|

市場調查報告書

商品編碼

1721470

汽車塑膠點火支架市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automotive Plastic Ignition Holders Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

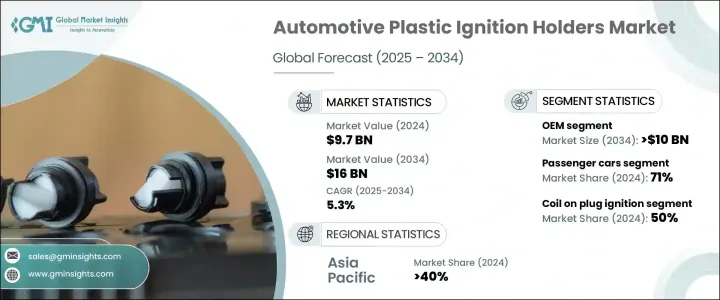

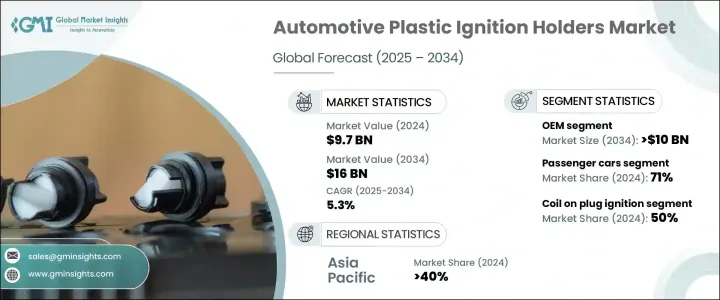

2024 年全球汽車塑膠點火支架市場價值為 97 億美元,預計到 2034 年將以 5.3% 的複合年成長率成長,達到 160 億美元。這一成長軌跡歸因於全球汽車產量和汽車保有量的強勁成長,尤其是在汽車基礎設施快速發展的新興經濟體。消費者更傾向於購買那些不僅省油、經濟實惠,而且配備有延長引擎壽命和降低排放的零件的汽車。因此,汽車製造商擴大採用高性能塑膠零件,以減輕車輛整體重量並滿足不斷變化的排放和燃油經濟性監管標準。

汽車塑膠點火支架因其出色的耐熱性、成本效益和耐用性已成為現代汽車設計中的重要組成部分。這些支架正在幫助原始設備製造商 (OEM) 實現關鍵目標,包括減輕引擎重量、改善熱管理和提高整體車輛效率。市場也見證了材料創新的強勁投資,主要行業參與者正在加快研發活動,以提高這些部件的結構完整性和性能。緊湊型汽車需求的不斷成長、先進燃燒技術的採用以及全球消費者對環保出行解決方案的偏好的穩步上升進一步推動了成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 97億美元 |

| 預測值 | 160億美元 |

| 複合年成長率 | 5.3% |

先進的複合材料和高性能熱塑性塑膠是該領域創新的關鍵推動因素。聚醯胺 (PA)、聚苯硫醚 (PPS) 和增強熱塑性塑膠等材料被廣泛用於製造能夠承受高溫和機械應力的點火支架。這些材料有助於減輕零件重量、提高燃油效率並減少排放,使其成為入門級和高檔汽車領域的理想選擇。塑膠點火支架的成本效益和可靠性使其成為全球汽車平台的首選。

就引擎類型而言,市場分為汽油、柴油和替代燃料類別。 2024 年,汽油引擎領域佔據市場主導地位,佔總佔有率的 60% 以上,預計到 2034 年將達到 90 億美元。人們對低排放和省油汽油汽車的偏好日益成長,這推動了對輕型點火零件的需求。塑膠點火支架在確保精確的點火正時方面發揮著關鍵作用,這對於最佳燃燒和引擎性能至關重要 - 特別是在現代直噴汽油引擎中。

乘用車是主要的車輛類型,到 2024 年將佔據 71% 的市場。緊湊型和省油型汽車產量的增加將繼續推動對輕型、經濟型點火支架的需求。乘用車中渦輪增壓引擎的日益整合,加劇了對熱穩定、耐用的點火部件的需求,以支援高性能輸出。

受嚴格的燃油效率標準和先進點火系統日益普及的推動,美國汽車塑膠點火支架市場預計將在 2025 年至 2034 年間經歷顯著成長。該地區的汽車製造商優先考慮輕量化設計和創新材料,以滿足環境法規並提高燃油經濟性,從而加速塑膠點火支架在OEM和售後市場應用中的普及。

領先的市場參與者包括Bosch、三菱電機、法雷奧、博格華納、日立、NGK 火星塞、標準汽車產品、Diamond Electric、電裝和海拉。這些公司正在透過擴大研發能力、推出創新點火解決方案以及與汽車製造商合作打造特定車輛設計來推進其市場策略。現代製造技術和增強材料的部署也幫助這些公司提高產品性能,而與監管機構的合作則確保遵守不斷發展的安全和環境標準。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 製造商

- 服務提供者

- 經銷商

- 最終用戶

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 價格趨勢

- 成本細分分析

- 衝擊力

- 成長動力

- 提高燃油效率對輕量化汽車零件的需求不斷增加

- 高性能熱塑性塑膠的進步提高了耐用性和耐熱性

- 新興市場汽車產量不斷成長,推動大規模採用

- 售後市場對經濟高效的替換點火系統零件的需求不斷成長

- 產業陷阱與挑戰

- 與金屬點火支架相比,在極端條件下存在耐久性問題

- 在需要更高強度材料的高性能和重型車輛中的應用有限

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 聚醯胺(PA)

- 聚丙烯(PP)

- 聚對苯二甲酸丁二醇酯(PBT)

- 聚苯硫醚(PPS)

- 聚對苯二甲酸乙二酯(PET)

- 其他

第6章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 越野車

- 轎車

- 掀背車

- 商用車

- 輕型商用車(LCV)

- 中型商用車(MCV)

- 重型商用車(HCV)

- 非公路車輛

第7章:市場估計與預測:按引擎,2021 - 2034 年

- 主要趨勢

- 汽油

- 柴油引擎

- 替代燃料

第8章:市場估計與預測:按 Ignition,2021 - 2034 年

- 主要趨勢

- 插頭點火線圈

- 同時點火

- 壓燃

第9章:市場估計與預測:依組件,2021 - 2034

- 主要趨勢

- 點火開關

- 火星塞

- 預熱塞

- 點火線圈

- 其他

第 10 章:市場估計與預測:按銷售管道,2021 年至 2034 年

- 主要趨勢

- OEM

- 售後市場

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第12章:公司簡介

- BorgWarner

- Bosch

- Continental

- Denso

- Diamond Electric

- DuPont

- HELLA

- Hitachi

- Magna

- Mitsubishi Electric

- NGK Spark Plug

- Polyplastics

- Samvardhana

- Sensata

- Standard Motor Products

- Sumitomo

- Toyoda Gosei

- Valeo

- Visteon

- Yazaki

The Global Automotive Plastic Ignition Holders Market was valued at USD 9.7 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 16 billion by 2034. This growth trajectory is attributed to a robust surge in global automobile production and vehicle ownership, especially in emerging economies where automotive infrastructure is rapidly advancing. Consumers are leaning toward vehicles that are not only fuel-efficient and cost-effective but also equipped with components that support longer engine life and lower emissions. As a result, automakers are increasingly adopting high-performance plastic components that reduce overall vehicle weight and meet evolving regulatory standards for emissions and fuel economy.

Automotive plastic ignition holders have become a vital component in modern vehicle designs due to their excellent heat resistance, cost-efficiency, and durability. These holders are helping original equipment manufacturers (OEMs) achieve critical goals, including reduced engine weight, better thermal management, and overall enhanced vehicle efficiency. The market is also witnessing strong investment in material innovation, with major industry players accelerating R&D activities to improve the structural integrity and performance of these components. Growth is further supported by increasing demand for compact vehicles, adoption of advanced combustion technologies, and a steady rise in global consumer preference for environmentally responsible mobility solutions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.7 Billion |

| Forecast Value | $16 Billion |

| CAGR | 5.3% |

Advanced composite materials and high-performance thermoplastics are key enablers of innovation in this space. Materials such as polyamide (PA), polyphenylene sulfide (PPS), and reinforced thermoplastics are being widely used to manufacture ignition holders that can withstand high temperatures and mechanical stress. These materials help reduce component weight, enhance fuel efficiency, and minimize emissions-making them ideal for use in both entry-level and premium vehicle segments. Their cost-effectiveness and reliability have made plastic ignition holders a preferred choice across global automotive platforms.

In terms of engine types, the market is segmented into gasoline, diesel, and alternative fuel categories. The gasoline engine segment led the market in 2024, capturing over 60% of the total share and is projected to reach USD 9 billion by 2034. The growing preference for low-emission and fuel-efficient gasoline vehicles is fueling the demand for lightweight ignition components. Plastic ignition holders play a critical role in ensuring precise ignition timing, which is essential for optimal combustion and engine performance-especially in modern direct-injection gasoline engines.

Passenger cars represented the dominant vehicle type, accounting for 71% of the market share in 2024. Rising production of compact and fuel-efficient cars continues to propel demand for lightweight, affordable ignition holders. The increasing integration of turbocharged engines in passenger cars has intensified the need for thermally stable, durable ignition components to support high-performance output.

The U.S. automotive plastic ignition holders market is forecast to experience notable growth from 2025 to 2034, spurred by strict fuel efficiency standards and rising adoption of advanced ignition systems. Automakers in the region are prioritizing lightweight designs and innovative materials to meet environmental regulations and enhance fuel economy, thereby accelerating the uptake of plastic ignition holders in both OEM and aftermarket applications.

Leading market players include Bosch, Mitsubishi Electric, Valeo, BorgWarner, Hitachi, NGK Spark Plug, Standard Motor Products, Diamond Electric, Denso, and HELLA. These companies are advancing their market strategies by expanding R&D capabilities, introducing innovative ignition solutions, and forming collaborations with automakers to create vehicle-specific designs. The deployment of modern manufacturing techniques and enhanced materials is also helping these firms improve product performance, while partnerships with regulatory agencies ensure compliance with evolving safety and environmental standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Manufacturers

- 3.2.3 Service providers

- 3.2.4 Distributors

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price trends

- 3.9 Cost breakdown analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Increasing demand for lightweight automotive components to enhance fuel efficiency

- 3.10.1.2 Advancements in high-performance thermoplastics improving durability and heat resistance

- 3.10.1.3 Growing automotive production in emerging markets driving mass adoption

- 3.10.1.4 Rising aftermarket demand for cost-effective replacement ignition system components

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 Durability concerns compared to metal ignition holders in extreme conditions

- 3.10.2.2 Limited adoption in high-performance and heavy-duty vehicles requiring higher strength materials

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Polyamide (PA)

- 5.3 Polypropylene (PP)

- 5.4 Polybutylene Terephthalate (PBT)

- 5.5 Polyphenylene Sulfide (PPS)

- 5.6 Polyethylene Terephthalate (PET)

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 SUV

- 6.2.2 Sedan

- 6.2.3 Hatchback

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicle (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

- 6.4 Off-highway vehicles

Chapter 7 Market Estimates & Forecast, By Engine, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Gasoline

- 7.3 Diesel

- 7.4 Alternative fuels

Chapter 8 Market Estimates & Forecast, By Ignition, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Coil on plug ignition

- 8.3 Simultaneous ignition

- 8.4 Compression ignition

Chapter 9 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Ignition switch

- 9.3 Spark plug

- 9.4 Glow plug

- 9.5 Ignition coil

- 9.6 Others

Chapter 10 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 OEM

- 10.3 Aftermarket

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 UK

- 11.3.2 Germany

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Russia

- 11.3.7 Nordics

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.4.5 ANZ

- 11.4.6 Southeast Asia

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 MEA

- 11.6.1 UAE

- 11.6.2 South Africa

- 11.6.3 Saudi Arabia

Chapter 12 Company Profiles

- 12.1 BorgWarner

- 12.2 Bosch

- 12.3 Continental

- 12.4 Denso

- 12.5 Diamond Electric

- 12.6 DuPont

- 12.7 HELLA

- 12.8 Hitachi

- 12.9 Magna

- 12.10 Mitsubishi Electric

- 12.11 NGK Spark Plug

- 12.12 Polyplastics

- 12.13 Samvardhana

- 12.14 Sensata

- 12.15 Standard Motor Products

- 12.16 Sumitomo

- 12.17 Toyoda Gosei

- 12.18 Valeo

- 12.19 Visteon

- 12.20 Yazaki