|

市場調查報告書

商品編碼

1721401

小型語言模型 (SLM) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Small Language Models (SLM) Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

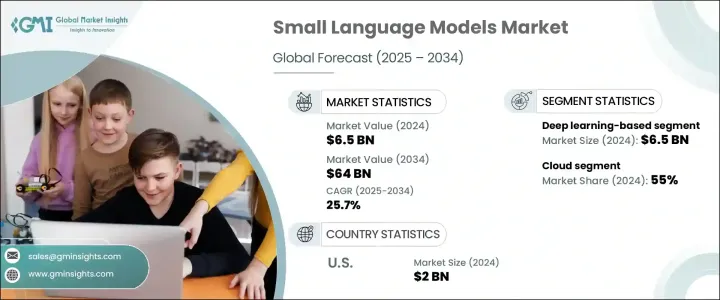

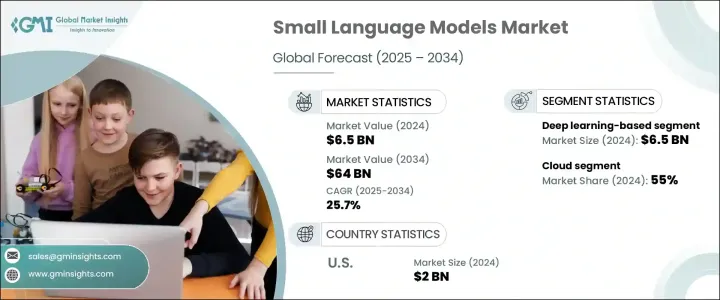

2024 年全球小型語言模型市場價值為 65 億美元,預計到 2034 年將以 25.7% 的複合年成長率成長,達到 640 億美元。隨著人工智慧繼續塑造企業營運的未來,SLM 正在不斷發展的人工智慧領域中開闢出一個獨特的利基市場。現在,全球企業都優先考慮智慧自動化、即時通訊和超個人化的用戶體驗,而無需承擔通常與大型語言模型 (LLM) 相關的巨額基礎設施成本。

這種轉變引發了對 SLM 的需求急劇上升,特別是在需要快速決策、高效語言處理和資料敏感操作的領域。隨著全球企業越來越依賴人工智慧驅動的工具來提高生產力,在有限資源上提供高性能的緊湊、靈活模型的採用正在穩步上升。隨著組織轉向分散式 AI 解決方案,SLM 成為裝置應用程式的完美選擇,可在準確性、效率和成本之間實現無縫平衡。人們對資料隱私的日益關注以及邊緣運算部署的激增進一步放大了 SLM 在當今技術前沿世界中的重要性。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 65億美元 |

| 預測值 | 640億美元 |

| 複合年成長率 | 25.7% |

企業正在積極轉向小型語言模型,以釋放人工智慧的潛力,而無需承擔傳統 LLM 繁重的計算和財務負擔。這些模型在醫療保健、金融、教育和客戶服務領域獲得了顯著的關注,其中即時文字生成、語音識別和上下文理解發揮關鍵作用。無論是支援智慧聊天機器人、增強語音助理或實現動態內容創建,SLM 都正在成為現代企業必不可少的工具。它們的輕量級架構使其成為必須在行動裝置、邊緣系統或嵌入式平台上高效運行的低延遲應用程式的理想選擇。

僅基於深度學習的小型語言模型領域在 2024 年就創造了 65 億美元的收入,凸顯了對神經網路和基於變壓器的架構的日益依賴。這些模型針對摘要、自然對話、翻譯等高精度任務進行了最佳化。隨著企業加速數位轉型,各個垂直產業對這些人工智慧解決方案的需求正在迅速擴大。

2024 年,基於雲端的部署佔據了 SLM 市場主導地位,佔有 55% 的佔有率。組織更喜歡雲端原生解決方案,因為它們具有可擴展性、可負擔性和易於整合。這一趨勢反映了向靈活部署模式的更廣泛轉變,企業可以快速調整其人工智慧工具以適應不斷變化的營運需求,而無需投資複雜的內部設定。

光是美國小型語言模型市場在 2024 年的規模就達到了 20 億美元。這一成長得益於該國創新驅動的技術生態系統、廣泛的雲端運算採用以及醫療保健、電子商務和金融等行業對基於 NLP 的自動化的日益廣泛使用。

推動這一市場發展的關鍵參與者包括亞馬遜 AWS AI、蘋果 AI、Cerebras Systems、Cohere、Databricks、Google、IBM Watson AI、Meta、微軟和 Nvidia。這些公司正在透過策略合作夥伴關係、雲端平台擴展和有針對性的研發投資來加強其影響力,以增強模型的可擴展性和特定領域的適應性。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 原物料供應商

- 組件提供者

- 製造商

- 技術提供者

- 配銷通路分析

- 最終用途

- 利潤率分析

- 供應商格局

- 技術與創新格局

- 專利分析

- 監管格局

- 成本細分分析

- 重要新聞和舉措

- 衝擊力

- 成長動力

- 對經濟高效的人工智慧解決方案的需求不斷成長

- 人工智慧在邊緣運算和設備處理的應用日益廣泛

- 越來越關注以隱私為中心的人工智慧模型

- 擴展人工智慧客戶支援和內容生成

- 產業陷阱與挑戰

- 有限的訓練資料和模型效能限制

- 對偏見、道德人工智慧和合規問題的擔憂

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 基於深度學習

- 基於機器學習

- 基於規則的系統

第6章:市場估計與預測:依車型,2021 - 2034

- 主要趨勢

- 預先訓練

- 精細調整

- 開源

第7章:市場估計與預測:按部署,2021 - 2034 年

- 主要趨勢

- 雲

- 混合

- 本地

第8章:市場估計與預測:依最終用途 2021 - 2034

- 主要趨勢

- 客戶支援和聊天機器人

- 金融服務及銀行業務

- 醫療保健和醫療人工智慧

- 媒體和內容生成

- 零售與電子商務

- 教育與電子學習

- 法律與合規

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳新銀行

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第10章:公司簡介

- AI21 Labs

- Aleph Alpha

- Amazon AWS AI

- Anthropic

- Apple AI

- Cerebras Systems

- Cohere

- Databricks (MosaicML)

- Google DeepMind

- Hugging Face

- IBM Watson AI

- Meta (FAIR)

- Microsoft

- Mistral AI

- NVIDIA AI

- OpenAI

- Rasa AI

- Salesforce AI Research

- SAP AI

- Stability AI

The Global Small Language Models Market was valued at USD 6.5 billion in 2024 and is estimated to grow at a CAGR of 25.7% to reach USD 64 billion by 2034. As artificial intelligence continues to shape the future of enterprise operations, SLMs are carving a distinct niche in the evolving AI landscape. Businesses worldwide are now prioritizing intelligent automation, real-time communication, and hyper-personalized user experiences-all without incurring the massive infrastructure costs typically associated with large language models (LLMs).

This shift has triggered a sharp rise in the demand for SLMs, particularly in sectors that require quick decision-making, efficient language processing, and data-sensitive operations. With global enterprises increasingly leaning on AI-driven tools to enhance productivity, the adoption of compact, agile models that offer high performance on limited resources is steadily climbing. As organizations move toward decentralized AI solutions, SLMs emerge as the perfect fit for on-device applications, offering a seamless balance between accuracy, efficiency, and cost. Growing concerns over data privacy and the surge in edge computing deployment further amplify the relevance of SLMs in today's tech-forward world.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.5 Billion |

| Forecast Value | $64 Billion |

| CAGR | 25.7% |

Businesses are actively turning to small language models to unlock the potential of artificial intelligence without the heavy computational and financial load of traditional LLMs. These models have gained notable traction in healthcare, finance, education, and customer service, where real-time text generation, voice recognition, and contextual understanding play critical roles. Whether powering intelligent chatbots, enhancing voice assistants, or enabling dynamic content creation, SLMs are becoming essential tools for modern enterprises. Their lightweight architecture makes them ideal for low-latency applications that must run efficiently on mobile devices, edge systems, or embedded platforms.

The deep learning-based small language models segment alone generated USD 6.5 billion in 2024, underscoring the growing reliance on neural networks and transformer-based architectures. These models are optimized for high-precision tasks such as summarization, natural conversation, translation, and more. As companies accelerate digital transformation, demand for these AI-powered solutions is rapidly expanding across verticals.

Cloud-based deployment dominated the SLM market in 2024, holding a 55% share. Organizations prefer cloud-native solutions for their scalability, affordability, and ease of integration. This trend reflects a broader movement toward flexible deployment models, where businesses can quickly adapt their AI tools to evolving operational needs without investing in complex on-premise setups.

The United States Small Language Models Market alone accounted for USD 2 billion in 2024. This growth is fueled by the nation's innovation-driven tech ecosystem, widespread cloud adoption, and increasing use of NLP-based automation across industries such as healthcare, e-commerce, and finance.

Key players driving this market include Amazon AWS AI, Apple AI, Cerebras Systems, Cohere, Databricks, Google, IBM Watson AI, Meta, Microsoft, and Nvidia. These companies are strengthening their presence through strategic partnerships, cloud platform expansions, and targeted investments in R&D to enhance model scalability and domain-specific adaptability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Cost breakdown analysis

- 3.6 Key news & initiatives

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising demand for cost-efficient AI solutions

- 3.7.1.2 Growing adoption of AI in edge computing & on-device processing

- 3.7.1.3 Increasing focus on privacy-centric AI models

- 3.7.1.4 Expansion of AI-powered customer support & content generation

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Limited training data & model performance constraints

- 3.7.2.2 Concerns over bias, ethical ai, and compliance issues

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter’s analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Deep learning based

- 5.3 Machine learning based

- 5.4 Rule based system

Chapter 6 Market Estimates & Forecast, By Model Type, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Pre-trained

- 6.3 Fine-tuned

- 6.4 Open source

Chapter 7 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Cloud

- 7.3 Hybrid

- 7.4 On-premises

Chapter 8 Market Estimates & Forecast, By End Use 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Customer support & chatbots

- 8.3 Financial services & banking

- 8.4 Healthcare & medical AI

- 8.5 Media & content generation

- 8.6 Retail & E-commerce

- 8.7 Education & E-learning

- 8.8 Legal & compliance

- 8.9 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AI21 Labs

- 10.2 Aleph Alpha

- 10.3 Amazon AWS AI

- 10.4 Anthropic

- 10.5 Apple AI

- 10.6 Cerebras Systems

- 10.7 Cohere

- 10.8 Databricks (MosaicML)

- 10.9 Google DeepMind

- 10.10 Hugging Face

- 10.11 IBM Watson AI

- 10.12 Meta (FAIR)

- 10.13 Microsoft

- 10.14 Mistral AI

- 10.15 NVIDIA AI

- 10.16 OpenAI

- 10.17 Rasa AI

- 10.18 Salesforce AI Research

- 10.19 SAP AI

- 10.20 Stability AI