|

市場調查報告書

商品編碼

1721425

吸入式一氧化氮輸送系統市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Inhaled Nitric Oxide Delivery System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

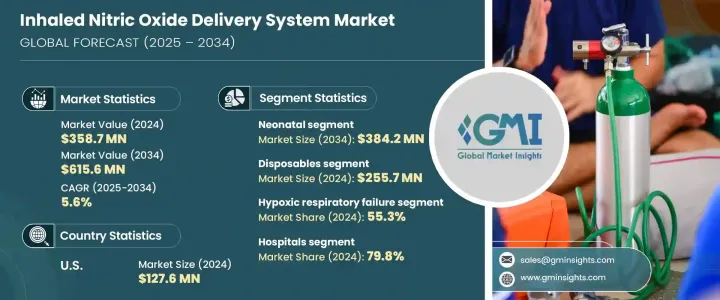

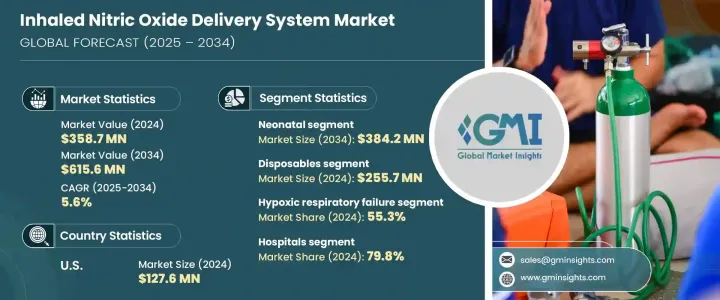

2024 年全球吸入式一氧化氮輸送系統市值為 3.587 億美元,預計到 2034 年將以 5.6% 的複合年成長率成長至 6.156 億美元。隨著急性呼吸窘迫症候群 (ARDS)、持續性肺動脈高壓和缺氧呼吸衰竭等呼吸道疾病在各個年齡層中持續增加,市場正在經歷顯著成長。吸入一氧化氮 (iNO) 因其血管擴張作用而成為一種重要的治療選擇,有助於改善氧合併減少對更具侵入性呼吸支持的需求。無論在已開發地區或發展中地區,呼吸系統疾病的負擔日益加重,這迫使醫療機構採用安全、有效且經濟高效的先進治療方式。隨著呼吸護理中對精準和非侵入性治療的日益重視,吸入式一氧化氮系統正成為新生兒加護病房 (NICU)、兒科重症監護病房和成人重症監護環境的首選。此外,醫療保健基礎設施的增強以及對早期診斷和介入的日益重視,導致全球吸入式一氧化氮輸送系統的採用率更高。越來越多的臨床研究驗證了 iNO 療法的療效,監管部門批准了創新輸送設備,治療肺部併發症的個人化醫療也隨之轉變,這進一步支持了市場的成長。

市場按年齡層細分,包括新生兒、兒科和成人類別。其中,新生兒領域表現突出,2024 年估值達到 2.212 億美元,預計到 2034 年將成長至 3.842 億美元。這一成長是由於新生兒呼吸窘迫發病率不斷上升,尤其是早產兒。經常採用吸入式一氧化氮療法來改善肺功能並減少體外生命維持的需要。早產率的上升,加上新興經濟體新生兒護理技術的進步和新生兒加護病房設施的改善,進一步加速了這一領域的需求。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 3.587億美元 |

| 預測值 | 6.156億美元 |

| 複合年成長率 | 5.6% |

在應用方面,缺氧呼吸衰竭在 2024 年佔據最大的市場佔有率,為 55.3%,預計到 2034 年將以 4.7% 的複合年成長率成長。這種疾病在新生兒和兒科患者中很常見,與體外膜氧合 (ECMO) 等侵入性手術相比,吸入一氧化氮提供了更容易獲得且更具成本效益的治療選擇。它的易用性、最小的副作用以及在重症監護情況下的積極效果使其在兒科和新生兒環境中受到青睞。

2024 年美國吸入式一氧化氮輸送系統市場價值為 1.276 億美元,並將持續穩定擴張。新生兒 ARDS 病例不斷增加,加上人們對其的高度認知以及先進呼吸護理基礎設施的可用性,支持了強勁的市場成長。在醫院和新生兒重症監護室 (NICU) 環境中的廣泛應用凸顯了該國在該領域的領導地位。

影響全球吸入式一氧化氮輸送系統格局的主要參與者包括默克公司、液化空氣醫療集團、林德、Bellerophon Therapeutics、Getinge、Beyond Air、普萊克斯、百特國際、Mallinckrodt Pharmaceuticals、Circassia Pharmaceuticals、EKU Elektronik、VEROtech、International Biomedical、MEDS、MED、MED、A 或 Biotechn Plus BioMNU。這些公司正在透過開發下一代交付系統、擴大其地理覆蓋範圍和建立策略聯盟來優先進行創新。他們的重點仍然是透過與醫療機構和研究機構的合作來提高治療效率、改善患者治療效果並探索監管途徑。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 呼吸系統疾病盛行率上升

- 吸入式一氧化氮輸送系統的技術進步

- 提高醫療專業人員和患者的意識

- 產業陷阱與挑戰

- 吸入一氧化氮療法成本高昂

- 存在嚴格的規定

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 差距分析

- 專利分析

- 未來市場趨勢

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:依年齡層,2021 年至 2034 年

- 主要趨勢

- 新生兒

- 兒科

- 成人

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 缺氧性呼吸衰竭

- 急性低氧血症性呼吸衰竭

- 其他應用

第7章:市場估計與預測:按產品,2021 年至 2034 年

- 主要趨勢

- 免洗用品

- 系統

第8章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 醫院

- 門診中心

- 診所

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Air Liquide Healthcare

- Baxter International

- Bellerophon Therapeutics

- Beyond Air

- Circassia Pharmaceuticals

- EKU Elektronik

- Getinge

- International Biomedical

- Linde

- Mallinckrodt Pharmaceuticals

- Merck KGaA

- NU-MED Plus

- Praxair

- SLE

- VERO Biotech

The Global Inhaled Nitric Oxide Delivery System Market was valued at USD 358.7 million in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 615.6 million by 2034. The market is witnessing notable growth as respiratory conditions like acute respiratory distress syndrome (ARDS), persistent pulmonary hypertension, and hypoxic respiratory failure continue to rise across various age groups. Inhaled nitric oxide (iNO) has emerged as a vital therapeutic option due to its vasodilatory effects, helping improve oxygenation and reducing the need for more invasive respiratory support. The increasing burden of respiratory illnesses, both in developed and developing regions, is pushing healthcare facilities to adopt advanced treatment modalities that are safe, effective, and cost-efficient. With the growing emphasis on precision and non-invasive therapies in respiratory care, inhaled nitric oxide systems are becoming a preferred choice across neonatal intensive care units (NICUs), pediatric ICUs, and adult critical care settings. Additionally, enhanced access to healthcare infrastructure and an increasing focus on early diagnosis and intervention have led to higher adoption of inhaled nitric oxide delivery systems globally. The market's growth is further supported by the rising number of clinical studies validating the efficacy of iNO therapy, regulatory approvals for innovative delivery devices, and a shift toward personalized medicine in treating pulmonary complications.

The market is segmented by age groups, including neonatal, pediatric, and adult categories. Among these, the neonatal segment stood out prominently, reaching a valuation of USD 221.2 million in 2024 and projected to grow to USD 384.2 million by 2034. This growth is fueled by the rising incidence of neonatal respiratory distress, especially among premature newborns. Inhaled nitric oxide therapy is frequently administered to improve pulmonary function and reduce the need for extracorporeal life support. The increasing rate of preterm births, combined with advancements in neonatal care technology and improved NICU facilities in emerging economies, is further accelerating demand within this segment.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $358.7 Million |

| Forecast Value | $615.6 Million |

| CAGR | 5.6% |

In terms of application, hypoxic respiratory failure held the largest market share at 55.3% in 2024 and is expected to grow at a CAGR of 4.7% through 2034. This condition is commonly seen in both neonatal and pediatric patients and inhaled nitric oxide offers a more accessible and cost-effective treatment option compared to invasive procedures like extracorporeal membrane oxygenation (ECMO). Its ease of use, minimal side effects, and positive outcomes in critical care scenarios are driving its preference across pediatric and neonatal settings.

The U.S. Inhaled Nitric Oxide Delivery System Market was valued at USD 127.6 million in 2024 and continues to expand steadily. The growing number of ARDS cases among newborns, coupled with high awareness and availability of advanced respiratory care infrastructure, supports strong market uptake. Widespread adoption across hospital and NICU environments underscores the country's leadership in this space.

Key players shaping the global inhaled nitric oxide delivery system landscape include Merck KGaA, Air Liquide Healthcare, Linde, Bellerophon Therapeutics, Getinge, Beyond Air, Praxair, Baxter International, Mallinckrodt Pharmaceuticals, Circassia Pharmaceuticals, EKU Elektronik, VERO Biotech, International Biomedical, SLE, and NU-MED Plus. These companies are prioritizing innovation through the development of next-generation delivery systems, expanding their geographic footprint, and forming strategic alliances. Their focus remains on enhancing therapy efficiency, improving patient outcomes, and navigating regulatory pathways through collaborations with healthcare institutions and research bodies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of respiratory diseases

- 3.2.1.2 Technological advancements in inhaled nitric oxide delivery systems

- 3.2.1.3 Increased awareness among healthcare professionals and patients

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with inhaled nitric oxide therapy

- 3.2.2.2 Presence of stringent regulations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Gap analysis

- 3.7 Patent analysis

- 3.8 Future market trends

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Age Group, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Neonatal

- 5.3 Pediatric

- 5.4 Adult

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hypoxic respiratory failure

- 6.3 Acute hypoxemic respiratory failure

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Disposables

- 7.3 System

Chapter 8 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals

- 8.3 Ambulatory centers

- 8.4 Clinics

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Air Liquide Healthcare

- 10.2 Baxter International

- 10.3 Bellerophon Therapeutics

- 10.4 Beyond Air

- 10.5 Circassia Pharmaceuticals

- 10.6 EKU Elektronik

- 10.7 Getinge

- 10.8 International Biomedical

- 10.9 Linde

- 10.10 Mallinckrodt Pharmaceuticals

- 10.11 Merck KGaA

- 10.12 NU-MED Plus

- 10.13 Praxair

- 10.14 SLE

- 10.15 VERO Biotech