcing the region's position as a leader in the global market.

Key players in the market include Kiehl's, Tata Harper Skincare, Clorox, Amorepacific, Johnson and Johnson, Clarins, The Body Shop, Beiersdorf, Herbivore Botanicals, Coty, Estee Lauder, Unilever, Procter and Gamble, Shiseido, and L'Oreal. These companies are innovating with hybrid oils that blend cosmetic appeal with clinical efficacy. R&D efforts are focused on creating lightweight, non-comedogenic formulas for sensitive skin, while brands are also prioritizing eco-friendly packaging and leveraging digital storytelling and influencer collaborations to elevate their market presence.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier Landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising consumer disposable income

- 3.10.1.2 Growing awareness about eye health

- 3.10.1.3 Changing consumer preferences

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Counterfeit products

- 3.10.2.2 Changing consumer preferences

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer behavior analysis

- 3.12.1 Demographic trends

- 3.12.2 Factors affecting buying decisions

- 3.12.3 Product Preference

- 3.12.4 Preferred price range

- 3.12.5 Preferred distribution channel

- 3.13 Porter’s analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Bn) (Thousand Units)

- 5.1 Key trends

- 5.2 Lip oils

- 5.2.1 Tinted lip oils

- 5.2.2 Clear lip oils

- 5.2.3 Plumping lip oils

- 5.3 Face oils

- 5.3.1 Hydrating face oils

- 5.3.2 Anti-aging face oils

- 5.3.3 Brightening face oils

- 5.3.4 Others (balancing face oils, calming face oils)

Chapter 6 Market Estimates & Forecast, By Price Range, 2021 - 2034 ($Bn) (Thousand Units)

- 6.1 Key trends

- 6.2 Low

- 6.3 Medium

- 6.4 High

Chapter 7 Market Estimates & Forecast, By Consumer Group, 2021 - 2034 ($Bn) (Thousand Units)

- 7.1 Key trends

- 7.2 Men

- 7.3 Women

- 7.4 Kids

Chapter 8 Market Estimates & Forecast, By Packaging, 2021 - 2034 ($Bn) (Thousand Units)

- 8.1 Key trends

- 8.2 Dropper bottles

- 8.3 Pump bottles

- 8.4 Roll-on bottles

- 8.5 Squeeze tubes

- 8.6 Stick containers

- 8.7 Others (airless pump bottles, etc.)

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn) (Thousand Units)

- 9.1 Key trends

- 9.2 Online

- 9.2.1 E-Commerce

- 9.2.2 Company website

- 9.3 Offline

- 9.3.1 Supermarkets and Hypermarkets

- 9.3.2 Specialty stores

- 9.3.3 Other retail stores

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Amorepacific

- 11.2 Beiersdorf

- 11.3 Clarins

- 11.4 Clorox

- 11.5 Coty

- 11.6 Estee Lauder

- 11.7 Herbivore Botanicals

- 11.8 Johnson and Johnson

- 11.9 Kiehl’s

- 11.10 L'Oreal

- 11.11 Procter and Gamble

- 11.12 Shiseido

- 11.13 Tata Harper Skincare

- 11.14 The Body Shop

- 11.15 Unilever