|

市場調查報告書

商品編碼

1721446

聚乙二醇化蛋白質市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測PEGylated Proteins Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

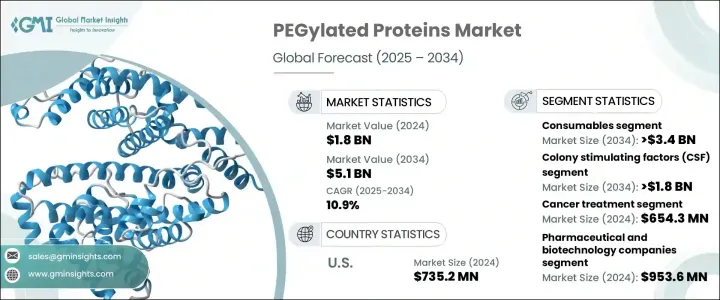

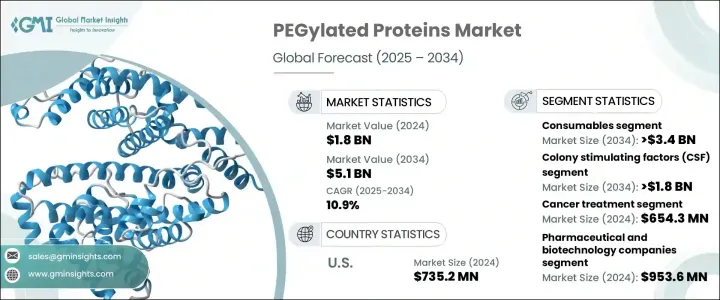

2024 年全球聚乙二醇化蛋白質市場價值為 18 億美元,預計到 2034 年將以 10.9% 的複合年成長率成長,達到 51 億美元。這一顯著的成長趨勢反映了蛋白質療法在現代醫學中的應用日益廣泛。隨著生物製劑和生物相似藥在全球製藥領域穩步發展,聚乙二醇化技術的角色變得越來越不可或缺。此過程涉及以聚乙二醇 (PEG) 對蛋白質或藥物進行化學修飾,增強其穩定性、溶解度和半衰期。這些優點使得聚乙二醇化成為藥物傳遞的重要工具,特別是對於單株抗體和重組蛋白等複雜生物製劑。

隨著針對性治療的研究力度不斷加大,聚乙二醇化製劑因其改善的藥物動力學和降低的免疫原性而成為首選。政府對生物製劑開發的支持不斷增加,加上蛋白質療法臨床試驗數量的增加,繼續推動該領域的創新。癌症、自體免疫疾病和糖尿病等慢性和危及生命的疾病發生率不斷上升,大大增加了對更安全、長效治療方案的需求,進一步加強了市場擴張。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 18億美元 |

| 預測值 | 51億美元 |

| 複合年成長率 | 10.9% |

市場大致分為消費品和服務。隨著對專用 PEG 衍生物的需求不斷成長,預測期內消耗品領域預計將實現 10.9% 的穩定複合年成長率。這些衍生物對於增強聚乙二醇化生物製劑(如單株抗體和酵素)的性能至關重要。隨著全球慢性病發病率的上升,對具有長期療效的先進治療方法的需求促使人們更加依賴優質 PEG 試劑和聚合物。對提供更好的患者依從性和治療效率的藥物傳遞系統的重視也促進了這一類別的成長。

根據蛋白質類型,聚乙二醇化蛋白質市場包括干擾素、集落刺激因子 (CSF)、促紅血球生成素、抗體、重組因子 VIII 和其他蛋白質類別。預計 2025 年至 2034 年期間 CSF 領域的複合年成長率為 11%,這主要是由於貧血和白血病等血液病患疾病率的不斷上升。腦脊髓液在支持化療和其他強化治療患者的骨髓恢復和增強免疫功能方面發揮關鍵作用。它們的應用也擴展到幹細胞動員和慢性中性粒細胞減少症等新的治療領域。

2024 年,美國聚乙二醇化蛋白質市場規模達到 7.352 億美元,預計在慢性病高發病率和先進醫療基礎設施的推動下,該市場將大幅成長。製藥公司的高度集中和聚乙二醇化技術的持續創新正在幫助美國保持主導市場地位。

全球市場的關鍵參與者包括 Biopharma PEG Scientific、Merck KGaA、Celares、Abcam、Biomatrik、Enzon Pharmaceuticals、JenKem Technology、Aurigene Pharmaceutical Services、Quanta BioDesign、Thermo Fisher Scientific、Laysan Bio、Iris Biotech、Profacgen、Creative Corporation。這些公司正在透過研發投資、產品組合擴展、收購和合作策略來提高治療效果和全球市場佔有率。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病盛行率上升

- 聚乙二醇化在藥物傳遞的優勢

- 不斷成長的生物製藥和生技產業

- 聚乙二醇化藥物的採用率不斷提高

- 產業陷阱與挑戰

- 聚乙二醇化和蛋白質類藥物成本高

- 監管挑戰和嚴格的核准流程

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 耗材

- 服務

第6章:市場估計與預測:按蛋白質類型,2021 - 2034 年

- 主要趨勢

- 集落刺激因子

- 干擾素

- 促紅血球生成素

- 重組Ⅷ因子

- 抗體

- 其他蛋白質類型

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 癌症治療

- 自體免疫疾病

- 血液系統疾病

- 肝炎

- 慢性腎臟疾病

- 胃腸道疾病

- 其他應用

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 製藥和生物技術公司

- CRO 和 CMO

- 學術和研究機構

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Abcam

- Aurigene Pharmaceutical Services

- Biomatrik

- Biopharma PEG Scientific

- Celares

- Creative PEGworks

- Enzon Pharmaceuticals

- Iris Biotech

- JenKem Technology

- Laysan Bio

- Merck KGaA

- NOF Corporation

- Profacgen

- Quanta BioDesign

- Thermo Fisher Scientific

The Global Pegylated Proteins Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 10.9% to reach USD 5.1 billion by 2034. This notable growth trend reflects the expanding use of protein-based therapeutics in modern medicine. With biologics and biosimilars steadily gaining traction in the global pharmaceutical space, the role of PEGylation technology is becoming increasingly indispensable. This process involves the chemical modification of proteins or drugs with polyethylene glycol (PEG), enhancing their stability, solubility, and half-life. These benefits make PEGylation an essential tool in drug delivery, especially for complex biologics like monoclonal antibodies and recombinant proteins.

As research efforts intensify to develop targeted therapies, PEGylated formulations are emerging as a preferred choice due to their improved pharmacokinetics and reduced immunogenicity. Increasing government support for biologics development, combined with a higher volume of clinical trials in protein therapeutics, continues to push the boundaries of innovation within this sector. The growing incidence of chronic and life-threatening diseases, including cancer, autoimmune disorders, and diabetes, has significantly escalated the need for safer, long-acting treatment options-further reinforcing market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 10.9% |

The market is broadly segmented into consumables and services. The consumables segment is poised to witness a steady CAGR of 10.9% during the forecast period as the demand for specialized PEG derivatives rises. These derivatives are key to enhancing the performance of PEGylated biologics, such as monoclonal antibodies and enzymes. With chronic disease rates on the rise globally, the requirement for advanced therapeutics that offer prolonged efficacy is prompting greater reliance on premium-grade PEG reagents and polymers. The emphasis on drug delivery systems that provide better patient compliance and therapeutic efficiency is also bolstering growth within this category.

Based on protein type, the PEGylated proteins market includes interferons, colony-stimulating factors (CSF), erythropoietin, antibodies, recombinant factor VIII, and other protein categories. The CSF segment is projected to grow at a CAGR of 11% from 2025 to 2034, primarily due to the increasing prevalence of hematological disorders such as anemia and leukemia. CSFs play a critical role in supporting bone marrow recovery and enhancing immune function in patients undergoing chemotherapy and other intensive treatments. Their applications are also expanding into newer therapeutic areas like stem cell mobilization and chronic neutropenia.

The U.S. PEGylated Proteins Market reached USD 735.2 million in 2024 and is expected to grow substantially, driven by the high incidence of chronic illnesses and the presence of advanced healthcare infrastructure. A strong concentration of pharmaceutical companies and ongoing innovation in PEGylation technologies are helping the U.S. maintain a dominant market position.

Key players in the global market include Biopharma PEG Scientific, Merck KGaA, Celares, Abcam, Biomatrik, Enzon Pharmaceuticals, JenKem Technology, Aurigene Pharmaceutical Services, Quanta BioDesign, Thermo Fisher Scientific, Laysan Bio, Iris Biotech, Profacgen, Creative PEGworks, and NOF Corporation. These companies are advancing through R&D investments, portfolio expansion, acquisitions, and collaborative strategies to enhance therapeutic efficacy and global market presence.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of chronic diseases

- 3.2.1.2 Advantages of PEGylation in drug delivery

- 3.2.1.3 Growing biopharmaceutical and biotechnology industry

- 3.2.1.4 Increasing adoption of PEGylated drugs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High costs of PEGylation and protein-based drugs

- 3.2.2.2 Regulatory challenges and stringent approval processes

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Consumables

- 5.3 Services

Chapter 6 Market Estimates and Forecast, By Protein Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Colony stimulating factors

- 6.3 Interferons

- 6.4 Erythropoietin

- 6.5 Recombinant factor VIII

- 6.6 Antibodies

- 6.7 Other protein types

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Cancer treatment

- 7.3 Autoimmune diseases

- 7.4 Hematological disorders

- 7.5 Hepatitis

- 7.6 Chronic kidney diseases

- 7.7 Gastrointestinal disorders

- 7.8 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical and biotechnology companies

- 8.3 CROs and CMOs

- 8.4 Academic and research institutes

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abcam

- 10.2 Aurigene Pharmaceutical Services

- 10.3 Biomatrik

- 10.4 Biopharma PEG Scientific

- 10.5 Celares

- 10.6 Creative PEGworks

- 10.7 Enzon Pharmaceuticals

- 10.8 Iris Biotech

- 10.9 JenKem Technology

- 10.10 Laysan Bio

- 10.11 Merck KGaA

- 10.12 NOF Corporation

- 10.13 Profacgen

- 10.14 Quanta BioDesign

- 10.15 Thermo Fisher Scientific