|

市場調查報告書

商品編碼

1721408

神經性疼痛治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Neuropathic Pain Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

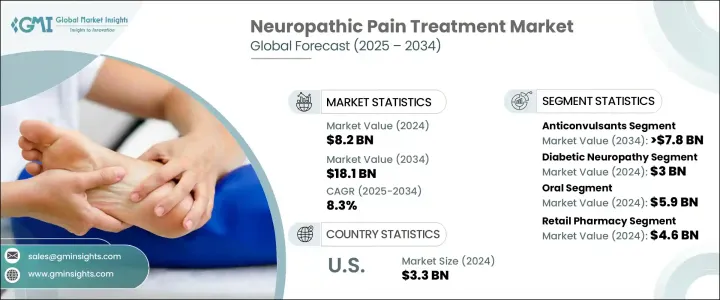

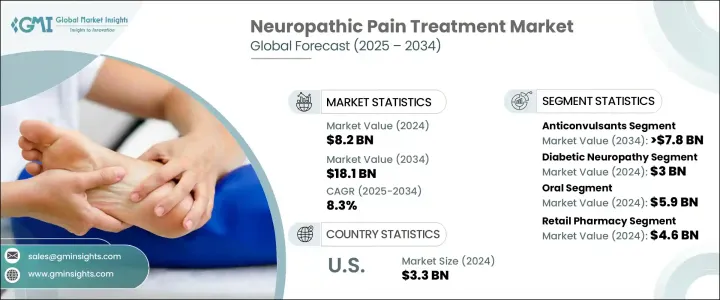

2024 年全球神經性疼痛治療市場價值為 82 億美元,預計到 2034 年將以 8.3% 的複合年成長率成長,達到 181 億美元。這一強勁的成長軌跡是由全球神經性疼痛疾病負擔不斷增加所推動的,而推動這一負擔增加的因素包括全球人口老化、生活方式相關疾病以及糖尿病和癌症等慢性病激增。隨著人們對神經相關疼痛及其致殘影響的認知不斷提高,對早期診斷和有效治療策略的需求持續飆升。不斷變化的患者偏好進一步推動了市場的發展,由於政府監管的嚴格和日益成長的安全問題,患者對鴉片類藥物的治療方式顯著減少。藥物傳輸系統、生物技術和新配方的進步為治療領域打開了新的大門。數位健康平台和遠距醫療服務的出現增強了人們獲得專科護理的機會,特別是在服務不足的地區,加快了神經病的診斷和及時干預。

慢性疼痛的日益普及以及對更安全的治療方案的迫切需求正在推動下一代療法的發展。製造商正專注於創新藥物管道,包括非鴉片類藥物、基因療法、單株抗體和生物相似藥,旨在解決急性和慢性神經性疼痛。這些突破性療法旨在提供有針對性的、持久的緩解,同時最大限度地減少副作用,代表疼痛管理領域的重大飛躍。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 82億美元 |

| 預測值 | 181億美元 |

| 複合年成長率 | 8.3% |

根據藥物類別,抗驚厥藥物繼續佔據市場主導地位,預計將以 8.5% 的複合年成長率成長,到 2034 年達到 78 億美元。普瑞巴林、加巴噴丁和卡馬西平等廣泛使用的藥物因其高效性和良好的安全性而被公認為一線治療藥物。它們的廣泛用途尤其顯著地體現在治療糖尿病引起的神經病變、帶狀皰疹後神經痛和脊髓損傷方面。隨著慢性病發病率的上升,這些經過驗證的藥物的採用率也在上升,鞏固了它們在市場上的地位。

從適應症來看,糖尿病神經病變在 2024 年的收入為 30 億美元。全球糖尿病患者數量的不斷增加對長期治療方案產生了持續的需求。保險覆蓋範圍的擴大和神經病治療報銷的增加使得患者更容易接受普瑞巴林和辣椒素貼片等療法,從而提高了依從性和治療效果。

光是美國神經性疼痛治療市場在 2024 年的價值就達到 33 億美元,預計未來將顯著成長。這種成長主要是由於該國人口老化以及癌症、糖尿病和帶狀皰疹等疾病的發病率上升。聯邦政府對鴉片類藥物處方的限制也增強了對非鴉片類藥物替代品的需求,促使治療模式發生重大轉變。

Assertio Therapeutics、Glenmark Pharmaceuticals、Cipla、Dr. Reddy's Laboratories、強生、禮來公司、葛蘭素史克、Biogen、Grunenthal、Mallinckrodt Pharmaceuticals、諾華、輝瑞、Sun Pharmaceutical Industries、Teva Pharmaceutical Industriest Pharmaceuticals、諾華、輝瑞、Sun Pharmaceutical Industries、Teva Pharmaceutical Industriest 和 Ver這些公司正在積極擴大其治療管道,並與研究機構建立策略聯盟,以更快、更有效地將新型治療方法推向市場。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 神經性疼痛疾病盛行率上升

- 藥物開發和新療法的進展

- 老年人口不斷增加

- 提高及時治療的意識

- 產業陷阱與挑戰

- 神經性疼痛藥物成本高昂

- 藥物濫用的副作用和風險

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 管道分析

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類別,2021 - 2034 年

- 主要趨勢

- 抗驚厥藥

- 抗憂鬱藥

- 鴉片類藥物

- 辣椒素

- 其他藥物類別

第6章:市場估計與預測:按適應症,2021 - 2034 年

- 主要趨勢

- 糖尿病神經病變

- 帶狀皰疹後神經痛

- 三叉神經痛

- 化療引起的周邊神經病變

- HIV相關神經病變

- 其他適應症

第7章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 外用

- 注射劑

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 電子商務

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第10章:公司簡介

- Assertio Therapeutics

- Biogen

- Cipla

- Dr. Reddy's Laboratories

- Eli Lilly and Company

- GlaxoSmithKline

- Glenmark Pharmaceuticals

- Grunenthal

- Johnson & Johnson

- Mallinckrodt Pharmaceuticals

- Novartis

- Pfizer

- Sun Pharmaceutical Industries

- Teva Pharmaceutical Industries

- Vertex Pharmaceuticals

The Global Neuropathic Pain Treatment Market was valued at USD 8.2 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 18.1 billion by 2034. This robust growth trajectory is fueled by a rising burden of neuropathic pain disorders worldwide, fueled by factors such as an aging global population, lifestyle-related diseases, and a surge in chronic conditions like diabetes and cancer. As awareness about nerve-related pain and its debilitating effects increases, the demand for early diagnosis and effective treatment strategies continues to soar. The market is further propelled by evolving patient preferences, with a significant shift away from opioid-based therapies due to stringent government regulations and growing safety concerns. Advancements in drug delivery systems, biotechnology, and novel formulations have opened new doors for the treatment landscape. The availability of digital health platforms and telemedicine services is enhancing access to specialized care, particularly in underserved regions, accelerating diagnosis and timely intervention for neuropathic conditions.

The increasing prevalence of chronic pain and the urgent need for safer treatment alternatives are driving the development of next-generation therapies. Manufacturers are focusing on innovative drug pipelines that include non-opioid medications, gene therapies, monoclonal antibodies, and biosimilars designed to address both acute and chronic forms of neuropathic pain. These breakthrough therapies aim to provide targeted, long-lasting relief while minimizing side effects, representing a major leap forward in pain management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $8.2 Billion |

| Forecast Value | $18.1 Billion |

| CAGR | 8.3% |

Based on drug class, anticonvulsants continue to dominate the market and are expected to grow at a CAGR of 8.5%, reaching USD 7.8 billion by 2034. Widely prescribed medications like pregabalin, gabapentin, and carbamazepine are recognized as first-line treatments due to their high efficacy and favorable safety profiles. Their extensive use is especially notable in the treatment of diabetes-induced neuropathy, postherpetic neuralgia, and spinal cord injuries. As chronic disease incidence rises, so does the adoption of these proven medications, reinforcing their stronghold in the market.

When it comes to indications, diabetic neuropathy accounted for USD 3 billion in revenue in 2024. The escalating number of diabetic patients globally is generating sustained demand for long-term treatment solutions. Increased insurance coverage and reimbursement for neuropathic treatments are making therapies such as pregabalin and capsaicin patches more accessible to patients, improving adherence and outcomes.

The U.S. Neuropathic Pain Treatment Market alone was valued at USD 3.3 billion in 2024 and is anticipated to witness significant growth ahead. This rise is primarily due to the country's aging population and the rising prevalence of conditions like cancer, diabetes, and shingles. Federal restrictions on opioid prescriptions are also reinforcing the demand for non-opioid alternatives, encouraging a major shift in treatment dynamics.

Assertio Therapeutics, Glenmark Pharmaceuticals, Cipla, Dr. Reddy's Laboratories, Johnson & Johnson, Eli Lilly and Company, GlaxoSmithKline, Biogen, Grunenthal, Mallinckrodt Pharmaceuticals, Novartis, Pfizer, Sun Pharmaceutical Industries, Teva Pharmaceutical Industries, and Vertex Pharmaceuticals are among the leading companies shaping this dynamic landscape. These firms are actively expanding their therapeutic pipelines and forging strategic alliances with research organizations to bring novel treatments to market faster and more effectively.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of neuropathic pain disorders

- 3.2.1.2 Advancements in drug development and novel therapies

- 3.2.1.3 Growing geriatric population

- 3.2.1.4 Increasing awareness towards timely treatment

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of neuropathic pain medications

- 3.2.2.2 Side effects and risk of drug abuse

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Pipeline analysis

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Anticonvulsants

- 5.3 Antidepressants

- 5.4 Opioids

- 5.5 Capsaicinoids

- 5.6 Other drug classes

Chapter 6 Market Estimates and Forecast, By Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Diabetic neuropathy

- 6.3 Postherpetic neuralgia

- 6.4 Trigeminal neuralgia

- 6.5 Chemotherapy-induced peripheral neuropathy

- 6.6 HIV-associated neuropathy

- 6.7 Other indications

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Topical

- 7.4 Injectable

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacy

- 8.3 Retail pharmacy

- 8.4 E-commerce

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Assertio Therapeutics

- 10.2 Biogen

- 10.3 Cipla

- 10.4 Dr. Reddy’s Laboratories

- 10.5 Eli Lilly and Company

- 10.6 GlaxoSmithKline

- 10.7 Glenmark Pharmaceuticals

- 10.8 Grunenthal

- 10.9 Johnson & Johnson

- 10.10 Mallinckrodt Pharmaceuticals

- 10.11 Novartis

- 10.12 Pfizer

- 10.13 Sun Pharmaceutical Industries

- 10.14 Teva Pharmaceutical Industries

- 10.15 Vertex Pharmaceuticals