|

市場調查報告書

商品編碼

1716716

陰道炎治療市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Vaginitis Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

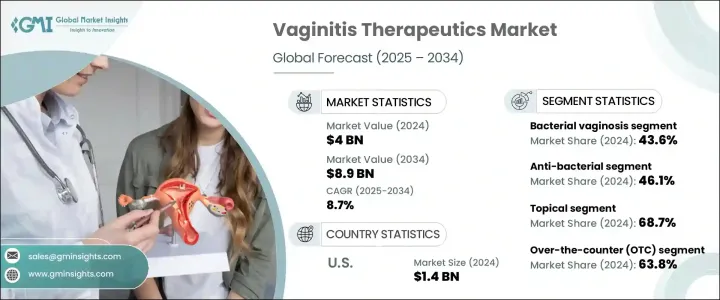

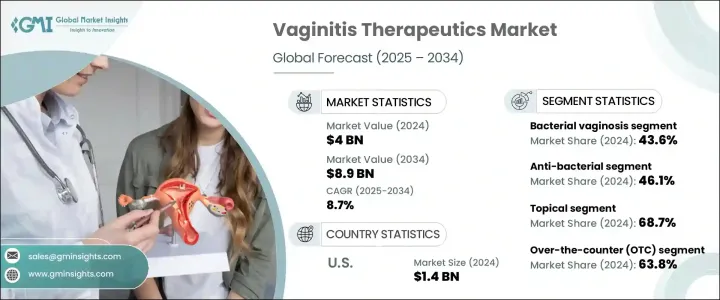

2024 年全球陰道炎治療市場規模達 40 億美元,預計 2025 年至 2034 年期間的複合年成長率為 8.7%。陰道感染的發病率上升,加上人們對女性健康的認知不斷提高以及可用治療方案的進步,顯著加速了市場成長。隨著全球越來越多的女性尋求及時治療陰道感染,對先進治療方案的需求持續增加。此外,人們對預防性醫療保健、定期婦科檢查和早期診斷的日益重視為治療創新創造了良好的環境。

醫療保健提供者和製藥公司也致力於推出解決復發性感染和提高患者依從性的新配方,例如控釋藥物和與益生菌的聯合療法。遠距醫療和電子藥局平台的擴展進一步使城市和農村地區的女性更容易獲得這些治療方法。隨著對細菌性陰道炎、念珠菌病和滴蟲病等常見陰道感染的了解不斷加深,人們對安全有效的藥物的需求也越來越大。非處方藥 (OTC) 和處方藥的日益普及在塑造陰道炎治療行業的整體格局方面發揮著關鍵作用。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 40億美元 |

| 預測值 | 89億美元 |

| 複合年成長率 | 8.7% |

市場依疾病類型分為細菌性陰道炎、念珠菌病、滴蟲病和其他類型的陰道炎。其中,細菌性陰道炎佔據全球主導地位,2024 年的市佔率為 43.6%。細菌性陰道炎復發率高,是育齡婦女最常見的感染之一,已成為治療需求的主要動力。患有復發性細菌性陰道炎的女性通常需要持續治療,這增加了對處方藥和非處方藥的需求。細菌性陰道炎率的不斷上升以及其慢性特徵促使人們對有效且長期的治療方案產生持續的需求,這使得細菌性陰道炎成為製藥商關注的焦點,他們致力於開發創新的解決方案,以最大程度地減少復發並改善患者的預後。

治療市場也依藥物類別分類,包括抗黴菌藥、抗菌藥、抗原蟲藥和其他藥物類型。抗菌療法佔最大佔有率,2024 年佔 46.1% 的市場。甲硝唑和克林黴素等抗生素因其已被證實的有效性和臨床成功率,仍被廣泛用於治療細菌性陰道炎。這些抗生素仍然是治療陰道炎的第一線選擇,推動了高處方率並促進了抗菌藥物領域的成長。對抗菌解決方案的強烈偏好反映了對能夠有效治療嚴重和復發性感染的標靶治療的需求。

2024 年,北美陰道炎治療市場規模達到 14 億美元,這得益於新型抗生素和抗真菌藥物的穩步獲批,尤其是那些與控釋膠囊和益生菌相結合以提高療效的藥物。該地區對能夠提供長期緩解並最大限度降低復發率的先進療法的需求正在激增。隨著製藥公司專注於創新藥物輸送機制,監管機構促進下一代療法的批准,北美將繼續佔據主導地位,預計僅在 2024 年就將創造 15 億美元的市場規模。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 陰道感染盛行率高

- 人們對女性健康和有效治療的認知不斷提高

- 藥物研發的進展

- 癌症病例增加

- 產業陷阱與挑戰

- 抗生素抗藥性日益增強

- 成長動力

- 成長潛力分析

- 監管格局

- 未來市場趨勢

- 差距分析

- 技術格局

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司矩陣分析

- 公司市佔率分析

- 競爭定位矩陣

- 供應商矩陣分析

- 策略儀表板

第5章:市場估計與預測:依疾病類型,2021 年至 2034 年

- 主要趨勢

- 細菌性陰道炎

- 念珠菌病

- 滴蟲病

- 其他疾病類型

第6章:市場估計與預測:依治療類型,2021 年至 2034 年

- 主要趨勢

- 抗菌

- 抗真菌

- 抗原蟲

- 其他治療類型

第7章:市場估計與預測:依管理路線,2021 年至 2034 年

- 主要趨勢

- 口服

- 外用

第8章:市場估計與預測:按模式,2021 年至 2034 年

- 主要趨勢

- 場外交易(OTC)

- 處方

第9章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 醫院藥房

- 零售藥局

- 網路藥局

第10章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 亞太地區

- 日本

- 中國

- 印度

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

第 11 章:公司簡介

- Astellas Pharma

- Bayer

- Cipla

- Dare Bioscience

- Dr. Reddy's Laboratories

- Lupin Pharmaceuticals

- Merck

- Novartis

- Pfizer

- Sanofi

- Sun Pharmaceuticals

- Takeda Pharmaceuticals

The Global Vaginitis Therapeutics Market reached USD 4 billion in 2024 and is projected to grow at a CAGR of 8.7% between 2025 and 2034. The rising incidence of vaginal infections, coupled with growing awareness about women's health and advancements in available treatment options, is significantly accelerating market growth. As more women worldwide seek timely medical care for vaginal infections, the demand for advanced therapeutic solutions continues to increase. Additionally, the growing focus on preventive healthcare, regular gynecological check-ups, and early diagnosis has created a favorable environment for therapeutic innovations.

Healthcare providers and pharmaceutical companies are also focusing on introducing novel formulations that address recurrent infections and enhance patient compliance, such as controlled-release drugs and combination therapies with probiotics. The expansion of telemedicine and e-pharmacy platforms is further making these therapeutics more accessible to women in both urban and rural areas. With a growing understanding of common vaginal infections such as bacterial vaginosis, candidiasis, and trichomoniasis, there is a heightened need for safe and effective medications. The increasing acceptance of over-the-counter (OTC) solutions and prescription medications is playing a pivotal role in shaping the overall landscape of the vaginitis therapeutics industry.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4 Billion |

| Forecast Value | $8.9 Billion |

| CAGR | 8.7% |

The market is segmented by disease type into bacterial vaginosis, candidiasis, trichomoniasis, and other types of vaginitis. Among these, bacterial vaginosis dominated the global landscape, accounting for a 43.6% market share in 2024. Known for its high recurrence rate and being one of the most common infections among women of reproductive age, bacterial vaginosis has become a major driver of therapeutic demand. Women suffering from recurring episodes of bacterial vaginosis often require ongoing treatment, boosting the need for both prescription-based and OTC medications. This increasing prevalence and the chronic nature of the condition are fueling continuous demand for effective and long-term therapeutic options, making bacterial vaginosis a key focus for pharmaceutical manufacturers aiming to develop innovative solutions that minimize recurrence and improve patient outcomes.

The therapeutics market is also categorized by drug class, including anti-fungal, anti-bacterial, anti-protozoal, and other drug types. Anti-bacterial therapeutics held the largest share, accounting for 46.1% of the market in 2024. Antibiotics such as metronidazole and clindamycin remain widely prescribed for bacterial vaginosis due to their proven effectiveness and clinical success. These antibiotics continue to be the first-line choice for treating vaginitis, driving high prescription rates and fueling the growth of the anti-bacterial segment. The strong preference for anti-bacterial solutions reflects the need for targeted therapies that can address severe and recurrent infections efficiently.

North America Vaginitis Therapeutics Market generated USD 1.4 billion in 2024, driven by the steady approval of new antibiotics and anti-fungals, especially those integrated with controlled-release capsules and probiotics for improved efficacy. The region is witnessing an upsurge in demand for advanced therapeutics that offer long-lasting relief and minimize recurrence rates. With pharmaceutical companies focusing on innovative drug delivery mechanisms and regulatory bodies facilitating the approval of next-gen therapeutics, North America is positioned to remain a dominant player, projected to generate USD 1.5 billion in 2024 alone.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 High prevalence of vaginal infections

- 3.2.1.2 Growing awareness about women's health and the availability of effective treatments

- 3.2.1.3 Advancements in drug development

- 3.2.1.4 Increasing cases of cancer

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Growing antibiotic resistance

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Future market trends

- 3.6 Gap analysis

- 3.7 Technology landscape

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive positioning matrix

- 4.5 Vendor matrix analysis

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Disease Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Bacterial vaginosis

- 5.3 Candidiasis

- 5.4 Trichomoniasis

- 5.5 Other disease type

Chapter 6 Market Estimates and Forecast, By Treatment Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Anti-bacterial

- 6.3 Anti-fungal

- 6.4 Anti-protozoal

- 6.5 Other treatment type

Chapter 7 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Oral

- 7.3 Topical

Chapter 8 Market Estimates and Forecast, By Mode, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Over-the-counter (OTC)

- 8.3 Prescription

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital pharmacy

- 9.3 Retail pharmacy

- 9.4 Online pharmacy

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 France

- 10.3.3 UK

- 10.3.4 Italy

- 10.3.5 Spain

- 10.4 Asia Pacific

- 10.4.1 Japan

- 10.4.2 China

- 10.4.3 India

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Argentina

- 10.5.3 Mexico

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Astellas Pharma

- 11.2 Bayer

- 11.3 Cipla

- 11.4 Dare Bioscience

- 11.5 Dr. Reddy’s Laboratories

- 11.6 Lupin Pharmaceuticals

- 11.7 Merck

- 11.8 Novartis

- 11.9 Pfizer

- 11.10 Sanofi

- 11.11 Sun Pharmaceuticals

- 11.12 Takeda Pharmaceuticals