|

市場調查報告書

商品編碼

1716720

電網規模固定電池儲存市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Grid Scale Stationary Battery Storage Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

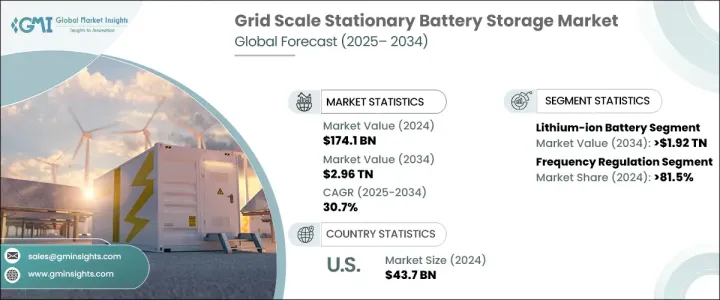

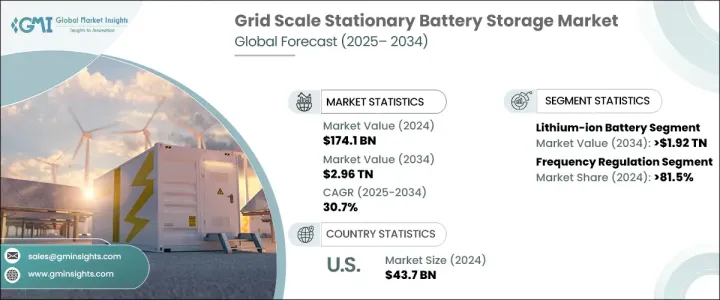

2024 年全球電網規模固定電池儲存市場價值為 1,741 億美元,預計 2025 年至 2034 年期間的複合年成長率為 30.7%。這種指數級成長是由太陽能和風能等再生能源的日益融合所推動的,這些能源需要可靠、高效的儲存解決方案來維持電網穩定並滿足波動的能源需求。隨著世界轉向更清潔的能源替代品,電網規模的電池儲存在確保穩定和持續的電力供應方面發揮關鍵作用。再生能源發電本質上是間歇性的,因此能源儲存系統對於在生產高峰期儲存多餘的能源並在需求高峰期釋放能源至關重要。全球各國政府和監管機構也在實施政策並提供激勵措施,鼓勵部署電網規模的電池儲存系統。

此外,先進電池技術成本的下降,加上能源儲存解決方案的創新,使得在不同市場大規模採用變得可行。對脫碳和實現淨零目標的日益重視進一步加強了對可擴展和高效能能源儲存解決方案的需求。能源密集型產業和公用事業擴大採用電池儲存來減少對化石燃料的依賴並最佳化電網營運,從而促進了市場令人印象深刻的成長軌跡。智慧電網技術和需求面管理策略的普及也加速了電網規模電池儲存系統的部署,為未來的成長提供了一個堅實的框架。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 1741億美元 |

| 預測值 | 2.96兆美元 |

| 複合年成長率 | 30.7% |

市場按電池類型細分為鈉硫電池、鋰離子電池、液流電池、鉛酸電池等。鋰離子電池引領這一領域,預計到 2034 年將創造 1.92 兆美元的市場價值。這些電池以其快速充電和放電能力而聞名,非常適合頻率調節、電網穩定和平衡再生能源等應用。電池化學技術的進步、熱管理系統的改進以及能量密度的提高顯著提高了鋰離子電池的壽命、安全性和效率。它們能夠提供快速的響應時間和更高的能量密度,使其成為大型電網儲存專案的首選。隨著鋰離子電池成本的持續下降,其在電網規模應用中的採用預計將呈指數級成長。

在應用方面,電網規模固定電池儲存市場包括頻率調節、黑啟動服務、能源轉移、容量延期、容量固定和其他服務。 2024 年,頻率調節領域佔據了令人印象深刻的 81.5% 的市場。一些地區正在實施市場激勵措施和框架,以鼓勵使用電池儲存系統進行頻率調節。在美國,儲能系統受到激勵,提供必要的電網服務,確保能源分配的穩定性和效率。這些激勵措施,加上對電網現代化計劃的投資不斷增加,正在推動電池儲存市場的快速擴張。

2024 年美國電網規模固定電池儲存市場價值為 437 億美元,投資稅收抵免 (ITC) 和生產稅收抵免 (PTC) 等優惠的聯邦政策刺激了對能源儲存基礎設施的大量投資。這些激勵措施使得電池儲存系統在經濟上更加可行,特別是在加州、德州和夏威夷州,這些州的電網現代化建設和再生能源整合是優先事項。州級授權進一步加強了電網規模電池儲存的採用,支持美國電網可靠性、再生能源採用和頻率調節

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略展望

- 創新與永續發展格局

第5章:市場規模及預測:按電池,2021 - 2034

- 主要趨勢

- 鋰離子

- 硫磺鈉

- 鉛酸

- 液流電池

- 其他

第6章:市場規模與預測:按應用,2021-2034 年

- 主要趨勢

- 頻率調節

- 駭啟動服務

- 能源轉移和產能延遲

- 產能鞏固

- 其他

第7章:市場規模及預測:依地區,2021-2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 法國

- 德國

- 義大利

- 俄羅斯

- 西班牙

- 亞太地區

- 中國

- 澳洲

- 印度

- 日本

- 韓國

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第8章:公司簡介

- BYD Company

- Contemporary Amperex Technology

- Exide Technologies

- GS Yuasa International

- Hitachi Energy

- HOPPECKE Batterien

- Johnson Controls

- LG Energy Solution

- Panasonic Corporation

- SAMSUNG SDI

- Siemens Energy

- SK Innovation

- Tesla

- Toshiba Corporation

The Global Grid Scale Stationary Battery Storage Market was valued at USD 174.1 billion in 2024 and is projected to grow at a CAGR of 30.7% between 2025 and 2034. This exponential growth is driven by the increasing integration of renewable energy sources like solar and wind, which require reliable and efficient storage solutions to maintain grid stability and meet fluctuating energy demands. As the world shifts toward cleaner energy alternatives, grid-scale battery storage plays a pivotal role in ensuring a stable and consistent power supply. Renewable energy generation is inherently intermittent, making energy storage systems essential to store excess energy during peak production and release it during periods of high demand. Governments and regulatory authorities across the globe are also implementing policies and providing incentives to encourage the deployment of grid-scale battery storage systems.

Additionally, the declining costs of advanced battery technologies, coupled with innovations in energy storage solutions, are making large-scale adoption feasible across diverse markets. The growing emphasis on decarbonization and achieving net-zero targets further strengthens the demand for scalable and efficient energy storage solutions. Energy-intensive industries and utilities are increasingly adopting battery storage to reduce dependency on fossil fuels and optimize grid operations, contributing to the market's impressive growth trajectory. The proliferation of smart grid technologies and demand-side management strategies is also accelerating the deployment of grid-scale battery storage systems, offering a robust framework for future growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $174.1 Billion |

| Forecast Value | $2.96 Trillion |

| CAGR | 30.7% |

The market is segmented by battery type into sodium-sulfur, lithium-ion, flow batteries, lead-acid, and others. Lithium-ion batteries lead this space and are expected to generate USD 1.92 trillion by 2034. These batteries, known for their fast charging and discharging capabilities, are ideal for applications such as frequency regulation, grid stabilization, and balancing renewable energy sources. Advances in battery chemistry, improved thermal management systems, and enhanced energy density have significantly increased the lifespan, safety, and efficiency of lithium-ion batteries. Their ability to provide rapid response times and higher energy density makes them a preferred choice for large-scale grid storage projects. As the cost of lithium-ion batteries continues to decline, their adoption in grid-scale applications is expected to rise exponentially.

In terms of application, the grid scale stationary battery storage market includes frequency regulation, black start services, energy shifting, capacity deferral, capacity firming, and other services. The frequency regulation segment held an impressive 81.5% market share in 2024. Several regions are implementing market incentives and frameworks to encourage the use of battery storage systems for frequency regulation. In the U.S., energy storage systems are incentivized to provide essential grid services, ensuring stability and efficiency in energy distribution. These incentives, coupled with increasing investments in grid modernization initiatives, are fueling the rapid expansion of the battery storage market.

The U.S. grid scale stationary battery storage market was valued at USD 43.7 billion in 2024, with favorable federal policies such as the Investment Tax Credit (ITC) and Production Tax Credit (PTC) stimulating substantial investments in energy storage infrastructure. These incentives have made battery storage systems more financially viable, especially in states like California, Texas, and Hawaii, where grid modernization efforts and renewable energy integration are priorities. State-level mandates further enhance the adoption of grid-scale battery storage, supporting grid reliability, renewable energy adoption, and frequency regulation across the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL Analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Strategic outlook

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Battery, 2021 - 2034, (MW & USD Million)

- 5.1 Key trends

- 5.2 Lithium-ion

- 5.3 Sodium sulphur

- 5.4 Lead acid

- 5.5 Flow battery

- 5.6 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034, (MW & USD Million)

- 6.1 Key trends

- 6.2 Frequency regulation

- 6.3 Black start services

- 6.4 Energy shifting & capacity deferral

- 6.5 Capacity firming

- 6.6 Others

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034, (MW & USD Million)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 UK

- 7.3.2 France

- 7.3.3 Germany

- 7.3.4 Italy

- 7.3.5 Russia

- 7.3.6 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Argentina

Chapter 8 Company Profiles

- 8.1 BYD Company

- 8.2 Contemporary Amperex Technology

- 8.3 Exide Technologies

- 8.4 GS Yuasa International

- 8.5 Hitachi Energy

- 8.6 HOPPECKE Batterien

- 8.7 Johnson Controls

- 8.8 LG Energy Solution

- 8.9 Panasonic Corporation

- 8.10 SAMSUNG SDI

- 8.11 Siemens Energy

- 8.12 SK Innovation

- 8.13 Tesla

- 8.14 Toshiba Corporation