|

市場調查報告書

商品編碼

1721559

住宅智慧鎖市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Residential Smart Lock Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

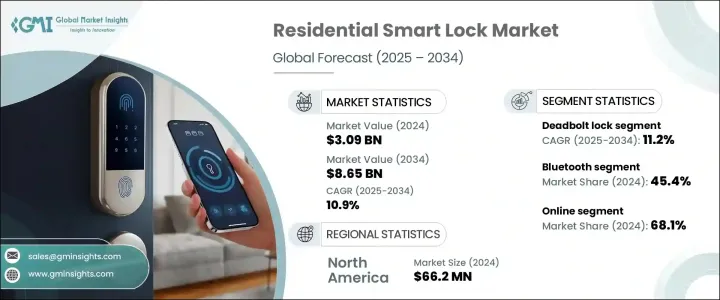

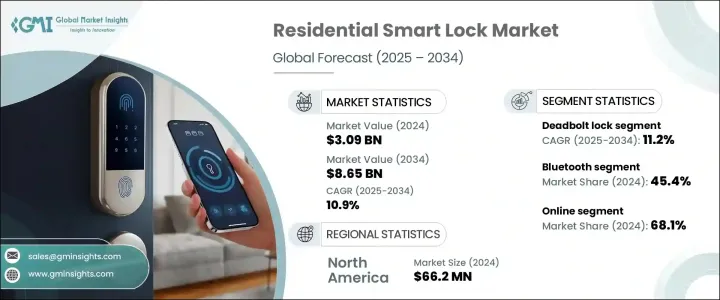

2024 年全球住宅智慧鎖市場價值為 30.9 億美元,預計到 2034 年將以 10.9% 的複合年成長率成長,達到 86.5 億美元。在向智慧家庭生態系統快速轉變的推動下,隨著屋主越來越重視便利性和安全性,市場正在獲得發展動力。人們對入室盜竊和入室搶劫的擔憂日益加劇,促使消費者從傳統的鎖系統升級到先進的智慧鎖解決方案,這種解決方案不僅可以提供增強的安全性,還提供無鑰匙進入和遠端控制功能。隨著城市人口的成長和智慧城市計畫的全球擴張,對互聯家居解決方案的需求持續上升。

技術進步,加上技術嫻熟人口的不斷成長,推動了住宅智慧鎖的普及。這些系統可以輕鬆地與語音助理、監視攝影機和家庭自動化平台整合,為用戶提供對家庭安全的集中控制。智慧型手機普及率的提高和網際網路基礎設施的改善也加速了這些設備的全球普及。此外,Airbnb 等租賃平台的日益普及使得智慧鎖成為非接觸式遠端訪客存取的首選解決方案,進一步擴大了其吸引力和實用性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 30.9億美元 |

| 預測值 | 86.5億美元 |

| 複合年成長率 | 10.9% |

市場依產品類型分類,包括槓桿手把、掛鎖、門閂鎖等。其中,2024 年門閂鎖市場價值為 13.7 億美元,預計預測期內複合年成長率為 11.2%。消費者更喜歡插銷鎖,因為它們結構堅固,功能先進。與傳統鎖相比,這些鎖具有更高的抗強行闖入能力,並且配備了藍牙、Wi-Fi 和生物識別等技術。智慧鎖具有遠端存取和免鑰匙進入功能,既方便又安心,成為現代家庭的首選。

根據連接性,市場分為 Wi-Fi、藍牙、Z-Wave 和其他。藍牙領域在 2024 年佔據 45.4% 的佔有率,並有望大幅成長。藍牙技術以其低功耗和經濟實惠而聞名,它允許用戶透過智慧型手機控制訪問,使其成為需要無縫整合和可靠性且無需持續網際網路連接的消費者的理想選擇。藍牙智慧鎖的可及性和能源效率正在推動其在住宅用戶中越來越受歡迎。

2024 年,北美佔據全球市場主導地位,佔有 36.1% 的佔有率,這歸功於該地區先進的基礎設施和智慧家居設備的廣泛採用。美國和加拿大的消費者正在積極投資安全升級,尤其是與家庭自動化系統相容的安全升級。生物辨識存取、行動警報和遠端鎖定等功能正在影響整個地區的購買決策。

全球住宅智慧鎖市場的主要參與者包括小米公司、Gantner Electronic GmbH、霍尼韋爾國際公司、Allegion Plc、Amadas Inc.、Salto Systems SL、Assa Abloy AB、Avent Security、Onity Inc.、Nord-Lock International AB、Spectrum Brands, Inc.、三星電子有限公司、ZegaTeco、三星電子有限公司, Home.這些公司專注於產品創新、策略合作和擴大分銷管道。他們在研發方面的投資旨在增強與智慧家庭平台的兼容性,並確保為現代屋主提供頂級的安全解決方案。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 定價分析

- 技術與創新格局

- 重要新聞和舉措

- 監管格局

- 製造商

- 經銷商

- 零售商

- 對部隊的影響

- 成長動力

- 全球智慧鎖的普及率不斷提高

- 安全擔憂加劇

- 智慧型手機使用率增加

- 增強功能與傳統鎖定系統的整合

- 產業陷阱與挑戰

- 不斷變化的消費者需求

- 高成本投資

- 成長動力

- 成長潛力分析

- 技術進步

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按產品類型,2021 - 2034 年(百萬美元)

- 主要趨勢

- 插銷鎖

- 槓桿手柄

- 掛鎖

- 其他

第6章:市場估計與預測:按解鎖機制,2021 - 2034 年(百萬美元)

- 主要趨勢

- 鍵盤

- 觸控螢幕

- 基於應用程式

- 混合

- 生物識別

- 其他

第7章:市場估計與預測:按連結類型,2021 - 2034 年(百萬美元)

- 主要趨勢

- 無線上網

- 藍牙

- Z-波

- 其他

第8章:市場估計與預測:依價格區間,2021 - 2034 年(百萬美元)

- 主要趨勢

- 低(100 美元)

- 中(100-300美元)

- 高(>300 美元)

第9章:市場估計與預測:按最終用途,2021 - 2034 年(百萬美元)

- 主要趨勢

- 共管公寓

- 獨立住宅

- 公寓

- 其他(度假屋等)

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年(百萬美元)

- 主要趨勢

- 線上通路

- 電子商務

- 公司網站

- 線下通路

- 專賣店

- 大型零售商店

- 其他

第 11 章:市場估計與預測:按地區,2021 年至 2034 年(百萬美元)

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 瑪米亞

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第12章:公司簡介

- Allegion Plc

- Amadas Inc.

- Assa Abloy AB

- August Home Inc.

- Avent Security

- Gantner Electronic GmbH

- Honeywell International Inc.

- Megadoorlock Technology Co., Ltd.

- Nord-Lock International AB

- Onity Inc.

- Salto Systems SL

- Samsung Electronics Co. Ltd.

- Spectrum Brands, Inc.

- Xiaomi Corporation

- ZKTeco USA

The Global Residential Smart Lock Market was valued at USD 3.09 billion in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 8.65 billion by 2034. Driven by a rapid shift toward smart home ecosystems, this market is gaining traction as homeowners increasingly prioritize both convenience and security. Rising concerns over break-ins and home invasions are prompting consumers to upgrade from traditional locking systems to advanced smart lock solutions that provide not only enhanced security but also keyless access and remote control features. As urban populations grow and smart city projects expand globally, the demand for connected home solutions continues to rise.

Technological advancements, combined with a growing tech-savvy population, are fueling the adoption of residential smart locks. These systems can be easily integrated with voice assistants, surveillance cameras, and home automation platforms, offering users centralized control of their home security. Increasing penetration of smartphones and improved internet infrastructure are also accelerating the global adoption of these devices. Furthermore, the growing popularity of rental platforms like Airbnb has made smart locks a go-to solution for contactless, remote guest access, further widening their appeal and utility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.09 Billion |

| Forecast Value | $8.65 Billion |

| CAGR | 10.9% |

The market is categorized by product type, including lever handles, padlocks, deadbolt locks, and others. Among these, the deadbolt lock segment generated USD 1.37 billion in 2024 and is anticipated to expand at a CAGR of 11.2% through the forecast period. Consumers prefer deadbolt locks for their robust build quality and advanced features. These locks provide higher resistance to forced entry compared to traditional options and are now equipped with technologies like Bluetooth, Wi-Fi, and biometrics. With remote access and keyless entry functionalities, smart deadbolt locks offer both convenience and peace of mind, making them a preferred choice for modern households.

Based on connectivity, the market is segmented into Wi-Fi, Bluetooth, Z-Wave, and others. The Bluetooth segment held a 45.4% share in 2024 and is positioned for substantial growth. Known for its low power consumption and affordability, Bluetooth technology allows users to control access via smartphones, making it an ideal fit for consumers who demand seamless integration and reliability without the need for constant internet connectivity. The accessibility and energy efficiency of Bluetooth-enabled smart locks are driving their popularity among residential users.

North America dominated the global market with a 36.1% share in 2024, attributed to the region's advanced infrastructure and widespread adoption of smart home devices. Consumers across the U.S. and Canada are actively investing in security upgrades, especially those compatible with home automation systems. Features like biometric access, mobile alerts, and remote locking are influencing purchasing decisions across the region.

Major players in the global residential smart lock market include Xiaomi Corporation, Gantner Electronic GmbH, Honeywell International Inc., Allegion Plc, Amadas Inc., Salto Systems S.L., Assa Abloy AB, Avent Security, Onity Inc., Nord-Lock International AB, Spectrum Brands, Inc., Samsung Electronics Co. Ltd., ZKTeco USA, Megadoorlock Technology Co., Ltd., and August Home Inc. These companies are focusing on product innovation, strategic collaborations, and expanding distribution channels. Their investments in R&D are aimed at enhancing compatibility with smart home platforms and ensuring top-tier security solutions for modern homeowners.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.3 Pricing analysis

- 3.4 Technology & innovation landscape

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Manufacturers

- 3.8 Distributors

- 3.9 Retailers

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increase in adoption of smart locks on a global scale

- 3.10.1.2 Rise in security concerns

- 3.10.1.3 Increased use of smartphones

- 3.10.1.4 Integration of enhanced features with traditional lock systems

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Evolving consumer demands

- 3.10.2.2 High-cost investments

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Technological advancements

- 3.13 Porter’s analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034 ($Mn) (Thousand Units)

- 5.1 Key trends

- 5.2 Deadbolt lock

- 5.3 Lever handle

- 5.4 Padlock

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Unlocking Mechanism, 2021 - 2034 ($Mn) (Thousand Units)

- 6.1 Key trends

- 6.2 Keyboard

- 6.3 Touchscreen

- 6.4 App based

- 6.5 Hybrid

- 6.6 Biometric

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Connectivity Type, 2021 - 2034 ($Mn) (Thousand Units)

- 7.1 Key trends

- 7.2 Wi-Fi

- 7.3 Bluetooth

- 7.4 Z-wave

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Price Range, 2021 - 2034 ($Mn) (Thousand Units)

- 8.1 Key trends

- 8.2 Low (100$)

- 8.3 Mid (100$-300$)

- 8.4 High (>300$)

Chapter 9 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Mn) (Thousand Units)

- 9.1 Key trends

- 9.2 Condominium

- 9.3 Individual houses

- 9.4 Apartments

- 9.5 Others (vacation homes, etc.)

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Mn) (Thousand Units)

- 10.1 Key trends

- 10.2 Online channels

- 10.2.1 E-commerce

- 10.2.2 Company websites

- 10.3 Offline channels

- 10.3.1 Specialty stores

- 10.3.2 Mega retail stores

- 10.3.3 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn) (Thousand Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 The U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.3.6 Russia

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MAMEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 Allegion Plc

- 12.2 Amadas Inc.

- 12.3 Assa Abloy AB

- 12.4 August Home Inc.

- 12.5 Avent Security

- 12.6 Gantner Electronic GmbH

- 12.7 Honeywell International Inc.

- 12.8 Megadoorlock Technology Co., Ltd.

- 12.9 Nord-Lock International AB

- 12.10 Onity Inc.

- 12.11 Salto Systems S.L.

- 12.12 Samsung Electronics Co. Ltd.

- 12.13 Spectrum Brands, Inc.

- 12.14 Xiaomi Corporation

- 12.15 ZKTeco USA