|

市場調查報告書

商品編碼

1721545

生質鍋爐市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Biomass Boiler Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

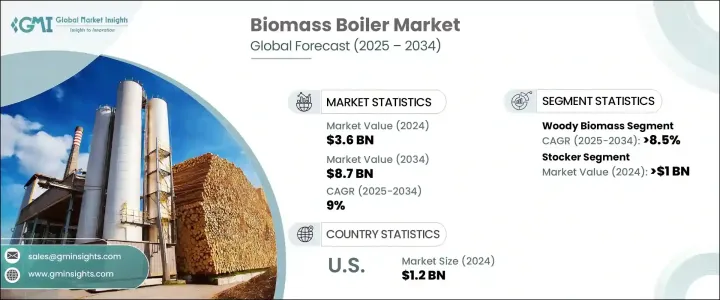

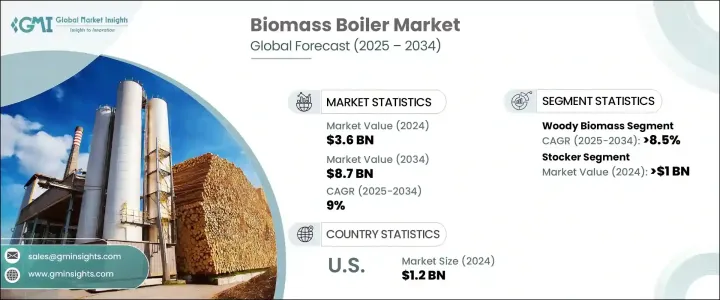

2024 年全球生質鍋爐市場價值為 36 億美元,預計到 2034 年將以 9% 的複合年成長率成長至 87 億美元。這一成長是由各行各業對清潔能源、永續性和再生能源應用的日益關注所推動的。隨著全球對傳統供暖和能源系統的環保替代品的需求不斷成長,生質能鍋爐正成為許多行業和商業領域的首選。政策制定者和政府正在實施支持措施,例如上網電價、再生能源目標、稅收抵免和補助金,這進一步刺激了市場需求並鼓勵廣泛採用這些系統。

木質生質能鍋爐市場將經歷強勁成長,預計到 2034 年複合年成長率將達到 8.5%。這一成長主要得益於全球向再生能源的轉變以及減少對化石燃料依賴的持續努力。由於木質生質能供應充足,這種再生資源在能源生產中變得越來越重要,尤其是在注重永續發展的產業中。隨著政府和政策制定者繼續實施對再生能源的支持性法規和激勵措施,生質能鍋爐的採用率可能會大幅上升。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 36億美元 |

| 預測值 | 87億美元 |

| 複合年成長率 | 9% |

流體化床生質能鍋爐部分在 2024 年佔據了 67.9% 的佔有率。流化床技術因其在燃燒各種生質能方面的多功能性而越來越受歡迎。這項技術有助於減少排放並提高燃燒效率,使其成為許多行業的首選。這些鍋爐擴大與熱電聯產 (CHP) 系統整合,從而能夠同時產生電力和熱能。熱電聯產系統的整合提高了能源效率,使得利用原本會被浪費的熱量成為可能。

2024 年美國生質鍋爐市場價值為 12 億美元。隨著對節能且經濟的化石燃料替代品的需求不斷成長,預計生質能鍋爐市場將在製造業、農業和區域供熱等行業中顯著擴張。人們對永續實踐和再生能源日益成長的興趣也推動了美國市場的成長。

參與全球生質鍋爐市場的主要參與者包括 Froling Heizkessel- Und Behalterbau、鄭州鍋爐(集團)、Forbes Marshall、Thermax、DP Cleantech、VIESSMANN、Hargassner GesmbH、Prime Thermals、Sugimat、Walchandames、Maxtherm Boilers、Theyne Boiler Thermals、Sugimat、Walchandamnagar、Maxtherm Boilers、Theyne Entilers、Firman Ent Woodco、Hoval、Schmid Energy Solutions、ARITERM、Binder Energietechnik、Cheema Boiler、Guntamatic Heiztechnik、Hurst Boiler & Welding、ANDRITZ Group、John Cockerill、Treco、KwB Energiesysteme、Sofinter、Windhager。生質能鍋爐行業的主要參與者正在採取各種策略來加強其市場地位。這些策略包括增加對研發(R&D)的投資,以提高產品性能和能源效率。透過專注於開發先進流化床鍋爐和整合熱電聯產系統等創新解決方案,公司正在改進其產品。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依原料,2021 - 2034

- 主要趨勢

- 木質生質能

- 農業廢棄物

- 工業廢棄物

- 城市殘留物

- 其他

第6章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 斯托克

- 流體化床

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 住宅

- 商業的

- 工業的

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 法國

- 英國

- 波蘭

- 義大利

- 西班牙

- 奧地利

- 德國

- 瑞典

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 菲律賓

- 日本

- 韓國

- 澳洲

- 印尼

- 中東和非洲

- 沙烏地阿拉伯

- 伊朗

- 阿拉伯聯合大公國

- 奈及利亞

- 南非

- 拉丁美洲

- 阿根廷

- 智利

- 巴西

第9章:公司簡介

- ANDRITZ Group

- ARITERM

- Babcock & Wilcox Enterprises, Inc.

- Binder Energietechnik Ges.mbH

- Cheema Boiler

- DP Cleantech

- Forbes Marshall

- Froling Heizkessel- Und Behalterbau Ges.mbH

- Guntamatic Heiztechnik GmbH

- Hargassner GesmbH

- Hoval

- Hurst Boiler & Welding Co, Inc.

- John Cockerill

- John Wood Group PLC

- KwB Energiesysteme GmbH

- Maxtherm Boilers

- OkoFEN Forschungs- und Entwicklungs Ges.mbH

- Prime Thermals

- Schmid Energy Solutions

- Sofinter Spa

- Sugimat

- Transparent Energy Systems Private Ltd.

- Thermax Limited

- Thermodyne Boiler

- Treco

- VIESSMANN

- Walchandnagar Industries Limited

- Windhager

- Woodco

- Zhengzhou Boiler (Group) Co., Ltd.

The Global Biomass Boiler Market was valued at USD 3.6 billion in 2024 and is estimated to grow at a CAGR of 9% to reach USD 8.7 billion by 2034. This growth is driven by an increasing focus on clean energy, sustainability, and the adoption of renewable energy sources across various industries. As global demand for eco-friendly alternatives to traditional heating and energy systems rises, biomass boilers are becoming a preferred choice for many industries and commercial sectors. Policymakers and governments are implementing supportive measures, such as feed-in tariffs, renewable energy targets, tax credits, and grants, which further fuel market demand and encourage widespread adoption of these systems.

The woody biomass boiler market is set to experience robust growth, projected to grow at a CAGR of 8.5% by 2034. This growth is primarily driven by the global shift towards renewable energy sources and the growing efforts to decrease reliance on fossil fuels. With an abundant supply of woody biomass, this renewable resource is becoming increasingly important in energy generation, especially in industries focused on sustainability. As governments and policymakers continue to implement supportive regulations and incentives for renewable energy, the adoption of biomass boilers is likely to rise significantly.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $8.7 Billion |

| CAGR | 9% |

The fluidized bed biomass boiler segment generated a 67.9% share in 2024. Fluidized bed technology is gaining popularity due to its versatility in burning various types of biomass. This technology helps in reducing emissions and improving combustion efficiency, making it a preferred option in many industries. These boilers are increasingly integrated with combined heat and power (CHP) systems, enabling simultaneous generation of electricity and heat. The integration of CHP systems enhances energy efficiency, making it possible to utilize the heat that would otherwise be wasted.

U.S. Biomass Boiler Market was valued at USD 1.2 billion in 2024. As demand for energy-efficient and cost-effective alternatives to fossil fuels rises, the market for biomass boilers is expected to see significant expansion in industries such as manufacturing, agriculture, and district heating. The market growth in the U.S. is also being driven by a growing interest in sustainable practices and renewable energy sources.

Major players involved in the Global Biomass boiler market include Froling Heizkessel- Und Behalterbau, Zhengzhou Boiler (Group), Forbes Marshall, Thermax, DP Cleantech, VIESSMANN, Hargassner GesmbH, Prime Thermals, Sugimat, Walchandnagar Industries, Maxtherm Boilers, Thermodyne Boiler, John Wood Group, OkoFEN Forschungs- und Entwicklungs, Woodco, Hoval, Schmid Energy Solutions, ARITERM, Binder Energietechnik, Cheema Boiler, Guntamatic Heiztechnik, Hurst Boiler & Welding, ANDRITZ Group, John Cockerill, Treco, KwB Energiesysteme, Sofinter, Windhager. Key players in the biomass boiler industry are adopting various strategies to strengthen their market presence. These strategies include increasing their investments in research and development (R&D) to enhance product performance and energy efficiency. By focusing on developing innovative solutions such as advanced fluidized bed boilers and integrating CHP systems, companies are improving their offerings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Feedstock, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Woody biomass

- 5.3 Agricultural waste

- 5.4 Industrial waste

- 5.5 Urban residue

- 5.6 Others

Chapter 6 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Stocker

- 6.3 Fluidized bed

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 France

- 8.3.2 UK

- 8.3.3 Poland

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.3.7 Germany

- 8.3.8 Sweden

- 8.3.9 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Philippines

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.4.6 Australia

- 8.4.7 Indonesia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 Iran

- 8.5.3 UAE

- 8.5.4 Nigeria

- 8.5.5 South Africa

- 8.6 Latin America

- 8.6.1 Argentina

- 8.6.2 Chile

- 8.6.3 Brazil

Chapter 9 Company Profiles

- 9.1 ANDRITZ Group

- 9.2 ARITERM

- 9.3 Babcock & Wilcox Enterprises, Inc.

- 9.4 Binder Energietechnik Ges.m.b.H

- 9.5 Cheema Boiler

- 9.6 DP Cleantech

- 9.7 Forbes Marshall

- 9.8 Froling Heizkessel- Und Behalterbau Ges.m.b.H

- 9.9 Guntamatic Heiztechnik GmbH

- 9.10 Hargassner GesmbH

- 9.11 Hoval

- 9.12 Hurst Boiler & Welding Co, Inc.

- 9.13 John Cockerill

- 9.14 John Wood Group PLC

- 9.15 KwB Energiesysteme GmbH

- 9.16 Maxtherm Boilers

- 9.17 OkoFEN Forschungs- und Entwicklungs Ges.m.b.H.

- 9.18 Prime Thermals

- 9.19 Schmid Energy Solutions

- 9.20 Sofinter S.p.a

- 9.21 Sugimat

- 9.22 Transparent Energy Systems Private Ltd.

- 9.23 Thermax Limited

- 9.24 Thermodyne Boiler

- 9.25 Treco

- 9.26 VIESSMANN

- 9.27 Walchandnagar Industries Limited

- 9.28 Windhager

- 9.29 Woodco

- 9.30 Zhengzhou Boiler (Group) Co., Ltd.