|

市場調查報告書

商品編碼

1721538

即時凝血檢測產品市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Point of Care Coagulation Testing Products Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

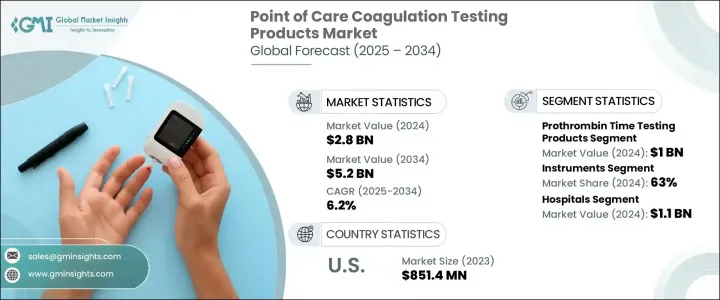

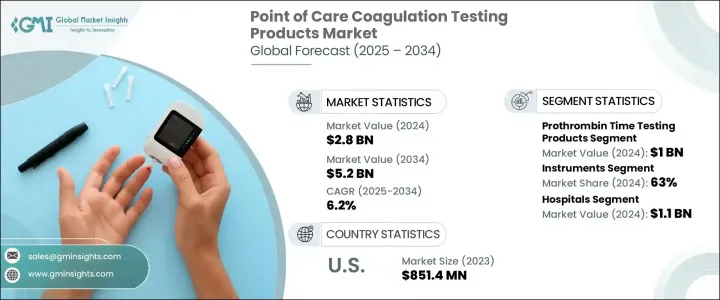

2024 年全球即時凝血檢測產品市場價值為 28 億美元,預計到 2034 年將以 6.2% 的複合年成長率成長,達到 52 億美元。這些創新設備透過直接在床邊或臨床照護端提供即時凝血評估,從而無需進行中央實驗室測試,從而改變了患者護理。隨著人們越來越依賴即時可靠的結果,這些設備現在已成為緊急情況、外科手術和慢性病長期管理中不可或缺的一部分。市場的成長是由心血管疾病和血液疾病發病率的增加以及對快速診斷和即時監控的需求的增加所推動的。隨著醫療保健提供者轉向這些工具來支持關鍵的醫療決策,全球對凝血檢測產品的需求正在加劇。此外,向分散醫療模式和可攜式診斷設備的轉變進一步推動了市場的擴張。這些工具不僅最佳化了工作流程,而且還透過及時介入改善了患者的治療效果。

市場根據測試類型進行細分,包括活化凝血時間、D-二聚體測試、血小板計數、凝血酶原時間測試和其他類別。其中,凝血酶原時間檢測領域佔據領先地位,2024 年產值達 10 億美元。預計 2025 年至 2034 年期間的複合年成長率為 6.3%。該領域的主導地位主要歸功於其能夠提供快速且可操作的資料,幫助醫生精確調整抗凝血劑劑量。在凝血監測延遲可能導致嚴重併發症的情況下,凝血酶原時間測試提供的快速可靠的結果對於制定臨床決策至關重要,特別是在重症監護和長期治療管理中。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 28億美元 |

| 預測值 | 52億美元 |

| 複合年成長率 | 6.2% |

就產品類型而言,市場分為儀器和耗材,其中儀器在 2024 年佔據 63% 的佔有率。預計到 2034 年,該細分市場將產生 33 億美元的產值,因為儀器因其能夠提供即時結果,從而提高高壓臨床環境中的效率而備受青睞。它們的便攜性和與數位醫療系統的無縫整合使它們在醫院和門診環境中不可或缺,快速凝固特徵對於挽救生命的干涉至關重要。

2023 年,美國即時凝血檢測產品市場規模達 8.514 億美元。該地區市場的成長得益於慢性血液病患病率的上升,以及對即時診斷工具的需求不斷成長。儘管監管協議嚴格,但由於有利的報銷模式和渴望接受最新診斷創新的醫療保健基礎設施,美國市場繼續蓬勃發展。

雅培實驗室、Sysmex Corporation、賽默飛世爾科技、西門子醫療、F. Hoffmann-La Roche 等領先企業處於這一成長的前沿。這些公司透過開發攜帶式、方便用戶使用型、週轉時間快的系統不斷創新。他們在研究合作、新興市場擴張以及雲端連接增強方面的投資是增加市場佔有率和改善全球臨床結果的關鍵策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性血液病患病率上升

- 政府加強遏制血液相關疾病

- 日益普及即時檢測產品

- 技術進步

- 產業陷阱與挑戰

- 嚴格的監管框架

- 產品開發成本高

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按測試類型,2021 - 2034 年

- 主要趨勢

- 凝血酶原時間檢測產品

- 活化凝血時間(ACT/APTT)檢測產品

- 血小板計數

- D-二聚體檢測

- 其他測試類型

第6章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 儀器

- 耗材

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 診斷中心

- 居家照護環境

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Abbott Laboratories

- Alere

- A&T Corporation

- Diagnostica Stago Sas

- F. Hoffmann-La Roche

- Genrui Biotech

- Helena Laboratories

- Horiba

- Medtronic

- Nihon Kohden Corporation

- Micropoint Biosciences

- Maccura Biotechnology

- Sysmex Corporation

- Siemens Healthineers

- Thermo Fisher Scientific

The Global Point of Care Coagulation Testing Products Market was valued at USD 2.8 billion in 2024 and is estimated to grow at a CAGR of 6.2% to reach USD 5.2 billion by 2034. These innovative devices are transforming patient care by providing real-time coagulation assessments directly at the bedside or clinical point of care, eliminating the need for central laboratory testing. With a growing reliance on immediate and reliable results, these devices are now integral in emergency situations, surgical procedures, and long-term management of chronic illnesses. The market's growth is driven by the increasing incidence of cardiovascular diseases and blood disorders, alongside the rising demand for rapid diagnoses and real-time monitoring. As healthcare providers turn to these tools to support critical medical decisions, the demand for coagulation testing products is intensifying globally. Moreover, the shift toward decentralized healthcare models and portable diagnostic devices further fuels the market's expansion. These tools not only optimize workflow but also enhance patient outcomes by enabling timely interventions.

The market is segmented based on test types, including activated clotting time, d-dimer tests, platelet count, prothrombin time testing, and other categories. Among these, the prothrombin time testing segment emerged as a leader, generating USD 1 billion in 2024. It is projected to grow at a CAGR of 6.3% between 2025 and 2034. The segment's dominance is primarily due to its ability to provide fast and actionable data that aids physicians in precisely adjusting anticoagulant dosages. In settings where delays in coagulation monitoring can lead to severe complications, the rapid and dependable results offered by prothrombin time tests have become critical in making clinical decisions, particularly in critical care and long-term therapy management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.8 Billion |

| Forecast Value | $5.2 Billion |

| CAGR | 6.2% |

In terms of product type, the market divides into instruments and consumables, with instruments holding a 63% share in 2024. This segment is expected to generate USD 3.3 billion by 2034, as instruments are highly favored for their ability to provide immediate results, thereby improving efficiency in high-pressure clinical environments. Their portability and seamless integration with digital healthcare systems make them indispensable in both hospital and outpatient settings, where quick coagulation profiles are essential for life-saving interventions.

The U.S. Point of Care Coagulation Testing Products Market generated USD 851.4 million in 2023. The market's growth in the region is supported by the rising prevalence of chronic hematologic conditions, coupled with a growing demand for real-time diagnostic tools. Despite stringent regulatory protocols, the U.S. market continues to thrive due to favorable reimbursement models and a healthcare infrastructure that is eager to embrace the latest diagnostic innovations.

Leading players such as Abbott Laboratories, Sysmex Corporation, Thermo Fisher Scientific, Siemens Healthineers, F. Hoffmann-La Roche, and others are at the forefront of this growth. These companies are continuously innovating by developing portable, user-friendly systems with rapid turnaround times. Their investment in research collaborations, expansion into emerging markets, and enhancement of cloud-based connectivity are key strategies to increase market presence and improve clinical outcomes globally.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic blood disorders

- 3.2.1.2 Growing government initiatives to curb blood-related diseases

- 3.2.1.3 Increasing adoption of point of care testing products

- 3.2.1.4 Technological advancements

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory framework

- 3.2.2.2 High cost of product development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Test Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Prothrombin time testing products

- 5.3 Activated clotting time (ACT/APTT) testing products

- 5.4 Platelet count

- 5.5 D-dimer test

- 5.6 Others test types

Chapter 6 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Instruments

- 6.3 Consumables

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Diagnostic centers

- 7.4 Home care settings

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Alere

- 9.3 A&T Corporation

- 9.4 Diagnostica Stago Sas

- 9.5 F. Hoffmann-La Roche

- 9.6 Genrui Biotech

- 9.7 Helena Laboratories

- 9.8 Horiba

- 9.9 Medtronic

- 9.10 Nihon Kohden Corporation

- 9.11 Micropoint Biosciences

- 9.12 Maccura Biotechnology

- 9.13 Sysmex Corporation

- 9.14 Siemens Healthineers

- 9.15 Thermo Fisher Scientific