|

市場調查報告書

商品編碼

1721474

浸潤性乳管癌 (IDC) 治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Invasive Ductal Carcinoma (IDC) Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

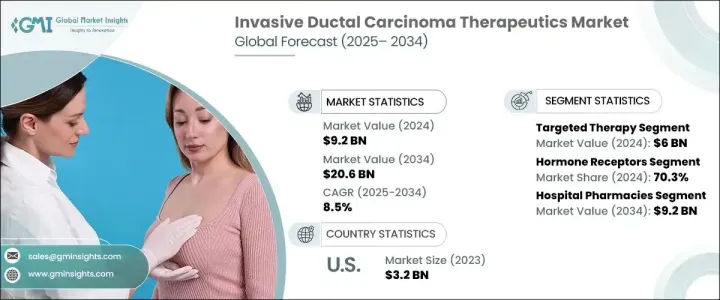

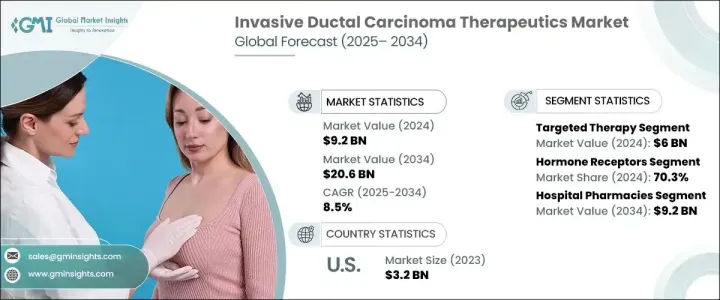

2024 年全球浸潤性乳管癌治療市場價值為 92 億美元,預計到 2034 年將以 8.5% 的複合年成長率成長,達到 206 億美元。這一強勁的成長前景受到全球乳癌盛行率持續上升的推動,其中浸潤性乳管癌是最常見的診斷亞型。 IDC 佔所有侵襲性乳癌病例的近 80%,是腫瘤學領域的重要關注領域。隨著乳癌篩檢計畫的擴大和早期檢測的改善,醫療保健提供者正在見證 IDC 診斷數量的顯著增加。這反過來又繼續推動對有效的、以患者為中心的治療方法的需求,這些治療方法不僅可以提高生存率,還可以提高生活品質。癌症負擔日益加重,加速了治療創新的需求,IDC 治療領域正在快速發展,以先進的解決方案滿足這一需求。患者和臨床醫生意識的提高、有利的報銷方案以及已開發和新興經濟體醫療保健基礎設施的擴大也促進了該市場的持續發展。

雖然傳統化療仍然是治療 IDC 的關鍵組成部分,但向創新和標靶治療的轉變正在加速。基於荷爾蒙的療法和生物製劑由於其療效增強且毒性降低而成為首選的治療選擇。芳香化酶抑制劑和選擇性雌激素受體分解劑 (SERD) 等療法對荷爾蒙受體陽性 (HR+) IDC 病例特別有效,這類病例佔診斷的很大一部分。這些治療方法幫助患者更好地控制病情,減少副作用,促使醫生和患者都傾向於這種先進的方法。因此,標靶治療正在成為 IDC 護理方案中不可或缺的元素,進一步鞏固了市場的上升趨勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 92億美元 |

| 預測值 | 206億美元 |

| 複合年成長率 | 8.5% |

IDC 治療市場依最終用途分為醫院、腫瘤診所和其他醫療機構。由於醫院能夠提供全面癌症治療、最先進的診斷系統以及多學科腫瘤學團隊,預計到 2034 年醫院的收入將達到 36 億美元。這些環境支持涉及化療、免疫療法和精準醫療的複雜治療方案的綜合管理,仍然是 IDC 治療的首選。

在北美,美國佔據浸潤性乳管癌治療市場的領先佔有率,這得益於該地區的高發病率和強大的醫療保健框架。知名癌症治療中心的存在和新型療法的廣泛普及推動了 IDC 治療的採用。

該領域的領先公司包括 AbbVie、AstraZeneca、Bristol-Myers Squibb、Celldex Therapeutics、Eli Lilly、F. Hoffmann-La Roche、Janssen Pharmaceuticals、Macrogenics、Merck、Novartis 和 Pfizer。這些參與者正在大力投資研發,以推出能夠帶來更好臨床效果和更少副作用的尖端免疫療法和聯合療法。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 乳癌盛行率和認知度不斷提高

- 改進的診斷技術

- 擴大治療選擇

- 產業陷阱與挑戰

- 治療費用高

- 副作用和對某些療法的抵抗力

- 成長動力

- 成長潛力分析

- 監管格局

- 管道分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類型,2021 - 2034 年

- 主要趨勢

- 標靶治療

- 阿貝馬西利

- 阿多曲妥珠單抗

- 依維莫司

- 曲妥珠單抗

- 瑞博西利

- 帕博西利

- 帕妥珠單抗

- 奧拉帕尼

- 其他標靶治療

- 荷爾蒙療法

- 選擇性雌激素受體調節劑(SERM)

- 芳香化酶抑制劑

- 選擇性雌激素受體分解劑(SERD)

- 化療

- 免疫療法

第6章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 荷爾蒙受體

- HER2+

- 三陰性乳癌(TNBC)

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 醫院

- 腫瘤診所

- 其他最終用途

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- AbbVie

- AstraZeneca

- Bristol-Myers Squibb Company

- Celldex Therapeutics

- Eli Lilly and Company

- F. Hoffmann-La Roche

- Gilead Sciences

- Janssen Pharmaceuticals

- Macrogenics

- Merck

- Novartis

- Pfizer

The Global Invasive Ductal Carcinoma Therapeutics Market was valued at USD 9.2 billion in 2024 and is projected to grow at a CAGR of 8.5% to reach USD 20.6 billion by 2034. This robust growth outlook is fueled by the consistently rising prevalence of breast cancer worldwide, with invasive ductal carcinoma being the most frequently diagnosed subtype. IDC accounts for nearly 80% of all invasive breast cancer cases, making it a significant area of focus in oncology. As breast cancer screening programs expand and early detection improves, healthcare providers are witnessing a notable increase in the number of IDC diagnoses. This, in turn, continues to drive demand for effective, patient-centric therapies that not only improve survival rates but also enhance the quality of life. The growing burden of cancer has accelerated the need for treatment innovation, and the IDC therapeutics space is rapidly evolving to meet that need with advanced solutions. Increasing awareness among patients and clinicians, favorable reimbursement scenarios, and expanding healthcare infrastructure across developed and emerging economies are also contributing to this market's sustained momentum.

While conventional chemotherapy remains a key component in managing IDC, the shift toward innovative and targeted therapies is gaining speed. Hormone-based therapies and biologics are becoming the preferred treatment options due to their enhanced efficacy and reduced toxicity profiles. Therapies such as aromatase inhibitors and selective estrogen receptor degraders (SERDs) are especially effective in hormone receptor-positive (HR+) IDC cases, which represent a significant portion of diagnoses. These treatments are helping patients achieve better disease control with fewer side effects, prompting both physicians and patients to lean toward such advanced approaches. As a result, targeted therapeutics are becoming an indispensable element in IDC care protocols, further reinforcing the market's upward trajectory.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.2 Billion |

| Forecast Value | $20.6 Billion |

| CAGR | 8.5% |

The IDC therapeutics market is segmented by end-use into hospitals, oncology clinics, and other healthcare facilities. Hospitals are expected to generate USD 3.6 billion by 2034, owing to their ability to provide integrated cancer care, state-of-the-art diagnostic systems, and access to multidisciplinary oncology teams. These environments support comprehensive management of complex treatment regimens involving chemotherapy, immunotherapy, and precision medicines, thereby remaining the go-to option for IDC treatment.

In North America, the U.S. holds a leading share of the invasive ductal carcinoma therapeutics market, backed by the region's high disease prevalence and strong healthcare framework. The presence of renowned cancer treatment centers and widespread access to novel therapeutics are driving the adoption of IDC treatments.

Leading companies in this space include AbbVie, AstraZeneca, Bristol-Myers Squibb, Celldex Therapeutics, Eli Lilly, F. Hoffmann-La Roche, Janssen Pharmaceuticals, Macrogenics, Merck, Novartis, and Pfizer. These players are investing heavily in R&D to introduce cutting-edge immunotherapies and combination therapies that deliver better clinical outcomes and fewer side effects.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence and awareness of breast cancer

- 3.2.1.2 Improved diagnostic technologies

- 3.2.1.3 Expanding therapeutic options

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High treatment cost

- 3.2.2.2 Side effects and resistance to certain therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Pipeline analysis

- 3.6 Porter’s analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Targeted therapy

- 5.2.1 Abemaciclib

- 5.2.2 Ado-trastuzumab emtansine

- 5.2.3 Everolimus

- 5.2.4 Trastuzumab

- 5.2.5 Ribociclib

- 5.2.6 Palbociclib

- 5.2.7 Pertuzumab

- 5.2.8 Olaparib

- 5.2.9 Other targeted therapies

- 5.3 Hormone therapy

- 5.3.1 Selective estrogen receptor modulators (SERMs)

- 5.3.2 Aromatase inhibitors

- 5.3.3 Selective estrogen receptor degraders (SERDs)

- 5.4 Chemotherapy

- 5.5 Immunotherapy

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hormone receptor

- 6.3 HER2+

- 6.4 Triple-negative breast cancer (TNBC)

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Oncology clinics

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AbbVie

- 9.2 AstraZeneca

- 9.3 Bristol-Myers Squibb Company

- 9.4 Celldex Therapeutics

- 9.5 Eli Lilly and Company

- 9.6 F. Hoffmann-La Roche

- 9.7 Gilead Sciences

- 9.8 Janssen Pharmaceuticals

- 9.9 Macrogenics

- 9.10 Merck

- 9.11 Novartis

- 9.12 Pfizer