|

市場調查報告書

商品編碼

1721436

摩托車鏈輪市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Motorcycle Chain Sprocket Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

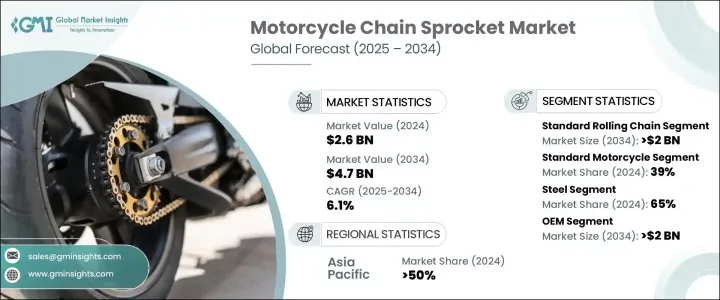

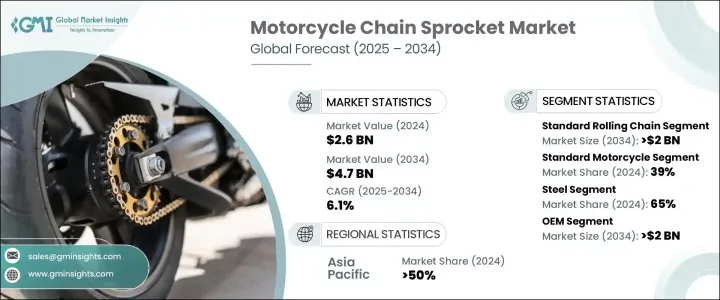

2024 年全球摩托車鏈輪市場價值為 26 億美元,預計到 2034 年將以 6.1% 的複合年成長率成長,達到 47 億美元。隨著全球出行趨勢轉向經濟實惠且省油的解決方案,摩托車將繼續成為主要的交通方式,尤其是在發展中地區。隨著都市化進程的加速,加上亞太和拉丁美洲各國中產階級人口的不斷擴大,摩托車已成為日常通勤的必需品。摩托車使用量的激增直接推動了對可靠、耐用且經濟高效的鏈輪的需求。

由於售後市場的強勁成長,該行業也獲得了發展動力,消費者經常更換磨損的零件以提高車輛性能。製造商越來越注重整合改進的材料和精密工程以滿足不斷變化的需求。此外,日益成長的環境問題和燃油效率要求迫使消費者從四輪車轉向二輪車,進一步推動了摩托車鏈輪市場的成長軌跡。各種鏈輪的供應可滿足不同類別的摩托車需求——從通勤自行車到高性能摩托車——這繼續刺激著原始OEM和售後市場管道的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 26億美元 |

| 預測值 | 47億美元 |

| 複合年成長率 | 6.1% |

市場根據鏈條類型、摩托車類型和材料進行細分。標準滾動鏈輪在 2024 年佔據了 50% 以上的市場佔有率,這主要是因為其成本低、簡單且在通勤摩托車中廣泛使用,尤其是在成本敏感的地區。這些鏈輪提供基本但有效的性能,是發展中經濟體常見的短途通勤和送貨服務的理想選擇。隨著摩托車成為注重預算的消費者的首選交通工具,對堅固耐用、維護成本低的鏈輪的需求也不斷增加。

就材料而言,鋼製鏈輪在 2024 年佔據了 65% 的市場佔有率,佔據了主導地位。鋼製鏈輪以其強度高、壽命長和價格實惠而聞名,尤其受到在嚴苛的日常條件下使用的摩托車的青睞。它們能夠承受嚴重的磨損,同時保持耐腐蝕性,使其成為通勤摩托車高使用率應用的首選。

從區域來看,亞太地區摩托車鏈輪市場在 2024 年佔據 50% 的佔有率,其中中國引領區域需求。該地區持續的城市化、不斷增加的可支配收入以及摩托車的廣泛使用極大地促進了鏈輪需求的成長。惡劣的道路條件和高里程使用率創造了一個相當大的售後市場,其中頻繁更換鏈輪是很常見的,以確保車輛的效率和使用壽命。

市場的主要參與者包括 Tsubakimoto Chain、Rockman、Regina Catene Calibrate、JT Sprockets、Daido Kogyo、Hengjiu、Renthal、LG Balakrishnan、TIDC India 和 RK Japan。這些公司正在投資材料創新和先進的生產技術,以提供更耐用的鏈輪。許多公司還根據不同的摩托車細分市場調整產品線,以增強在OEM)和替換市場的競爭力。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 製造商

- 服務提供者

- 經銷商

- 最終用途

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 監管格局

- 價格趨勢

- 成本細分分析

- 衝擊力

- 成長動力

- 新興市場摩托車銷售不斷成長

- 對輕量化和高性能鏈輪的需求不斷成長

- 電子商務平台的擴展

- 電動摩托車的普及率不斷提高

- 產業陷阱與挑戰

- 維護成本高且更換頻繁

- 原物料價格波動

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按連鎖,2021 - 2034

- 主要趨勢

- 標準滾子鏈

- X型環鏈

- O型環鏈條

第6章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 鋼

- 鋁

- 碳纖維

- 合成的

- 其他

第7章:市場估計與預測:按摩托車,2021 - 2034 年

- 主要趨勢

- 標準

- 運動的

- 巡洋艦

- 越野自行車

- 輕型機車

- 其他

第8章:市場估計與預測:按引擎容量,2021 - 2034 年

- 主要趨勢

- 高達 150 CC

- 151-300立方厘米

- 301-500立方厘米

- 500CC以上

第9章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Acerbis

- Adeline Group

- Bajaj Auto Ltd.

- Brembo

- Daido Kogyo

- Hengjiu

- Jomthai Asahi

- JT Sprockets

- KTM AG

- LGBalakrishnan

- Molnar Sprockets

- PBR Sprockets

- Regina Catene Calibrate

- Renthal

- RK Japan

- Rockman

- Sunstar Engineering

- TIDC India

- Tsubakimoto Chain

- Vortex Racing

The Global Motorcycle Chain Sprocket Market was valued at USD 2.6 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 4.7 billion by 2034. As global mobility trends shift toward affordable and fuel-efficient solutions, motorcycles continue to emerge as a primary mode of transport, particularly in developing regions. With the rapid pace of urbanization, coupled with expanding middle-class populations in countries across Asia-Pacific and Latin America, motorcycles are becoming essential for daily commuting. This surge in motorcycle usage directly drives the demand for reliable, durable, and cost-effective chain sprockets.

The industry is also gaining traction due to the robust aftermarket segment, where consumers frequently replace worn-out parts to enhance vehicle performance. Manufacturers are increasingly focusing on integrating improved materials and precision engineering to cater to this evolving demand. Additionally, rising environmental concerns and fuel efficiency mandates are compelling consumers to shift from four-wheelers to two-wheelers, further pushing the growth trajectory of the motorcycle chain sprocket market. The availability of a wide range of chain sprockets, catering to different motorcycle classes-from commuter bikes to performance motorcycles-continues to fuel demand across both OEM and aftermarket channels.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.6 Billion |

| Forecast Value | $4.7 Billion |

| CAGR | 6.1% |

The market is segmented based on chain type, motorcycle type, and material. Standard rolling chain sprockets captured more than 50% of the market share in 2024, mainly due to their low cost, simplicity, and wide usage in commuter motorcycles, especially in cost-sensitive regions. These sprockets offer basic yet effective performance and are ideal for short-distance commuting and delivery services, commonly found across developing economies. As motorcycles become the go-to transportation option for budget-conscious consumers, the need for rugged, low-maintenance sprockets continues to rise.

In terms of materials, steel sprockets dominated the market with a 65% share in 2024. Known for their strength, longevity, and affordability, steel sprockets are particularly preferred for motorcycles used in rigorous, everyday conditions. Their ability to withstand significant wear and tear while maintaining resistance to corrosion makes them a go-to choice for high-usage applications in commuter motorcycles.

Regionally, the Asia-Pacific Motorcycle Chain Sprocket Market accounted for a 50% share in 2024, with China leading the regional demand. The region's ongoing urbanization, increasing disposable incomes, and widespread motorcycle usage contribute heavily to the rising demand for sprockets. Challenging road conditions and high mileage usage create a sizable aftermarket, where frequent replacement of sprockets is common to ensure vehicle efficiency and longevity.

Key players in the market include Tsubakimoto Chain, Rockman, Regina Catene Calibrate, JT Sprockets, Daido Kogyo, Hengjiu, Renthal, L.G. Balakrishnan, TIDC India, and RK Japan. These companies are investing in material innovation and advanced production techniques to offer longer-lasting sprockets. Many are also tailoring product lines to suit various motorcycle segments, enhancing competitiveness across OEM and replacement markets.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Manufacturers

- 3.2.3 Service providers

- 3.2.4 Distributors

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.8 Price trends

- 3.9 Cost breakdown analysis

- 3.10 Impact forces

- 3.10.1 Growth drivers

- 3.10.1.1 Rising motorcycle sales in emerging markets

- 3.10.1.2 Growing demand for lightweight and high-performance sprockets

- 3.10.1.3 Expansion of e-commerce platforms

- 3.10.1.4 Increasing adoption of electric motorcycles

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High maintenance and frequent replacement costs

- 3.10.2.2 Fluctuating raw material prices

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter’s analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Chain, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Standard rolling chain

- 5.3 X ring chain

- 5.4 O ring chain

Chapter 6 Market Estimates & Forecast, By Material, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Steel

- 6.3 Aluminum

- 6.4 Carbon fiber

- 6.5 Composite

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Motorcycle, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Standard

- 7.3 Sports

- 7.4 Cruiser

- 7.5 Off-road bikes

- 7.6 Mopeds

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Engine Capacity, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Up to 150 CC

- 8.3 151-300 CC

- 8.4 301-500 CC

- 8.5 Above 500 CC

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Acerbis

- 11.2 Adeline Group

- 11.3 Bajaj Auto Ltd.

- 11.4 Brembo

- 11.5 Daido Kogyo

- 11.6 Hengjiu

- 11.7 Jomthai Asahi

- 11.8 JT Sprockets

- 11.9 KTM AG

- 11.10 L.G.Balakrishnan

- 11.11 Molnar Sprockets

- 11.12 PBR Sprockets

- 11.13 Regina Catene Calibrate

- 11.14 Renthal

- 11.15 RK Japan

- 11.16 Rockman

- 11.17 Sunstar Engineering

- 11.18 TIDC India

- 11.19 Tsubakimoto Chain

- 11.20 Vortex Racing