|

市場調查報告書

商品編碼

1721457

血漿蛋白酶 C1 抑制劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Plasma Protease C1-inhibitor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

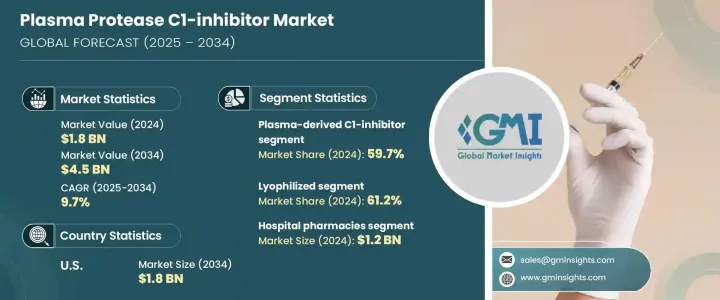

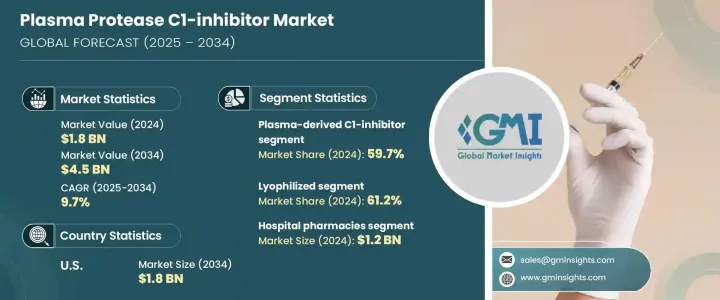

2024 年全球血漿蛋白酶 C1 抑制劑市值為 18 億美元,預計到 2034 年將以 9.7% 的複合年成長率成長至 45 億美元。血漿蛋白酶 C1 抑制劑在控制人體內補體和接觸系統的活化方面發揮著至關重要的作用。這些來自血漿的蛋白質對於治療遺傳性血管性水腫(HAE)等罕見遺傳疾病至關重要。隨著醫療保健系統的不斷發展,人們對罕見疾病管理的認知不斷提高,這極大地促進了對 C1 抑制劑等有效和專業療法的需求。

血漿分離和收集方法的技術進步正在透過提高血漿衍生療法的產量和純度來重塑生物製劑的模式。反過來,這些發展使得醫療服務提供者和患者更容易獲得治療,治療費用更低,治療規模也更大。隨著臨床興趣的不斷成長和個人化醫療的出現,市場有望在發炎和自體免疫疾病等新治療應用方面取得更大的滲透。已開發經濟體和新興經濟體的監管支持和不斷增加的醫療保健基礎設施進一步促進了市場擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 45億美元 |

| 複合年成長率 | 9.7% |

就藥物類別而言,血漿衍生的 C1 抑制劑領域佔據市場主導地位,佔 2024 年全球佔有率的 59.7%。雖然也有選擇性緩激肽 B2 受體拮抗劑和激肽釋放酶抑制劑等替代方案,但目前它們在市場中所佔佔有率較小。血漿衍生製劑仍然是首選,因為它們具有已確定的安全性,並且在管理 HAE 的急性和預防性治療方面已證明有效。

從劑型來看,冷凍乾燥 C1 抑制劑將繼續引領市場,2024 年的市佔率為 61.2%。這些冷凍乾燥製劑因其較長的保存期限而受到青睞,並且不需要冷藏,非常適合在可靠冷鏈基礎設施有限的地區使用。這一優勢在農村醫療保健環境和中低收入國家尤其重要,因為這些地方保持一致的儲存條件可能是一個挑戰。

美國血漿蛋白酶 C1 抑制劑市場正在經歷強勁成長。 2024 年的價值為 7.294 億美元,預計到 2034 年將達到 18 億美元。推動這一成長的因素包括 HAE 盛行率的上升、基因篩檢的改善、早期診斷意識的提高以及罕見疾病治療機會的擴大。美國 FDA 對孤兒藥(特別是針對 HAE 等疾病的孤兒藥)的持續支持正在加速產品核准並鼓勵該領域的更多創新。

市場的主要參與者包括 BioCryst Pharmaceuticals、武田製藥公司、KalVista、Ionis Pharmaceuticals、CSL Behring、Fresenius Kabi、Pharming、Pharvaris 和 Astria。這些公司正在大力投資研發,以發現 C1 抑制劑的新適應症,尤其是在免疫學和發炎領域。策略合作也透過擴大產品線和加速下一代療法來推動成長。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 遺傳性血管性水腫 (HAE) 和補體系統疾病盛行率上升

- 生物技術和藥物開發的進步

- 有利的政府法規和報銷政策

- 罕見疾病研發投資不斷增加

- 產業陷阱與挑戰

- C1抑制劑療法成本高昂

- 供應有限和供應鏈限制

- 成長動力

- 成長潛力分析

- 監管格局

- 差距分析

- 專利分析

- 管道分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類別,2021 年至 2034 年

- 主要趨勢

- 血漿衍生的C1抑制劑

- 選擇性緩激肽B2受體拮抗劑

- 激肽釋放酶抑制劑

第6章:市場估計與預測:按劑型,2021 年至 2034 年

- 主要趨勢

- 冷凍乾燥

- 注射劑

第7章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 電子商務

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第9章:公司簡介

- Astria

- BioCryst Pharmaceuticals

- CSL Behring

- Fresenius Kabi

- Ionis Pharmaceuticals

- KalVista

- Pharming

- Pharvaris

- Takeda Pharmaceutical Company

The Global Plasma Protease C1-Inhibitor Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 9.7% to reach USD 4.5 billion by 2034. Plasma protease C1-inhibitors serve a vital role in controlling the activation of the complement and contact systems within the human body. These proteins, derived from blood plasma, are crucial in the treatment of rare genetic disorders such as Hereditary Angioedema (HAE). As healthcare systems continue to evolve, there is increasing awareness surrounding rare disease management, which is significantly contributing to the demand for effective and specialized therapies like C1-inhibitors.

Technological progress in plasma fractionation and collection methods is reshaping the landscape of biologics by enhancing the yield and purity of plasma-derived therapies. In turn, these developments are making treatments more accessible, affordable, and scalable for healthcare providers and patients alike. With growing clinical interest and the emergence of personalized medicine, the market is poised to witness greater penetration across new therapeutic applications, such as inflammatory and autoimmune diseases. Regulatory support and increasing healthcare infrastructure in both developed and emerging economies are further bolstering market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 9.7% |

In terms of drug classes, the plasma-derived C1-inhibitor segment dominated the market, accounting for 59.7% of the global share in 2024. While alternative options like selective bradykinin B2 receptor antagonists and Kallikrein inhibitors are also available, they currently serve as smaller segments within the market. Plasma-derived formulations remain the preferred option due to their established safety profiles and proven efficacy in managing acute and prophylactic treatment for HAE.

When looking at dosage forms, lyophilized C1-inhibitors continue to lead the market with a 61.2% share in 2024. These freeze-dried formulations are favored for their extended shelf life and do not require refrigeration, making them ideal for use in regions with limited access to reliable cold chain infrastructure. This advantage is particularly critical in rural healthcare settings and low-to-middle-income countries where consistent storage conditions can be a challenge.

The U.S. Plasma Protease C1-Inhibitor Market is experiencing robust growth. Valued at USD 729.4 million in 2024, it is projected to reach USD 1.8 billion by 2034. The expansion is driven by the rising prevalence of HAE, improvements in genetic screening, increased awareness of early diagnosis, and broader access to rare disease treatments. The U.S. FDA's continued support for orphan drugs, particularly for conditions like HAE, is accelerating product approvals and encouraging more innovation in this space.

Key players in the market include BioCryst Pharmaceuticals, Takeda Pharmaceutical Company, KalVista, Ionis Pharmaceuticals, CSL Behring, Fresenius Kabi, Pharming, Pharvaris, and Astria. These companies are heavily investing in R&D to discover new indications for C1-inhibitors, especially in the fields of immunology and inflammation. Strategic collaborations are also fueling growth by expanding product pipelines and fast-tracking next-generation therapies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of hereditary angioedema (HAE) and complement system disorders

- 3.2.1.2 Advancements in biotechnology and drug development

- 3.2.1.3 Favorable government regulations and reimbursement policies

- 3.2.1.4 Growing investment in rare disease research and development

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of C1-inhibitor therapies

- 3.2.2.2 Limited availability and supply chain constraints

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Gap analysis

- 3.6 Patent analysis

- 3.7 Pipeline analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Plasma-derived C1-inhibitor

- 5.3 Selective bradykinin B2 receptor antagonist

- 5.4 Kallikrein inhibitor

Chapter 6 Market Estimates and Forecast, By Dosage Form, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Lyophilized

- 6.3 Injectables

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospital pharmacies

- 7.3 Retail pharmacies

- 7.4 E-commerce

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Astria

- 9.2 BioCryst Pharmaceuticals

- 9.3 CSL Behring

- 9.4 Fresenius Kabi

- 9.5 Ionis Pharmaceuticals

- 9.6 KalVista

- 9.7 Pharming

- 9.8 Pharvaris

- 9.9 Takeda Pharmaceutical Company