|

市場調查報告書

商品編碼

1721604

AGM 電池市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測AGM Battery Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

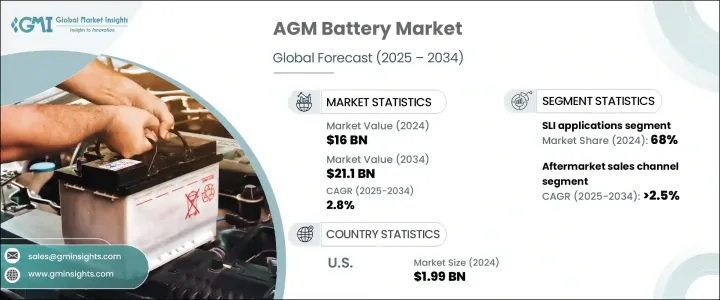

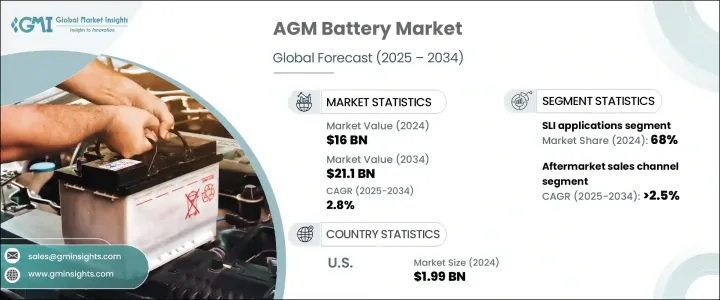

2024 年全球 AGM 電池市場價值為 160 億美元,預計到 2034 年將以 2.8% 的複合年成長率成長,達到 211 億美元。這項市場擴張主要得益於電動和混合動力車的日益普及,這需要先進的電池技術來提高性能。隨著汽車製造商專注於提高燃油效率和減少排放,AGM 電池已成為這些努力的關鍵組成部分。它們對於支援啟動停止系統尤其重要,啟動停止系統透過在怠速期間自動關閉和重新啟動引擎來幫助車輛減少燃料消耗。對車輛效率和永續性的貢獻推動了 AGM 電池在汽車和工業領域的普及。對能源儲存系統和環保運輸解決方案的投資不斷增加,進一步加速了市場的成長。

售後市場正在穩步成長,預計到 2034 年複合年成長率將達到 2.5%。老舊車輛(尤其是配備啟停系統的車輛)對可靠替換電池的需求不斷增加,推動了這項需求。同時,原始設備製造商正在加速採用 AGM 電池,並將其作為新型車型的標準或可選組件。隨著車輛設計繼續優先考慮能源效率,AGM 電池符合更廣泛的永續性、性能和監管目標。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 160億美元 |

| 預測值 | 211億美元 |

| 複合年成長率 | 2.8% |

2024 年,SLI 應用領域佔據主導地位,達 68%。現代車輛廣泛採用啟停系統,需要可靠、持久的動力,這為這一領域帶來了顯著的益處。 AGM 電池非常適合這種高性能需求,使其成為此類應用中的首選。受儲能系統需求不斷成長的推動,固定應用領域也正在經歷持續成長。隨著再生能源變得越來越普遍,AGM 電池正在部署在備用和離網電力系統中,確保穩定性和不間斷的能源供應。其低維護和耐用的設計進一步支持了它們在商業和住宅能源基礎設施中日益廣泛的應用。

在美國,AGM 電池市場在 2024 年創造了 19.9 億美元的產值。這一成長得益於燃油效率和混合動力汽車的日益普及,以及老舊車輛對可靠替換電池的持續需求。隨著人們不斷關注減少碳足跡和提高車輛性能,AGM 電池正成為越來越多先進車型的標準配備。售後市場仍保持強勁,這得益於高使用率地區對電池更換的持續需求。

Exide Technologies、C&D Technologies、EnerSys、GS Yuasa International、Hoppecke Batterien、The Furukawa Battery、Mutlu Battery、Amara Raja Batteries、East Penn Manufacturing、Leoch International Technology、First National Battery、Crown Battery、Clarios 和山東聖陽電源等公司都專注於垂直整合、形成運動並擴大度。這些公司正在投資先進的電池化學技術,提高能量密度並改善電池生命週期性能。許多公司也正在建立OEM合作夥伴關係並擴大其全球分銷網路,同時透過回收計劃和環保製造實踐優先實現永續性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 固定式

- 電信

- UPS

- 控制和開關設備

- 其他

- 動機

- 速連

第6章:市場規模及預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 俄羅斯

- 義大利

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 伊朗

- 土耳其

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

第8章:公司簡介

- Amara Raja Batteries

- C&D Technologies

- Clarios

- Crown Battery

- East Penn Manufacturing

- EnerSys

- Exide Technologies

- First National Battery

- GS Yuasa International

- Hoppecke Batterien

- Leoch International Technology

- Mutlu Battery

- Shandong Sacred Sun Power Sources

- The Furukawa Battery

The Global AGM Battery Market was valued at USD 16 billion in 2024 and is estimated to grow at a CAGR of 2.8% to reach USD 21.1 billion by 2034. This market expansion is primarily driven by the increasing adoption of electric and hybrid vehicles, which demand advanced battery technologies to enhance performance. As automotive manufacturers focus on improving fuel efficiency and reducing emissions, AGM batteries have emerged as a key component in these efforts. They are especially crucial for supporting start-stop systems, which help vehicles cut down on fuel consumption by automatically shutting off and restarting engines during idle periods. This contribution to vehicle efficiency and sustainability is driving the popularity of AGM batteries across both automotive and industrial sectors. The growing investment in energy storage systems and environmentally friendly transportation solutions is further accelerating market growth.

The aftermarket segment is experiencing steady growth, projected to register a CAGR of 2.5% through 2034. The increasing need for dependable replacement batteries in older vehicles, particularly those equipped with start-stop systems, is fueling this demand. Meanwhile, original equipment manufacturers are incorporating AGM batteries at an accelerating pace, using them as standard or optional components in newer car models. As vehicle designs continue to prioritize energy efficiency, AGM batteries align with broader sustainability, performance, and regulatory goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $16 Billion |

| Forecast Value | $21.1 Billion |

| CAGR | 2.8% |

In 2024, the SLI applications segment accounted for a dominant 68% share. This segment benefits significantly from the widespread adoption of start-stop systems in modern vehicles, which require reliable, long-lasting power. AGM batteries are well-suited for this high-performance need, making them the preferred option in such applications. The stationary application segment is also experiencing consistent growth, driven by the increasing demand for energy storage systems. As renewable energy sources become more prevalent, AGM batteries are being deployed in backup and off-grid power systems, ensuring stability and an uninterrupted energy supply. Their low-maintenance and durable design further supports their growing use across commercial and residential energy infrastructures.

In the U.S., the AGM Battery Market generated USD 1.99 billion in 2024. This growth is bolstered by the rise in popularity of fuel-efficient and hybrid vehicles, as well as the ongoing need for reliable replacement batteries in older vehicles. With a continued focus on reducing carbon footprints and enhancing vehicle performance, AGM batteries are becoming standard in an increasing number of advanced vehicle models. The aftermarket segment remains robust, driven by consistent demand for battery replacements in high-usage regions.

Companies like Exide Technologies, C&D Technologies, EnerSys, GS Yuasa International, Hoppecke Batterien, The Furukawa Battery, Mutlu Battery, Amara Raja Batteries, East Penn Manufacturing, Leoch International Technology, First National Battery, Crown Battery, Clarios, and Shandong Sacred Sun Power Sources are focused on vertical integration, expanding their R&D efforts, and forming strategic alliances. These companies are investing in advanced battery chemistries, enhancing energy density, and improving battery lifecycle performance. Many are also forging OEM partnerships and expanding their global distribution networks while prioritizing sustainability through recycling programs and environmentally conscious manufacturing practices.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Application, 2021 - 2034 (USD Million, Million Units)

- 5.1 Key trends

- 5.2 Stationary

- 5.2.1 Telecommunications

- 5.2.2 UPS

- 5.2.3 Control & switchgear

- 5.2.4 Others

- 5.3 Motive

- 5.4 SLI

Chapter 6 Market Size and Forecast, By Sales Channel, 2021 - 2034 (USD Million, Million Units)

- 6.1 Key trends

- 6.2 OEM

- 6.3 Aftermarket

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million, Million Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Russia

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 South Korea

- 7.4.5 Indonesia

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 Iran

- 7.5.4 Turkey

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

- 7.6.3 Mexico

Chapter 8 Company Profiles

- 8.1 Amara Raja Batteries

- 8.2 C&D Technologies

- 8.3 Clarios

- 8.4 Crown Battery

- 8.5 East Penn Manufacturing

- 8.6 EnerSys

- 8.7 Exide Technologies

- 8.8 First National Battery

- 8.9 GS Yuasa International

- 8.10 Hoppecke Batterien

- 8.11 Leoch International Technology

- 8.12 Mutlu Battery

- 8.13 Shandong Sacred Sun Power Sources

- 8.14 The Furukawa Battery