|

市場調查報告書

商品編碼

1721410

多巴胺激動劑市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Dopamine Agonists Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

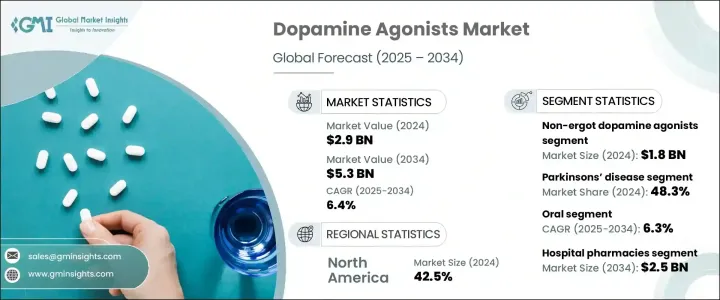

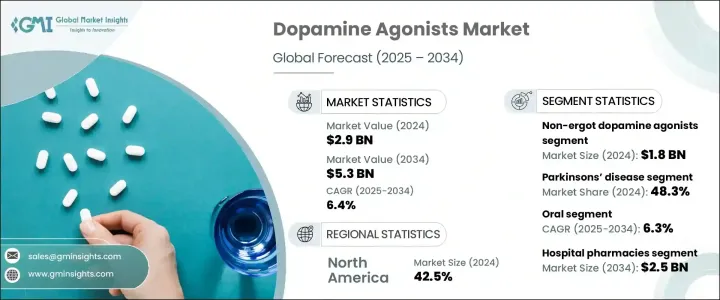

2024 年全球多巴胺激動劑市場價值為 29 億美元,預計到 2034 年將以 6.4% 的複合年成長率成長,達到 53 億美元。這種穩定的成長反映了對先進神經系統療法日益成長的需求,而推動這一需求的因素是全球帕金森氏症和不安腿症候群 (RLS) 等神經退化性疾病的激增。由於人口老化、久坐的生活方式和壓力水平升高,神經系統疾病變得越來越普遍,醫療保健提供者更加重視早期發現和介入。

隨著患者對可用治療方案的了解越來越多,診斷率也在上升,患者能夠比以前更快地接受有效的藥物治療。同時,醫藥創新持續推動市場向前發展。公司正在積極投資具有卓越療效和更少副作用的下一代多巴胺激動劑。經皮貼片和緩釋片等藥物傳遞系統的改進正在改變治療體驗並提高藥物依從性。無論是在已開發經濟體還是新興經濟體,不斷成長的醫療保健投資和技術進步正在重塑神經系統疾病的治療格局,為多巴胺激動劑領域的持續市場成長創造有利條件。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 29億美元 |

| 預測值 | 53億美元 |

| 複合年成長率 | 6.4% |

非麥角多巴胺激動劑在 2024 年創造了 18 億美元的銷售額,成為該治療領域的主導藥物類別。與傳統的麥角類藥物相比,臨床醫生現在更喜歡這些藥物,因為它們更安全,而且心血管和纖維化併發症的風險顯著降低。每日一次給藥的便利性和使用者友善的經皮應用的可用性也促使更多患者選擇非麥角替代品。製藥公司正大力投入研發,以開發耐受性更好、長期效益更高的創新化合物。隨著這些改進的治療方案變得越來越普及,醫生擴大推薦它們作為第一線療法,這增加了處方量並改善了主要市場的患者治療效果。

2024 年,帕金森氏症領域佔據了整體市場的 48.3%,繼續保持多巴胺激動劑最大應用領域的地位。鑑於帕金森氏症是全球第二常見的神經退化性疾病,其發生率不斷上升(尤其是在老年人群中),持續推動對有效治療的巨大需求。在新興國家,醫療服務可近性的提高、公共衛生政策的加強以及疾病意識的增強正在促進治療的採用率的提高。藥物開發商正專注於開發能夠解決運動和非運動症狀(如疲勞、睡眠障礙和憂鬱)的新配方。這些創新有助於彌合帕金森氏症治療領域的差距,進一步擴大市場潛力。

2024 年,美國多巴胺激動劑市場規模達到 11 億美元,這得益於強大的醫療保健基礎設施和廣泛的專業神經病學護理。市場受益於藥物研究的不斷創新和加速藥物核准的支持性監管環境。人工智慧和先進影像技術的融合使得早期檢測變得更加普遍,而宣傳活動則鼓勵主動進行神經系統篩檢。這些努力正在推動全國患者獲得更及時的診斷和更好的臨床結果。

包括 Adamas Pharma、Sunovion Pharmaceuticals、諾華、Teva Pharmaceutical Industries、輝瑞、AbbVie、UCB Pharma、勃林格殷格翰製藥、Avvisto Therapeutics (VeroScience)、葛蘭素史克 (GSK)、Bertek Pharmaceuticals (Mylantical)、Amneal Pharmaceticals、Amneal Pharmaceticals 和控股公司正在競爭中的頂級生產公司格局。這些公司正在將投資投入尖端多巴胺激動劑療法、改進藥物傳輸機制以及擴大其在高成長地區的業務。與生技公司和學術機構的策略合作夥伴關係正在加速研發管道,實現快速創新,並使這些參與者在全球多巴胺激動劑市場中取得長期成功。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 帕金森氏症和其他神經系統疾病的盛行率不斷上升

- 藥物開發和配方的進步

- 提高對神經系統疾病的認知和早期診斷

- 產業陷阱與挑戰

- 監理挑戰和新藥核准延遲

- 來自替代療法的競爭

- 成長動力

- 成長潛力分析

- 監管格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類型,2021 - 2034 年

- 主要趨勢

- 麥角多巴胺激動劑

- 非麥角類多巴胺激動劑

第6章:市場估計與預測:按適應症,2021 - 2034 年

- 主要趨勢

- 帕金森氏症

- 不安腿症候群(RLS)

- 高催乳素血症

- 其他適應症

第7章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 注射劑

- 其他給藥途徑

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 醫院藥房

- 藥局和零售藥局

- 網路藥局

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- AbbVie

- Adamas Pharma

- Amneal Pharmaceuticals

- Avvisto Therapeutics (VeroScience)

- Boehringer Ingelheim Pharmaceuticals

- Bertek Pharmaceuticals (Mylan)

- GlaxoSmithKline (GSK)

- Kirin Holdings Company

- Novartis

- Pfizer

- Sunovion Pharmaceuticals

- Teva Pharmaceutical Industries

- UCB Pharma

The Global Dopamine Agonists Market was valued at USD 2.9 billion in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 5.3 billion by 2034. This steady growth reflects the increasing demand for advanced neurological therapies, driven by a global surge in neurodegenerative conditions like Parkinson's disease and restless legs syndrome (RLS). With neurological disorders becoming more common due to aging populations, sedentary lifestyles, and heightened stress levels, healthcare providers are placing greater emphasis on early detection and intervention.

As patients become more aware of available treatment options, diagnosis rates are rising, and patients are being placed on effective medication regimens sooner than before. In parallel, pharmaceutical innovation continues to drive the market forward. Companies are actively investing in next-generation dopamine agonists with superior efficacy and reduced side effects. Improvements in drug delivery systems, such as transdermal patches and extended-release tablets, are transforming treatment experiences and improving medication adherence. Across both developed and emerging economies, rising healthcare investments and technological advancements are reshaping the treatment landscape for neurological disorders, creating favorable conditions for sustained market growth in the dopamine agonists space.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.9 Billion |

| Forecast Value | $5.3 Billion |

| CAGR | 6.4% |

Non-ergot dopamine agonists generated USD 1.8 billion in 2024, establishing themselves as the dominant drug class in this therapeutic area. Clinicians now prefer these over traditional ergot-based options due to their safer profiles and significantly lower risk of cardiovascular and fibrotic complications. The convenience of once-daily dosing and the availability of user-friendly transdermal applications are also pushing more patients toward non-ergot alternatives. Pharmaceutical companies are focusing heavily on R&D to develop innovative compounds that offer better tolerability and long-term benefits. As these improved options become more widely available, physicians are increasingly recommending them as first-line therapies, which is boosting prescription volumes and improving patient outcomes across key markets.

The Parkinson's disease segment held a 48.3% share of the overall market in 2024, maintaining its position as the largest application area for dopamine agonists. Given that Parkinson's is the second most prevalent neurodegenerative disorder worldwide, its rising incidence-especially among the elderly-continues to drive significant demand for effective treatments. In emerging countries, enhanced access to medical care, stronger public health policies, and increased disease awareness are contributing to higher treatment adoption. Drug developers are focusing on novel formulations that address both motor and non-motor symptoms, such as fatigue, sleep disturbances, and depression. These innovations are helping bridge therapeutic gaps in Parkinson's management, further amplifying market potential.

The U.S. Dopamine Agonists Market reached USD 1.1 billion in 2024, underpinned by robust healthcare infrastructure and widespread access to specialized neurology care. The market benefits from continuous innovation in pharmaceutical research and a supportive regulatory environment that accelerates drug approvals. The integration of AI and advanced imaging technologies is making early detection more common, while awareness campaigns encourage proactive neurological screenings. These efforts are driving more timely diagnoses and better clinical outcomes for patients nationwide.

Top pharmaceutical players, including Adamas Pharma, Sunovion Pharmaceuticals, Novartis, Teva Pharmaceutical Industries, Pfizer, AbbVie, UCB Pharma, Boehringer Ingelheim Pharmaceuticals, Avvisto Therapeutics (VeroScience), GlaxoSmithKline (GSK), Bertek Pharmaceuticals (Mylan), Amneal Pharmaceuticals, and Kirin Holdings Company, are actively reshaping the competitive landscape. These companies are channeling investments into cutting-edge dopamine agonist therapies, improving drug delivery mechanisms, and expanding their presence in high-growth regions. Strategic partnerships with biotech firms and academic institutions are accelerating R&D pipelines, enabling rapid innovation and positioning these players for long-term success in the global dopamine agonists market.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of parkinson’s disease and other neurological disorders

- 3.2.1.2 Advancements in drug development and formulations

- 3.2.1.3 Growing awareness and early diagnosis of neurological disorders

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Regulatory challenges and delay in approvals of new drugs

- 3.2.2.2 Competition from alternative therapies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Porter’s analysis

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Ergot dopamine agonists

- 5.3 Non-ergot dopamine agonists

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Parkinson’s disease

- 6.3 Restless legs syndrome (RLS)

- 6.4 Hyperprolactinemia

- 6.5 Other indications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Injectables

- 7.4 Other routes of administration

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Drug store and retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Adamas Pharma

- 10.3 Amneal Pharmaceuticals

- 10.4 Avvisto Therapeutics (VeroScience)

- 10.5 Boehringer Ingelheim Pharmaceuticals

- 10.6 Bertek Pharmaceuticals (Mylan)

- 10.7 GlaxoSmithKline (GSK)

- 10.8 Kirin Holdings Company

- 10.9 Novartis

- 10.10 Pfizer

- 10.11 Sunovion Pharmaceuticals

- 10.12 Teva Pharmaceutical Industries

- 10.13 UCB Pharma