|

市場調查報告書

商品編碼

1721472

環柵 (GAA) 電晶體市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Gate-All-Around (GAA) Transistor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

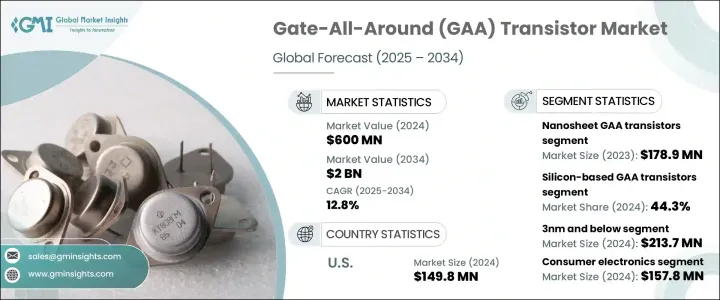

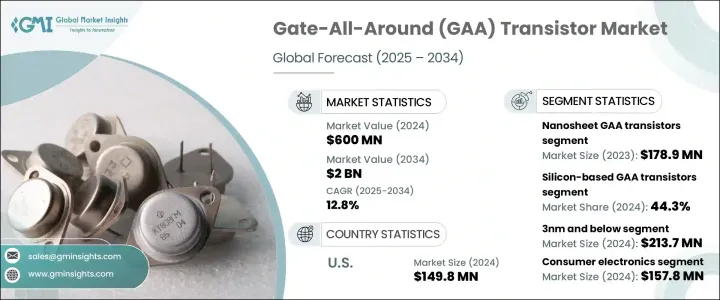

2024 年全球環柵電晶體市場價值為 6 億美元,預計到 2034 年將以 12.8% 的複合年成長率成長,達到 20 億美元。這一成長是由對高效能處理器日益成長的需求、5G 網路的擴展以及邊緣運算技術的興起所推動的。 GAA 電晶體將在行動處理器、網路硬體和 AI 驅動平台使用的下一代晶片組中發揮關鍵作用。與傳統的 FinFET 設計相比,它們具有更高的能源效率、更快的切換能力以及卓越的靜電控制,是滿足現代運算應用效能需求的理想解決方案。隨著雲端運算、電信和汽車等資料密集產業的發展,GAA 電晶體正在成為未來技術的基石。

奈米片 GAA 電晶體已成為市場上最突出的部分,2023 年的產值達到 1.789 億美元。這些電晶體因其對短溝道效應的先進控制、針對 3nm 以下製程節點的改進可擴展性以及更高的電晶體密度而備受青睞。領先的半導體代工廠正在採用奈米片架構來提高電源效率和晶片性能,使其成為人工智慧、高效能運算和行動平台的關鍵選擇。奈米片 GAA 電晶體與現有製造設備的兼容性也有助於其在大規模生產中的快速應用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 6億美元 |

| 預測值 | 20億美元 |

| 複合年成長率 | 12.8% |

2024 年,矽基 GAA 電晶體領域佔有 44.3% 的市佔率。矽的成本效益以及與成熟半導體製造製程的兼容性使其成為市場主導。英特爾和台灣半導體製造公司 (TSMC) 等主要參與者正在其 5nm 以下技術中利用基於矽的奈米片設計,最佳化能源效率並提高邏輯密度。這些進步對於滿足數位設備日益成長的性能需求和解決電晶體尺寸縮小的挑戰至關重要。

在德國,GAA 電晶體市場規模預計到 2034 年將達到 1.126 億美元。該國強大的半導體產業與汽車、自動化和智慧製造等產業相結合,正在推動 GAA 電晶體的採用。值得注意的是,GAA 技術正在整合到電動車系統和工業自動化平台中。德國也大力投資研究,以保持在先進晶片技術的前沿,將自己定位為歐洲半導體自力更生和技術主權策略的關鍵參與者。

該市場正見證英特爾、三星電子和台灣半導體製造公司 (TSMC) 等行業巨頭的重大貢獻。這些領先的公司正在大力投資奈米片和叉片電晶體架構的研發。此外,他們正在與設計工具提供者和代工廠建立戰略合作夥伴關係,以加快產品上市時間,同時擴大其地理覆蓋範圍並參與政府資助的半導體計劃。這些努力有助於他們在快速發展的 GAA 電晶體市場中保持競爭優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 對高效能運算(HPC)的需求不斷成長

- 半導體製造技術的進步

- 5G和邊緣運算的成長

- 人工智慧和物聯網設備投資不斷增加

- 代工廠和IDM的策略性擴張

- 產業陷阱與挑戰

- 製造複雜性高且成本高

- 供應鍊和產量挑戰

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依類型,2021-2034

- 主要趨勢

- 奈米片 GAA 電晶體

- 奈米線GAA電晶體

- Forksheet GAA電晶體

- 其他

第6章:市場估計與預測:依材料,2021-2034

- 主要趨勢

- 矽基GAA電晶體

- 鍺基GAA電晶體

- III-V族化合物半導體GAA電晶體

第7章:市場預估與預測:依節點規模,2021-2034

- 主要趨勢

- 3奈米及以下

- 3奈米以上

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 高效能運算 (HPC)

- 物聯網 (IoT) 設備

- 人工智慧和機器學習處理器

- 5G和通訊基礎設施

- 其他

第9章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 消費性電子產品

- 汽車

- 資料中心和雲端運算

- 工業電子

- 醫療保健和醫療器械

- 其他

第10章:市場估計與預測:按地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Analog Devices

- ams-OSRAM AG

- Broadcom Inc.

- Everlight Electronics Co., Ltd.

- Honeywell International Inc.

- Melexis NV

- Microchip Technology Inc.

- OmniVision Technologies, Inc.

- ON Semiconductor Corporation

- Panasonic Corporation

- Renesas Electronics Corporation

- ROHM Semiconductor

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Silicon Labs

- Sony Semiconductor Solutions Corporation

- STMicroelectronics

- Texas Instruments Incorporated

- Vishay Intertechnology

The Global Gate-All-Around Transistor Market was valued at USD 600 million in 2024 and is estimated to grow at a CAGR of 12.8% to reach USD 2 billion by 2034. This growth is driven by the increasing demand for high-performance processors, the expansion of 5G networks, and the rise of edge computing technologies. GAA transistors are poised to play a critical role in next-generation chipsets used across mobile processors, network hardware, and AI-driven platforms. Their enhanced energy efficiency, faster switching capabilities, and superior electrostatic control compared to traditional FinFET designs make them an ideal solution for addressing the performance demands of modern computing applications. As data-intensive industries like cloud computing, telecom, and automotive evolve, GAA transistors are emerging as a cornerstone for future technology.

Nanosheet GAA transistors have become the most prominent segment in the market, generating USD 178.9 million in 2023. These transistors are highly favored due to their advanced control over short-channel effects, improved scalability for sub-3nm process nodes, and higher transistor density. Leading semiconductor foundries are adopting nanosheet architecture to enhance power efficiency and chip performance, making them a critical choice for AI, high-performance computing, and mobile platforms. The compatibility of nanosheet GAA transistors with existing manufacturing equipment is also contributing to their rapid adoption in large-scale production.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $600 Million |

| Forecast Value | $2 Billion |

| CAGR | 12.8% |

The silicon-based GAA transistor segment held a 44.3% market share in 2024. Silicon's cost-effectiveness and compatibility with established semiconductor fabrication processes contribute to its dominance. Major players like Intel and Taiwan Semiconductor Manufacturing Company (TSMC) are leveraging silicon-based nanosheet designs in their sub-5nm technologies, optimizing energy efficiency, and boosting logic density. These advancements are crucial for meeting the growing performance needs of digital devices and addressing the challenges of shrinking transistor sizes.

In Germany, the GAA transistor market is set to reach USD 112.6 million by 2034. The country's strong semiconductor sector, aligned with industries like automotive, automation, and smart manufacturing, is driving the adoption of GAA transistors. Notably, GAA technology is being integrated into electric vehicle systems and industrial automation platforms. Germany is also investing heavily in research to stay at the forefront of advanced chip technologies, positioning itself as a key player in Europe's strategy for semiconductor self-reliance and technological sovereignty.

The market is witnessing significant contributions from industry giants such as Intel, Samsung Electronics, and Taiwan Semiconductor Manufacturing Company (TSMC). These leading companies are investing heavily in research and development for nanosheet and forksheet transistor architectures. Additionally, they are forming strategic partnerships with design tool providers and foundries to speed up time-to-market, while expanding their geographic reach and participating in government-funded semiconductor initiatives. These efforts help maintain their competitive edge in the rapidly evolving GAA transistor market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Increasing demand for High-Performance Computing (HPC)

- 3.6.1.2 Advancements in semiconductor fabrication technology

- 3.6.1.3 Growth in 5G and edge computing

- 3.6.1.4 Rising investments in AI and IoT devices

- 3.6.1.5 Strategic expansion by foundries and IDMs

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High manufacturing complexity and costs

- 3.6.2.2 Supply chain and yield challenges

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Nanosheet GAA transistors

- 5.3 Nanowire GAA transistors

- 5.4 Forksheet GAA transistors

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Material, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Silicon-based GAA transistors

- 6.3 Germanium-based GAA transistors

- 6.4 III-V compound semiconductor GAA transistors

Chapter 7 Market Estimates & Forecast, By Node Size, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 3nm and below

- 7.3 Above 3nm

Chapter 8 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 High-Performance Computing (HPC)

- 8.3 Internet of Things (IoT) devices

- 8.4 AI & machine learning processors

- 8.5 5G & communication infrastructure

- 8.6 Others

Chapter 9 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 Consumer electronics

- 9.3 Automotive

- 9.4 Data centers & cloud computing

- 9.5 Industrial electronics

- 9.6 Healthcare & medical devices

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Analog Devices

- 11.2 ams-OSRAM AG

- 11.3 Broadcom Inc.

- 11.4 Everlight Electronics Co., Ltd.

- 11.5 Honeywell International Inc.

- 11.6 Melexis NV

- 11.7 Microchip Technology Inc.

- 11.8 OmniVision Technologies, Inc.

- 11.9 ON Semiconductor Corporation

- 11.10 Panasonic Corporation

- 11.11 Renesas Electronics Corporation

- 11.12 ROHM Semiconductor

- 11.13 Samsung Electronics Co., Ltd.

- 11.14 Sharp Corporation

- 11.15 Silicon Labs

- 11.16 Sony Semiconductor Solutions Corporation

- 11.17 STMicroelectronics

- 11.18 Texas Instruments Incorporated

- 11.19 Vishay Intertechnology