|

市場調查報告書

商品編碼

1721409

機械性能調校零件市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Mechanical Performance Tuning Component Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

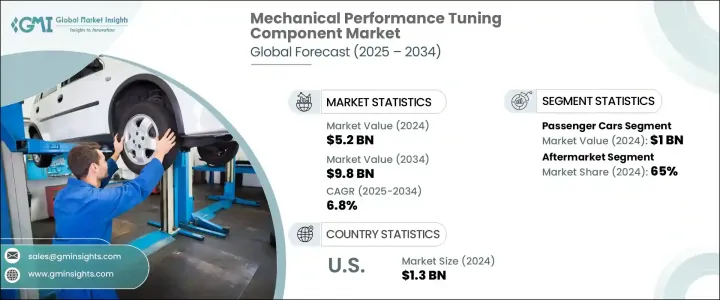

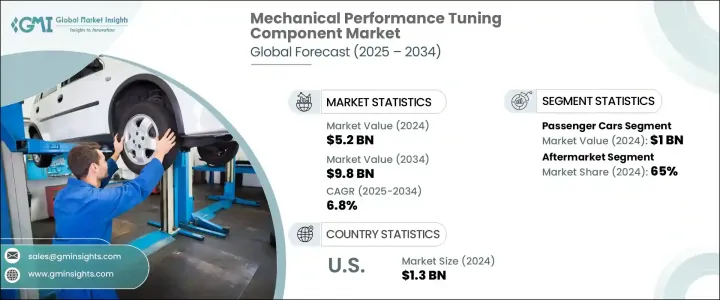

2024 年全球機械性能調校零件市場價值為 52 億美元,預計到 2034 年將以 6.8% 的複合年成長率成長,達到 98 億美元。消費者對汽車個人化和性能提升的熱情日益高漲,在塑造該市場的未來方面發揮著重要作用。隨著汽車製造商不斷突破汽車技術的界限,駕駛者正在尋求更聰明、更快、更有反應的汽車。性能調校組件(從升級的懸吊和高性能排氣系統到先進的控制模組)在愛好者和日常駕駛員中越來越受歡迎。

隨著技術進步的不斷推進,性能調校組件的整合變得更加複雜,可同時滿足 ICE(內燃機)和 EV(電動車)平台的需求。調校組件不再僅適用於賽車運動或汽車愛好者;它們正在成為提高燃油效率、增強加速和提升整體駕駛動力的主流解決方案。數位連網汽車和智慧診斷的興起也幫助車主在改裝升級方面做出更明智的決定,從而推動售後市場的成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 52億美元 |

| 預測值 | 98億美元 |

| 複合年成長率 | 6.8% |

對電動車(EV)的需求不斷成長,為性能調校組件提供了巨大的成長機會,尤其是在混合動力和電動車市場。隨著電動車銷量的成長,人們更加重視改進電池系統、動力系統和車輛軟體等各種機械部件。這一趨勢推動了對性能晶片和電動馬達等更先進的調校組件的需求,進一步推動了市場擴張。

從應用方面來看,機械性能調校零件市場包括乘用車、商用車、越野車、摩托車、船舶和賽車運動等領域。 2024年,乘用車市場佔有25%的佔有率,價值10億美元。這個細分市場由售後性能部件的需求推動,這些部件是根據乘用車的特定需求量身定做的。這些部件很容易獲得,並為車主提供了一種經濟實惠的方式來提高汽車性能。

根據分銷管道,市場分為售後市場和OEM。 2024 年售後市場佔有 65% 的佔有率。售後零件對於缺少OEM零件或型號較舊的車輛至關重要。這些組件可透過線上平台、零售店和專業性能網點輕鬆取得,為消費者提供更靈活、更易於調整的選項。這種廣泛的可用性和採購的便利性使售後市場成為整個市場的重要參與者。

2024 年,北美機械性能調校零件市場佔有 30% 的佔有率。美國以 2024 年 13 億美元的市值領先該地區。美國的汽車文化是性能調校需求的主要驅動力,在美國,汽車被視為個人身分和自由的延伸。這種文化傾向導致車輛客製化和售後改裝服務的增加,進一步推動了市場成長。

機械性能調校組件市場的關鍵公司包括 Magna International、AEM Electronics、ZF Friedrichshafen、BorgWarner、Borla Performance Industries、Bosch、Brembo、COBB Tuning、Holley Performance Products 和 K&N Filters。為了鞏固其地位,這些公司正專注於產品創新、策略合作夥伴關係和擴大分銷管道。他們透過開發先進的高性能組件來不斷改進產品,以滿足電動和混合動力汽車不斷變化的需求。許多公司正在投資研發以提高產品的耐用性和效率,同時也透過區域分銷商和零售商擴大其全球影響力,以拓寬市場範圍。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 零件製造商

- 改裝專家和定製商店

- 售後市場供應商和經銷商

- 最終用戶

- 利潤率分析

- 技術與創新格局

- 專利分析

- 價格趨勢

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- 調音組件的技術進步

- 電動車日益普及

- 提高汽車產業的性能標準

- 人們對越野車和探險車的興趣日益濃厚

- 產業陷阱與挑戰

- 相容性問題和可用性有限

- 性能調校部件成本高

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:按組件,2021 - 2034 年

- 主要趨勢

- 引擎

- 渦輪增壓器和機械增壓器

- 進氣系統

- 排氣系統

- 引擎管理系統

- 燃油系統部件

- 懸吊和底盤

- 支撐桿和塔桿

- 防傾桿/穩定桿

- 降低彈簧

- 其他

- 煞車

- 高性能煞車廣告

- 高性能煞車碟盤/碟盤

- 升級的煞車鉗

- 其他

- 傳染

- 離合器

- 飛輪

- 短換檔桿

- 冷卻系統

- 散熱器

- 油冷卻器

- 其他

- 其他

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 轎車

- 越野車

- 掀背車

- 商用車

- 輕型商用車

- 平均血紅素 (MCV)

- 丙型肝炎病毒

- 越野車

- 摩托車

- 海洋

- 賽車運動

第7章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- AEM Electronics

- BorgWarner

- Borla Performance Industries

- Bosch

- Brembo SpA

- COBB Tuning

- Corsa Performance

- Edelbrock

- Flowmaster Mufflers

- Garrett Motion

- HKS

- Holley Performance Products

- Injen Technology

- K&N Filters

- Magna International

- MagnaFlow

- Sparco

- Whiteline Automotive

- Wilwood Engineering

- ZF Friedrichshafen

The Global Mechanical Performance Tuning Component Market was valued at USD 5.2 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 9.8 billion by 2034. Rising consumer enthusiasm for vehicle personalization and performance enhancement is playing a major role in shaping the future of this market. As automakers continue to push the boundaries of automotive technology, drivers are seeking smarter, faster, and more responsive vehicles. Performance tuning components-ranging from upgraded suspensions and high-performance exhaust systems to advanced control modules-are increasingly in demand among enthusiasts and daily drivers alike.

With technological advancements gaining momentum, the integration of performance tuning components has become more sophisticated, catering to both ICE (internal combustion engine) and EV (electric vehicle) platforms. Tuning components are no longer just for motorsports or car hobbyists; they are becoming mainstream solutions for improving fuel efficiency, enhancing acceleration, and boosting overall driving dynamics. The rise in digitally connected vehicles and intelligent diagnostics is also helping car owners make more informed decisions about tuning upgrades, fueling a growing aftermarket.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.2 Billion |

| Forecast Value | $9.8 Billion |

| CAGR | 6.8% |

The increasing demand for electric vehicles (EVs) is providing significant growth opportunities for performance tuning components, particularly in hybrid and electric vehicle markets. As EV sales rise, there is a heightened focus on improving various mechanical components such as battery systems, powertrains, and vehicle software. This trend is driving the need for more advanced tuning components like performance chips and electric motors, further fueling market expansion.

In terms of application, the mechanical performance tuning component market includes segments such as passenger cars, commercial vehicles, off-road vehicles, motorcycles, marine, and motorsports. In 2024, the passenger cars segment held a 25% share, valued at USD 1 billion. This segment is driven by the demand for aftermarket performance parts, which are customized to meet the specific needs of passenger vehicles. These components are easily accessible and offer vehicle owners an affordable way to enhance their car's performance.

Based on distribution channels, the market is divided into aftermarket and OEM. The aftermarket segment held a 65% share in 2024. Aftermarket parts are crucial for vehicles that either lack OEM parts or are older models. These components are readily available through online platforms, retail stores, and specialized performance outlets, giving consumers more flexibility and accessibility to tuning options. This widespread availability and ease of procurement make the aftermarket segment a significant player in the overall market.

North America Mechanical Performance Tuning Component Market held 30% share in 2024. The U.S. led the region with a market value of USD 1.3 billion in 2024. The automotive culture in the U.S. is a key driver for the demand for performance tuning, where cars are seen as an extension of personal identity and freedom. This cultural inclination has led to an increase in vehicle customization and aftermarket tuning services, further propelling market growth.

Key companies in the mechanical performance tuning component market include Magna International, AEM Electronics, ZF Friedrichshafen, BorgWarner, Borla Performance Industries, Bosch, Brembo, COBB Tuning, Holley Performance Products, and K&N Filters. To strengthen their position, these companies are focusing on product innovation, strategic partnerships, and expanding distribution channels. They are continuously improving product offerings by developing advanced, high-performance components that cater to the evolving demands of electric and hybrid vehicles. Many firms are investing in R&D to enhance product durability and efficiency while also expanding their global footprint through regional distributors and retailers to broaden market reach.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Tuning specialists and customization shops

- 3.2.4 Aftermarket suppliers and distributors

- 3.2.5 End users

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Price trend

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Technological advancements in tuning components

- 3.9.1.2 Rising popularity of EVs

- 3.9.1.3 Enhanced performance standards in the automotive industry

- 3.9.1.4 Growing interest in off-road and adventure vehicles

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Compatibility issues and limited availability

- 3.9.2.2 High cost of performance tuning parts

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter’s analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Engine

- 5.2.1 Turbochargers & superchargers

- 5.2.2 Intake system

- 5.2.3 Exhaust system

- 5.2.4 Engine management system

- 5.2.5 Fuel system component

- 5.3 Suspension & chassis

- 5.3.1 Strut braces & tower bars

- 5.3.2 Anti-roll/sway bars

- 5.3.3 Lowering springs

- 5.3.4 Others

- 5.4 Brake

- 5.4.1 High-performance brake ads

- 5.4.2 Performance brake rotors/discs

- 5.4.3 Upgraded brake calipers

- 5.4.4 Others

- 5.5 Transmission

- 5.5.1 Clutches

- 5.5.2 Flywheels

- 5.5.3 Short shifters

- 5.6 Cooling system

- 5.6.1 Radiators

- 5.6.2 Oil coolers

- 5.6.3 Others

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger cars

- 6.2.1 Sedan

- 6.2.2 SUV

- 6.2.3 Hatchback

- 6.3 Commercial vehicle

- 6.3.1 LCV

- 6.3.2 MCV

- 6.3.3 HCV

- 6.4 Off road vehicles

- 6.5 Motorcycle

- 6.6 Marine

- 6.7 Motorsport

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 AEM Electronics

- 9.2 BorgWarner

- 9.3 Borla Performance Industries

- 9.4 Bosch

- 9.5 Brembo S.p.A

- 9.6 COBB Tuning

- 9.7 Corsa Performance

- 9.8 Edelbrock

- 9.9 Flowmaster Mufflers

- 9.10 Garrett Motion

- 9.11 HKS

- 9.12 Holley Performance Products

- 9.13 Injen Technology

- 9.14 K&N Filters

- 9.15 Magna International

- 9.16 MagnaFlow

- 9.17 Sparco

- 9.18 Whiteline Automotive

- 9.19 Wilwood Engineering

- 9.20 ZF Friedrichshafen