|

市場調查報告書

商品編碼

1721455

微型電腦斷層掃描市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Micro Computed Tomography Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

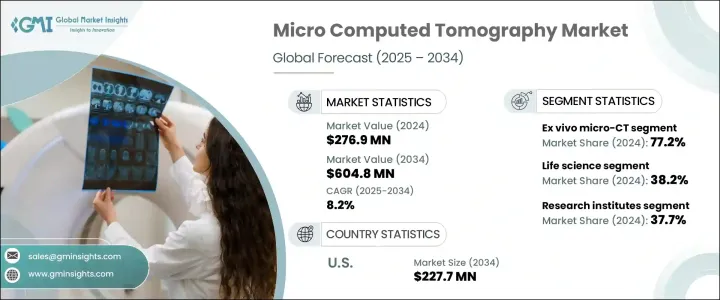

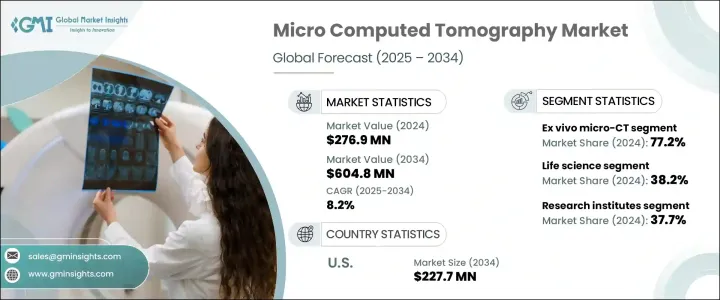

2024 年全球微型電腦斷層掃描市場價值為 2.769 億美元,預計到 2034 年將以 8.2% 的複合年成長率成長,達到 6.048 億美元。微型電腦斷層掃描 (micro-CT) 是一種強大的成像技術,可提供內部結構的超高解析度 3D 影像,實現無與倫比的精確度和細節。工業和科學應用對先進成像解決方案的需求不斷成長,推動了該市場的大幅成長。

Micro-CT 系統提供無損檢測功能,這在需要高水準品質保證的行業(例如航太、汽車和電子)中尤其有價值。隨著技術的不斷進步,包括更快的掃描時間、更高的解析度和更緊湊的系統,微型 CT 正在發展成為一種用途廣泛的工具。它不僅支持關鍵的研發活動,而且在新材料和新產品的商業化中發揮關鍵作用。人工智慧和機器學習在自動影像分析中的整合進一步提高了微型 CT 系統的效率和準確性,使其在各個領域變得更加不可或缺。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 2.769億美元 |

| 預測值 | 6.048億美元 |

| 複合年成長率 | 8.2% |

微型 CT 最初是為生物醫學和醫療保健成像而開發的,多年來其應用範圍已顯著擴大。能夠在不損壞物體的情況下以 3D 形式可視化微觀結構,這使其非常適合用於材料科學、生物學、電子學和地質學研究。製造環境中對精密工程和品質控制的日益重視,擴大了全球對微型 CT 系統的需求。此外,製藥和生物技術研究的激增,特別是臨床前研究和藥物開發,推動了生命科學的廣泛應用。

市場依產品類型分為體內微型 CT 和體外微型 CT。 2024 年,體外微型 CT 領域將佔據 77.2% 的主導佔有率。體外系統因其能夠極其清晰地掃描提取的樣本而被廣泛應用於材料科學、生物學和醫療保健成像。這些系統對於需要對生物樣本或結構材料進行詳細內部成像而不改變或破壞它們的研究人員特別有益。它們提供的超高解析度成像對於探索各種應用中的微觀細節至關重要。

Micro-CT 有多種關鍵應用,包括生命科學、牙科、骨骼研究、植物和食品分析、材料科學以及地質學或石油和天然氣。 2024 年,生命科學領域以 38.2% 的市佔率領先市場。微型 CT 能夠提供組織和器官的詳細、非侵入性 3D 視覺化,這使其在腫瘤學、心臟病學和神經病學等領域至關重要。它支持從假設檢驗到藥物開發和疾病建模驗證的整個研究生命週期。

2023 年,美國微型電腦斷層掃描市場規模達 9,750 萬美元,預計到 2034 年將達到 2.277 億美元。強勁的研發投入、先進診斷工具的採用以及不斷成長的工業應用將繼續推動該國市場擴張。

影響競爭格局的主要參與者包括布魯克、珀金埃爾默、蔡司、TESCAN、島津、Micro Photonics、理學、北極星成像、台達電子、NeoScan、SCANCO Medical 和三英精密儀器。這些公司正在大力投資研發並擴大其產品組合,包括具有更高解析度、更快掃描速度和方便用戶使用功能的系統。與學術機構和行業利益相關者的策略合作夥伴關係也在擴大其全球影響力和增強創新方面發揮核心作用。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 微型電腦斷層掃描技術進步

- 拓展不同產業的應用

- 增加研發投入

- 產業陷阱與挑戰

- 缺乏訓練有素的專業人員

- 設備成本高

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 年至 2034 年

- 主要趨勢

- 體內微型CT

- 離體微型CT

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 生命科學

- 骨頭

- 牙科

- 植物和食物

- 材料科學

- 地質學/石油天然氣地質學

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 產業

- 研究機構

- 診斷影像實驗室

- 其他最終用途

第8章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第9章:公司簡介

- Bruker

- PerkinElmer

- Delta Electronics

- Zeiss

- NeoScan

- Sanying Precision Instruments

- North Star Imaging

- SCANCO Medical

- TESCAN

- Micro Photonics

- Shimadzu

- Rigaku

The Global Micro Computed Tomography Market was valued at USD 276.9 million in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 604.8 million by 2034. Micro computed tomography (micro-CT) is a powerful imaging technology that delivers ultra-high-resolution 3D images of internal structures, enabling unmatched accuracy and detail. The increasing demand for advanced imaging solutions across both industrial and scientific applications is driving substantial growth in this market.

Micro-CT systems offer non-destructive testing capabilities that are especially valuable in industries requiring high levels of quality assurance, such as aerospace, automotive, and electronics. With ongoing technological advancements, including faster scan times, improved resolution, and more compact systems, micro-CT is evolving into a highly versatile tool. It not only supports critical R&D activities but also plays a pivotal role in the commercialization of new materials and products. The integration of AI and machine learning for automated image analysis is further enhancing the efficiency and accuracy of micro-CT systems, making them even more indispensable across diverse sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $276.9 Million |

| Forecast Value | $604.8 Million |

| CAGR | 8.2% |

Initially developed for biomedical and healthcare imaging, micro-CT has significantly broadened its reach over the years. The ability to visualize microstructures in 3D without damaging the object makes it ideal for use in material science, biology, electronics, and geological research. The growing emphasis on precision engineering and quality control across manufacturing environments is amplifying the demand for micro-CT systems worldwide. Moreover, the surge in pharmaceutical and biotech research, especially in preclinical studies and drug development, has fueled widespread adoption in life sciences.

The market is segmented by product type into in vivo and ex vivo micro-CT. In 2024, the ex vivo micro-CT segment accounted for a dominant 77.2% share. Ex vivo systems are widely used in material science, biology, and healthcare imaging for their ability to scan extracted samples with extreme clarity. These systems are particularly beneficial for researchers who need detailed internal imaging of biological specimens or structural materials without altering or destroying them. The ultra-high-resolution imaging they offer is critical in exploring microscopic details in various applications.

Micro-CT serves several key applications, including life science, dentistry, bone research, plant and food analysis, material science, and geology or oil and gas. In 2024, the life science segment led the market with a 38.2% share. The ability of micro-CT to offer detailed, non-invasive 3D visualization of tissues and organs makes it crucial in fields like oncology, cardiology, and neurology. It supports the entire research lifecycle from hypothesis testing to validation in drug development and disease modeling.

The U.S. Micro Computed Tomography Market generated USD 97.5 million in 2023 and is anticipated to reach USD 227.7 million by 2034. Robust R&D investments, adoption of advanced diagnostic tools, and growing industrial applications continue to drive market expansion in the country.

Key players shaping the competitive landscape include Bruker, PerkinElmer, Zeiss, TESCAN, Shimadzu, Micro Photonics, Rigaku, North Star Imaging, Delta Electronics, NeoScan, SCANCO Medical, and Sanying Precision Instruments. These companies are investing heavily in R&D and expanding their product portfolios to include systems with superior resolution, faster scanning speeds, and user-friendly features. Strategic partnerships with academic institutions and industry stakeholders are also playing a central role in extending their global footprint and enhancing innovation.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Technological advancements in micro computed tomography

- 3.2.1.2 Expanding applications across different industries

- 3.2.1.3 Increasing R&D investments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of trained professionals

- 3.2.2.2 High cost of equipment

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 In vivo micro-CT

- 5.3 Ex vivo micro-CT

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Life science

- 6.3 Bones

- 6.4 Dentistry

- 6.5 Plant and food

- 6.6 Material science

- 6.7 Geology/oil and gas geology

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Industries

- 7.3 Research institutes

- 7.4 Diagnostic imaging labs

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Bruker

- 9.2 PerkinElmer

- 9.3 Delta Electronics

- 9.4 Zeiss

- 9.5 NeoScan

- 9.6 Sanying Precision Instruments

- 9.7 North Star Imaging

- 9.8 SCANCO Medical

- 9.9 TESCAN

- 9.10 Micro Photonics

- 9.11 Shimadzu

- 9.12 Rigaku