|

市場調查報告書

商品編碼

1721423

小分子 API 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Small Molecule API Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

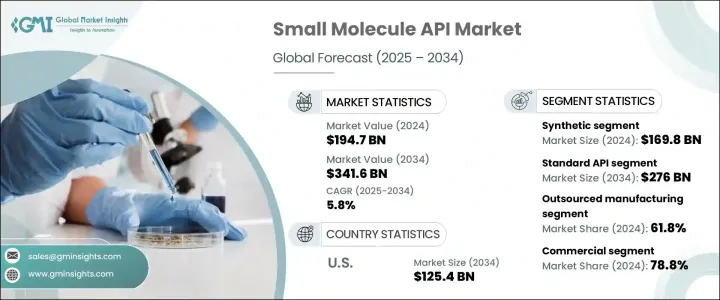

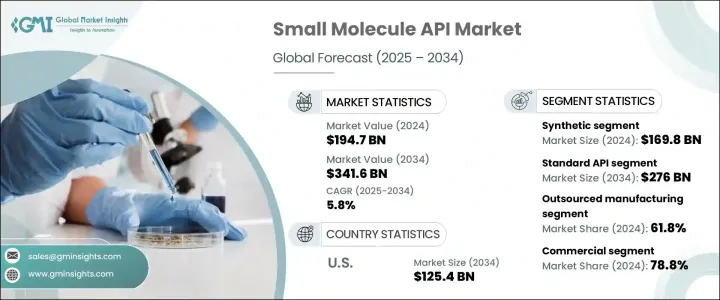

2024 年全球小分子 API 市場價值為 1,947 億美元,預計到 2034 年將以 5.8% 的複合年成長率成長,達到 3,416 億美元。小分子活性藥物成分 (API) 因其易於配製、口服生物利用度高且製造程序完善,繼續在現代治療中發揮關鍵作用。這些化合物具有低分子量的特點,容易穿透細胞膜,為多種疾病提供治療效果。隨著製藥業越來越關注精準醫療和快速藥物開發,小分子 API 重新引起了人們的興趣。製藥公司擴大利用人工智慧和高通量篩選工具來最佳化發現和開發過程。這些創新縮短了藥物開發時間,提高了標靶效率,並顯著降低了生產成本。此外,慢性病盛行率上升、人口老化以及對具成本效益藥物的需求不斷成長等全球醫療保健趨勢正在推動製藥公司擴大 API 生產。主要市場的政府也積極推動學名藥的普及,為 API 製造創造良好的生態系統。對經濟實惠、可擴展且有效的治療方法的需求進一步推動 API 製造商投資於強大的基礎設施、法規遵循和研發創新。

市場按類型細分為生物技術 API 和合成 API,其中合成類別在 2024 年創造 1,698 億美元的產值。合成 API 因其可擴展性、可負擔性和廣譜治療應用而佔據主導地位。這些 API 透過化學合成生產,具有一致的品質和穩定性,因此在大規模生產過程中具有高度的可靠性。他們在感染、心血管疾病、代謝疾病等治療領域的強大立足點使其成為全球藥物製劑的中堅力量。由於醫療保健系統面臨著以較低成本提供有效解決方案的壓力,合成 API 正在應對這項挑戰,確保大規模生產且不影響品質或效能。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1947億美元 |

| 預測值 | 3416億美元 |

| 複合年成長率 | 5.8% |

根據效力,小分子 API 市場分為標準 API 和高效能 API(HPAPI)。標準 API 部分在 2024 年佔據了 81.4% 的市場佔有率,預計到 2034 年將達到 2,760 億美元。這些 API 對於製造學名藥至關重要,而學名藥佔全球藥品消費的很大一部分。它們的成本效益和對各種治療類別(從疼痛管理到慢性病治療)的適應性使製藥公司能夠維持廣泛、有利可圖的產品線。透過提供可負擔性和治療多樣性,標準 API 可確保全球人口能夠持續獲得基本藥物。

預計到 2034 年,美國小分子 API 市場規模將達到 1,254 億美元。美國擁有先進的製藥生態系統、強大的學名藥製造商網路以及支持加速藥品核准的監管框架。醫療保健基礎設施的持續投資、慢性病治療需求的不斷成長以及可負擔藥物取得的政策支持正在推動市場成長。

百時美施貴寶、莊信萬豐、阿斯特捷利康、諾華、吉利德科學、默克、勃林格殷格翰、羅氏、梯瓦製藥、葛蘭素史克、Curia Global、巴斯夫、輝瑞、EUROAPI、南京康友生化製藥等領先公司正在優先考慮擴大研發、開發先進的合成技術和人工智慧驅動的藥物開發。許多公司正在尋求許可交易、收購和製造擴張,以擴大營運規模並拓寬治療範圍。隨著企業努力加強全球供應鏈並滿足不斷成長的需求,監管合規性和永續性也處於首要地位。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 慢性病盛行率不斷上升

- 藥物開發技術的進步

- 擴大學名藥和生物相似藥市場

- 產業陷阱與挑戰

- 製造成本高

- 嚴格的監管情景

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 合成的

- 生物技術

第6章:市場估計與預測:依效力,2021 年至 2034 年

- 主要趨勢

- 標準 API

- 高效API

第7章:市場估計與預測:依製造類型,2021 年至 2034 年

- 主要趨勢

- 內部

- 外包

第 8 章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 臨床

- 商業的

第9章:市場估計與預測:按治療領域,2021 年至 2034 年

- 主要趨勢

- 心血管

- 腫瘤學

- 中樞神經系統和神經病學

- 骨科

- 內分泌學

- 肺部疾病學

- 胃腸病學

- 腎臟病學

- 眼科

- 其他治療領域

第 10 章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 製藥公司

- 生技公司

- 合約開發與製造組織 (CDMO)

- 其他最終用戶

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第12章:公司簡介

- AstraZeneca

- BASF

- Boehringer Ingelheim

- Bristol-Myers

- Curia Global

- EUROAPI

- GILEAD Sciences

- GlaxoSmithKline

- Hoffmann-La Roche

- Johnson Matthey

- Merck

- Nanjing King-Friend Biochemical Pharmaceutical

- Novartis

- Pfizer

- Teva Pharmaceuticals

The Global Small Molecule API Market was valued at USD 194.7 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 341.6 billion by 2034. Small molecule active pharmaceutical ingredients (APIs) continue to play a pivotal role in modern therapeutics due to their ease of formulation, oral bioavailability, and well-established manufacturing processes. These compounds, characterized by low molecular weight, easily penetrate cell membranes to deliver therapeutic benefits across a wide range of diseases. As the pharmaceutical industry intensifies its focus on precision medicine and rapid drug development, small molecule APIs are witnessing renewed interest. Pharmaceutical companies are increasingly leveraging artificial intelligence and high-throughput screening tools to optimize discovery and development processes. These innovations have shortened drug development timelines, improved targeting efficiency, and significantly reduced production costs. Additionally, global healthcare trends such as the increasing prevalence of chronic diseases, aging populations, and rising demand for cost-effective drugs are pushing pharmaceutical firms to scale up API production. Governments across key markets are also actively promoting generic drug availability, creating a favorable ecosystem for API manufacturing. The need for affordable, scalable, and effective treatments is further driving API manufacturers to invest in robust infrastructure, regulatory compliance, and R&D innovation.

The market is segmented by type into biotech and synthetic APIs, with the synthetic category generating USD 169.8 billion in 2024. Synthetic APIs dominate the landscape due to their scalability, affordability, and broad-spectrum therapeutic applications. Produced through chemical synthesis, these APIs offer consistent quality and stability, making them highly reliable during mass production. Their strong foothold in treatments for infections, cardiovascular diseases, metabolic conditions, and more has positioned them as the backbone of global pharmaceutical formulations. With healthcare systems under pressure to deliver effective solutions at lower costs, synthetic APIs are meeting the challenge by ensuring large-scale production without compromising on quality or efficacy.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $194.7 Billion |

| Forecast Value | $341.6 Billion |

| CAGR | 5.8% |

Based on potency, the small molecule API market is divided into standard APIs and high potency APIs (HPAPIs). The standard API segment held an 81.4% market share in 2024 and is forecasted to reach USD 276 billion by 2034. These APIs are crucial for manufacturing generic medications, which account for a significant portion of global drug consumption. Their cost-effective nature and adaptability across various therapeutic categories-from pain management to chronic disease treatment-allow pharmaceutical companies to maintain broad, profitable product pipelines. By delivering affordability and therapeutic versatility, standard APIs are ensuring consistent access to essential medications for global populations.

The U.S. Small Molecule API Market is projected to reach USD 125.4 billion by 2034. The country benefits from an advanced pharmaceutical ecosystem, a robust network of generic drug manufacturers, and a regulatory framework that supports accelerated drug approvals. Ongoing investments in healthcare infrastructure, rising demand for chronic illness treatments, and policy support for affordable medication access are propelling market growth.

Leading companies such as Bristol-Myers, Johnson Matthey, AstraZeneca, Novartis, GILEAD Sciences, Merck, Boehringer Ingelheim, Hoffmann-La Roche, Teva Pharmaceuticals, GlaxoSmithKline, Curia Global, BASF, Pfizer, EUROAPI, and Nanjing King-Friend Biochemical Pharmaceutical are prioritizing R&D expansion, advanced synthesis technologies, and AI-powered drug development. Many are pursuing licensing deals, acquisitions, and manufacturing expansions to scale operations and broaden therapeutic offerings. Regulatory compliance and sustainability are also at the forefront as companies strive to enhance global supply chains and meet escalating demand.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of chronic diseases

- 3.2.1.2 Advancements in drug development technologies

- 3.2.1.3 Expanding generic and biosimilar market

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High manufacturing costs

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter’s analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Synthetic

- 5.3 Biotech

Chapter 6 Market Estimates and Forecast, By Potency, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Standard API

- 6.3 HPAPI

Chapter 7 Market Estimates and Forecast, By Manufacturing Type, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 In-house

- 7.3 Outsourced

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Clinical

- 8.3 Commercial

Chapter 9 Market Estimates and Forecast, By Therapeutic Area, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Cardiovascular

- 9.3 Oncology

- 9.4 CNS and Neurology

- 9.5 Orthopedic

- 9.6 Endocrinology

- 9.7 Pulmonology

- 9.8 Gastroenterology

- 9.9 Nephrology

- 9.10 Ophthalmology

- 9.11 Other therapeutic areas

Chapter 10 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Pharmaceutical companies

- 10.3 Biotechnology companies

- 10.4 Contract development and manufacturing organizations (CDMOs)

- 10.5 Other end users

Chapter 11 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Netherlands

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

Chapter 12 Company Profiles

- 12.1 AstraZeneca

- 12.2 BASF

- 12.3 Boehringer Ingelheim

- 12.4 Bristol-Myers

- 12.5 Curia Global

- 12.6 EUROAPI

- 12.7 GILEAD Sciences

- 12.8 GlaxoSmithKline

- 12.9 Hoffmann-La Roche

- 12.10 Johnson Matthey

- 12.11 Merck

- 12.12 Nanjing King-Friend Biochemical Pharmaceutical

- 12.13 Novartis

- 12.14 Pfizer

- 12.15 Teva Pharmaceuticals