|

市場調查報告書

商品編碼

1716713

自動百葉窗市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automated Window Blinds Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

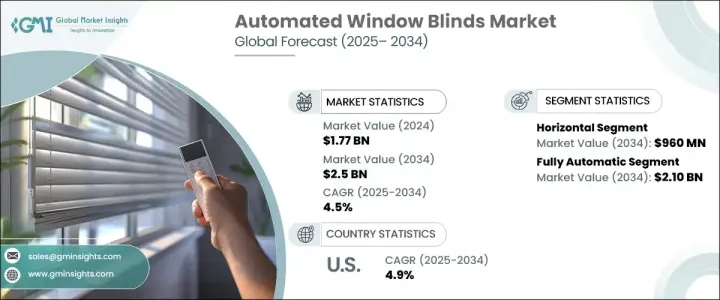

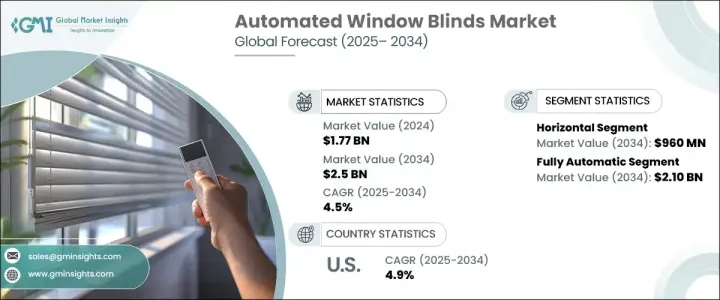

全球自動百葉窗市場規模在 2024 年將達到 17.7 億美元,預計在 2025 年至 2034 年期間的複合年成長率為 4.5%,這得益於全球範圍內智慧家居技術的日益普及。隨著消費者越來越重視生活空間的便利性、能源效率和增強的安全性,對自動百葉窗的需求正在激增。這些系統為屋主提供了靈活地控制自然光水平的便利,減少了對人工照明的依賴,並最佳化了氣候控制系統以最大限度地減少能源消耗。此外,自動百葉窗可以增強隱私並提供額外的安全保障,使其成為現代家庭越來越有吸引力的選擇。物聯網、語音助理和行動應用程式控制的整合等技術進步進一步增強了這些系統的功能和吸引力。人們日益關注永續生活和智慧家庭自動化,尤其是在城市地區,這對市場擴張做出了巨大貢獻。此外,政府推動節能住宅的舉措以及環保解決方案的日益普及正在鼓勵消費者投資智慧窗簾。

市場按產品類型細分,包括水平、垂直、羅馬、捲簾和其他,例如 PVC、斑馬和窗簾。 2024 年,水平自動百葉窗的收入為 6.1 億美元,因其多功能性和有效控制自然光的能力而成為最受歡迎的選擇。這些百葉窗特別適用於住宅和商業場所的大窗戶,它們既能營造精緻的美感,又能提高能源效率。北美和歐洲等地區的消費者尤其喜歡水平百葉窗,因為它設計時尚,功能強大,是現代室內空間的理想解決方案。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 17.7億美元 |

| 預測值 | 25億美元 |

| 複合年成長率 | 4.5% |

從操作上來說,市場分為全自動百葉窗和半自動百葉窗。全自動百葉窗在 2024 年佔據了市場主導地位,佔有 71.7% 的佔有率,因為它們透過預設感測器來適應不斷變化的光線條件、一天中的時間或室溫,從而提供更大的便利。這些百葉窗與智慧家居系統無縫整合,使屋主能夠保持理想的室內環境,同時顯著降低能源成本。隨著配備智慧技術的節能住宅數量的不斷增加,全自動百葉窗的需求預計將穩定成長。

受節能住宅開發激增和中產階級人口成長的推動,光是美國自動百葉窗市場在 2024 年就創造了 3.2 億美元的產值。城市地區對行動控制百葉窗的需求尤其強勁,精通科技的消費者渴望採用先進的家庭自動化解決方案。此外,在住宅和商業房地產中整合智慧窗簾的趨勢日益成長,進一步推動了美國市場的成長,使其成為自動窗簾最有利可圖的地區之一。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 影響價值鏈的因素

- 利潤率分析

- 中斷

- 未來展望

- 製造商

- 經銷商

- 零售商

- 衝擊力

- 成長動力

- 智慧家庭科技的普及率不斷提高

- 對節能解決方案的需求不斷成長

- 可支配所得增加

- 客製化傾向日益增強

- 產業陷阱與挑戰

- 初始成本高

- 隱私問題

- 成長動力

- 技術與創新格局

- 成長潛力分析

- 監管格局

- 定價分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依產品類型,2021 - 2034 年

- 主要趨勢

- 水平的

- 垂直的

- 羅馬

- 捲起

- 其他(PVC、斑馬、窗簾)

第6章:市場估計與預測:按營運,2021 - 2034 年

- 主要趨勢

- 全自動

- 半自動

第7章:市場估計與預測:依資料,2021 - 2034 年

- 主要趨勢

- 木製的

- 鋁

- PVC

- 其他(乙烯基、金屬)

第8章:市場估計與預測:按安裝量,2021 - 2034 年

- 主要趨勢

- 新的

- 改造

第9章:市場估計與預測:依最終用途,2021-2034

- 主要趨勢

- 家

- 辦公室

- 餐廳和飯店

- 醫院及療養院

第 10 章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 線上

- 公司網站

- 電子商務

- 離線

- 超市/大賣場

- 專賣店

- 獨立零售商

第 11 章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

第12章:公司簡介

- Hunter Douglas NV

- Legrand SA

- Lutron Electronics Co., Inc.

- MechoSystems, Inc.

- Nien Made Enterprise Co., Ltd.

- QMotion Incorporated

- Somfy SA

- Springs Window Fashions, LLC

- The Shade Store LLC

- Warema Renkhoff SE

The Global Automated Window Blinds Market, valued at USD 1.77 billion in 2024, is projected to grow at a CAGR of 4.5% between 2025 and 2034, driven by the increasing adoption of smart home technologies worldwide. As consumers continue to prioritize convenience, energy efficiency, and enhanced security in their living spaces, the demand for automated window blinds is surging. These systems offer homeowners the flexibility to control natural light levels effortlessly, reducing dependence on artificial lighting and optimizing climate control systems to minimize energy consumption. Additionally, automated window blinds enhance privacy and provide an added layer of security, making them an increasingly attractive choice for modern households. Technological advancements such as the integration of IoT, voice assistants, and mobile app controls are further enhancing the functionality and appeal of these systems. The rising focus on sustainable living and smart home automation, particularly in urban areas, is significantly contributing to the market's expansion. Furthermore, government initiatives promoting energy-efficient homes and the rising popularity of eco-friendly solutions are encouraging consumers to invest in smart window treatments.

The market is segmented by product type, including horizontal, vertical, roman, roll-up, and others, such as PVC, zebra, and curtain blinds. Horizontal automated blinds accounted for USD 610 million in revenue in 2024, emerging as the most preferred choice due to their versatility and ability to effectively control natural light. These blinds are especially popular for large windows in both residential and commercial settings, where they create a sophisticated aesthetic while improving energy efficiency. Consumers in regions such as North America and Europe are particularly drawn to horizontal blinds because of their stylish design and functional benefits, making them an ideal solution for modern interior spaces.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.77 Billion |

| Forecast Value | $2.5 Billion |

| CAGR | 4.5% |

In terms of operation, the market is divided into fully automatic and semi-automatic blinds. Fully automatic blinds dominated the market in 2024, holding a 71.7% share, as they offer enhanced convenience through preset sensors that adjust to changing light conditions, time of day, or room temperature. These blinds seamlessly integrate with smart home systems, allowing homeowners to maintain an ideal indoor environment while significantly lowering energy costs. As the number of energy-efficient homes equipped with smart technologies continues to rise, the demand for fully automatic blinds is expected to grow steadily.

The U.S. Automated Window Blinds Market alone generated USD 320 million in 2024, driven by a surge in energy-efficient home developments and a growing middle-class population. Urban areas are witnessing a particularly strong demand for mobile-controlled window blinds, where tech-savvy consumers are eager to incorporate advanced home automation solutions. Additionally, the increasing trend of integrating smart window treatments in residential and commercial properties is further fueling market growth in the U.S., making it one of the most lucrative regions for automated window blinds.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2018 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factors affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.1.7 Retailers

- 3.2 Impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing adoption of smart home technologies

- 3.2.1.2 Growing demand for energy-efficient solutions

- 3.2.1.3 Rising disposable income

- 3.2.1.4 Increasing inclination towards customization

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High initial cost

- 3.2.2.2 Privacy concerns

- 3.2.1 Growth drivers

- 3.3 Technology & innovation landscape

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Pricing analysis

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Billion) (Million Units)

- 5.1 Key trends

- 5.2 Horizontal

- 5.3 Vertical

- 5.4 Roman

- 5.5 Roll Up

- 5.6 Others (PVC, zebra, curtain)

Chapter 6 Market Estimates & Forecast, By Operation, 2021 - 2034, (USD Billion) (Million Units)

- 6.1 Key trends

- 6.2 Fully automatic

- 6.3 Semi-automatic

Chapter 7 Market Estimates & Forecast, By Material, 2021 - 2034, (USD Billion) (Million Units)

- 7.1 Key trends

- 7.2 Wooden

- 7.3 Aluminum

- 7.4 PVC

- 7.5 Others (vinyl, metal)

Chapter 8 Market Estimates & Forecast, By Installation, 2021 - 2034, (USD Billion) (Million Units)

- 8.1 Key trends

- 8.2 New

- 8.3 Retrofit

Chapter 9 Market Estimates & Forecast, By End Use, 2021- 2034, (USD Billion) (Million Units)

- 9.1 Key trends

- 9.2 Home

- 9.3 Office

- 9.4 Restaurants and hotels

- 9.5 Hospitals & nursing homes

Chapter 10 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Million Units)

- 10.1 Key trends

- 10.2 Online

- 10.2.1 Company website

- 10.2.2 E-commerce

- 10.3 Offline

- 10.3.1 Supermarket/hypermarket

- 10.3.2 Specialty stores

- 10.3.3 Independent retailer

Chapter 11 Market Estimates & Forecast, By Region, 2021- 2034, (USD Billion) (Million Units)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Italy

- 11.3.5 Spain

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 South Korea

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.6 MEA

- 11.6.1 Saudi Arabia

- 11.6.2 UAE

- 11.6.3 South Africa

Chapter 12 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 12.1 Hunter Douglas N.V.

- 12.2 Legrand SA

- 12.3 Lutron Electronics Co., Inc.

- 12.4 MechoSystems, Inc.

- 12.5 Nien Made Enterprise Co., Ltd.

- 12.6 QMotion Incorporated

- 12.7 Somfy SA

- 12.8 Springs Window Fashions, LLC

- 12.9 The Shade Store LLC

- 12.10 Warema Renkhoff SE