|

市場調查報告書

商品編碼

1721515

配電自動化市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Distribution Automation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

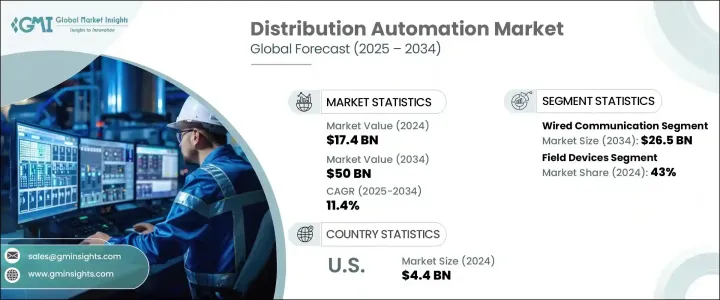

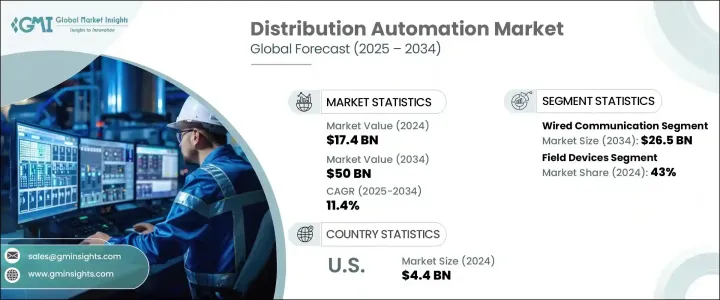

2024 年全球配電自動化市場價值為 174 億美元,預計到 2034 年將以 11.4% 的複合年成長率成長,達到 500 億美元。隨著世界各地的公用事業公司採用先進技術來實現電網現代化,該市場正經歷著顯著的發展勢頭。不斷成長的能源需求、不斷增加的可再生能源整合以及對電網可靠性和彈性的日益關注,正在促使公共和私營部門的參與者優先考慮配電自動化解決方案。政府和公用事業供應商正在迅速投資自動化,以減少停電、提高能源效率並支援永續的電力基礎設施。

隨著電力基礎設施老化以及城鄉電氣化趨勢的不斷加劇,自動化配電網路正成為向智慧能源系統轉型的重要支柱。自動化在處理即時電力消耗資料和提高資產管理能力方面也發揮著至關重要的作用,使公用事業公司能夠更快地應對故障並更有效地平衡能源供應。隨著數位轉型不斷重塑能源基礎設施,配電自動化系統在全球建立可靠、安全且適應性強的能源電網的努力中變得不可或缺。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 174億美元 |

| 預測值 | 500億美元 |

| 複合年成長率 | 11.4% |

電網現代化的日益成長的需求、智慧電網的實施以及可靠電力分配的需求是該市場的主要驅動力。公用事業公司擴大採用自動化解決方案來提高效率、降低營運成本並為消費者提供更穩定、更可靠的電力供應。作為向更智慧、更具彈性的基礎設施邁進的一部分,配電自動化正在全球範圍內獲得關注,旨在提高電網性能並支持再生能源的整合。

有線通訊仍然是市場中的主導部分,預計到 2034 年將成長 265 億美元。光纖和乙太網路以其穩定性、低延遲和抗干擾性而聞名,將繼續為高可靠性應用提供幫助。公用事業公司嚴重依賴有線網路來實現 SCADA 系統和電網即時監控等功能,確保關鍵操作順利運作。

現場設備部分包括智慧重合閘、自動開關和故障指示器,到 2024 年將佔據 43% 的佔有率,因為這些設備與物聯網和邊緣運算相結合,可以提高電網的可靠性和效率。這些設備對於提高電網的功能和可靠性至關重要。透過與物聯網 (IoT) 技術和邊緣運算相結合,這些設備增強了即時監控、預測性維護和故障檢測能力。智慧重合器對於自動偵測故障和在暫時中斷後恢復供電尤為重要,可顯著縮短停電時間。

2024 年,美國配電自動化市場產值將達 44 億美元。這一成長歸功於電網系統的進步、再生能源的採用以及創新技術的日益普及。旨在提高能源效率的聯邦和州政策,以及 5G 和邊緣網路的整合以增強監控和控制,正在進一步推動該市場的擴張。採用人工智慧和基於物聯網的系統使公用事業公司能夠最佳化營運、減少停機時間並增強電網彈性。

全球配電自動化市場的主要參與者包括 Landis+Gyr、ABB、思科、伊頓、通用電氣、G&W Electric、S&C Electric Company、Hubbell、Itron、NovaTech、施耐德電氣、日立、Schweitzer Engineering Laboratories、西門子、東芝能源系統與解決方案、Trilliant Holdings 和 Xylem。為了加強其影響力,配電自動化市場的公司正專注於技術創新和產品開發。許多公司正在投資基於人工智慧的自動化和物聯網解決方案,以改善電網管理和最佳化能源分配。與公用事業和能源供應商的合作也是一項重要策略,使公司能夠根據特定需求量身定做解決方案並擴大其影響力。此外,各公司正在探索併購方式,以實現產品多樣化並進入新的區域市場。增加對網路安全解決方案的投資是解決與電網安全和資料隱私日益成長的擔憂的另一個關鍵策略。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

第4章:競爭格局

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依通訊方式,2021 - 2034 年

- 主要趨勢

- 有線

- 無線的

第6章:市場規模及預測:依組成部分,2021 - 2034 年

- 主要趨勢

- 軟體

- 現場設備

- 服務

第7章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 公用事業

- 私人公用事業

第8章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 亞太地區

- 中國

- 澳洲

- 日本

- 韓國

- 印度

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 智利

第9章:公司簡介

- ABB

- Cisco

- Eaton

- GE

- G&W Electric

- Hitachi

- Hubbell

- Itron

- Landis+Gyr

- NovaTech

- Schneider Electric

- Schweitzer Engineering Laboratories

- S&C Electric Company

- Siemens

- Toshiba Energy Systems & Solutions

- Trilliant Holdings

- Xylem

The Global Distribution Automation Market was valued at USD 17.4 billion in 2024 and is estimated to grow at a CAGR of 11.4% to reach USD 50 billion by 2034. The market is witnessing remarkable momentum as utilities worldwide embrace advanced technologies to modernize power grids. Rising energy demands, increasing integration of renewable energy sources, and heightened concerns around grid reliability and resilience are pushing both public and private sector players to prioritize distribution automation solutions. Governments and utility providers are rapidly investing in automation to reduce power outages, enhance energy efficiency, and support a sustainable electricity infrastructure.

With aging electrical infrastructure and surging electrification trends across urban and rural areas alike, automated distribution networks are emerging as a critical pillar in the transition toward smarter energy systems. Automation is also proving essential in handling real-time power consumption data and improving asset management capabilities, enabling utilities to respond faster to faults and balance energy supply more effectively. As digital transformation continues to reshape energy infrastructure, distribution automation systems are becoming indispensable in the global effort to build a reliable, secure, and adaptive energy grid.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $17.4 Billion |

| Forecast Value | $50 Billion |

| CAGR | 11.4% |

The growing demand for grid modernization, the implementation of smart grids, and the need for reliable power distribution are the primary drivers of this market. Utilities are increasingly turning to automation solutions to enhance efficiency, reduce operational costs, and provide a more stable and reliable power supply to consumers. Distribution automation is gaining traction globally as part of the larger push toward smarter, more resilient infrastructure, aiming to improve grid performance and support the integration of renewable energy sources.

Wired communication remains the dominant segment within the market and is projected to grow by USD 26.5 billion by 2034. Fiber optics and Ethernet networks, known for their stability, low latency, and resistance to interference, continue to help in high-reliability applications. Utility companies rely heavily on wired networks for functions like SCADA systems and real-time monitoring of the grid, ensuring that critical operations run smoothly.

The field devices segment, which includes smart reclosers, automated switches, and fault indicators, accounted for a 43% share in 2024, as these devices integrate with IoT and edge computing to improve the reliability and efficiency of power grids. These devices are essential for improving the functionality and reliability of power grids. By integrating with Internet of Things (IoT) technology and edge computing, these devices enhance real-time monitoring, predictive maintenance, and fault detection capabilities. Smart reclosers are particularly important for automatically detecting faults and restoring power after temporary disruptions, significantly reducing the duration of outages.

U.S. Distribution Automation Market generated USD 4.4 billion in 2024. The growth is attributed to advancements in grid systems, the adoption of renewable energy sources, and the increasing deployment of innovative technologies. Federal and state policies aimed at improving energy efficiency, along with the integration of 5G and edge networks for enhanced monitoring and control, are further driving the expansion of this market. The adoption of artificial intelligence and IoT-based systems is enabling utilities to optimize operations, reduce downtime, and enhance grid resilience.

Key players in the Global Distribution Automation Market include Landis+Gyr, ABB, Cisco, Eaton, GE, G&W Electric, S&C Electric Company, Hubbell, Itron, NovaTech, Schneider Electric, Hitachi, Schweitzer Engineering Laboratories, Siemens, Toshiba Energy Systems & Solutions, Trilliant Holdings, and Xylem. To strengthen their presence, companies in the distribution automation market are focusing on technological innovation and product development. Many are investing in AI-based automation and IoT solutions to improve grid management and optimize energy distribution. Partnerships with utilities and energy providers are also a significant strategy, allowing companies to tailor solutions to specific needs and expand their reach. Additionally, companies are exploring mergers and acquisitions to diversify their offerings and enter new regional markets. Increased investment in cybersecurity solutions is another key strategy to address the growing concerns related to grid security and data privacy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Communication, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Wired

- 5.3 Wireless

Chapter 6 Market Size and Forecast, By Components, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Software

- 6.3 Field devices

- 6.4 Services

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Public utility

- 7.3 Private utility

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 India

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Chile

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Cisco

- 9.3 Eaton

- 9.4 GE

- 9.5 G&W Electric

- 9.6 Hitachi

- 9.7 Hubbell

- 9.8 Itron

- 9.9 Landis+Gyr

- 9.10 NovaTech

- 9.11 Schneider Electric

- 9.12 Schweitzer Engineering Laboratories

- 9.13 S&C Electric Company

- 9.14 Siemens

- 9.15 Toshiba Energy Systems & Solutions

- 9.16 Trilliant Holdings

- 9.17 Xylem