|

市場調查報告書

商品編碼

1721511

乙醇生物燃料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Ethanol Biofuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

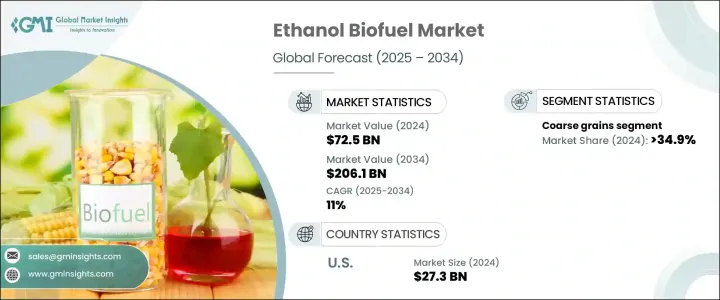

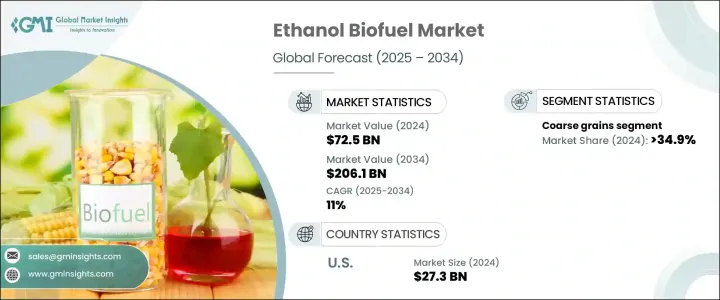

2024 年全球乙醇生物燃料市場價值為 725 億美元,預計到 2034 年將以 11% 的複合年成長率成長,達到 2,061 億美元。隨著各國尋求化石燃料的永續替代品,乙醇生物燃料在全球範圍內繼續受到關注。減少碳排放、實現再生能源目標以及轉型為低碳經濟的迫切性日益增強,增加了全球對生物燃料基礎設施的投資。乙醇主要來自粗糧和糖料作物等可再生生質能,為運輸業提供了可靠且環保的解決方案。隨著政府監管力度加大、油價上漲以及消費者對氣候變遷意識的增強,乙醇生物燃料成為一種兼顧性能與永續性的戰略能源。它與現有車輛引擎和基礎設施的兼容性,加上對 E10 和 E85 等更清潔燃料混合物的需求不斷成長,進一步增強了其市場吸引力。此外,酵素技術和發酵製程的進步正在降低生產成本並提高轉化效率,從而增強各地區乙醇生物燃料的商業可行性。

乙醇生物燃料被廣泛認為是一種更清潔、更永續的汽油替代品,尤其是在交通運輸領域。當乙醇與汽油混合時,它有助於降低一氧化碳和顆粒物等有害排放,同時也能提高辛烷值。這些優勢使得 E10(10% 乙醇)和 E85(85% 乙醇)等乙醇混合物成為消費者和政府的有吸引力的選擇,旨在在不影響車輛性能的情況下減少對環境的影響。乙醇可以靈活地融入現有的燃料系統,使其成為實現減排目標的實用的短期和中期解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 725億美元 |

| 預測值 | 2061億美元 |

| 複合年成長率 | 11% |

航空業正日益轉向由乙醇生產的永續航空燃料(SAF),這支持淨零碳計畫。與傳統航空燃料相比,以乙醇為基礎的 SAF 已被證明可以將生命週期排放量減少高達 80%,這使其成為實現航空旅行脫碳的可行且可擴展的途徑。這種日益成長的應用進一步加強了乙醇在全球燃料市場的地位。

市場依原料類型分類,包括粗糧、糖料作物和植物油。 2024年,粗糧部分佔乙醇生物燃料市場的34.9%。高澱粉含量使得粗糧特別適合用於生物燃料生產,因為它們很容易轉化為可發酵的糖。政府的支持性政策,包括混合授權和對農業生產者的補貼,大大鼓勵了粗糧在乙醇生產中的使用。

2024 年美國乙醇生物燃料市場價值為 273 億美元。再生燃料標準 (RFS) 要求每年混合 150 億加侖乙醇,以確保穩定的需求和持續成長。乙醇仍然是該國推動永續發展和能源安全戰略的關鍵參與者。

領先的市場參與者包括 ADM、BP、嘉吉、雪佛龍、Codexis、杜邦、Green Plains、荷蘭皇家殼牌、瓦萊羅能源和利安德巴塞爾工業。這些公司正專注於擴大生產能力、投資先進的生物燃料技術以及簽訂長期原料協議。許多公司也正在努力減少碳足跡,同時提供符合全球永續發展目標的再生燃料。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:依原料,2021 - 2034

- 主要趨勢

- 粗粒

- 糖料作物

- 植物油

- 其他

第6章:市場規模及預測:依應用,2021 - 2034

- 主要趨勢

- 運輸

- 航空

- 其他

第7章:市場規模及預測:依地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 西班牙

- 英國

- 義大利

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- ADM

- Borregaard

- Blue Biofuel

- BTG Bioliquids

- Cargill

- Chevron

- Clariant

- COFCO

- CropEnergies

- Munzer Bioindustrie

- Neste

- POET LLC

- Praj Industries

- Raizen

- The Andersons

- TotalEnergies

- UPM

- Valero

- Verbio

- Wilmar International

- Zilor

The Global Ethanol Biofuel Market was valued at USD 72.5 billion in 2024 and is estimated to grow at a CAGR of 11% to reach USD 206.1 billion by 2034. Ethanol biofuel continues to gain traction worldwide as countries look for sustainable alternatives to fossil fuels. The growing urgency to reduce carbon emissions, meet renewable energy targets, and transition toward low-carbon economies has intensified global investments in biofuel infrastructure. Ethanol, derived primarily from renewable biomass like coarse grains and sugar crops, offers a reliable and environmentally responsible solution for the transportation sector. With increasing government mandates, rising oil prices, and heightened consumer awareness about climate change, ethanol biofuel emerges as a strategic energy resource that balances performance with sustainability. Its compatibility with existing vehicle engines and infrastructure, combined with rising demand for cleaner fuel blends like E10 and E85, is further fueling its market appeal. Additionally, advances in enzyme technology and fermentation processes are reducing production costs and improving conversion efficiencies, boosting the commercial viability of ethanol biofuels across regions.

Ethanol biofuel is being widely recognized as a cleaner and more sustainable alternative to gasoline, especially in transportation. When blended with gasoline, ethanol helps lower harmful emissions, such as carbon monoxide and particulate matter, while also increasing octane levels. These benefits make ethanol blends like E10 (10% ethanol) and E85 (85% ethanol) attractive choices for both consumers and governments, aiming to reduce environmental impact without compromising vehicle performance. The flexibility of ethanol to be integrated into existing fuel systems positions it as a practical short- and mid-term solution to emissions reduction goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $72.5 Billion |

| Forecast Value | $206.1 Billion |

| CAGR | 11% |

The aviation industry is increasingly shifting toward sustainable aviation fuel (SAF) produced from ethanol, which supports net-zero carbon initiatives. Ethanol-based SAF has demonstrated the potential to cut lifecycle emissions by up to 80% compared to conventional jet fuel, making it a viable and scalable path for decarbonizing air travel. This growing application further strengthens ethanol's position in the global fuel market.

The market is categorized based on feedstock types, including coarse grains, sugar crops, and vegetable oils. In 2024, the coarse grains segment accounted for a 34.9% share of the ethanol biofuel market. High starch content makes coarse grains particularly efficient for biofuel production, as they are easily converted into fermentable sugars. Supportive government policies, including blending mandates and subsidies for agricultural producers, have significantly encouraged the use of coarse grains in ethanol production.

The U.S. Ethanol Biofuel Market was valued at USD 27.3 billion in 2024. The Renewable Fuel Standard (RFS) mandates the blending of 15 billion gallons of ethanol annually, ensuring steady demand and continued growth. Ethanol remains a key player in the country's strategy to advance sustainability and energy security.

Leading market participants include ADM, BP, Cargill, Chevron, Codexis, DuPont, Green Plains, Royal Dutch Shell, Valero Energy, and LyondellBasell Industries. These companies are focusing on expanding production capacity, investing in advanced biofuel technologies, and entering long-term feedstock agreements. Many are also working to minimize their carbon footprints while delivering renewable fuels that align with global sustainability goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Feedstock, 2021 - 2034 (MToe, USD Billion)

- 5.1 Key trends

- 5.2 Coarse grain

- 5.3 Sugar crop

- 5.4 Vegetable oil

- 5.5 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (MToe, USD Billion)

- 6.1 Key trends

- 6.2 Transportation

- 6.3 Aviation

- 6.4 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (MToe, USD Billion)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 France

- 7.3.3 Spain

- 7.3.4 UK

- 7.3.5 Italy

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 ADM

- 8.2 Borregaard

- 8.3 Blue Biofuel

- 8.4 BTG Bioliquids

- 8.5 Cargill

- 8.6 Chevron

- 8.7 Clariant

- 8.8 COFCO

- 8.9 CropEnergies

- 8.10 Munzer Bioindustrie

- 8.11 Neste

- 8.12 POET LLC

- 8.13 Praj Industries

- 8.14 Raizen

- 8.15 The Andersons

- 8.16 TotalEnergies

- 8.17 UPM

- 8.18 Valero

- 8.19 Verbio

- 8.20 Wilmar International

- 8.21 Zilor