|

市場調查報告書

商品編碼

1721606

住宅地毯捲市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Residential Carpet Roll Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

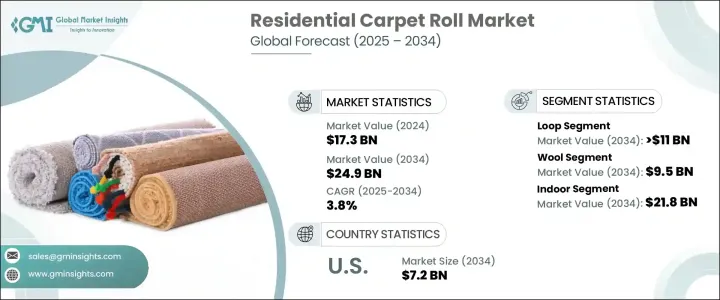

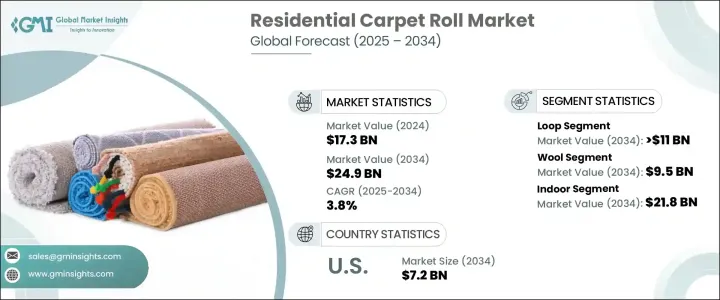

2024 年全球住宅地毯捲市場價值為 173 億美元,預計到 2034 年將以 3.8% 的複合年成長率成長,達到 249 億美元。隨著全球屋主更加重視室內舒適度、永續性和美觀性,市場正在獲得強勁發展勢頭。隨著房屋建設和改造率的上升,特別是在城市地區和郊區,地毯捲正在成為首選的地板材料。它們具有柔軟、溫暖、吸音的表面,可改善日常生活。隨著家居設計趨勢轉向舒適和個性化的室內裝飾,消費者正在積極選擇兼具功能性和風格的地毯捲。室內裝潢師和房地產專業人士也建議鋪設地毯,以提高房產吸引力和轉售價值。新屋主,尤其是千禧世代,傾向於易於安裝、維護成本低且符合現代美學的地板。由於有各種各樣的紋理、圖案和永續材料可供選擇,地毯捲現在被視為既實用又時尚的投資。

已開發地區房屋裝修活動的興起和新興經濟體持續的城市化浪潮推動了市場擴張。隨著新住宅項目的出現和老房子的升級,地板仍然是一個關鍵的關注領域。地毯捲具有舒適性、隔音性和設計多功能性,使其成為首次購房者和升級空間者的熱門選擇。無論是新建住宅還是翻新住宅,對經濟實惠、外觀美觀且易於鋪設的地板解決方案的需求持續激增。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 173億美元 |

| 預測值 | 249億美元 |

| 複合年成長率 | 3.8% |

城市人口成長導致緊湊居住空間明顯增加,尤其是在大城市。地毯捲可以節省空間,提供實用的地板,並且易於處理和維護。隨著環保生活意識的增強,再生纖維地毯和低影響生產方法正在掀起波瀾。消費者越來越傾向於提供可生物分解或永續來源材料的品牌,而擁抱這些綠色趨勢的製造商正在獲得競爭優勢。

按產品類型分類,圈絨地毯市場在 2024 年的產值達 74 億美元,預計到 2034 年將達到 110 億美元。圈絨地毯因其耐污性、卓越的耐用性和輕鬆的保養而廣受歡迎。圈絨地毯專為人流量大的區域而設計,由於採用連續纖維結構,因此能夠保持形狀,減少脫落和磨損。它們緊密的編織給人一種堅實的腳感,這對尋求長期價值和彈性的家庭來說很有吸引力。

根據材料,羊毛部分在 2024 年的價值為 64 億美元,預計到 2034 年將達到 95 億美元。羊毛因其天然的柔軟性、可再生性和長壽命而脫穎而出。即使在繁忙區域也能保持其外觀,並具有隔熱和阻燃功能,使其成為優質的住宅地板選擇。

2024 年,美國住宅地毯捲市場產值達 47 億美元,預計到 2034 年將達到 72 億美元。強勁的住房趨勢、高額的家居裝修支出以及對舒適地板的偏好推動了這一需求。美國各地的獨戶住宅由於使用地毯來保暖和控制噪音,做出了巨大貢獻。

為了擴大影響力,Milliken & Company、Beaulieu International Group、Tarkett、Shaw Industries Group、Dixie Group、Kraus Flooring、J+J Flooring Group、Bentley Mills、Godfrey Hirst Carpets、Mohawk Industries、Masland Carpets、Interface、Phenix Flooring、Engineered Flooring 和Engineered許多公司正在加強其數位影響力、擴大零售網路並提供客製化選項。與建築商和家居裝飾零售商建立策略合作夥伴關係,以及推出適合現代生活方式的產品,有助於品牌提高知名度並培養長期的客戶忠誠度。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 定價分析

- 技術與創新格局

- 重要新聞和舉措

- 監管格局

- 製造商

- 經銷商

- 零售商

- 對部隊的影響

- 成長動力

- 房屋裝修日益增多

- 都市化進程加速

- 產業陷阱與挑戰

- 偏愛硬地板

- 成長動力

- 成長潛力分析

- 消費者購買行為

- 人口趨勢

- 影響購買決策的因素

- 消費者產品採用

- 首選配銷通路

- 首選價格範圍

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 環形

- 切割和循環

- 割絨(紋理)

- 扭曲飾帶

第6章:市場估計與預測:依資料,2021 年至 2034 年

- 主要趨勢

- 尼龍

- 羊毛

- 絲綢

- 聚酯纖維

- 丙烯酸纖維

- 其他(黃麻、聚丙烯等)

第7章:市場估計與預測:依樁高,2021 年至 2034 年

- 主要趨勢

- 低(小於 1/4 英吋)

- 中(1/4英寸 - 1/2英寸)

- 高(1/2吋以上)

第8章:市場估計與預測:依厚度,2021 年至 2034 年

- 主要趨勢

- 小於6毫米

- 6毫米-10毫米

- 10毫米-15毫米

- 15毫米以上

第9章:市場估計與預測:依設計,2021 年至 2034 年

- 主要趨勢

- 堅硬的

- 列印

第10章:市場估計與預測:依價格,2021 年至 2034 年

- 主要趨勢

- 低的

- 中等的

- 高的

第 11 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 室內的

- 客廳

- 臥室

- 樓梯

- 飯廳

- 其他(廚房、地下室、家庭劇院等)

- 戶外的

- 花園

- 水池

- 其他

第 12 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 離線

第 13 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第 14 章:公司簡介

- Beaulieu International Group

- Bentley Mills

- Dixie Group

- Engineered Floors

- Godfrey Hirst Carpets

- Interface

- J+J Flooring Group

- Kraus Flooring

- Masland Carpets

- Milliken & Company

- Mohawk Industries

- Phenix Flooring

- Shaw Industries Group

- Stanton Carpet

- Tarkett

The Global Residential Carpet Roll Market was valued at USD 17.3 billion in 2024 and is estimated to grow at a CAGR of 3.8% to reach USD 24.9 billion by 2034. This market is gaining strong momentum as homeowners worldwide place more focus on interior comfort, sustainability, and aesthetics. With housing construction and renovation rates climbing, especially in urban areas and suburban neighborhoods, carpet rolls are becoming a top flooring choice. They offer a soft, warm, and sound-absorbing surface that enhances everyday living. As home design trends shift toward cozy and personalized interiors, consumers are actively choosing carpet rolls that deliver both function and flair. Interior decorators and real estate professionals are also recommending carpeted floors to boost property appeal and resale value. New homeowners, particularly millennials, are leaning toward easy-to-install, low-maintenance flooring that fits modern aesthetics. With a wide variety of textures, patterns, and sustainable materials available, carpet rolls are now seen as both a practical and stylish investment.

Market expansion is fueled by rising home renovation activity in developed regions and the continued wave of urbanization across emerging economies. As new housing developments emerge and older homes undergo upgrades, flooring remains a critical focus area. Carpet rolls provide comfort, sound insulation, and design versatility, making them a popular pick for first-time buyers and those upgrading their spaces. The demand for budget-friendly, visually appealing, and easy-to-lay flooring solutions continues to surge in both new constructions and renovated residences.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.3 Billion |

| Forecast Value | $24.9 Billion |

| CAGR | 3.8% |

Urban population growth has led to a noticeable uptick in compact living spaces, particularly in metro cities. Carpet rolls offer space-saving, practical flooring that's easy to handle and maintain. As eco-conscious living gains traction, recycled fiber carpets and low-impact production methods are making waves. Consumers are gravitating toward brands offering biodegradable or sustainably sourced materials, and manufacturers embracing these green trends are gaining a competitive edge.

By product type, the loop carpets segment generated USD 7.4 billion in 2024 and is projected to reach USD 11 billion by 2034. Their popularity stems from their stain resistance, superior durability, and hassle-free upkeep. Built for high-traffic areas, loop carpets hold their form due to continuous fiber construction, reducing shedding and wear. Their tight weave gives a firm feel underfoot, which appeals to households seeking long-term value and resilience.

Based on materials, the wool segment accounted for USD 6.4 billion in 2024 and is forecasted to reach USD 9.5 billion by 2034. Wool stands out for its natural softness, renewability, and longevity. It retains its appearance even in busy areas and offers thermal insulation and flame resistance, positioning it as a premium residential flooring option.

The U.S. Residential Carpet Roll Market generated USD 4.7 billion in 2024 and is projected to hit USD 7.2 billion by 2034. The demand is driven by strong housing trends, high home improvement spending, and a preference for cozy flooring. Single-family homes across the U.S. contribute significantly due to their use of carpets for warmth and noise control.

To expand their footprint, companies like Milliken & Company, Beaulieu International Group, Tarkett, Shaw Industries Group, Dixie Group, Kraus Flooring, J+J Flooring Group, Bentley Mills, Godfrey Hirst Carpets, Mohawk Industries, Masland Carpets, Interface, Phenix Flooring, Engineered Floors, and Stanton Carpet are prioritizing eco-friendly product innovation. Many are strengthening their digital presence, widening retail networks, and offering customization options. Strategic partnerships with builders and home improvement retailers, along with launches tailored to modern lifestyles, are helping brands gain visibility and foster long-term customer loyalty.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising home renovations

- 3.10.1.2 Growing urbanization

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Preference for hard flooring

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Consumer buying behavior

- 3.12.1 Demographic trends

- 3.12.2 Factors affecting buying decisions

- 3.12.3 Consumer product adoption

- 3.12.4 Preferred distribution channel

- 3.12.5 Preferred price range

- 3.13 Porter’s analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 – 2034, (USD Billion) (Million Square Meters)

- 5.1 Key trends

- 5.2 Loop

- 5.3 Cut & loop

- 5.4 Cut pile (texture)

- 5.5 Twist frieze

Chapter 6 Market Estimates & Forecast, By Material, 2021 – 2034, (USD Billion) (Million Square Meters)

- 6.1 Key trends

- 6.2 Nylon

- 6.3 Wool

- 6.4 Silk

- 6.5 Polyester

- 6.6 Acrylic

- 6.7 Others (jute, polypropylene, etc.)

Chapter 7 Market Estimates & Forecast, By Pile Height, 2021 – 2034, (USD Billion) (Million Square Meters)

- 7.1 Key trends

- 7.2 Low (less than 1/4")

- 7.3 Medium (1/4" - 1/2")

- 7.4 High (1/2" and above)

Chapter 8 Market Estimates & Forecast, By Thickness, 2021 – 2034, (USD Billion) (Million Square Meters)

- 8.1 Key trends

- 8.2 Less than 6 mm

- 8.3 6mm -10mm

- 8.4 10mm - 15mm

- 8.5 Above 15mm

Chapter 9 Market Estimates & Forecast, By Design, 2021 – 2034, (USD Billion) (Million Square Meters)

- 9.1 Key trends

- 9.2 Solid

- 9.3 Printed

Chapter 10 Market Estimates & Forecast, By Price, 2021 – 2034, (USD Billion) (Million Square Meters)

- 10.1 Key trends

- 10.2 Low

- 10.3 Medium

- 10.4 High

Chapter 11 Market Estimates & Forecast, By Application, 2021 – 2034, (USD Billion) (Million Square Meters)

- 11.1 Key trends

- 11.2 Indoor

- 11.2.1 Living room

- 11.2.2 Bedroom

- 11.2.3 Stairs

- 11.2.4 Dining room

- 11.2.5 Others (kitchen, basement, home theater, etc.)

- 11.3 Outdoor

- 11.3.1 Garden

- 11.3.2 Pool

- 11.3.3 Others

Chapter 12 Market Estimates & Forecast, By Distribution Channel, 2021 – 2034, (USD Billion) (Million Square Meters)

- 12.1 Key trends

- 12.2 Online

- 12.3 Offline

Chapter 13 Market Estimates & Forecast, By Region, 2021 – 2034, (USD Billion) (Million Square Meters)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Italy

- 13.3.5 Spain

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 India

- 13.4.3 Japan

- 13.4.4 South Korea

- 13.4.5 Australia

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.6 MEA

- 13.6.1 Saudi Arabia

- 13.6.2 UAE

- 13.6.3 South Africa

Chapter 14 Company Profiles

- 14.1 Beaulieu International Group

- 14.2 Bentley Mills

- 14.3 Dixie Group

- 14.4 Engineered Floors

- 14.5 Godfrey Hirst Carpets

- 14.6 Interface

- 14.7 J+J Flooring Group

- 14.8 Kraus Flooring

- 14.9 Masland Carpets

- 14.10 Milliken & Company

- 14.11 Mohawk Industries

- 14.12 Phenix Flooring

- 14.13 Shaw Industries Group

- 14.14 Stanton Carpet

- 14.15 Tarkett