|

市場調查報告書

商品編碼

1721497

靜液壓傳動市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Hydrostatic Transmission Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

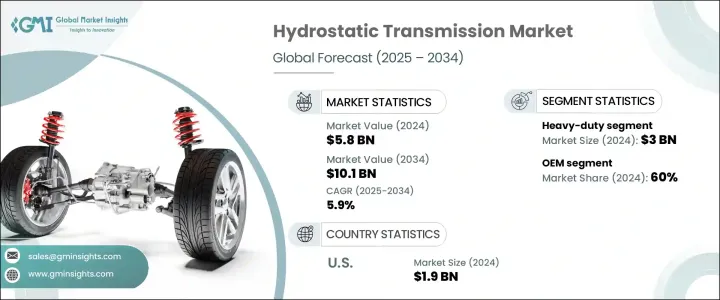

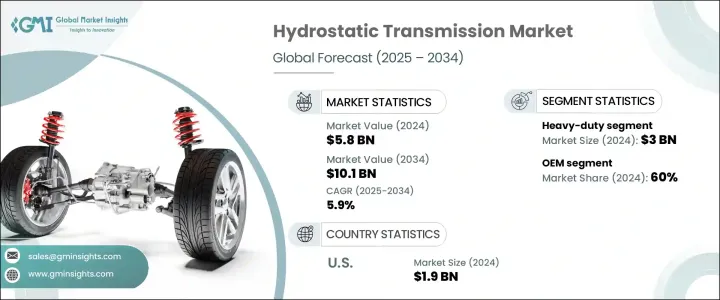

2024 年全球靜液壓傳動市場價值為 58 億美元,預計到 2034 年將以 5.9% 的複合年成長率成長,達到 101 億美元。隨著全球各行各業不斷朝向更智慧、更乾淨、更節能的技術發展,靜液壓傳動系統正獲得強勁發展。汽車、農業、建築和採礦等行業對市場的需求日益增加,這些行業對平穩、響應迅速且省油的電力傳輸的需求正在重塑設計重點。工業和車輛平台日益採用自動化和電氣化,對傳輸技術產生了重大影響。

製造商正專注於整合支援無縫機器操作和智慧控制的先進功能,以滿足下一代設備的需求。最終用戶傾向於確保精確處理、減少排放和更高可靠性的系統,這些因素在當今以性能為導向、注重永續性的環境中至關重要。此外,不斷成長的基礎設施投資、勞動力短缺以及對智慧農業和自動化物料處理的推動,為靜液壓傳動市場增添了巨大的發展動力,尤其是在北美、歐洲、亞太地區以及中東和非洲。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 58億美元 |

| 預測值 | 101億美元 |

| 複合年成長率 | 5.9% |

各主要產業的成長主要受到對節能輸電系統的日益青睞以及對無縫功率調節的需求的推動。增強的車輛性能、精確的控制和提高的燃油經濟性是推動採用的核心優勢。隨著液壓技術的不斷成熟,製造商正在將電子控制和智慧感測器等智慧功能融入他們的系統中。這些創新正在重新定義車輛架構,以實現更平穩的運作和更高的系統可靠性。向自動化、永續機械的轉變正在推動重型建築、農業設備和工業車輛等領域的強勁需求。

按容量分類,市場包括輕型、中型和重型系統。其中,重型靜液壓傳動裝置在 2024 年佔據主導地位,市場規模達 30 億美元。這種主導地位源於其在高負荷、惡劣應用中提供高扭矩、長使用壽命和可靠性的能力。重型系統因其在極端條件下保持穩定的性能並保持燃油效率而特別具有吸引力。產業領導者正在開發配備精密控制模組、電子管理單元和節能增強功能的下一代系統,以滿足不斷升級的工業需求。這些升級加強了重型解決方案在關鍵任務操作中的立足點。

根據分銷情況,市場分為OEM通路和售後市場通路。到 2024 年, OEM部門將獲得 60% 的佔有率,這得益於靜液壓系統擴大融入新車設計中。消費者越來越青睞工廠安裝的、與內建安全和自動化功能同步運作的設備。原始設備製造商 (OEM) 的應對措施是提供與 ADAS 和其他智慧駕駛系統相容而最佳化的設備。高階車型的需求尤其高,因為平穩的駕駛控制和節省燃料是不可妥協的。監管要求加強安全性和永續性,繼續推動OEM 的採用。

2024 年,美國靜液壓傳動市場規模達 19 億美元,預估 2025 年至 2034 年期間複合年成長率將達到 6.2%。成長主要受到液壓系統設計創新、基礎設施投資以及農業和建築領域精密設備的激增的推動。混合動力變速箱和基於感測器的控制功能的採用正在加速。隨著國家對自動化和永續工業實踐的重視,美國市場正在見證各種應用的快速部署。

派克漢尼汾、德納、博世力士樂、約翰迪爾、凱斯紐荷蘭工業、伊頓、丹佛斯、馬恆達、胡斯瓦納和久保田等公司正在透過研發投資、策略合作夥伴關係和創新產品發布來增強其優勢。許多參與者正在投資支援物聯網的系統和診斷技術,以最佳化生命週期性能和營運效率。與 OEM 的合作簡化了與先進汽車平台的整合,而合併和區域擴張使全球參與者能夠更好地滿足新興市場不斷成長的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 組件提供者

- 製造商

- 技術提供者

- 配銷通路分析

- 最終用途

- 利潤率分析

- 供應商格局

- 技術與創新格局

- 專利分析

- 監管格局

- 成本細分分析

- 重要新聞和舉措

- 衝擊力

- 成長動力

- 在非公路車輛和特殊車輛的使用增加

- 智慧液壓系統的進步

- 監理推動燃油效率

- 靜液壓電動混合動力傳動系統的開發

- 產業陷阱與挑戰

- 初始成本高

- 複雜的維護要求

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產能,2021 - 2034 年

- 主要趨勢

- 重負

- 中型

- 輕型

第6章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 液壓泵浦

- 油壓馬達

- 閥門和控制器

- 過濾器

- 其他

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 農業

- 建造

- 物料處理

- 其他

第8章:市場估計與預測:依傳輸方式,2021 - 2034 年

- 主要趨勢

- 閉迴路

- 開迴路

第9章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- 售後市場

- OEM

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- AGCO

- Ariens

- Bosch Rexroth

- CNH Industrial

- Daedong Industrial

- Dana

- Danfoss

- Eaton

- Husqvarna

- Iseki

- JCB

- John Deere

- Kubota

- Mahindra & Mahindra

- MTD

- Parker Hannifin

- Sauer-Danfoss

- Tuff Torq

- Yanmar

- ZF Friedrichshafen

The Global Hydrostatic Transmission Market was valued at USD 5.8 billion in 2024 and is estimated to grow at a CAGR of 5.9% to reach USD 10.1 billion by 2034. As industries worldwide continue to evolve toward smarter, cleaner, and more energy-efficient technologies, hydrostatic transmission systems are gaining strong traction. The market is experiencing heightened demand from sectors such as automotive, agriculture, construction, and mining, where the need for smooth, responsive, and fuel-efficient power delivery is reshaping design priorities. The increasing adoption of automation and electrification across industrial and vehicular platforms is significantly influencing transmission technologies.

Manufacturers are focusing on integrating advanced features that support seamless machine operation and intelligent control to match the needs of next-generation equipment. End users are leaning toward systems that ensure precision handling, reduced emissions, and higher reliability-factors that are crucial in today's performance-driven and sustainability-conscious landscape. Moreover, growing infrastructure investments, labor shortages, and the push for smart farming and automated material handling are adding substantial momentum to the hydrostatic transmission market, especially across North America, Europe, Asia Pacific, and the Middle East & Africa.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.8 Billion |

| Forecast Value | $10.1 Billion |

| CAGR | 5.9% |

Growth across key industries is largely driven by the rising preference for energy-efficient transmission systems and the demand for seamless power modulation. Enhanced vehicle performance, precise control, and improved fuel economy are among the core benefits propelling adoption. As hydraulic technology continues to mature, manufacturers are incorporating intelligent features such as electronic controls and smart sensors into their systems. These innovations are redefining vehicle architecture, allowing smoother operation and greater system reliability. The movement toward automated, sustainable machinery is fueling robust demand in sectors such as heavy construction, agricultural equipment, and industrial vehicles.

Segmented by capacity, the market includes light-duty, medium-duty, and heavy-duty systems. Among these, heavy-duty hydrostatic transmissions held a commanding USD 3 billion in 2024. This dominance stems from their ability to deliver high torque, long operational life, and reliability in high-load, rugged applications. Heavy-duty systems are especially attractive for their consistent performance under extreme conditions while maintaining fuel efficiency. Industry leaders are developing next-gen systems equipped with precision control modules, electronic management units, and energy-saving enhancements to meet escalating industrial requirements. These upgrades are strengthening the foothold of heavy-duty solutions across mission-critical operations.

Based on distribution, the market is split between OEM and aftermarket channels. The OEM segment secured a 60% share in 2024, bolstered by rising integration of hydrostatic systems into new vehicle designs. Consumers are increasingly favoring factory-installed units that work in sync with built-in safety and automation features. OEMs are responding by delivering units optimized for compatibility with ADAS and other intelligent driving systems. The demand is especially high among premium models where smooth drive control and fuel savings are non-negotiable. Regulatory mandates pushing for enhanced safety and sustainability continue to drive OEM adoption.

United States Hydrostatic Transmission Market generated USD 1.9 billion in 2024 and is poised to grow at 6.2% CAGR between 2025-2034. Growth is primarily driven by innovation in hydraulic system designs, infrastructure investments, and the surge in precision-focused equipment in agriculture and construction. The adoption of hybrid transmissions and sensor-based control features is accelerating. With a national focus on automation and sustainable industrial practices, the US market is witnessing fast-paced deployment across varied applications.

Companies such as Parker Hannifin, Dana, Bosch Rexroth, John Deere, CNH Industrial, Eaton, Danfoss, Mahindra & Mahindra, Husqvarna, and Kubota are sharpening their edge with R&D investments, strategic partnerships, and innovative product launches. Many players are investing in IoT-enabled systems and diagnostic technologies to optimize lifecycle performance and operational efficiency. Collaborations with OEMs are simplifying integration into advanced vehicle platforms, while mergers and regional expansions are enabling global players to better serve the surging demand from emerging markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Cost breakdown analysis

- 3.6 Key news & initiatives

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increased use in off-highway and specialty vehicles

- 3.7.1.2 Advancements in smart hydraulic systems

- 3.7.1.3 Regulatory push for fuel efficiency

- 3.7.1.4 Development of hybrid hydrostatic-electric powertrains

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial costs

- 3.7.2.2 Complex maintenance requirements

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Capacity, 2021 - 2034 ($Mn, Units)

- 5.1 Key trends

- 5.2 Heavy-duty

- 5.3 Medium-duty

- 5.4 Light-duty

Chapter 6 Market Estimates & Forecast, By Component, 2021 - 2034 ($Mn, Units)

- 6.1 Key trends

- 6.2 Hydraulic pumps

- 6.3 Hydraulic motors

- 6.4 Valves & controls

- 6.5 Filters

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn, Units)

- 7.1 Key trends

- 7.2 Agriculture

- 7.3 Construction

- 7.4 Material handling

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By Transmission, 2021 - 2034 ($Mn, Units)

- 8.1 Key trends

- 8.2 Closed-loop

- 8.3 Open-loop

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn, Units)

- 9.1 Key trends

- 9.2 Aftermarket

- 9.3 OEM

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 France

- 10.3.3 UK

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 AGCO

- 11.2 Ariens

- 11.3 Bosch Rexroth

- 11.4 CNH Industrial

- 11.5 Daedong Industrial

- 11.6 Dana

- 11.7 Danfoss

- 11.8 Eaton

- 11.9 Husqvarna

- 11.10 Iseki

- 11.11 JCB

- 11.12 John Deere

- 11.13 Kubota

- 11.14 Mahindra & Mahindra

- 11.15 MTD

- 11.16 Parker Hannifin

- 11.17 Sauer-Danfoss

- 11.18 Tuff Torq

- 11.19 Yanmar

- 11.20 ZF Friedrichshafen