|

市場調查報告書

商品編碼

1721548

電路保護市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Circuit Protection Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

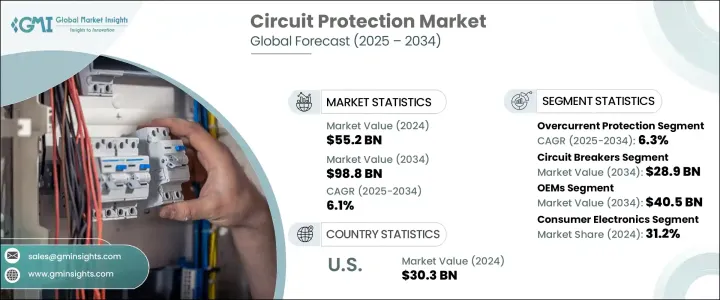

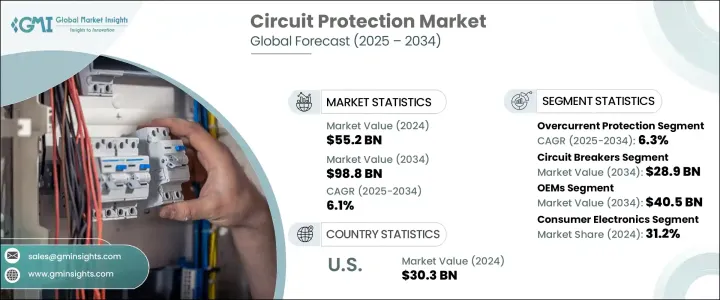

2024 年全球電路保護市場價值為 552 億美元,預計到 2034 年將以 6.1% 的複合年成長率成長,達到 988 億美元。這一勢頭很大程度上是由於多個行業對穩定、安全的電氣系統的依賴性日益增強。隨著世界向電氣化和智慧基礎設施轉變,對先進電路保護技術的需求正在穩步上升。電動車的快速普及、向再生能源的轉變以及智慧城市的擴張都在推動這一趨勢。同時,全球各地的企業正在採用人工智慧、機器學習和工業自動化等下一代技術,這些技術需要穩定、高品質的電源。這些技術使能源系統變得更加複雜,從而增加了對有效電路保護機制的需求,以避免停機、防止設備損壞並確保運作連續性。

從住宅建築到大型工業設施,電路保護的角色變得越來越重要。在現代基礎設施中,系統高度互聯且由數據驅動,電力波動或過載會嚴重影響性能並造成重大財務損失。斷路器、保險絲和電湧保護器等電路保護解決方案正在升級,以滿足不斷變化的電力需求,同時整合預測診斷、遠端管理和即時故障檢測等數位功能。隨著消費者和企業繼續優先考慮安全性、能源效率和長期系統可靠性,全球電路保護市場將在未來十年內持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 552億美元 |

| 預測值 | 988億美元 |

| 複合年成長率 | 6.1% |

過流保護領域正在獲得顯著的關注,預計到 2034 年將以 6.3% 的複合年成長率成長。住宅、商業建築和工業設施對智慧、高性能系統的需求不斷成長,迫使製造商提供更智慧的解決方案。遠端監控、自動診斷和延長耐用性等創新正在將這些設備推向基本基礎設施類別,特別是在能源可靠性和安全性不可協商的情況下。

根據產品類別,斷路器將佔據市場主導地位,預計到 2034 年將達到 289 億美元。電力基礎設施數位化整合的推動正在推動這一需求。配備智慧感測器和即時監控工具的斷路器正在成為預測性維護系統的重要組成部分。這些設備在智慧電網、電動車充電站和自動化製造單元中的部署日益增多,反映了智慧能源系統的更廣泛趨勢。

預計到 2034 年,德國電路保護市場將以 6.8% 的複合年成長率擴張。該國雄心勃勃的清潔能源目標和工業 4.0 的廣泛實施正在推動對先進保護系統的需求。數位化生產環境和再生能源設施正在尋求可靠的保護,以保持效率並最大限度地減少中斷。

推動全球市場創新的主要參與者包括三菱電機、Bel Fuse、西門子、ABB 和 Littelfuse。這些公司正在透過將物聯網、人工智慧和雲端分析整合到電路保護系統中來投資產品開發。擴大製造中心、與電動車和能源公司建立合作夥伴關係以及推出用於資料中心和智慧基礎設施的緊湊、高效產品仍然是首要策略。以提高能源效率和滿足全球安全標準為重點的研發支出和收購也推動長期成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 消費性電子產品需求不斷成長

- 電動車(EV)的普及率不斷提高

- 工業自動化和智慧製造的擴展

- 電信和5G部署的成長

- 對資料中心和雲端運算的需求不斷成長

- 產業陷阱與挑戰

- 先進電路保護裝置的初始成本高

- 與先進電子系統整合的複雜性

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依類型,2021-2034

- 主要趨勢

- 過流保護

- 靜電放電 (ESD) 保護

- 過壓保護

第6章:市場估計與預測:按產品,2021-2034

- 主要趨勢

- 斷路器

- 保險絲

- 過壓保護裝置

- 突波電流限制器

- 漏電斷路器

- 其他

第7章:市場估計與預測:按配銷通路,2021-2034

- 主要趨勢

- OEM

- 零售

- 批發的

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 消費性電子產品

- 汽車

- 商業和住宅

- 工業的

- 其他

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳新銀行

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- ABB

- Bel Fuse

- Eaton

- General Electric

- Hitachi

- Legrand

- Littelfuse

- Mitsubishi Electric

- NXP Semiconductors

- ON Semiconductor

- Panasonic

- Rockwell Automation

- Schneider Electric

- Siemens

- Texas Instruments

The Global Circuit Protection Market was valued at USD 55.2 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 98.8 billion by 2034. This momentum is largely driven by increasing reliance on stable and secure electrical systems across multiple industries. As the world shifts toward electrification and smart infrastructure, the demand for advanced circuit protection technologies is seeing a steady rise. The rapid adoption of electric vehicles, the transition to renewable energy, and the expansion of smart cities are all contributing to this trend. At the same time, businesses across the globe are adopting next-generation technologies like artificial intelligence, machine learning, and industrial automation, which require a consistent, high-quality power supply. These technologies are making energy systems more complex, thereby increasing the need for effective circuit protection mechanisms to avoid downtimes, prevent equipment damage, and ensure operational continuity.

From residential buildings to large-scale industrial setups, the role of circuit protection is becoming increasingly critical. In modern infrastructure, where systems are hyperconnected and data-driven, power fluctuations or overloads can severely impact performance and cause significant financial losses. Circuit protection solutions such as breakers, fuses, and surge protectors are being upgraded to handle evolving electrical demands while integrating digital features like predictive diagnostics, remote management, and real-time fault detection. As consumers and enterprises continue to prioritize safety, energy efficiency, and long-term system reliability, the global circuit protection market is positioned for sustained growth over the coming decade.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $55.2 Billion |

| Forecast Value | $98.8 Billion |

| CAGR | 6.1% |

The overcurrent protection segment is gaining significant traction and is expected to grow at a CAGR of 6.3% through 2034. Rising requirements for smart, high-performance systems in homes, commercial buildings, and industrial facilities are compelling manufacturers to deliver more intelligent solutions. Innovations such as remote monitoring, automated diagnostics, and extended durability are pushing these devices into essential infrastructure categories, especially where energy reliability and safety are non-negotiable.

Based on product category, circuit breakers are set to dominate the market and are projected to reach USD 28.9 billion by 2034. The push for digital integration in power infrastructure is driving this demand. Circuit breakers equipped with smart sensors and real-time monitoring tools are becoming vital components in predictive maintenance systems. The increasing deployment of these devices in smart grids, EV charging stations, and automated manufacturing units reflects a broader trend toward intelligent energy systems.

Germany circuit protection market is forecast to expand at a CAGR of 6.8% through 2034. The country's ambitious clean energy goals and widespread implementation of Industry 4.0 are boosting demand for advanced protective systems. Digitized production environments and renewable power facilities are seeking reliable protection to maintain efficiency and minimize disruptions.

Key players driving innovation in the global market include Mitsubishi Electric, Bel Fuse, Siemens, ABB, and Littelfuse. These companies are investing in product development by integrating IoT, AI, and cloud analytics into circuit protection systems. Expansion of manufacturing hubs, partnerships with EV and energy companies, and the launch of compact, high-efficiency products for data centers and smart infrastructure remain top strategies. R&D spending and acquisitions focused on enhancing energy efficiency and meeting global safety standards are also steering long-term growth.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for consumer electronics

- 3.2.1.2 Growing adoption of electric vehicles (EVs)

- 3.2.1.3 Expansion of industrial automation and smart manufacturing

- 3.2.1.4 Growth in telecommunications and 5G deployment

- 3.2.1.5 Rising demand for data centers and cloud computing

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial cost of advanced circuit protection devices

- 3.2.2.2 Complexity in integration with advanced electronic systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Overcurrent protection

- 5.3 Electrostatic discharge (ESD) protection

- 5.4 Overvoltage protection

Chapter 6 Market Estimates & Forecast, By Product, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 Circuit breakers

- 6.3 Fuses

- 6.4 Overvoltage protection devices

- 6.5 Inrush current limiter

- 6.6 GFCI

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Retail

- 7.4 Wholesale

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.3 Automotive

- 8.4 Commercial and residential

- 8.5 Industrial

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 ANZ

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 ABB

- 10.2 Bel Fuse

- 10.3 Eaton

- 10.4 General Electric

- 10.5 Hitachi

- 10.6 Legrand

- 10.7 Littelfuse

- 10.8 Mitsubishi Electric

- 10.9 NXP Semiconductors

- 10.10 ON Semiconductor

- 10.11 Panasonic

- 10.12 Rockwell Automation

- 10.13 Schneider Electric

- 10.14 Siemens

- 10.15 Texas Instruments