|

市場調查報告書

商品編碼

1721605

口袋門市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Pocket Door Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

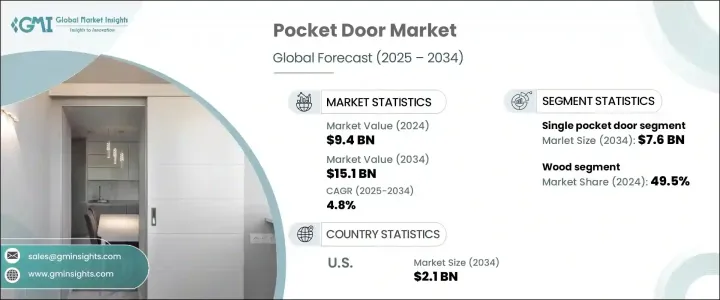

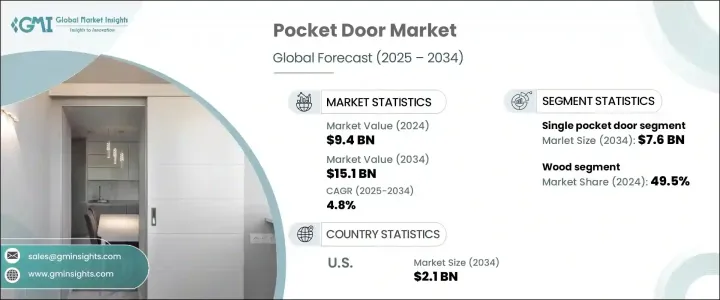

2024 年全球口袋門市場價值為 94 億美元,預計到 2034 年將以 4.8% 的複合年成長率成長,達到 151 億美元。隨著越來越多的人優先考慮智慧、節省空間的室內空間,住宅和商業環境中對口袋門的需求都在穩步上升。這些滑動門可以巧妙地融入牆壁空腔中,而無需旋轉打開,從而提供了一種時尚實用的解決方案,可以最大限度地利用地面空間。緊湊的城市生活、簡約的美學和多功能房間佈局的轉變正在推動一波設計創新浪潮,而口袋門正是這波浪潮的中心。消費者正在尋找無縫的設計元素,不僅可以從視覺上提升室內裝飾,還可以最佳化每一吋空間。隨著靈活的平面圖成為現代建築的標準,這些門正成為重要的建築特徵。無論是根據需求連接或分隔房間、改善交通流量或創造整潔的環境,滑動門都證明了其價值。隨著建築和裝修趨勢繼續傾向於更聰明、更適應性的佈局,口袋門市場在未來幾年將進一步蓬勃發展。

2024 年,單口袋門市場產值達 47 億美元,預計到 2034 年將達到 76 億美元。這些門在浴室、壁櫥和小臥室等緊湊空間中尤其常見,在這些空間中節省面積最為重要。與傳統的鉸鏈門不同,單口袋門可以滑入牆壁並釋放可用空間,同時保持區域清潔和實用。雙開口袋門在開放式平面圖中越來越受歡迎,特別是在需要較大入口以在房間之間實現無縫流動的住宅和辦公室中。單邊口袋門具有更大的設計靈活性和易於安裝的特點,正在成為追求客製化佈局的設計師的首選。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 94億美元 |

| 預測值 | 151億美元 |

| 複合年成長率 | 4.8% |

按材質分類,木材在 2024 年佔據市場主導地位,佔有 49.5% 的佔有率。木質口袋門憑藉其自然的外觀、多功能性以及適應各種裝飾風格的能力,仍然是屋主和設計師的首選。憑藉出色的隔音效果和溫暖的外觀,它們非常適合臥室、家庭辦公室和閱讀角落等安靜區域。買家還可以選擇使用各種染色和飾面來個性化木門,以匹配其室內主題。木材的適應性和永恆的吸引力繼續支持其在傳統和現代室內設計中的成長。

2024年,美國折疊門市場規模達13.6億美元,預計2034年將達21億美元。持續的城市化、蓬勃發展的房地產市場和商業房地產開發為折疊門的安裝創造了有利條件。開發商和建築師越來越依賴這些門來滿足大都會對高效、現代化空間日益成長的需求。

全球口袋門市場的主要參與者包括 Hafele、Crown Industrial、Larsen & Shaw Limited、Amba Products、Raydoor、Johnson Hardware、Colonial Elegance Inc.、Marwin Company、Hafele America Co.、Sun Mountain, Inc.、Klein USA、Andersen Windows & Doors、REE-HHTEC Co.、Sun Mountain, Inc.、Klein USA、Andersen Windows & Doors、REE-HHTECHTEC、Scurssea, Ltd.、Scurez。塑造競爭格局的關鍵策略包括持續的產品創新、擴大環保和可客製化的產品線以及與房地產開發商和室內設計師建立合作夥伴關係。該公司也在改善其線上形象和電子商務平台,以滿足 DIY 買家的需求並簡化客戶旅程。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 原料分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 快速的城市化和生活方式的改變

- 酒店業蓬勃發展

- 增加消費支出

- 增加可支配收入

- 產業陷阱與挑戰

- 安裝複雜性

- 維護要求

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 單扇口袋門

- 雙口袋門

- 單側口袋門

第6章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 木頭

- 玻璃

- 鋁

- 乙烯基塑膠

- 其他(鋼、玻璃纖維)

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 住宅

- 商業和工業

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 線上

- 電子商務網站

- 公司自有網站

- 離線

- 專賣店

- 百貨公司

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Amba Products

- Andersen Windows & Doors

- Colonial Elegance Inc.

- Crown Industrial

- Eclisse

- Hafele

- Hafele America Co.

- Johnson Hardware

- Klein USA

- Larsen & Shaw Limited

- Marwin Company

- Raydoor

- REE-TECH Industrial Co., Ltd.

- Saima Sicurezza SpA

- Sun Mountain, Inc.

The Global Pocket Door Market was valued at USD 9.4 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 15.1 billion by 2034. As more people prioritize smart, space-saving interiors, the demand for pocket doors is steadily rising across both residential and commercial settings. These sliding doors disappear neatly into wall cavities instead of swinging open, offering a sleek and practical solution to maximize floor space. The shift toward compact urban living, minimalist aesthetics, and multifunctional room layouts is driving a wave of design innovation-and pocket doors are right at the center of it. Consumers are looking for seamless design elements that not only elevate interiors visually but also optimize every inch of space. With flexible floor plans becoming the norm in modern construction, these doors are turning into an essential architectural feature. Whether it's about connecting or separating rooms on demand, improving traffic flow, or creating clutter-free environments, pocket doors are proving their worth. As construction and renovation trends continue leaning into smarter, more adaptable layouts, the pocket door market is set to thrive further in the coming years.

In 2024, the single-pocket door segment generated USD 4.7 billion and is projected to reach USD 7.6 billion by 2034. These doors are especially common in compact spaces like bathrooms, closets, and small bedrooms, where saving square footage matters most. Unlike traditional hinged doors, single-pocket doors slide into the wall and free up usable space while keeping the area clean and functional. Double pocket doors are gaining popularity in open-concept floor plans, especially in homes and offices where larger entryways are needed to create a seamless flow between rooms. Unilateral pocket doors, offering more design flexibility and ease of installation, are becoming the go-to choice for designers aiming for customized layouts.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.4 Billion |

| Forecast Value | $15.1 Billion |

| CAGR | 4.8% |

By material, wood dominated the market in 2024, accounting for a 49.5% share. Wooden pocket doors remain a top choice for homeowners and designers alike, thanks to their natural look, versatility, and ability to fit into a wide range of decor styles. With excellent sound insulation and a warm finish, they are ideal for quiet zones such as bedrooms, home offices, and reading nooks. Buyers are also drawn to the option of personalizing wood doors with various stains and finishes to match their interior themes. Wood's adaptability and timeless appeal continue to support its growth in both traditional and modern interiors.

The U.S. Pocket Door Market reached USD 1.36 billion in 2024 and is expected to generate USD 2.1 billion by 2034. Ongoing urbanization, a booming housing market, and commercial real estate development are creating favorable conditions for pocket door installations. Developers and architects are increasingly relying on these doors to meet the growing need for efficient, modern spaces in metropolitan areas.

Major players in the global pocket door market include Hafele, Crown Industrial, Larsen & Shaw Limited, Amba Products, Raydoor, Johnson Hardware, Colonial Elegance Inc., Marwin Company, Hafele America Co., Sun Mountain, Inc., Klein USA, Andersen Windows & Doors, REE-TECH Industrial Co., Ltd., Eclisse, and Saima Sicurezza S.p.A. Key strategies shaping the competitive landscape include continuous product innovation, expanding eco-friendly and customizable product lines, and forming partnerships with real estate developers and interior designers. Companies are also improving their online presence and e-commerce platforms to cater to DIY buyers and streamline the customer journey.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Raw material analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rapid urbanization and lifestyle changes

- 3.7.1.2 Growing hospitality sector

- 3.7.1.3 Increasing consumer spending

- 3.7.1.4 Increasing disposable income

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Installation complexity

- 3.7.2.2 Maintenance requirements

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Single pocket door

- 5.3 Double pocket door

- 5.4 Unilateral pocket door

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Wood

- 6.3 Glass

- 6.4 Aluminum

- 6.5 Vinyl

- 6.6 Others (steel, fiberglass)

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial & industrial

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 Online

- 8.2.1 E-commerce websites

- 8.2.2 Company-owned websites

- 8.3 Offline

- 8.3.1 Specialty stores

- 8.3.2 Departmental stores

- 8.3.3 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amba Products

- 10.2 Andersen Windows & Doors

- 10.3 Colonial Elegance Inc.

- 10.4 Crown Industrial

- 10.5 Eclisse

- 10.6 Hafele

- 10.7 Hafele America Co.

- 10.8 Johnson Hardware

- 10.9 Klein USA

- 10.10 Larsen & Shaw Limited

- 10.11 Marwin Company

- 10.12 Raydoor

- 10.13 REE-TECH Industrial Co., Ltd.

- 10.14 Saima Sicurezza S.p.A.

- 10.15 Sun Mountain, Inc.