|

市場調查報告書

商品編碼

1721466

被忽視的熱帶疾病治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Neglected Tropical Disease Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

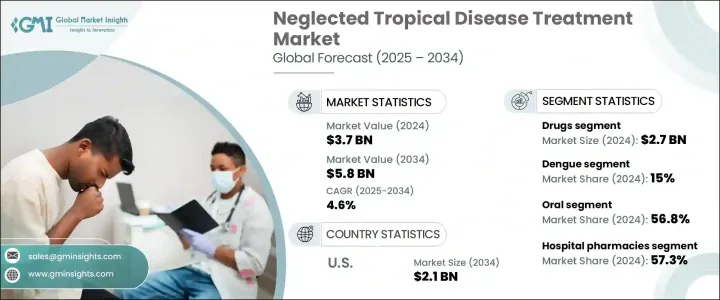

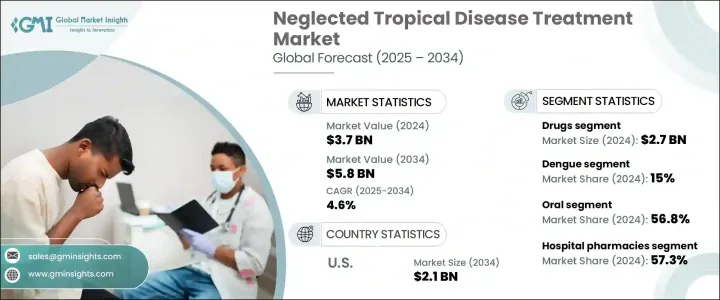

2024 年全球被忽視的熱帶疾病治療市場價值為 37 億美元,預計到 2034 年將以 4.6% 的複合年成長率成長,達到 58 億美元。這一成長反映了全球對抗擊被忽視的熱帶疾病 (NTD) 的日益關注,這種疾病仍然是低收入和發展中地區持續存在的健康挑戰。被忽視的熱帶疾病是世界衛生組織確定的一組 20 種傳染病,主要影響基本醫療保健有限的熱帶和亞熱帶地區的個體。這些疾病持續給醫療資源匱乏的社區帶來巨大的負擔,常常導致嚴重的發病率、長期殘疾和死亡。

儘管多年來取得了進展,但被忽視的熱帶疾病仍然影響著全球超過十億人,氣候變遷、快速城市化和人口流動性增加進一步加速了其傳播。衛生組織、政府和製藥公司正在透過大規模藥物管理計劃、宣傳活動和公私合作夥伴關係加強合作,以改善獲得有效治療方案的機會。診斷技術的進步、研究投入的增加以及解決熱帶感染中抗生素抗藥性的需要進一步影響市場動態。隨著全球醫療保健系統推動永續和包容性的解決方案以遏制這些衰弱性疾病發病率的上升,對可靠的治療干預的需求從未如此迫切。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 37億美元 |

| 預測值 | 58億美元 |

| 複合年成長率 | 4.6% |

被忽視的熱帶疾病治療市場按疾病類型細分,其中登革熱、狂犬病和沙眼是主要因素。 2024年,光是登革熱領域就佔據了全球市場佔有率的15%。登革熱繼續成為一個主要的健康問題,每年影響數億人,並導致數萬人死亡。過去五十年來,報告病例的數量急劇上升,這進一步表明有效治療和預防策略的迫切需求。市場也致力於解決其他高負擔疾病,如布魯裡潰瘍、雅司病和恰加斯病,每種疾病都帶來了獨特的治療挑戰並增加了全球醫療負擔。

神經管缺陷的治療方案大致分為藥物和疫苗。 2024年,藥品部門創造了27億美元的收入。抗寄生蟲、抗真菌和抗生素藥物仍然是治療這些疾病的第一線工具,在降低感染率和改善弱勢群體預後的公共衛生策略中發揮關鍵作用。

受部分地區被忽視的熱帶病患病率上升以及政府和慈善機構的積極支持推動,美國被忽視的熱帶疾病治療市場規模到 2024 年將達到 13.3 億美元。美國國立衛生研究院等組織正與全球衛生機構聯手擴大治療管道並推動創新。

全球市場的主要參與者包括拜耳、安斯泰來製藥和衛材,它們在神經管缺陷藥物和疫苗開發方面處於領先地位。這些公司優先考慮研發,與衛生組織和政府結盟,致力於為受影響的社區提供可負擔的、可擴展的解決方案。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 被忽視的熱帶疾病發病率不斷上升

- 有利的政府舉措

- 提高對被忽視的熱帶疾病的認知

- 產業陷阱與挑戰

- 缺乏醫療基礎設施

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依疾病類型,2021 年至 2034 年

- 主要趨勢

- 登革熱

- 狂犬病

- 沙眼

- 布魯裡潰瘍

- 雅司病

- 麻風

- 恰加斯病

- 非洲人類錐蟲病(昏睡病)

- 利甚曼病

- 土源性蠕蟲病

- 其他疾病類型

第6章:市場估計與預測:依治療類型,2021 年至 2034 年

- 主要趨勢

- 藥物

- 抗寄生蟲

- 抗真菌

- 抗生素

- 其他藥物

- 疫苗

第7章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 口服

- 注射劑

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Astellas Pharma

- Bayer

- Bharat Biotech

- Eisai

- Gilead Sciences

- GlaxoSmithKline

- Johnson & Johnson

- Merck

- Novartis

- Pfizer

- Sanofi

- Takeda Pharmaceutical

- Tarsus Pharmaceuticals

The Global Neglected Tropical Disease Treatment Market was valued at USD 3.7 billion in 2024 and is estimated to grow at a CAGR of 4.6% to reach USD 5.8 billion by 2034. This growth reflects the increasing global focus on combating neglected tropical diseases (NTDs), which remain a persistent health challenge across low-income and developing regions. NTDs refer to a group of 20 communicable diseases identified by the World Health Organization that mainly affect individuals in tropical and subtropical regions with limited access to essential healthcare. These diseases continue to place an immense burden on underserved communities, often leading to significant morbidity, long-term disability, and mortality.

Despite years of progress, NTDs still impact more than a billion people worldwide, with climate change, rapid urbanization, and increased human mobility further accelerating their spread. Health organizations, governments, and pharmaceutical companies are stepping up collaborative efforts through mass drug administration programs, awareness campaigns, and public-private partnerships to improve access to effective treatment options. Market dynamics are further influenced by advancements in diagnostics, growing investments in research, and the need to address antimicrobial resistance in tropical infections. The demand for reliable therapeutic interventions has never been more urgent as healthcare systems around the globe push for sustainable and inclusive solutions to curb the rising incidence of these debilitating diseases.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.7 Billion |

| Forecast Value | $5.8 Billion |

| CAGR | 4.6% |

The Neglected Tropical Disease Treatment Market is segmented by disease type, with dengue, rabies, and trachoma among the top contributors. In 2024, the dengue segment alone accounted for 15% of the global market share. Dengue continues to emerge as a major health concern, affecting hundreds of millions every year and resulting in tens of thousands of deaths. The number of reported cases has seen a dramatic rise over the last five decades, reinforcing the critical need for effective treatments and prevention strategies. The market also addresses other high-burden conditions such as Buruli ulcer, yaws, and Chagas disease, each presenting unique treatment challenges and adding to the global healthcare load.

Treatment options for NTDs are broadly classified into drugs and vaccines. In 2024, the drug segment generated USD 2.7 billion in revenue. Anti-parasitic, antifungal, and antibiotic medications continue to be frontline tools in managing these diseases, playing a pivotal role in public health strategies to reduce infection rates and improve outcomes in vulnerable populations.

The U.S. Neglected Tropical Disease Treatment Market reached USD 1.33 billion in 2024, driven by increasing NTD prevalence in select regions and active support from government and philanthropic institutions. Organizations like the NIH are joining forces with global health bodies to expand treatment access and drive innovation.

Key players in the global market include Bayer, Astellas Pharma, and Eisai, which are leading innovations in drug and vaccine development for NTDs. These companies are prioritizing R&D, forming alliances with health organizations and governments, and aiming to deliver affordable, scalable solutions for affected communities.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of neglected tropical diseases

- 3.2.1.2 Favorable government initiatives

- 3.2.1.3 Growing awareness of neglected tropical diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of healthcare infrastructure

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Disease Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Dengue

- 5.3 Rabies

- 5.4 Trachoma

- 5.5 Buruli ulcer

- 5.6 Yaws

- 5.7 Leprosy

- 5.8 Chagas disease

- 5.9 Human African trypanosomiasis (sleeping sickness)

- 5.10 Leishmaniases

- 5.11 Soil-transmitted helminthiases

- 5.12 Other disease types

Chapter 6 Market Estimates and Forecast, By Treatment Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Drugs

- 6.2.1 Anti-parasite

- 6.2.2 Antifungal

- 6.2.3 Antibiotics

- 6.2.4 Other drugs

- 6.3 Vaccines

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectable

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Astellas Pharma

- 10.2 Bayer

- 10.3 Bharat Biotech

- 10.4 Eisai

- 10.5 Gilead Sciences

- 10.6 GlaxoSmithKline

- 10.7 Johnson & Johnson

- 10.8 Merck

- 10.9 Novartis

- 10.10 Pfizer

- 10.11 Sanofi

- 10.12 Takeda Pharmaceutical

- 10.13 Tarsus Pharmaceuticals