|

市場調查報告書

商品編碼

1716722

加氫植物油市場機會、成長動力、產業趨勢分析及2025-2034年預測Hydrotreated Vegetable Oil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

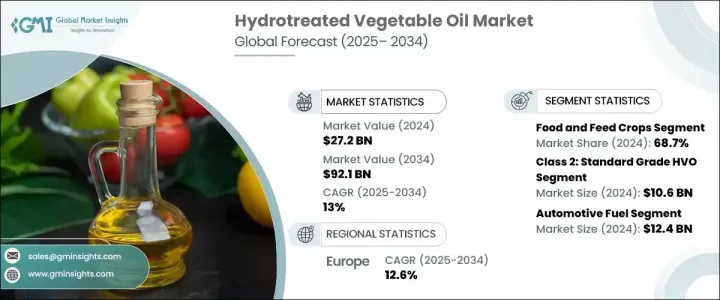

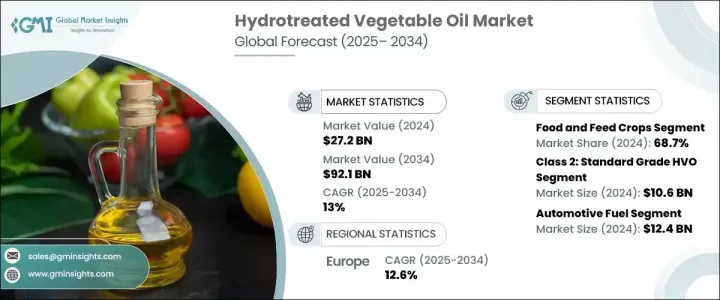

2024 年全球加氫植物油市場規模達到 272 億美元,預計 2025 年至 2034 年期間的複合年成長率將達到 13%。向再生能源的日益轉變正在迅速提升 HVO 作為各行各業永續燃料替代品的作用。隨著全球經濟轉向減少對化石燃料的依賴,HVO 正成為實現脫碳目標的關鍵解決方案。它可以作為傳統柴油的直接替代品,加上更清潔的燃燒和更低的溫室氣體排放,正在推動交通運輸、航空和工業發電等主要行業的需求。

一些國家的政府,特別是北美和歐洲的政府,正在透過稅收抵免、混合授權和排放上限等政策框架加強削減碳排放的授權,直接鼓勵使用 HVO。這些政策為 HVO 生產商開闢了新的成長機會,並加強了它們在全球向綠色能源轉變的重要性。隨著企業探索擴大 HVO 生產規模並保持成本競爭力的創新方法,公共和私人對先進生物燃料和下一代原料的投資不斷增加,進一步增強了市場前景。隨著越來越多的產業尋求 ESG(環境、社會和治理)目標,對 HVO 等清潔燃燒、低碳替代品的關注度不斷加大,推動了已開發經濟體和新興經濟體的快速採用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 272億美元 |

| 預測值 | 921億美元 |

| 複合年成長率 | 13% |

2024 年,糧食和飼料作物佔據 HVO 市場的 68.7%,預計到 2034 年將以 12.4% 的複合年成長率成長。糧食和飼料作物在 HVO 生產中的廣泛使用很大程度上是由於其豐富的供應、強大的供應鏈以及完善的農業框架的支持。大豆和油菜籽等作物對於高效生產 HVO 所需的油脂供應至關重要,可確保穩定的原料供應以滿足日益成長的生物燃料需求。儘管人們對糧食安全和土地使用的擔憂日益受到關注,但各地區的政策仍支持以農作物為基礎的生物燃料,進一步推動了市場成長。

市場也按等級細分,包括高級、標準級、基礎級和特種級。其中,標準級 HVO 市場在 2024 年創造了 106 億美元的收入,預計在 2025 年至 2034 年期間的複合年成長率將達到 12.7%。標準級因其成本、性能和多功能性的平衡而越來越受到青睞,使其成為運輸、工業營運和發電的理想選擇。與通常用於利基高性能領域的高階優質產品相比,它符合嚴格的排放標準,同時保持經濟可行性。

從地區來看,歐洲加氫植物油市場規模在 2024 年達到 103 億美元,預計到 2034 年將以 12.6% 的複合年成長率成長。在強力的監管支持和對再生燃料不斷成長的需求的推動下,歐洲繼續引領全球加氫植物油市場。歐盟的RED II指令和不斷增加的生物燃料混合要求極大地加速了HVO的整合,使歐洲處於全球向低碳能源轉型努力的前沿。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 供應商格局

- 利潤率分析

- 重要新聞和舉措

- 監管格局

- 衝擊力

- 成長動力

- HVO生產技術的進步

- 對再生能源的需求不斷成長

- 汽車產業需求不斷成長

- 產業陷阱與挑戰

- 生產成本高

- 來自其他再生燃料的競爭

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場規模及預測:依原料來源,2021 年至 2034 年

- 主要趨勢

- 糧食和飼料作物

- 大豆油

- 菜籽油

- 葵花籽油

- 棕櫚油

- 其他

- 動物脂肪

- 脂

- 豬油

- 廢棄食用油

- 棕櫚油廠廢水

- 其他

第6章:市場規模及預測:依等級,2021 年至 2034 年

- 主要趨勢

- 第 1 類:優質 HVO

- 第 2 類:標準級 HVO

- 第 3 類:基礎級 HVO

- 第 4 類:特種級 HVO

第7章:市場規模及預測:依技術分類,2021 年至 2034 年

- 主要趨勢

- 獨立加氫處理技術

- 協同處理技術

第 8 章:市場規模與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 永續航空燃料

- 汽車燃料

- 船用燃料

- 工業發電

- 加熱燃料

- 農業設備燃料

- 潤滑劑

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- ALFA LAVAL

- Cepsa

- Desmet

- DIAMOND GREEN DIESEL

- Neste

- Preem

- Repsol

- Shell

- TotalEnergies

- UPM Biofuels

- Valero Energy

- World Energy

The Global Hydrotreated Vegetable Oil Market reached USD 27.2 billion in 2024 and is projected to expand at a CAGR of 13% between 2025 and 2034. The growing shift toward renewable energy sources is rapidly elevating HVO's role as a sustainable fuel alternative across industries. As global economies pivot to reducing dependence on fossil fuels, HVO is emerging as a critical solution for meeting decarbonization goals. Its ability to serve as a drop-in replacement for traditional diesel, combined with cleaner combustion and lower greenhouse gas emissions, is pushing demand among major sectors, including transportation, aviation, and industrial power generation.

Several governments, particularly in North America and Europe, are stepping up mandates to cut carbon emissions with policy frameworks like tax credits, blending mandates, and emission caps that directly encourage the use of HVO. These policies are opening new growth opportunities for HVO producers and reinforcing their importance in the global shift toward greener energy. Increasing public and private investments in advanced biofuels and next-generation feedstocks are further enhancing the market outlook as companies explore innovative ways to scale HVO production while keeping costs competitive. As more industries seek to meet ESG (Environmental, Social, and Governance) goals, the focus on clean-burning, low-carbon alternatives like HVO continues to intensify, fueling rapid adoption across both developed and emerging economies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $27.2 Billion |

| Forecast Value | $92.1 Billion |

| CAGR | 13% |

In 2024, the food and feed crops segment dominated the HVO market with a 68.7% share and is anticipated to grow at a CAGR of 12.4% through 2034. The widespread use of food and feed crops in HVO production is largely driven by their abundant availability, robust supply chains, and the well-established agricultural framework supporting them. Crops like soybeans and rapeseed are pivotal in supplying the oils required for efficient HVO production, ensuring a steady feedstock supply to meet growing biofuel demand. While concerns around food security and land use are gaining attention, policies across regions still back crop-based biofuels, further propelling market growth.

The market is also segmented by grade, covering premium grade, standard grade, basic grade, and specialty grade. Among these, the standard grade HVO segment generated USD 10.6 billion in 2024 and is set to grow at a CAGR of 12.7% from 2025 to 2034. Standard grade is increasingly preferred due to its balance of cost, performance, and versatility, making it an ideal choice for transportation, industrial operations, and power generation. It meets stringent emission norms while remaining economically viable compared to higher-end premium grades that are typically used in niche, high-performance sectors.

Regionally, Europe's Hydrotreated Vegetable Oil Market reached USD 10.3 billion in 2024 and is projected to grow at a CAGR of 12.6% through 2034. Europe continues to lead the global HVO landscape, driven by powerful regulatory backing and escalating demand for renewable fuels. The European Union's RED II directive and rising biofuel blending mandates have greatly accelerated HVO integration, positioning Europe at the forefront of global efforts to transition to low-carbon energy.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Key news & initiatives

- 3.5 Regulatory landscape

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Advancements in HVO production technology

- 3.6.1.2 Growing demand for renewable energy sources

- 3.6.1.3 Increasing demand from the automotive sector

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 High production costs

- 3.6.2.2 Competition from other renewable fuels

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Size and Forecast, By Source of Feedstock, 2021 – 2034 (USD Billion, Kilo Tons)

- 5.1 Key trends

- 5.2 Food and feed crops

- 5.2.1 Soybean oil

- 5.2.2 Canola oil

- 5.2.3 Sunflower oil

- 5.2.4 Palm oil

- 5.2.5 Others

- 5.3 Animal fats

- 5.3.1 Tallow

- 5.3.2 Lard

- 5.4 Used cooking oils

- 5.5 Palm oil mill effluent

- 5.6 Others

Chapter 6 Market Size and Forecast, By Grade, 2021 – 2034 (USD Billion, Kilo Tons)

- 6.1 Key trends

- 6.2 Class 1: premium grade HVO

- 6.3 Class 2: standard grade HVO

- 6.4 Class 3: basic grade HVO

- 6.5 Class 4: specialty grade HVO

Chapter 7 Market Size and Forecast, By Technology, 2021 – 2034 (USD Billion, Kilo Tons)

- 7.1 Key trends

- 7.2 Standalone hydrotreating technology

- 7.3 Co-Processing technology

Chapter 8 Market Size and Forecast, By Application, 2021 – 2034 (USD Billion, Kilo Tons)

- 8.1 Key trends

- 8.2 Sustainable aviation fuel

- 8.3 Automotive fuel

- 8.4 Marine fuel

- 8.5 Industrial power generation

- 8.6 Heating fuel

- 8.7 Agricultural equipment fuel

- 8.8 Lubricants

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ALFA LAVAL

- 10.2 Cepsa

- 10.3 Desmet

- 10.4 DIAMOND GREEN DIESEL

- 10.5 Neste

- 10.6 Preem

- 10.7 Repsol

- 10.8 Shell

- 10.9 TotalEnergies

- 10.10 UPM Biofuels

- 10.11 Valero Energy

- 10.12 World Energy