|

市場調查報告書

商品編碼

1721469

協作機器人市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Collaborative Robots Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

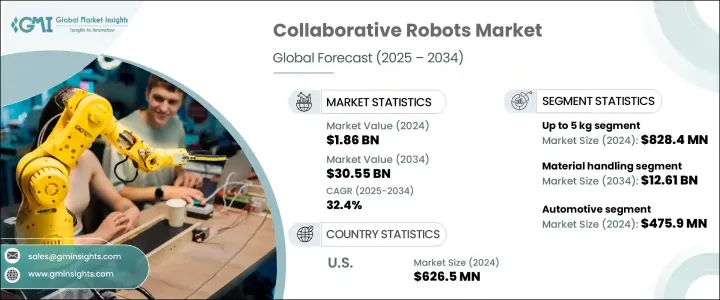

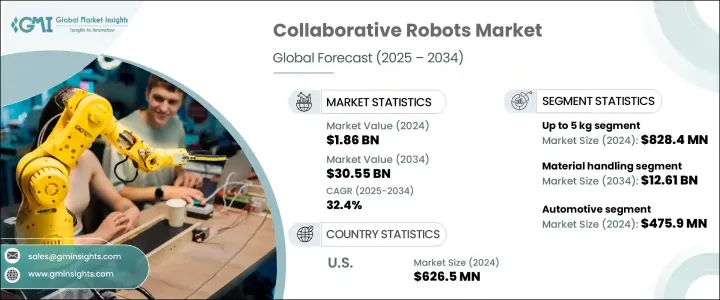

2024 年全球協作機器人市場價值為 18.6 億美元,預計到 2034 年將以 32.4% 的複合年成長率成長,達到 305.5 億美元。這一顯著的成長軌跡反映了人們對智慧自動化日益成長的重視以及人機協作在現代製造環境中不斷演變的作用。隨著工業部門優先考慮提高生產力、成本效率和勞動力安全,協作機器人(通常稱為 cobots)正在成為尋求最佳化營運的企業的首選解決方案。這些機器人經過精心設計,可以與人類工人一起安全運行,為動態生產線提供靈活性、適應性和精確性。

隨著工業 4.0 原則越來越被接受,企業擴大將協作機器人與人工智慧、物聯網和機器學習技術相結合,以建立靈活且能夠響應不斷變化的市場需求的智慧工廠。數位轉型的趨勢不僅重塑了傳統的工作流程,而且還將協作機器人定位為解決勞動力短缺和簡化重複性或危險任務的重要工具。此外,隨著中小型企業 (SME) 尋求在全球市場上保持競爭力,他們正在採用經濟實惠且方便用戶使用的機器人解決方案來減少停機時間並加快產品上市時間。政府對智慧製造計畫的支持,以及人機介面 (HMI) 系統的創新,繼續推動各行各業協作機器人的部署。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18.6億美元 |

| 預測值 | 305.5億美元 |

| 複合年成長率 | 32.4% |

依照有效載重能力,市場分為 5 公斤以下、5-10 公斤、10-25 公斤和 25 公斤以上的類別。酬載能力高達 5 公斤的機器人領域引領市場,2024 年估值達 8.284 億美元。這些協作機器人廣泛應用於組裝、品質檢查和包裝等輕型任務,非常適合進軍自動化領域的中小企業。它們體積小、成本低、操作直覺,對於轉型為自動化流程的產業來說,是一個有吸引力的切入點。

協作機器人應用於各種領域,包括物料搬運、焊接、釬焊、分配、組裝、拆卸和加工。其中,物料搬運領域預計到 2034 年將創造 126.1 億美元的產值。協作機器人透過自動化揀貨、包裝和堆疊等功能來提高物流和倉儲效率。它們整合了機器視覺系統和先進的感測器,使它們能夠準確地執行重複性任務,同時確保工人的安全。

2024 年美國協作機器人市場規模達到 6.265 億美元,體現了其在自動化創新領域的領導地位。美國的公司正在透過提供只需要極少技術專長的即插即用機器人系統來簡化採用流程,使得即使是小型企業也能自動化。

主要參與者包括 Universal Robots A/S、ABB、FANUC America Corporation、KUKA AG 和 Yaskawa America, Inc.,他們都在繼續投資人工智慧整合、競爭性定價策略和新興市場的擴張,以加強其全球影響力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 需要提高生產力和營運效率

- 越來越關注工作場所的安全和合規性

- 各行業勞動力短缺加劇

- 工業4.0的快速成長

- 產業陷阱與挑戰

- 高資本投入

- 開發中國家採用率低

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依酬載,2021-2034

- 主要趨勢

- 最多 5 公斤

- 5-10公斤

- 10-25公斤

- 超過25公斤

第6章:市場估計與預測:按應用,2021-2034

- 主要趨勢

- 物料處理

- 組裝和拆卸

- 焊接和釬焊

- 分配

- 加工

- 其他

第7章:市場估計與預測:按最終用途產業,2021-2034 年

- 主要趨勢

- 汽車

- 電子產品

- 金屬與機械加工

- 塑膠和聚合物

- 食品和飲料

- 家具和設備

- 衛生保健

- 後勤

- 其他

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Universal Robots A/S

- ABB

- FANUC America Corporation

- KUKA AG

- Yaskawa America, Inc.

- Techman Robot Inc.

- Doosan Robotics Co., Ltd.

- Rethink Robotics

- DENSO WAVE INCORPORATED

- OMRON Corporation

- Hanwha Group

- Staubli International AG

- ROBOTICS TECHNOLOGY CO., LTD

The Global Collaborative Robots Market was valued at USD 1.86 billion in 2024 and is estimated to grow at a CAGR of 32.4% to reach USD 30.55 billion by 2034. This remarkable growth trajectory reflects the rising emphasis on intelligent automation and the evolving role of human-robot collaboration in modern manufacturing environments. As industrial sectors prioritize enhanced productivity, cost efficiency, and workforce safety, collaborative robots-commonly known as cobots-are becoming a preferred solution for businesses seeking to optimize their operations. These robots are engineered to operate safely alongside human workers, offering flexibility, adaptability, and precision in dynamic production lines.

With the growing acceptance of Industry 4.0 principles, companies are increasingly integrating cobots with AI, IoT, and machine learning technologies to build smart factories that are agile and responsive to shifting market demands. The trend toward digital transformation is not only reshaping traditional workflows but also positioning cobots as a vital tool for addressing labor shortages and streamlining repetitive or hazardous tasks. Moreover, as small and medium-sized enterprises (SMEs) look to stay competitive in the global marketplace, they are embracing affordable and user-friendly robotic solutions to reduce downtime and accelerate time-to-market. Government support for smart manufacturing initiatives, alongside innovations in human-machine interface (HMI) systems, continues to fuel the momentum behind cobot deployment across industries.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.86 Billion |

| Forecast Value | $30.55 Billion |

| CAGR | 32.4% |

In terms of payload capacity, the market is segmented into up to 5 kg, 5-10 kg, 10-25 kg, and above 25 kg categories. The segment for robots with up to 5 kg payload capacity led the market, reaching a valuation of USD 828.4 million in 2024. These cobots are widely adopted for light-duty tasks such as assembly, quality inspection, and packaging, making them highly suitable for SMEs venturing into automation. Their compact footprint, low cost, and intuitive operation make them an attractive entry point for industries transitioning to automated processes.

Collaborative robots are deployed in various applications, including material handling, welding, soldering, dispensing, assembly, disassembly, and processing. Among these, the material handling segment is projected to generate USD 12.61 billion by 2034. Cobots enhance logistics and warehousing efficiency by automating functions like picking, packing, and palletizing. They integrate machine vision systems and advanced sensors that allow them to perform repetitive tasks with accuracy while ensuring worker safety.

The U.S. Collaborative Robots Market reached USD 626.5 million in 2024, reflecting its leadership in automation innovation. Companies in the U.S. are simplifying adoption by offering plug-and-play robotic systems that require minimal technical expertise, making automation accessible even to smaller businesses.

Key players include Universal Robots A/S, ABB, FANUC America Corporation, KUKA AG, and Yaskawa America, Inc., all of whom continue to invest in AI integration, competitive pricing strategies, and expansion across emerging markets to strengthen their global footprint.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Need to enhance productivity and operational efficiency

- 3.2.1.2 Growing focus on workplace safety and compliance

- 3.2.1.3 Rising labor shortages across various industries

- 3.2.1.4 Rapid growth of Industry 4.0

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High capital investment

- 3.2.2.2 Low adoption rate in developing countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Payload, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Up to 5 kg

- 5.3 5-10 kg

- 5.4 10-25 kg

- 5.5 More than 25 kg

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Material handling

- 6.3 Assembling & dissembling

- 6.4 Welding & soldering

- 6.5 Dispensing

- 6.6 Processing

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Electronics

- 7.4 Metals & machining

- 7.5 Plastics & polymers

- 7.6 Food & beverages

- 7.7 Furniture & equipment

- 7.8 Healthcare

- 7.9 Logistics

- 7.10 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Universal Robots A/S

- 9.2 ABB

- 9.3 FANUC America Corporation

- 9.4 KUKA AG

- 9.5 Yaskawa America, Inc.

- 9.6 Techman Robot Inc.

- 9.7 Doosan Robotics Co., Ltd.

- 9.8 Rethink Robotics

- 9.9 DENSO WAVE INCORPORATED

- 9.10 OMRON Corporation

- 9.11 Hanwha Group

- 9.12 Staubli International AG

- 9.13 ROBOTICS TECHNOLOGY CO., LTD