|

市場調查報告書

商品編碼

1721450

無人機通訊市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Drone Communication Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

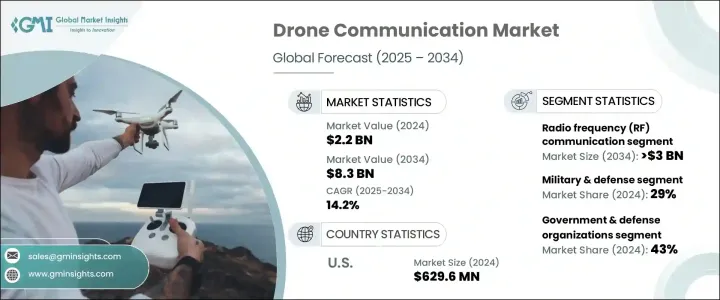

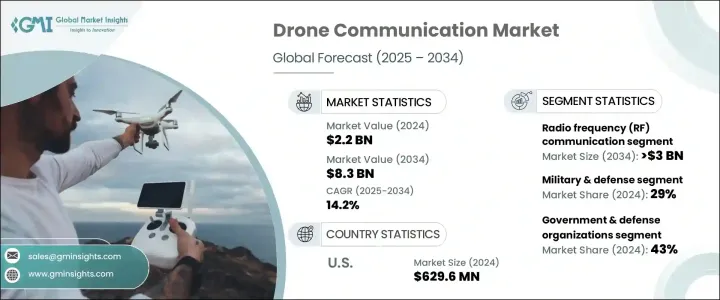

2024 年全球無人機通訊市場價值為 22 億美元,預計到 2034 年將以 14.2% 的複合年成長率成長,達到 83 億美元。這一顯著的成長軌跡反映了無縫高速通訊系統在軍事和商業無人機操作中日益成長的重要性。隨著無人機 (UAV) 在各行各業繼續發揮關鍵作用,對安全、即時和有彈性的通訊技術的需求變得越來越重要。人工智慧整合系統、5G 網路和先進衛星通訊平台的出現正在徹底改變無人機的功能,從而突破無人機所能實現的界限。

隨著對超視距 (BVLOS) 營運的需求激增,該行業正將重點轉向確保即使在偏遠或高風險區域也能不間斷連接的創新技術。無人機現已成為國防、災害應變、基礎設施監控和物流不可或缺的一部分,需要超可靠和加密的資料傳輸系統。隨著全球格局變得更加複雜,地緣政治緊張和安全問題促使各國和企業大力投資複雜的通訊基礎設施。群體智慧、邊緣運算和即時威脅偵測的融合正在塑造無人機操作的新時代,其中通訊技術不再是一個附加元件,而是一個關鍵任務元件。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 22億美元 |

| 預測值 | 83億美元 |

| 複合年成長率 | 14.2% |

無人機通訊市場涵蓋廣泛的技術,包括射頻 (RF)、衛星通訊 (SATCOM)、基於 5G 和 LTE 的系統、網狀網路以及光學和紅外線通訊。 2024年,射頻通訊佔據全球市場41%的主導佔有率。這種廣泛採用主要歸功於射頻的成本效益、可靠性以及與各種應用的兼容性。 RF 系統支援即時資料傳輸、命令和控制操作,並提供加密、抗干擾的連接。這些屬性對於要求高精度和高安全性的軍事、工業和緊急應變行動至關重要。

根據應用,市場細分為農業、建築、石油和天然氣、國防、商業和緊急服務。 2024 年,國防領域以 29% 的佔有率佔據市場主導地位,反映出自動無人機在監視、偵察和安全通訊任務中的應用日益廣泛。人工智慧驅動的群體技術、加密的衛星通訊鏈路和 BVLOS 功能正在重新定義國防戰略,將通訊技術置於任務規劃和執行的核心。

2024 年,北美佔據全球無人機通訊市場的 34%。美國持續引領潮流,大力投資人工智慧增強無人機系統、5G 基礎設施和下一代衛星通訊。農業、物流和緊急管理領域對自主無人機的需求不斷成長,進一步推動了區域市場的成長。

全球無人機通訊市場的關鍵參與者包括 BAE Systems、Drone Deploy、Elbit Systems、Honeywell、Iridium、Israel 航太 Industries、L3Harris Technologies、洛克希德馬丁、諾斯羅普格魯曼和 Skydio。這些公司積極專注於人工智慧整合、安全衛星通訊和戰略合作夥伴關係,以擴大其在國防和商業領域的影響力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 零件供應商

- 軟體和網路供應商

- 原始設備製造商

- 網路基礎設施供應商

- 監管和標準組織

- 分銷商和系統整合商

- 最終用戶

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- BVLOS無人機操作需求不斷成長

- 5G和衛星通訊技術的進步

- 軍事和國防無人機採用率增加

- 全球商業無人機應用的擴展

- 產業陷阱與挑戰

- 無人機通訊頻率的監管限制

- 衛星通訊和5G基礎設施成本高昂

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依通訊方式,2021 - 2034 年

- 主要趨勢

- 射頻(RF)通訊

- 衛星通訊(SATCOM)

- 基於5G和LTE的通訊

- 網狀網路

- 光學和紅外線通訊

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 農業

- 建築和採礦

- 石油和天然氣

- 軍事與國防

- 商業的

- 緊急服務

- 其他

第7章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 政府和國防組織

- 商業企業

- 私人營運商

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- AeroVironment

- ASELSAN

- BAE Systems

- DJI

- DroneDeploy

- Droneshield

- EchoStar

- Elbit Systems

- General Atomics Aeronautical Systems

- Honeywell

- Inmarsat

- Iridium

- Israel Aerospace Industries

- L3Harris Technologies

- Lockheed Martin

- Northrop Grumman

- Orbit communication

- Parrot Drones

- Qinetiq

- Rheinmetall

- Skydio

- Skytrac System

- Teledyne Flir

- Thales

- Yuneec

The Global Drone Communication Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 14.2% to reach USD 8.3 billion by 2034. This remarkable growth trajectory reflects the rising importance of seamless, high-speed communication systems in both military and commercial drone operations. As unmanned aerial vehicles (UAVs) continue to play a pivotal role across a range of industries, the need for secure, real-time, and resilient communication technologies becomes increasingly critical. The emergence of AI-integrated systems, 5G-enabled networks, and advanced satellite communication platforms is revolutionizing drone capabilities, thus pushing the boundaries of what UAVs can achieve.

With demand surging for beyond-visual-line-of-sight (BVLOS) operations, the industry is shifting focus toward innovative technologies that ensure uninterrupted connectivity, even in remote or high-risk zones. Drones are now an integral part of defense, disaster response, infrastructure monitoring, and logistics, necessitating ultra-reliable and encrypted data transfer systems. As the global landscape becomes more complex, geopolitical tensions and security concerns are prompting nations and enterprises to invest heavily in sophisticated communication infrastructures. The integration of swarm intelligence, edge computing, and real-time threat detection is shaping a new era in drone operations, where communication technology is no longer an add-on but a mission-critical component.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $8.3 billion |

| CAGR | 14.2% |

The drone communication market spans a wide spectrum of technologies, including radio frequency (RF), satellite communication (SATCOM), 5G and LTE-based systems, mesh networking, and optical and infrared communication. In 2024, RF communication accounted for a dominant 41% share of the global market. This widespread adoption is primarily due to RF's cost efficiency, reliability, and compatibility with diverse applications. RF systems enable real-time data transmission, command and control operations, and offer encrypted, interference-resistant connectivity. These attributes are essential for military, industrial, and emergency response operations that demand high accuracy and security.

On the basis of application, the market is segmented into agriculture, construction, oil and gas, defense, commercial, and emergency services. The defense segment led the market in 2024 with a 29% share, reflecting the growing adoption of autonomous drones for surveillance, reconnaissance, and secure communication missions. AI-powered swarm technology, encrypted SATCOM links, and BVLOS capabilities are redefining defense strategies, placing communication technology at the core of mission planning and execution.

North America held a 34% share of the global drone communication market in 2024. The United States continues to lead the charge with strong investments in AI-enhanced UAV systems, 5G infrastructure, and next-gen satellite communications. The growing demand for autonomous drones in agriculture, logistics, and emergency management is further driving regional market growth.

Key players in the global drone communication market include BAE Systems, Drone Deploy, Elbit Systems, Honeywell, Iridium, Israel Aerospace Industries, L3Harris Technologies, Lockheed Martin, Northrop Grumman, and Skydio. These companies are aggressively focusing on AI integration, secure SATCOM, and strategic partnerships to scale their presence across defense and commercial sectors.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 360º synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Component suppliers

- 3.2.2 Software & networking providers

- 3.2.3 OEMs

- 3.2.4 Network infrastructure providers

- 3.2.5 Regulatory & standards organizations

- 3.2.6 Distributors & system integrators

- 3.2.7 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for BVLOS drone operations

- 3.8.1.2 Advancements in 5G and SATCOM technologies

- 3.8.1.3 Increased military and defense drone adoption

- 3.8.1.4 Expansion of commercial drone applications globally

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Regulatory restrictions on drone communication frequencies

- 3.8.2.2 High infrastructure costs for SATCOM and 5G

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter’s analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Communication, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Radio frequency (RF) communication

- 5.3 Satellite communication (SATCOM)

- 5.4 5G and LTE-based communication

- 5.5 Mesh networking

- 5.6 Optical and infrared communication

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Agriculture

- 6.3 Construction & mining

- 6.4 Oil & gas

- 6.5 Military & defense

- 6.6 Commercial

- 6.7 Emergency services

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Government & defense organizations

- 7.3 Commercial enterprises

- 7.4 Private operators

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 ANZ

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 AeroVironment

- 9.2 ASELSAN

- 9.3 BAE Systems

- 9.4 DJI

- 9.5 DroneDeploy

- 9.6 Droneshield

- 9.7 EchoStar

- 9.8 Elbit Systems

- 9.9 General Atomics Aeronautical Systems

- 9.10 Honeywell

- 9.11 Inmarsat

- 9.12 Iridium

- 9.13 Israel Aerospace Industries

- 9.14 L3Harris Technologies

- 9.15 Lockheed Martin

- 9.16 Northrop Grumman

- 9.17 Orbit communication

- 9.18 Parrot Drones

- 9.19 Qinetiq

- 9.20 Rheinmetall

- 9.21 Skydio

- 9.22 Skytrac System

- 9.23 Teledyne Flir

- 9.24 Thales

- 9.25 Yuneec