|

市場調查報告書

商品編碼

1721438

BOPP 薄膜市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測BOPP Films Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

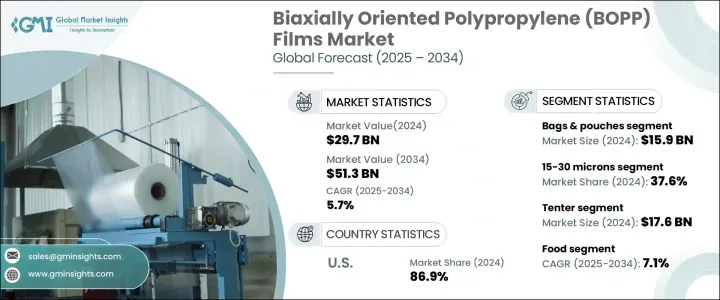

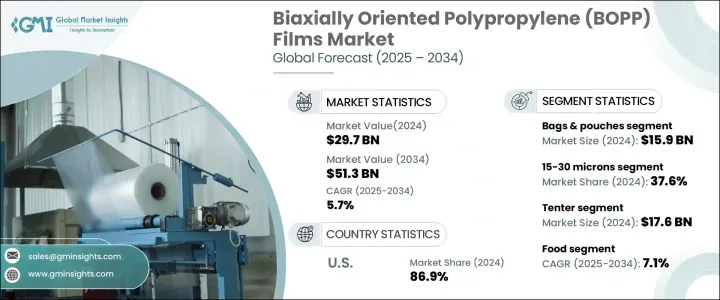

2024 年全球 BOPP 薄膜市場價值為 297 億美元,預計到 2034 年將以 5.7% 的複合年成長率成長,達到 513 億美元。隨著各行各業認知到 BOPP 薄膜在包裝應用中的卓越性能和成本優勢,市場將繼續保持強勁成長。這些薄膜之所以受到青睞,不僅是因為價格低廉,還因為其卓越的強度、清晰度和多功能性。食品飲料、製藥、電子和個人護理行業的製造商擴大轉向 BOPP 薄膜,以滿足消費者對輕質、耐用和永續包裝材料不斷變化的偏好。

在高效的供應鏈和產品貨架吸引力對企業成功至關重要的時代,BOPP 薄膜提供了滿足功能和美學需求的理想解決方案。它們的可回收性和與不斷發展的永續發展目標的兼容性進一步鞏固了它們在軟包裝市場中的地位。隨著包裝要求變得越來越複雜以及全球需求持續成長,BOPP 薄膜生產和塗層技術的創新仍然是製造商保持競爭力的重點。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 297億美元 |

| 預測值 | 513億美元 |

| 複合年成長率 | 5.7% |

推動這一市場擴張的主要動力是 BOPP 薄膜因其成本效益、高抗張強度、防潮性和出色的印刷性而在各個行業中的應用日益廣泛。順序拉伸和同時拉伸等先進的生產方法顯著提高了透明度和阻隔性。金屬化增強了視覺吸引力和保存期限,使這些薄膜成為高階品牌的首選。塗層 BOPP 薄膜具有耐熱性能,特別適合微波爐包裝,增加了其功能價值。

市場依產品分為包裝紙、袋子和小袋子、膠帶和標籤。 2024 年,僅箱包和小袋領域的市場規模就將達到 159 億美元,主要得益於電子商務的快速成長。與傳統的硬質包裝形式相比,零售商和配送中心越來越青睞 BOPP 袋和小袋,因為它們具有抗穿刺性、結構輕巧、並且能夠降低物流成本。

按厚度分類,15-30 微米的部分在 2024 年佔 37.6% 的佔有率。這一類別在強度、成本效益和材料減少之間實現了完美平衡,這些屬性與人們對環保和高效包裝解決方案的日益重視相一致。這些薄膜廣泛用於食品包裝,其耐用性和最少的材料使用至關重要。

2024 年,美國 BOPP 薄膜市場佔北美營收的 86.9%。其主導地位源自於領先製造商的大量研發投資,旨在提高薄膜強度、清晰度和多功能性,以拓寬最終用途應用。隨著電子商務的激增以及對輕質、永續包裝的需求,美國市場繼續在全球範圍內引領步伐。

Uflex Ltd.、Inteplast Group 和 Jindal Poly Films 等主要參與者正在大力投資先進的生產系統、產品創新和永續發展計劃,以擴大其市場佔有率並滿足不斷變化的行業需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 快速的技術創新和自動化

- 對永續和環保包裝解決方案的需求不斷成長

- 研發的進步提高了薄膜的品質和性能

- 擴大食品、醫療、電子等領域的應用

- 監管變化

- 產業陷阱與挑戰

- 原料成本波動

- 激烈的市場競爭導致價格壓力

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 裹麵

- 包包和小袋

- 磁帶

- 標籤

第6章:市場估計與預測:依厚度,2021 年至 2034 年

- 主要趨勢

- 低於15微米

- 15-30微米

- 30-45微米

- 超過45微米

第7章:市場估計與預測:依生產流程,2021 年至 2034 年

- 主要趨勢

- 拉幅機

- 管狀

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 食物

- 飲料

- 菸草

- 個人護理

- 製藥

- 電氣和電子產品

- 其他

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 澳洲

- 韓國

- 日本

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第10章:公司簡介

- CCL Industries

- Cosmo Films Limited

- Gulf Packaging Industries Co.

- Inteplast Group

- Jindal Poly Films

- Oben Group

- Polibak

- Polinas

- Sibur Holdings

- Taghleef Industries

- TOPPAN Group

- Toray Industries

- Uflex Ltd.

- Zhejiang Kinlead Innovative Materials

The Global BOPP Films Market was valued at USD 29.7 billion in 2024 and is estimated to grow at a CAGR of 5.7% to reach USD 51.3 billion by 2034. The market continues to witness robust growth as industries across the board recognize the superior performance and cost advantages of BOPP films in packaging applications. These films are gaining traction not only due to their affordability but also because of their exceptional strength, clarity, and versatility. Manufacturers across food and beverage, pharmaceutical, electronics, and personal care sectors are increasingly shifting toward BOPP films to meet changing consumer preferences for lightweight, durable, and sustainable packaging materials.

In an era where efficient supply chains and product shelf appeal are critical to business success, BOPP films offer an ideal solution that meets both functional and aesthetic demands. Their recyclability and compatibility with evolving sustainability goals have further strengthened their position in the flexible packaging market. As packaging requirements become more complex and global demand continues to rise, innovation in BOPP film production and coating technologies remains a key focus for manufacturers aiming to stay competitive.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $29.7 Billion |

| Forecast Value | $51.3 Billion |

| CAGR | 5.7% |

The primary driver of this market expansion is the increasing use of BOPP films across diverse industries due to their cost-effectiveness, high tensile strength, moisture resistance, and excellent printability. Advanced production methods like sequential and simultaneous stretching have significantly improved clarity and barrier properties. Metallization enhances visual appeal and shelf life, making these films a preferred choice for premium branding. Coated BOPP films, with heat-resistant capabilities, are especially suitable for microwaveable packaging, adding to their functional value.

The market is segmented by product into wraps, bags and pouches, tapes, and labels. In 2024, the bags and pouches segment alone accounted for USD 15.9 billion, driven largely by the exponential growth of e-commerce. Retailers and fulfillment centers increasingly prefer BOPP bags and pouches for their puncture resistance, lightweight structure, and ability to reduce logistics costs when compared to traditional rigid packaging formats.

When classified by thickness, the 15-30 microns segment commanded a 37.6% share in 2024. This category offers a perfect balance of strength, cost-efficiency, and material reduction-key attributes that align with the growing emphasis on eco-friendly and efficient packaging solutions. These films are widely used in food packaging, where durability and minimal material usage are essential.

The U.S. BOPP Films Market accounted for 86.9% of North American revenue in 2024. Its dominance stems from significant R&D investments by leading manufacturers aiming to enhance film strength, clarity, and versatility for broadening end-use applications. With the surge in e-commerce and demand for lightweight, sustainable packaging, the U.S. market continues to set the pace globally.

Key players like Uflex Ltd., Inteplast Group, and Jindal Poly Films are investing heavily in advanced production systems, product innovation, and sustainability initiatives to expand their market presence and cater to evolving industry demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research Approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rapid technological innovation and automation

- 3.2.1.2 Growing demand for sustainable and eco-friendly packaging solutions

- 3.2.1.3 Advancements in R&D enhance film quality and performance

- 3.2.1.4 Expanding applications in sectors like food, medical, and electronics

- 3.2.1.5 Regulatory changes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Volatility in raw material costs

- 3.2.2.2 Intense market competition results in pricing pressures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn & Kilo Tons)

- 5.1 Key trends

- 5.2 Wraps

- 5.3 Bags & pouches

- 5.4 Tapes

- 5.5 Labels

Chapter 6 Market Estimates and Forecast, By Thickness, 2021 – 2034 ($ Mn & Kilo Tons)

- 6.1 Key trends

- 6.2 Below 15 microns

- 6.3 15-30 microns

- 6.4 30-45 microns

- 6.5 More than 45 microns

Chapter 7 Market Estimates and Forecast, By Production Process, 2021 – 2034 ($ Mn & Kilo Tons)

- 7.1 Key trends

- 7.2 Tenter

- 7.3 Tubular

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn & Kilo Tons)

- 8.1 Key trends

- 8.2 Food

- 8.3 Beverage

- 8.4 Tobacco

- 8.5 Personal care

- 8.6 Pharmaceutical

- 8.7 Electrical & electronics

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Australia

- 9.4.4 South Korea

- 9.4.5 Japan

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 U.A.E.

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 CCL Industries

- 10.2 Cosmo Films Limited

- 10.3 Gulf Packaging Industries Co.

- 10.4 Inteplast Group

- 10.5 Jindal Poly Films

- 10.6 Oben Group

- 10.7 Polibak

- 10.8 Polinas

- 10.9 Sibur Holdings

- 10.10 Taghleef Industries

- 10.11 TOPPAN Group

- 10.12 Toray Industries

- 10.13 Uflex Ltd.

- 10.14 Zhejiang Kinlead Innovative Materials