|

市場調查報告書

商品編碼

1721592

生物光子學市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Biophotonics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

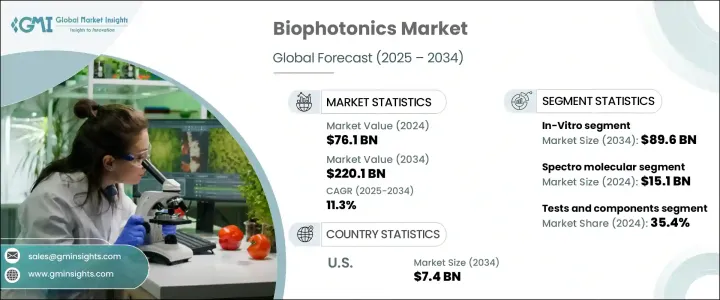

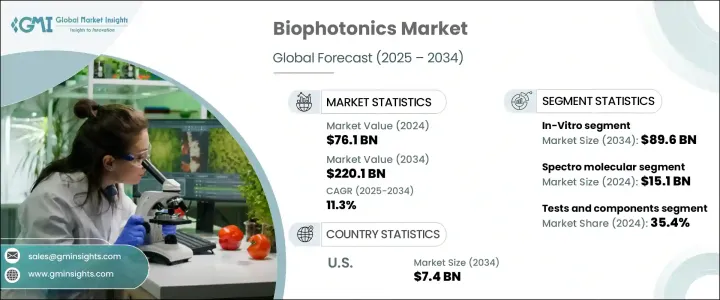

2024 年全球生物光子學市場價值為 761 億美元,預計到 2034 年將以 11.3% 的複合年成長率成長,達到 2,201 億美元。這一顯著的成長軌跡主要得益於醫療技術的快速進步以及奈米技術在診斷和治療平台上的加速融合。奈米技術在奈米尺度上增強光物質相互作用的能力徹底改變了生物系統的分析方式,使生物光子設備更加高效和精確。這些技術現在在檢測生物標記和成像組織時提供了更高的靈敏度和特異性,為更準確的診斷和客製化治療鋪平了道路,特別是在早期疾病檢測方面。

隨著對非侵入性手術和即時診斷的日益重視,醫療保健領域對生物光子創新的需求正在激增。全球日益關注個人化醫療,而個人化醫療在很大程度上依賴精確的分子資料,這進一步加強了對先進光學技術的需求。隨著技術的進步,醫療保健產業在研發、自動化和數據驅動決策方面的投資正在增加,這有助於簡化研究、診斷和治療領域的生物光子應用。此外,全球慢性病的增加促使人們更深入地探索高效、準確、更快捷的診斷方法——這是推動市場持續擴張的另一個因素。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 761億美元 |

| 預測值 | 2201億美元 |

| 複合年成長率 | 11.3% |

根據技術,市場分為體外和體內平台。其中,體外診斷領域成長顯著,預計到 2034 年將達到 896 億美元。這一成長主要得益於實驗室診斷的突破以及人工智慧驅動的分析和自動化的整合。這些進步最大限度地減少了人為錯誤,提高了操作效率,並使實驗室工作流程更加準確和靈敏。隨著醫療保健產業繼續優先考慮早期疾病檢測,體外生物光子平台的採用正在迅速擴大。

在應用方面,市場涵蓋各個領域,包括透視成像、顯微鏡、內部成像、光譜分子、分析感測、光療、表面成像和生物感測器。光譜分子領域佔據主導市場佔有率,2024 年價值 151 億美元。其在該領域的領先地位歸功於光譜工具的演變,這些工具現在可以在分子層面上提供更高的靈敏度和診斷精度。這些工具在識別與疾病相關的生化變化方面發揮著至關重要的作用,從而可以製定早期和更個性化的干涉策略。

從最終用途的角度來看,市場分為測試和組件、醫療診斷、醫療治療和非醫療應用。由於對先進診斷工具和精密成像技術的需求不斷成長,測試和組件部分在 2024 年佔據最大佔有率,為 35.4%。

從地區來看,美國引領北美生物光子學市場,預計到 2034 年其估值將達到 74 億美元,這得益於大量的研發支出、先進的醫療保健基礎設施以及為應對日益加重的慢性病負擔而對先進診斷解決方案的需求不斷成長。

該行業仍保持適度整合,賽默飛世爾科技公司、卡爾蔡司公司、濱松光子學株式會社、奧林巴斯公司和牛津儀器等頂級公司共佔約 55%-60% 的市場佔有率。這些公司繼續投資高精度生物光子技術,並擴大其地理覆蓋範圍以增強其競爭優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 奈米科技的出現

- 人口老化和生活方式疾病增多

- 生物光子學在細胞和組織診斷的應用日益廣泛

- 家用 POC 設備需求不斷成長

- 與人工智慧和機器學習的日益融合

- 產業陷阱與挑戰

- 技術成本高

- 商業化速度緩慢

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按技術,2021 年至 2034 年

- 主要趨勢

- 體外

- 體內

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 透明成像

- 顯微鏡

- 內部影像

- 光譜分子

- 分析感知

- 光療法

- 表面成像

- 生物感測器

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 測試和組件

- 醫學治療學

- 醫療診斷

- 非醫療應用

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 澳洲

- 韓國

- 日本

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第9章:公司簡介

- Becton, Dickinson and Company

- Carl Zeiss AG

- Glenbrook Technologies

- Hamamatsu Photonics KK

- IDEX

- IPG Photonics Corporation

- NU Skin Enterprises

- Olympus Corporation

- Oxford Instruments PLC

- PerkinElmer Inc.

- Thermo Fisher Scientific

- TOSHIBA CORPORATION

- Zecotek Photonics Inc.

- Zenalux Biomedical Inc

The Global Biophotonics Market was valued at USD 76.1 billion in 2024 and is estimated to grow at a CAGR of 11.3% to reach USD 220.1 billion by 2034. This remarkable growth trajectory is largely driven by rapid advancements in medical technology and the accelerating integration of nanotechnology across diagnostic and therapeutic platforms. The ability of nanotechnology to enhance light-matter interactions at the nanoscale has revolutionized the way biological systems are analyzed, making biophotonic devices more efficient and precise. These technologies now offer increased sensitivity and specificity when detecting biomarkers and imaging tissues, paving the way for more accurate diagnostics and tailored treatments, especially in early-stage disease detection.

With a growing emphasis on non-invasive procedures and real-time diagnostics, the demand for biophotonic innovations is surging across healthcare settings. The increasing global focus on personalized medicine, which relies heavily on precise molecular data, further reinforces the need for advanced optical technologies. Alongside technological evolution, the healthcare industry is witnessing greater investment in R&D, automation, and data-driven decision-making, which is helping streamline biophotonic applications across research, diagnostics, and treatment. Additionally, the rise in chronic conditions worldwide is prompting deeper exploration into efficient, accurate, and faster diagnostic methods-another factor contributing to the market's sustained expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $76.1 Billion |

| Forecast Value | $220.1 Billion |

| CAGR | 11.3% |

Based on technology, the market is bifurcated into In-Vitro and In-Vivo platforms. Among these, the In-Vitro segment is registering notable growth and is expected to reach USD 89.6 billion by 2034. This surge is primarily fueled by breakthroughs in lab-based diagnostics, as well as the integration of AI-driven analytics and automation. These advancements are minimizing human error, increasing operational efficiency, and making laboratory workflows more accurate and responsive. As the healthcare sector continues to prioritize early disease detection, the adoption of In-Vitro biophotonic platforms is expanding rapidly.

In terms of application, the market spans various segments, including see-through imaging, microscopy, inside imaging, spectro molecular, analytics sensing, light therapy, surface imaging, and biosensors. The spectro molecular segment held the dominant market share, valued at USD 15.1 billion in 2024. Its leadership in the segment is due to the evolution of spectroscopic tools that now offer enhanced sensitivity and diagnostic precision at the molecular level. These tools play a vital role in identifying biochemical changes linked to disease, thereby enabling early and more personalized intervention strategies.

From an end-use perspective, the market is segmented into tests and components, medical diagnostics, medical therapeutics, and non-medical applications. The tests and components segment accounted for the largest share at 35.4% in 2024, supported by rising demand for advanced diagnostic tools and precision imaging technologies.

Regionally, the United States leads the North American biophotonics market and is expected to achieve a valuation of USD 7.4 billion by 2034, thanks to heavy R&D spending, sophisticated healthcare infrastructure, and increasing demand for advanced diagnostic solutions in response to the growing burden of chronic illnesses.

The industry remains moderately consolidated, with top players like Thermo Fisher Scientific Inc., Carl Zeiss AG, Hamamatsu Photonics K.K., Olympus Corporation, and Oxford Instruments collectively controlling around 55%-60% of the market. These companies continue to invest in high-precision biophotonic technologies and expand their geographic footprint to reinforce their competitive edge.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Emergence of nanotechnology

- 3.2.1.2 Aging population and growing lifestyle diseases

- 3.2.1.3 Increasing use of biophotonics in cell and tissue diagnostics

- 3.2.1.4 Increasing demand for home-based POC devices

- 3.2.1.5 Rising integration with AI & ML

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of technology

- 3.2.2.2 Slow rate of commercialization

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Technology, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 In-Vitro

- 5.3 In-Vivo

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 See-Through imaging

- 6.3 Microscopy

- 6.4 Inside imaging

- 6.5 Spectro molecular

- 6.6 Analytics sensing

- 6.7 Light therapy

- 6.8 Surface imaging

- 6.9 Biosensors

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Tests and components

- 7.3 Medical therapeutics

- 7.4 Medical diagnostics

- 7.5 Non-medical application

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Australia

- 8.4.4 South Korea

- 8.4.5 Japan

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 U.A.E.

- 8.6.3 South Africa

Chapter 9 Company Profiles

- 9.1 Becton, Dickinson and Company

- 9.2 Carl Zeiss AG

- 9.3 Glenbrook Technologies

- 9.4 Hamamatsu Photonics K.K

- 9.5 IDEX

- 9.6 IPG Photonics Corporation

- 9.7 NU Skin Enterprises

- 9.8 Olympus Corporation

- 9.9 Oxford Instruments PLC

- 9.10 PerkinElmer Inc.

- 9.11 Thermo Fisher Scientific

- 9.12 TOSHIBA CORPORATION

- 9.13 Zecotek Photonics Inc.

- 9.14 Zenalux Biomedical Inc