|

市場調查報告書

商品編碼

1721429

毛細管電泳市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Capillary Electrophoresis Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

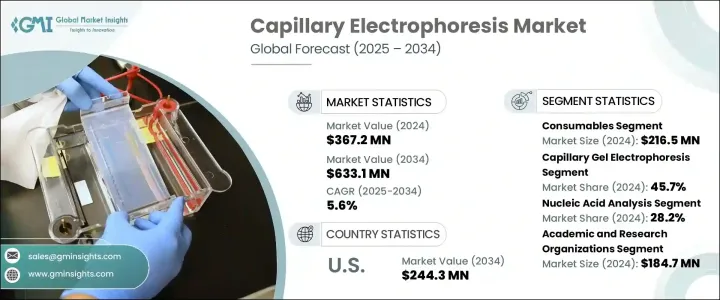

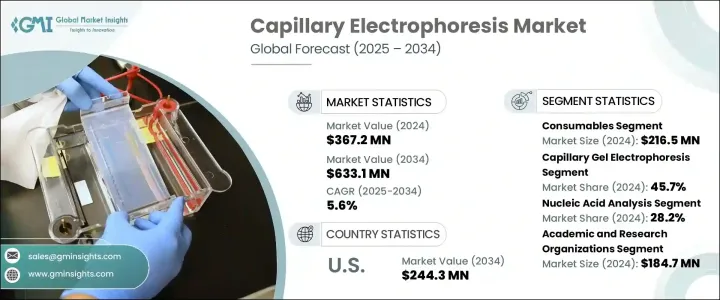

2024 年全球毛細管電泳市場價值為 3.672 億美元,預計到 2034 年將以 5.6% 的複合年成長率成長,達到 6.331 億美元。隨著醫療保健產業轉向更準確、個人化和數據驅動的治療方法,對毛細管電泳等高效分析工具的需求正在上升。該技術因其能夠根據大小和電荷分離小分子或離子的高精度而越來越受到人們的重視,這使其在基因分析、疾病診斷和藥物研究中非常有效。隨著基因組學、蛋白質組學和法醫學中應用的不斷成長,毛細管電泳法繼續受到學術、臨床和工業研究領域的關注。

研究人員和臨床醫生越來越依賴這種方法來檢測基因突變、監測病原體和分析複雜的生物混合物,這有助於他們制定更有針對性的治療方法並改善患者的整體治療效果。由於研發投資的增加、對先進診斷方法的監管支持以及該技術與下一代測序工作流程的快速整合,市場也見證了強勁的發展勢頭。隨著全球對精準醫療的需求不斷成長,毛細管電泳正成為分子診斷工具包中不可或缺的一部分。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.672億美元 |

| 預測值 | 6.331億美元 |

| 複合年成長率 | 5.6% |

市場分為儀器、消耗品和軟體。其中,消耗品佔了相當大的佔有率,2024 年創造了 2.165 億美元的市場規模,預計到 2034 年將以 5.4% 的複合年成長率成長。毛細管和專用試劑等消耗品對於維持技術的完整性和性能至關重要。由於實驗室嚴重依賴一致的高品質耗材來確保準確的結果,這一領域在常規需求的推動下繼續保持穩定成長。

根據類型,毛細管凝膠電泳 (CGE) 部分在 2024 年佔據了 45.7% 的市場佔有率。 CGE 廣泛用於分離 DNA、RNA 和蛋白質等大型生物分子,使其成為基因定序、突變分析和蛋白質體學的首選技術。它能夠提供高度準確的結果,這使得它對於需要分離複雜生物化合物的研究和診斷應用來說不可或缺。

美國毛細管電泳市場正在迅速擴張,這得益於對早期疾病檢測(尤其是腫瘤學)的需求不斷成長。該技術可以對與癌症相關的遺傳標記進行高解析度分析,從而促進個人化治療計劃的發展。領先研究機構的持續創新正在提高該技術的精確度,特別是在生物標記識別方面。

包括賽默飛世爾科技、凱傑公司、Bio-Techne 和安捷倫科技在內的領導企業都致力於推動其產品組合。這些公司正在提高儀器靈敏度、改善耗材性能,並尋求合作推出滿足日益成長的個人化醫療解決方案需求的整合系統。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 傳染病發生率不斷上升

- 擴大製藥和生物技術產業的應用

- 遺傳和分子研究需求不斷成長

- 毛細管電泳技術進步

- 產業陷阱與挑戰

- 初期投資及維護成本高

- 新興國家高素質專業人才有限

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 儀器

- 全自動毛細管電泳系統

- 半自動毛細管電泳系統

- 耗材

- 軟體

第6章:市場估計與預測:按類型,2021 - 2034 年

- 主要趨勢

- 毛細管區帶電泳(CZE)

- 膠束電動毛細管層析法(MEKC)

- 毛細管電色譜法(CEC)

- 毛細管等電聚焦(CIEF)

- 毛細管等速電泳(CITP)

- 毛細管凝膠電泳(CGE)

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 核酸分析

- 蛋白質分析

- 基因組DNA

- 質粒DNA

- 片段分析

- RNA/mRNA分析

- 其他應用

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 主要趨勢

- 製藥和生物技術公司

- 學術和研究組織

- 臨床實驗室

- 其他最終用途

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Agilent Technologies

- Bio-Rad Laboratories

- Bio-Techne

- Danaher Corporation

- Helena Laboratories Corporation

- Lumex Instruments

- Merck

- Prince Technologies

- QIAGEN

- Thermo Fisher Scientific

The Global Capillary Electrophoresis Market was valued at USD 367.2 million in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 633.1 million by 2034. As the healthcare industry shifts toward more accurate, personalized, and data-driven treatment approaches, the demand for efficient analytical tools like capillary electrophoresis is on the rise. This technology is gaining ground due to its high precision in separating small molecules or ions based on size and charge, which makes it exceptionally effective for genetic analysis, disease diagnostics, and pharmaceutical research. With growing applications in genomics, proteomics, and forensic science, capillary electrophoresis continues to attract attention across academic, clinical, and industrial research landscapes.

Researchers and clinicians are increasingly leaning on this method to detect genetic mutations, monitor pathogens, and analyze complex biological mixtures, which is helping them formulate better-targeted therapies and improve overall patient outcomes. The market is also witnessing strong momentum due to rising investments in R&D, regulatory support for advanced diagnostic methods, and the rapid integration of this technology into next-generation sequencing workflows. As global demand for precision medicine grows, capillary electrophoresis is emerging as an indispensable part of the molecular diagnostics toolkit.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $367.2 Million |

| Forecast Value | $633.1 Million |

| CAGR | 5.6% |

The market is segmented into instruments, consumables, and software. Among these, consumables held a significant share, generating USD 216.5 million in 2024, and are expected to expand at a CAGR of 5.4% through 2034. Consumables such as capillaries and specialized reagents are critical to maintaining the integrity and performance of the technique. With laboratories relying heavily on consistent, high-quality consumables to ensure accurate results, this segment continues to see steady growth driven by routine demand.

Based on type, the capillary gel electrophoresis (CGE) segment accounted for a 45.7% market share in 2024. CGE is widely used to separate large biomolecules like DNA, RNA, and proteins, making it a go-to technique for genetic sequencing, mutation analysis, and proteomics. Its ability to deliver highly accurate results makes it indispensable for research and diagnostic applications that require the separation of complex biological compounds.

The U.S. Capillary Electrophoresis Market is expanding rapidly, driven by rising demand for early disease detection, especially in oncology. The technique enables high-resolution analysis of genetic markers linked to cancer, facilitating the development of personalized treatment plans. Ongoing innovations from leading research institutions are enhancing the technique's precision, particularly in biomarker identification.

Leading players, including Thermo Fisher Scientific, QIAGEN, Bio-Techne, and Agilent Technologies, are focused on advancing their product portfolios. These companies are enhancing instrument sensitivity, improving consumable performance, and pursuing collaborations to introduce integrated systems that align with the growing need for personalized healthcare solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing incidences of infectious disease

- 3.2.1.2 Expanding applications in pharmaceutical and biotech industries

- 3.2.1.3 Rising demand for genetic and molecular research

- 3.2.1.4 Technological advancement in capillary electrophoresis

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High initial investment and maintenance costs

- 3.2.2.2 Limited availability of highly trained professionals in emerging countries

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.2.1 Automatic capillary electrophoresis systems

- 5.2.2 Semi-automatic capillary electrophoresis systems

- 5.3 Consumables

- 5.4 Software

Chapter 6 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Capillary zone electrophoresis (CZE)

- 6.3 Micellar electrokinetic capillary chromatography (MEKC)

- 6.4 Capillary electrochromatography (CEC)

- 6.5 Capillary isoelectric focusing (CIEF)

- 6.6 Capillary isotachophoresis (CITP)

- 6.7 Capillary gel electrophoresis (CGE)

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Nucleic acid analysis

- 7.3 Protein analysis

- 7.4 Genomic DNA

- 7.5 Plasmid DNA

- 7.6 Fragment analysis

- 7.7 RNA/mRNA analysis

- 7.8 Other applications

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Pharmaceutical and biotechnology companies

- 8.3 Academic and research organizations

- 8.4 Clinical laboratories

- 8.5 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Agilent Technologies

- 10.2 Bio-Rad Laboratories

- 10.3 Bio-Techne

- 10.4 Danaher Corporation

- 10.5 Helena Laboratories Corporation

- 10.6 Lumex Instruments

- 10.7 Merck

- 10.8 Prince Technologies

- 10.9 QIAGEN

- 10.10 Thermo Fisher Scientific