|

市場調查報告書

商品編碼

1721464

浮動發電廠市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Floating Power Plants Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

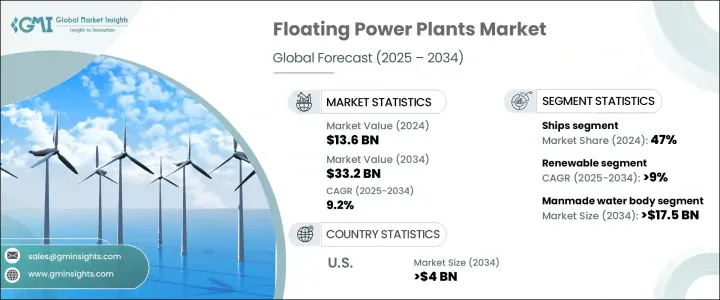

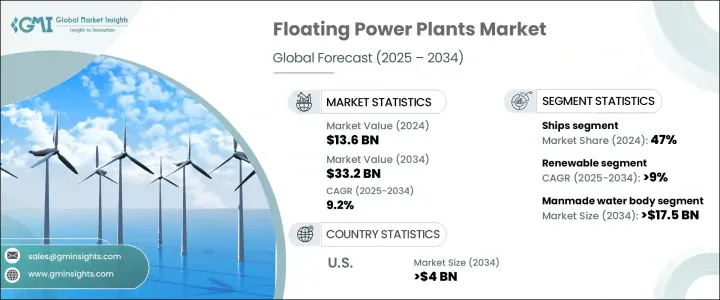

2024 年全球浮動發電廠市場價值為 136 億美元,預計到 2034 年將以 9.2% 的複合年成長率成長,達到 332 億美元。對分散、靈活發電解決方案的需求不斷成長,極大地推動了該市場的擴張。隨著世界轉向更清潔的能源和有彈性的基礎設施,浮動發電廠正在成為能源領域的重要創新。這些系統具有獨特的優勢,可以為偏遠島嶼、災害多發地區和海上工業設施輸送電力,而這些地區的傳統電力基礎設施要么成本過高,要么不切實際。隨著全球能源消耗穩步成長,許多地區仍然缺乏穩定的電力供應,浮動發電廠被證明是有效的替代方案。全球各國政府和公用事業供應商正在轉向這些移動、可擴展的系統,作為彌補能源供應缺口的快速解決方案。按需部署的靈活性,加上最小的土地要求以及與再生能源的輕鬆整合,增強了它們在當今動態能源格局中的吸引力。

對海上和遠端發電的需求不斷成長,以及對再生能源整合的日益關注,正在推動全球市場向前發展。浮動發電廠正在提供永續且有彈性的能源供應解決方案,特別是在面臨電網限制或自然災害的地區。運作效率、模組化和可靠性的不斷改進進一步提高了這些裝置的性能。隨著風能、太陽能等再生能源與傳統燃氣渦輪機結合的混合系統變得越來越普遍,浮動發電廠產業正在經歷快速創新。先進儲能技術的融入也增加了價值,實現了更好的負載管理和全天候電力傳輸。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 136億美元 |

| 預測值 | 332億美元 |

| 複合年成長率 | 9.2% |

再生能源領域的浮動發電廠市場預計到 2034 年將以 9% 的複合年成長率成長。新興市場的工業化加速和海上再生能源設施投資的增加是這一趨勢的主要推動因素。將能源儲存與海上風能或太陽能裝置結合的混合系統正在擴大該領域的機會。此外,旨在降低燃氣發電廠排放的環境法規正在推動製造商採用碳高效技術,以增強市場的長期永續性。

到 2034 年,駁船市場的複合年成長率也有望達到 9%。駁船是部署浮動發電廠的經濟高效且靈活的平台,尤其是在偏遠的沿海或內陸地區。模組化結構、最佳化燃料使用和可再生系統整合的創新預計將支持該領域的穩定成長。

2022 年美國浮動發電廠市場價值為 14 億美元,預計到 2034 年將達到 40 億美元。該國對液化天然氣發電廠的緊急和臨時電力供應的依賴不斷加強其市場地位。排放控制系統、混合能源配置和燃油效率的改進進一步支持了這一成長軌跡。

主要市場參與者包括西門子能源、Ciel & Terre、Equinor、Floating Power Plant、HEXA Renewables、MAN Energy Solutions、GE Vernova、三菱重工、Karadeniz Holding、BW Ideol、川崎重工、Orsted、RWE、Sterling and Wilson Renewable Energy、CHN Energy、Swimsol、VVestas。這些公司正專注於透過研發、策略合作夥伴關係和先進浮動技術的部署來增強其競爭優勢。他們在模組化、可擴展和混合發電廠模型方面的創新實現了更快的安裝和更大的靈活性,同時與政府和私人能源公司的合作為全球大規模實施鋪平了道路。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 川普政府關稅對貿易和整體產業的影響

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- 供應商的議價能力

- 買家的議價能力

- 新進入者的威脅

- 替代品的威脅

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:依電源分類,2021 - 2034 年

- 主要趨勢

- 再生能源

- 風

- 太陽的

- 不可再生

- 瓦斯渦輪機

- 內燃機

第6章:市場規模及預測:依產能,2021 - 2034 年

- 主要趨勢

- > 1 – 5 兆瓦

- > 5 – 20 兆瓦

- > 20 – 100 兆瓦

- > 100 兆瓦

第7章:市場規模及預測:依部署,2021 - 2034 年

- 主要趨勢

- 船舶

- 駁船

- 模組化筏

- 其他

第 8 章:市場規模與預測:按應用,2021 - 2034 年

- 主要趨勢

- 人造水體

- 天然水體

第9章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 拉丁美洲

- 巴西

- 阿根廷

第10章:公司簡介

- BW Ideol

- CHN Energy

- Ciel & Terre

- Equinor

- Floating Power Plant

- GE Vernova

- HEXA Renewables

- Karadeniz Holding

- Kawasaki Heavy Industries

- MAN Energy Solutions

- Mitsubishi Heavy Industries

- Ørsted

- RWE

- Siemens Energy

- Sterling and Wilson Renewable Energy

- Swimsol

- Vestas

- Wartsila

The Global Floating Power Plants Market was valued at USD 13.6 billion in 2024 and is estimated to grow at a CAGR of 9.2% to reach USD 33.2 billion by 2034. The rising demand for decentralized, flexible power generation solutions is significantly fueling the expansion of this market. As the world pivots toward cleaner energy and resilient infrastructure, floating power plants are emerging as a key innovation in the energy sector. These systems are uniquely positioned to deliver power to remote islands, disaster-prone regions, and offshore industrial facilities, where traditional power infrastructure is either too costly or impractical to deploy. With global energy consumption steadily increasing and many regions still lacking access to stable electricity, floating power plants are proving to be an efficient alternative. Governments and utility providers across the globe are turning to these mobile, scalable systems as a fast-track solution to bridge energy supply gaps. The flexibility of deploying them on demand, coupled with minimal land requirements and easy integration with renewable energy sources, enhances their appeal in today's dynamic energy landscape.

The growing need for offshore and remote power generation, along with the rising focus on renewable energy integration, is driving the global market forward. Floating power plants are providing a sustainable and resilient energy supply solution, particularly in areas facing grid limitations or natural calamities. Ongoing improvements in operational efficiency, modularity, and reliability are further enhancing the performance of these units. As hybrid systems combining renewable sources like wind and solar with traditional gas turbines become more prevalent, the floating power plant industry is witnessing rapid innovation. The incorporation of advanced energy storage technologies is also adding value, enabling better load management and round-the-clock power delivery.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.6 Billion |

| Forecast Value | $33.2 Billion |

| CAGR | 9.2% |

The floating power plants market in the renewable segment is anticipated to grow at a CAGR of 9% by 2034. Accelerated industrialization across emerging markets and rising investments in offshore renewable installations are major contributors to this trend. Hybrid systems that integrate energy storage with offshore wind or solar installations are expanding opportunities in the sector. Additionally, environmental regulations aimed at lowering emissions from gas-fired power plants are pushing manufacturers to adopt carbon-efficient technologies, enhancing the market's long-term sustainability.

The barges segment is also set to grow at a CAGR of 9% by 2034. Barges serve as cost-effective, flexible platforms for deploying floating power plants, especially in remote coastal or inland regions. Innovations in modular construction, optimized fuel use, and renewable system integration are expected to support the segment's steady growth.

The U.S. Floating Power Plants Market was valued at USD 1.4 billion in 2022 and is expected to reach USD 4 billion by 2034. The country's dependence on LNG-based power plants for emergency and temporary electricity supply continues to strengthen its market position. Improvements in emissions control systems, hybrid energy configurations, and fuel efficiency further support this growth trajectory.

Key market players include Siemens Energy, Ciel & Terre, Equinor, Floating Power Plant, HEXA Renewables, MAN Energy Solutions, GE Vernova, Mitsubishi Heavy Industries, Karadeniz Holding, BW Ideol, Kawasaki Heavy Industries, Orsted, RWE, Sterling and Wilson Renewable Energy, CHN Energy, Swimsol, Vestas, and Wartsila. These companies are focusing on enhancing their competitive edge through R&D, strategic partnerships, and deployment of advanced floating technologies. Their innovations in modular, scalable, and hybrid power plant models are enabling faster installation and greater flexibility, while collaboration with governments and private energy firms is paving the way for large-scale implementation worldwide.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Impact of trump administration tariffs on trade & overall industry

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Power Source, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 Renewable

- 5.2.1 Wind

- 5.2.2 Solar

- 5.3 Non-renewable

- 5.3.1 Gas turbine

- 5.3.2 IC engines

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 > 1 – 5 MW

- 6.3 > 5 – 20 MW

- 6.4 > 20 – 100 MW

- 6.5 > 100 MW

Chapter 7 Market Size and Forecast, By Deployment, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Ships

- 7.3 Barges

- 7.4 Modular rafts

- 7.5 Others

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 Manmade water bodies

- 8.3 Natural water bodies

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.5 Middle East & Africa

- 9.5.1 UAE

- 9.5.2 Saudi Arabia

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 BW Ideol

- 10.2 CHN Energy

- 10.3 Ciel & Terre

- 10.4 Equinor

- 10.5 Floating Power Plant

- 10.6 GE Vernova

- 10.7 HEXA Renewables

- 10.8 Karadeniz Holding

- 10.9 Kawasaki Heavy Industries

- 10.10 MAN Energy Solutions

- 10.11 Mitsubishi Heavy Industries

- 10.12 Ørsted

- 10.13 RWE

- 10.14 Siemens Energy

- 10.15 Sterling and Wilson Renewable Energy

- 10.16 Swimsol

- 10.17 Vestas

- 10.18 Wartsila