|

市場調查報告書

商品編碼

1721456

心血管藥物市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Cardiovascular Drugs Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

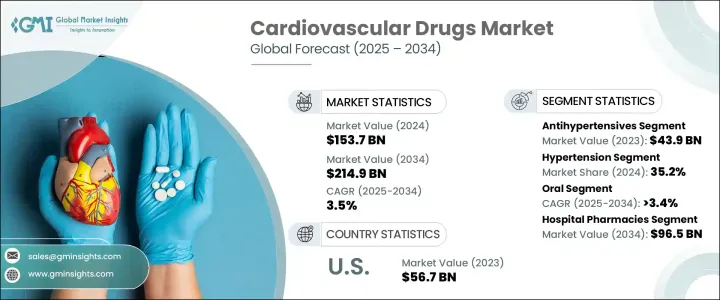

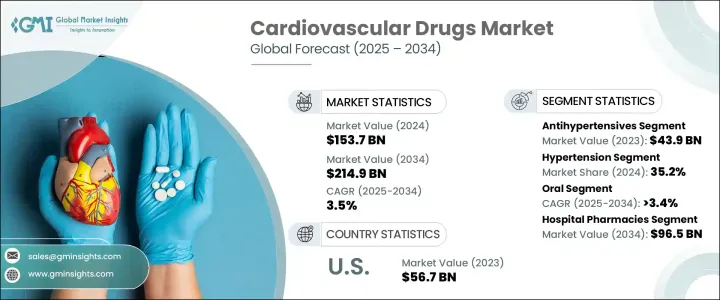

2024 年全球心血管藥物市場價值為 1,537 億美元,預計到 2034 年將以 3.5% 的複合年成長率成長至 2,149 億美元。隨著全球心血管疾病負擔持續增加,對有效且可近的治療方案的需求正以前所未有的速度成長。世界各地的醫療保健系統面臨巨大的壓力,需要控制冠狀動脈疾病、心臟衰竭、心律不整和高血壓等疾病,這些疾病仍然是所有地區死亡的主要原因。人們對心血管健康的認知不斷提高、診斷率不斷上升以及預防保健措施的激增,對市場成長做出了重大貢獻。此外,與缺乏運動、不良飲食習慣、壓力、吸煙和飲酒等生活方式相關的風險因素也增加了持續藥物介入的必要性。

全球人口老化,特別是已開發國家人口老化,進一步加劇了對心血管藥物的需求,因為老年人更容易罹患慢性心臟疾病。在創新方面,藥物傳遞技術的進步和下一代治療方式的引入正在提高治療效果和患者依從性。主要參與者正在大力投資研發,以推出能夠提供更好療效、更少副作用、並能滿足各種患者需求的客製化治療藥物。個人化醫療的日益成長的傾向也正在重塑心血管治療格局,使公司能夠透過更有針對性的治療方法來滿足以前未滿足的醫療需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1537億美元 |

| 預測值 | 2149億美元 |

| 複合年成長率 | 3.5% |

市場根據藥物類別進行細分,例如抗高血壓藥、抗高血脂藥、抗凝血藥、抗心律不整藥和其他療法。其中,光是抗高血壓藥物領域在 2023 年就創造了 439 億美元的收入,這得益於全球高血壓盛行率的不斷上升。此類藥物包括 ACE 抑制劑、血管緊張素 II 受體阻斷劑 (ARB)、BETA 受體阻斷劑、鈣通道阻斷劑和利尿劑 - 均被認為對於降低血壓和最大限度地降低嚴重心血管併發症的風險至關重要。 2024 年,高血壓細分市場將佔據 35.2% 的佔有率,這主要得益於全球高血壓發病率的不斷上升及其與中風、腎衰竭和心臟病等危及生命的疾病的直接聯繫。有效控制高血壓仍然是醫療保健提供者的首要任務,單一療法和固定劑量聯合療法的可用性確保了治療可以根據個人需求進行客製化。

2024 年,北美佔據全球心血管藥物市場的 41.2%,預計到 2034 年將以 3.2% 的複合年成長率成長。該地區受益於強大的醫療保健基礎設施、高人均醫療支出以及領先製藥公司的存在。此外,美國心血管疾病發生率的上升和人口老化的快速發展也推動了對先進療法的需求。政府推動的促進醫療創新和治療可近性的措施預計將進一步支持區域市場擴張。

全球心血管藥物市場的主要參與者包括輝瑞、強生、百時美施貴寶、吉利德科學、拜耳、默克、安進、賽諾菲、諾華、阿斯特捷利康、魯賓和 Viatris。這些公司正在積極擴大其產品組合,推出新型藥物和下一代療法,同時策略合作和研發投資繼續推動競爭優勢。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 心血管疾病盛行率不斷上升

- 藥物配方技術進步

- 預防保健意識不斷增強

- 產業陷阱與挑戰

- 嚴格的監管框架

- 藥物研發成本高昂

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類別,2021 - 2034 年

- 主要趨勢

- 抗高血壓藥

- 抗高血脂

- 抗凝血劑

- 抗心律不整藥物

- 其他藥物類別

第6章:市場估計與預測:按適應症,2021 - 2034 年

- 主要趨勢

- 高血壓

- 高血脂症

- 冠狀動脈疾病

- 心律不整

- 其他適應症

第7章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 腸外

- 其他給藥途徑

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 醫院藥房

- 網路藥局

- 零售藥局

- 其他分銷管道

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Amgen

- AstraZeneca

- Baxter

- Bayer

- Boehringer Ingelheim

- Bristol-Myers Squibb

- Gilead Sciences

- Johnson & Johnson

- Lupin

- Merck

- Novartis

- Pfizer

- Sanofi

- Viatris

The Global Cardiovascular Drugs Market was valued at USD 153.7 billion in 2024 and is projected to grow at a CAGR of 3.5% to reach USD 214.9 billion by 2034. As the global burden of cardiovascular diseases continues to rise, the demand for effective and accessible treatment options is growing at an unprecedented pace. Healthcare systems around the world are under immense pressure to manage conditions such as coronary artery disease, heart failure, arrhythmias, and hypertension, which remain the leading causes of mortality across all regions. Increasing awareness of cardiovascular health, growing diagnosis rates, and a surge in preventive care initiatives are contributing significantly to market growth. In addition, lifestyle-related risk factors like physical inactivity, poor dietary habits, stress, smoking, and alcohol consumption are amplifying the need for ongoing pharmaceutical intervention.

The aging global population, particularly in developed nations, is further fueling the need for cardiovascular drugs as elderly individuals are more prone to developing chronic heart-related ailments. On the innovation front, advancements in drug delivery technologies and the introduction of next-generation treatment modalities are enhancing both therapeutic efficacy and patient compliance. Key players are investing heavily in research and development to launch drugs that offer better outcomes, reduced side effects, and tailored treatments suited for a variety of patient needs. The growing inclination toward personalized medicine is also reshaping the cardiovascular treatment landscape, allowing companies to address previously unmet medical needs through more targeted therapies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $153.7 Billion |

| Forecast Value | $214.9 Billion |

| CAGR | 3.5% |

The market is segmented based on drug classes such as antihypertensives, antihyperlipidemic agents, anticoagulants, antiarrhythmics, and other therapies. Among these, the antihypertensives segment alone generated USD 43.9 billion in 2023, fueled by the increasing prevalence of high blood pressure worldwide. This drug class includes ACE inhibitors, angiotensin II receptor blockers (ARBs), beta-blockers, calcium channel blockers, and diuretics-all considered essential in lowering blood pressure and minimizing the risk of severe cardiovascular complications. The hypertension segment accounted for a 35.2% share in 2024, driven by the growing global incidence of high blood pressure and its direct link to life-threatening conditions such as strokes, kidney failure, and heart attacks. Managing hypertension effectively remains a top priority for healthcare providers, and the availability of both monotherapies and fixed-dose combination therapies ensures treatment can be customized to individual needs.

North America held a 41.2% share of the global cardiovascular drugs market in 2024 and is projected to grow at a 3.2% CAGR through 2034. The region benefits from strong healthcare infrastructure, high per capita health expenditure, and the presence of leading pharmaceutical firms. Additionally, the rising incidence of cardiovascular conditions and a rapidly aging population in the U.S. are boosting demand for advanced therapies. Government-driven initiatives promoting healthcare innovation and treatment accessibility are expected to further support regional market expansion.

Key players operating in the Global Cardiovascular Drugs Market include Pfizer, Johnson & Johnson, Bristol-Myers Squibb, Gilead Sciences, Bayer, Merck, Amgen, Sanofi, Novartis, AstraZeneca, Lupin, and Viatris. These companies are actively expanding their portfolios with novel drug classes and next-gen therapies, while strategic collaborations and investments in R&D continue to drive competitive advantage.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular diseases

- 3.2.1.2 Technological advancements in drug formulation

- 3.2.1.3 Growing awareness of preventive healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory frameworks

- 3.2.2.2 High costs of drug development

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Antihypertensives

- 5.3 Antihyperlipidemic

- 5.4 Anticoagulants

- 5.5 Antiarrhythmics

- 5.6 Other drug classes

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hypertension

- 6.3 Hyperlipidemia

- 6.4 Coronary artery disease

- 6.5 Arrhythmia

- 6.6 Other indications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Parenteral

- 7.4 Other routes of administration

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Online pharmacies

- 8.4 Retail pharmacies

- 8.5 Other distribution channels

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Amgen

- 10.2 AstraZeneca

- 10.3 Baxter

- 10.4 Bayer

- 10.5 Boehringer Ingelheim

- 10.6 Bristol-Myers Squibb

- 10.7 Gilead Sciences

- 10.8 Johnson & Johnson

- 10.9 Lupin

- 10.10 Merck

- 10.11 Novartis

- 10.12 Pfizer

- 10.13 Sanofi

- 10.14 Viatris