|

市場調查報告書

商品編碼

1721441

獸醫心臟病學市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Veterinary Cardiology Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

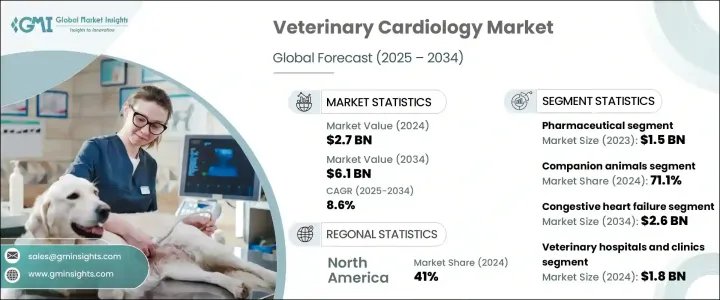

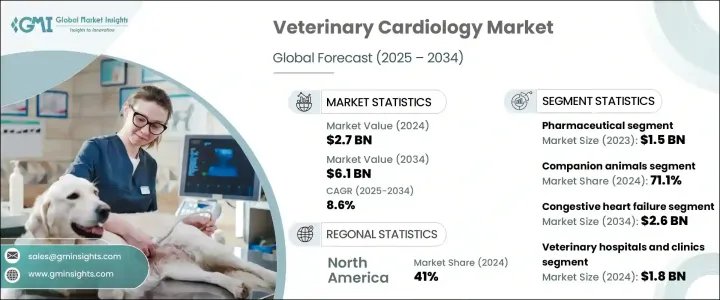

2024 年全球獸醫心臟病學市場價值為 27 億美元,預計到 2034 年將以 8.6% 的複合年成長率成長,達到 61 億美元。寵物擁有量的增加和人們對動物健康意識的提高在這一擴張中發揮關鍵作用。隨著寵物日益成為家庭不可或缺的成員,主人也更加積極主動地尋求及時和專業的慢性病護理,包括心血管疾病。獸醫發現心臟相關病例明顯增加,尤其是在老年犬和貓中,促使對心臟病學服務的投資增加。

此外,寵物保險覆蓋範圍正在逐步擴大,包括先進的診斷測試和治療,這進一步鼓勵主人選擇專門的護理。隨著獸醫專家數量的不斷增加、動物保健基礎設施的不斷擴大以及旨在改善伴侶動物心臟病學結果的研發投資的不斷增加,市場也在不斷成長。隨著獸醫學和技術的融合,該行業正在經歷快速轉型,重新定義動物心臟病的診斷、監測和治療方式。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 27億美元 |

| 預測值 | 61億美元 |

| 複合年成長率 | 8.6% |

這種成長是由患有心臟病的寵物數量的增加以及診斷和治療方法的進步所推動的。球囊瓣膜成形術和心律調節器植入等微創手術由於風險降低和恢復時間較快而越來越受歡迎。匹莫苯丹、血管緊張素轉換酶 (ACE) 抑制劑和BETA受體阻斷劑等較新的藥物也有助於延長患有心臟病的寵物的壽命。

市場分為藥品和診斷。 2023 年,製藥業創造了 15 億美元的收入。這一顯著表現主要歸功於治療方案的持續創新以及老年寵物心血管疾病發病率的不斷上升。人們對能夠調節心臟功能、控制體液積聚和控制動物血壓的藥物的需求不斷成長,從而導致該領域的投資和產品開發增加。

2024 年,獸醫心臟病學市場中的伴侶動物部分佔有 71.1% 的佔有率。這一類別包括狗、貓和其他家養寵物,由於收養率不斷提高以及寵物隨著年齡成長而出現心臟問題的可能性更高,它們繼續佔據主導地位。如今,寵物主人更加重視疾病的早期發現,這促使他們尋求專門的心臟病學服務。超音波心動圖和心電圖 (ECG) 等先進診斷技術的需求正在不斷成長。

2024 年,北美獸醫心臟病學市場佔有 41% 的佔有率。該地區的主導地位得益於大量的伴侶動物、診斷工具的進步以及專科獸醫醫院的擴張。尤其是美國市場,人工智慧和穿戴式心臟監測器的融合日益緊密,這正在改變寵物心臟健康的監測方式。

獸醫心臟病學市場的主要參與者包括 TriviumVet、ESAOTE、Bionet America、Medtronic、Jurox、西門子醫療、富士膠片、Zoetis、Antech Diagnostics、通用電氣公司、IDEXX、默克、勃林格殷格翰國際、Ceva 和 GSK 等。公司正專注於創新產品開發,引進超音波心動圖和導管療法等先進的診斷工具。與獸醫診所、研究機構和科技公司的策略合作正在幫助他們擴大在全球市場的影響力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 寵物收養率上升,動物保健支出增加

- 獸醫心臟病診斷和治療技術的進步

- 伴侶動物心血管疾病盛行率不斷上升

- 產業陷阱與挑戰

- 先進的獸醫心臟病治療和設備成本高昂

- 專業獸醫心臟科專家數量有限

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 製藥

- 匹莫苯丹

- 螺內酯和鹽酸貝那普利

- 其他藥品

- 診斷

- 身體檢查

- 胸部X光檢查

- 心電圖(ECG)

- 其他診斷

第6章:市場估計與預測:依動物類型,2021 - 2034 年

- 主要趨勢

- 伴侶動物

- 狗

- 貓

- 其他伴侶動物

- 牲畜

- 牛

- 家禽

- 其他牲畜

第7章:市場估計與預測:按適應症,2021 - 2034 年

- 主要趨勢

- 充血性心臟衰竭

- 心肌疾病

- 心律不整

- 其他適應症

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 獸醫醫院和診所

- 學術和研究機構

- 其他最終用戶

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Antech Diagnostics

- Boehringer Ingelheim International

- Jurox

- Ceva

- Merck

- IDEXX

- General Electric Company

- FUJIFILM

- ESAOTE

- Medtronic

- Siemens Healthineers

- TriviumVet

- Zoetis

- Bionet America

The Global Veterinary Cardiology Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 6.1 billion by 2034. The rise in pet ownership and heightened awareness of animal health are playing a pivotal role in this expansion. As pets increasingly become integral family members, owners are more proactive in seeking timely and specialized care for chronic conditions, including cardiovascular diseases. Veterinarians are witnessing a notable surge in heart-related cases, especially among aging dogs and cats, prompting increased investments in cardiology services.

Moreover, pet insurance coverage is gradually expanding to include advanced diagnostic tests and treatments, which is further encouraging owners to opt for specialized care. The market is also gaining momentum with the growing presence of veterinary specialists, expanding infrastructure in animal healthcare, and rising R&D investments aimed at improving cardiology outcomes in companion animals. With the convergence of veterinary medicine and technology, the industry is undergoing a rapid transformation that is redefining how heart conditions in animals are diagnosed, monitored, and treated.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $6.1 Billion |

| CAGR | 8.6% |

This growth is driven by a rising number of pets with heart disease and advancements in diagnostic and treatment methods. Minimally invasive procedures, such as balloon valvuloplasty and pacemaker implantation, are gaining popularity due to reduced risks and quicker recovery times. Newer medications like pimobendan, ACE inhibitors, and beta-blockers are also helping extend the lifespan of pets diagnosed with heart conditions.

The market is divided into pharmaceuticals and diagnostics. The pharmaceuticals segment generated USD 1.5 billion in 2023. This notable performance is mainly attributed to ongoing innovation in treatment protocols and a growing incidence of cardiovascular conditions in senior pets. There is a rising demand for medications that can regulate heart function, manage fluid buildup, and control blood pressure in animals, leading to increased investments and product development in this space.

The companion animal segment in the veterinary cardiology market held a 71.1% share in 2024. This category, which includes dogs, cats, and other domestic pets, continues to dominate due to increasing adoption rates and the higher likelihood of pets developing heart issues as they age. Pet owners today are far more conscious about the early detection of diseases, prompting them to pursue specialized cardiology services. Advanced diagnostics such as echocardiograms and electrocardiograms (ECGs) are seeing growing demand.

North America Veterinary Cardiology Market held a 41% share in 2024. The region's dominance is supported by a large population of companion animals, advancements in diagnostic tools, and the expansion of specialty veterinary hospitals. The U.S. market, in particular, is seeing growing integration of artificial intelligence and wearable heart monitors, which are changing how cardiac health is monitored in pets.

Major players involved in the veterinary cardiology market include TriviumVet, ESAOTE, Bionet America, Medtronic, Jurox, Siemens Healthineers, Fujifilm, Zoetis, Antech Diagnostics, General Electric Company, IDEXX, Merck, Boehringer Ingelheim International, Ceva, and GSK among others. Companies are focusing on innovative product development, introducing advanced diagnostic tools like echocardiograms and catheter-based therapies. Strategic collaborations with veterinary clinics, research bodies, and tech firms are helping them expand their reach and influence across global markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising pet adoption and increasing expenditure on animal healthcare

- 3.2.1.2 Advancements in veterinary cardiology diagnostics and treatment technologies

- 3.2.1.3 Increasing prevalence of cardiovascular diseases in companion animals

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced veterinary cardiology treatments and devices

- 3.2.2.2 Limited availability of specialized veterinary cardiologists

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Pharmaceuticals

- 5.2.1 Pimobendan

- 5.2.2 Spironolactone and benazepril hydrochloride

- 5.2.3 Other pharmaceuticals

- 5.3 Diagnostics

- 5.3.1 Physical exam

- 5.3.2 Chest X-rays

- 5.3.3 Electrocardiogram (ECG)

- 5.3.4 Other diagnostics

Chapter 6 Market Estimates and Forecast, By Animal Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Companion animals

- 6.2.1 Dogs

- 6.2.2 Cats

- 6.2.3 Other companion animals

- 6.3 Livestock animals

- 6.3.1 Cattle

- 6.3.2 Poultry

- 6.3.3 Other livestock animals

Chapter 7 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Congestive heart failure

- 7.3 Myocardial (heart muscle) disease

- 7.4 Arrhythmias

- 7.5 Other indications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Veterinary hospitals and clinics

- 8.3 Academic and research institutions

- 8.4 Other end users

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Antech Diagnostics

- 10.2 Boehringer Ingelheim International

- 10.3 Jurox

- 10.4 Ceva

- 10.5 Merck

- 10.6 IDEXX

- 10.7 General Electric Company

- 10.8 FUJIFILM

- 10.9 ESAOTE

- 10.10 Medtronic

- 10.11 Siemens Healthineers

- 10.12 TriviumVet

- 10.13 Zoetis

- 10.14 Bionet America