|

市場調查報告書

商品編碼

1721402

胃食道逆流症治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Gastroesophageal Reflux Disease Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

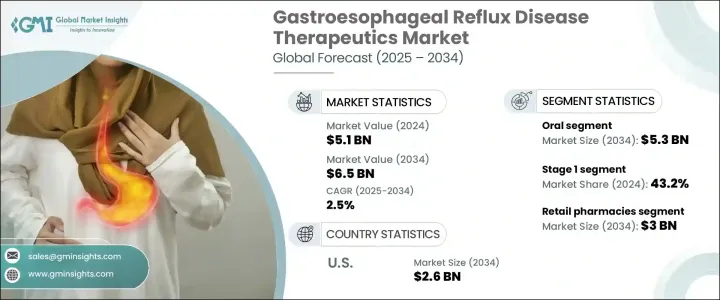

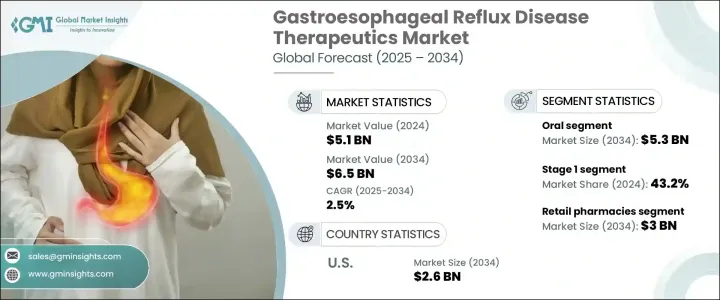

2024 年全球胃食道逆流症治療市場價值為 51 億美元,預計到 2034 年將以 2.5% 的複合年成長率成長,達到 65 億美元。 GERD 持續對全球造成越來越大的健康負擔,隨著飲食模式的改變、酒精和菸草消費的增加、久坐的生活方式以及全球肥胖率的上升,GERD 病例不斷增加。這種慢性疾病是由胃酸倒流到食道引起的,會導致胃灼熱、胸痛和逆流等症狀,如果不及時治療,可能會導致食道炎甚至食道癌等併發症。隨著人們對胃食道逆流症及其併發症的認知不斷提高,越來越多的人開始尋求及時的醫療介入。

製藥商正在改進藥物開發技術,不僅可以緩解症狀,還可以提供長期管理解決方案。新型質子幫浦抑制劑 (PPI)、緩釋製劑和聯合療法的引入正在改善臨床結果,同時也提高了患者的依從性。這些創新反映了業界向以患者為中心的解決方案的更廣泛轉變,公司優先考慮有效、可及且耐受性良好的治療方法,以滿足不同年齡層和風險狀況的未滿足的醫療需求。發展中市場醫療保健服務的普及以及非處方藥零售通路的擴大也支持了全球市場的持續成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 51億美元 |

| 預測值 | 65億美元 |

| 複合年成長率 | 2.5% |

GERD 治療市場按藥物類別細分,包括 PPI、H2 受體拮抗劑 (H2RA)、制酸劑、促動力劑等。 2024 年,光是制酸劑就創造了 22 億美元的收入。它們之所以受歡迎是因為它們能夠快速緩解胃灼熱和消化不良等症狀,使其成為尋求立即緩解的患者的首選。它們作為非處方產品廣泛普及,增加了它們的便利性和廣泛的吸引力,使患者無需處方干預即可自行管理輕度 GERD 症狀。

根據給藥途徑,GERD 治療市場分為口服和注射部分。口服製劑,尤其是 PPI 和制酸劑,在 2024 年佔了 80% 的佔有率。人們對口服藥物的強烈偏好歸因於其易於使用、價格實惠且廣泛可及。由於能夠在櫃檯購買許多口服藥物,患者可以享受更快的治療開始和更低的醫療保健成本,這可能會鞏固該領域在 2034 年之前的主導地位。

預計到 2034 年,美國胃食道逆流治療市場規模將達到 26 億美元。 GERD 盛行率不斷上升(部分原因是不良的飲食習慣和肥胖率上升)繼續推動對先進治療方法的需求。由於持續創新、不斷加強的宣傳活動以及強大的品牌和學名藥療法(包括促動力劑等新興選擇),美國市場正在經歷顯著成長。

全球 GERD 治療市場的知名參與者包括阿斯特捷利康、Camber Pharmaceuticals、衛材、強生、Onconic Therapeutics、輝瑞、Phathom Pharmaceuticals、Sebela Pharmaceuticals、武田製藥、Teva Pharmaceuticals 和 Viatris。這些公司正在透過增強藥物輸送系統、臨床研究和擴大分銷管道積極創新。他們還投資與醫療保健提供者建立合作夥伴關係,以加強患者的就醫機會並提高治療效果。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 胃食道逆流症(GERD)盛行率上升

- 藥物輸送系統的技術進步

- 提高消費者意識

- 產業陷阱與挑戰

- 副作用和安全問題

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按藥物類別,2021 - 2034 年

- 主要趨勢

- 質子幫浦抑制劑(PPI)

- H2受體拮抗劑(H2RAs)

- 抗酸藥

- 促動力劑

- 其他藥物類別

第6章:市場估計與預測:按管理路線,2021 - 2034 年

- 主要趨勢

- 口服

- 注射劑

第7章:市場估計與預測:按階段,2021 - 2034 年

- 主要趨勢

- 第一階段

- 第 2 階段

- 第 3 階段

- 第四階段

第8章:市場估計與預測:按配銷通路,2021 - 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- AstraZeneca

- Camber Pharmaceuticals

- Eisai

- Johnson & Johnson

- Onconic Therapeutics

- Pfizer

- Phathom Pharmaceuticals

- Sebela Pharmaceuticals

- Takeda Pharmaceutical Company

- Teva Pharmaceuticals

- Viatris

The Global Gastroesophageal Reflux Disease Therapeutics Market was valued at USD 5.1 billion in 2024 and is estimated to grow at a CAGR of 2.5% to reach USD 6.5 billion by 2034. GERD continues to pose a growing health burden worldwide, with a rising cases driven by shifting dietary patterns, increased alcohol and tobacco consumption, sedentary lifestyles, and the global rise in obesity. This chronic condition, caused by the backward flow of stomach acid into the esophagus, leads to symptoms like heartburn, chest pain, and regurgitation, and if left untreated, may result in complications such as esophagitis and even esophageal cancer. As awareness around GERD and its complications grows, more individuals are seeking timely medical interventions.

Pharmaceutical manufacturers are responding with improved drug development technologies that not only relieve symptoms but also offer long-term management solutions. The introduction of novel proton pump inhibitors (PPIs), extended-release formulations, and combination therapies is improving clinical outcomes while also enhancing patient compliance. These innovations reflect a broader industry shift toward patient-centric solutions, with companies prioritizing effective, accessible, and well-tolerated therapeutics to meet unmet medical needs across different age groups and risk profiles. Increasing access to healthcare in developing markets and expanding retail availability of over-the-counter options are also supporting sustained market growth on a global scale.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.1 Billion |

| Forecast Value | $6.5 Billion |

| CAGR | 2.5% |

The market for GERD therapeutics is segmented by drug class, including PPIs, H2 receptor antagonists (H2RAs), antacids, prokinetic agents, and others. In 2024, antacids alone generated USD 2.2 billion in revenue. Their popularity stems from their ability to offer quick relief from symptoms such as heartburn and acid indigestion, making them the go-to choice for patients seeking immediate comfort. Their wide availability as over-the-counter products adds to their convenience and broad appeal, allowing patients to self-manage mild GERD symptoms without prescription intervention.

By route of administration, the GERD therapeutics market is divided into oral and injectable segments. Oral formulations, particularly PPIs and antacids, accounted for an 80% share in 2024. This strong preference for oral drugs is attributed to their ease of use, affordability, and widespread accessibility. With the ability to purchase many oral therapies over the counter, patients benefit from faster treatment initiation and lower healthcare costs, which will likely reinforce the dominance of this segment through 2034.

The U.S. Gastroesophageal Reflux Disease Therapeutics Market is projected to reach USD 2.6 billion by 2034. The increasing prevalence of GERD, partly driven by poor dietary habits and rising obesity rates, continues to drive demand for advanced treatments. The U.S. market is witnessing significant growth thanks to continuous innovation, increasing awareness campaigns, and a strong pipeline of branded and generic therapies, including emerging options like prokinetic agents.

Notable players in the Global GERD Therapeutics Market include AstraZeneca, Camber Pharmaceuticals, Eisai, Johnson & Johnson, Onconic Therapeutics, Pfizer, Phathom Pharmaceuticals, Sebela Pharmaceuticals, Takeda Pharmaceutical Company, Teva Pharmaceuticals, and Viatris. These companies are actively innovating through enhanced drug delivery systems, clinical research, and expanded distribution channels. They are also investing in partnerships with healthcare providers to strengthen patient access and elevate treatment outcomes.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of gastroesophageal reflux disease (GERD)

- 3.2.1.2 Technological advancements in drug delivery systems

- 3.2.1.3 Increasing consumer awareness

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects and safety concerns

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Gap analysis

- 3.7 Porter’s analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Proton pump inhibitors (PPIs)

- 5.3 H2 receptor antagonists (H2RAs)

- 5.4 Antacids

- 5.5 Prokinetic agents

- 5.6 Other drug classes

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Injectable

Chapter 7 Market Estimates and Forecast, By Stage, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Stage 1

- 7.3 Stage 2

- 7.4 Stage 3

- 7.5 Stage 4

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AstraZeneca

- 10.2 Camber Pharmaceuticals

- 10.3 Eisai

- 10.4 Johnson & Johnson

- 10.5 Onconic Therapeutics

- 10.6 Pfizer

- 10.7 Phathom Pharmaceuticals

- 10.8 Sebela Pharmaceuticals

- 10.9 Takeda Pharmaceutical Company

- 10.10 Teva Pharmaceuticals

- 10.11 Viatris