|

市場調查報告書

商品編碼

1716697

電子燃料市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測E-Fuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

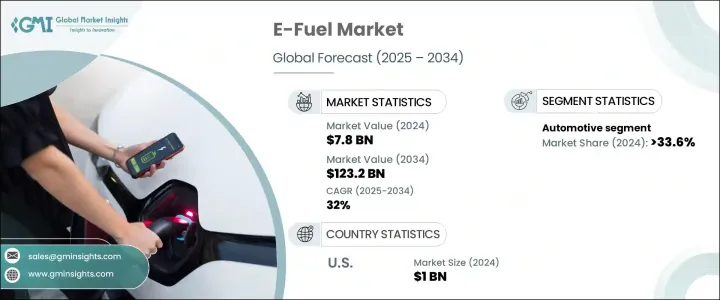

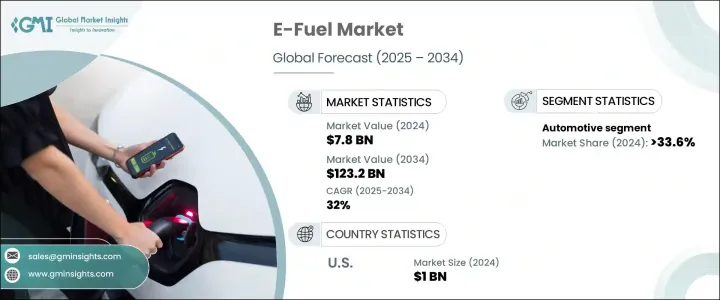

2024 年全球電子燃料市場價值為 78 億美元,預計 2025 年至 2034 年期間複合年成長率將達到 32%。這一成長主要歸因於再生能源技術的進步、環保意識的增強以及更嚴格的碳排放法規。電子燃料正在成為一種有前途的解決方案,可以克服氫燃料電池和電池電動車(BEV)的局限性,並提供可行的能源儲存選擇。世界各國政府紛紛推出優惠政策和獎勵措施,鼓勵發展電子燃料,進而推動相關基礎建設的投資。

人們對環境問題的關注度不斷上升,尤其是航空、航運和重型運輸等產業的溫室氣體排放問題,刺激了對替代能源解決方案的需求。這些行業很難脫碳,因此電子燃料成為一個引人注目的選擇。政府法規和激勵措施在促進電子燃料的採用方面發揮著至關重要的作用,許多地區都建立了將再生燃料納入其能源系統的框架。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 78億美元 |

| 預測值 | 1232億美元 |

| 複合年成長率 | 32% |

電子燃料生產過程中的技術進步和創新也促進了市場的成長。電解和碳捕獲方法的改進有助於降低生產成本並提高電子燃料的經濟可行性。將風能和太陽能等再生能源融入電子燃料生產,可以減少碳足跡和營運費用,進一步支持產業擴張。

電子燃料市場根據產品類型進行細分,包括電子汽油、電子柴油、電子煤油、電子甲醇和乙醇。其中,電子汽油越來越受歡迎,尤其是在汽車領域,作為現有內燃機 (ICE) 汽車的替代燃料。這種成長是由人們希望在不改變現有基礎設施的情況下實現汽車產業脫碳的願望所推動的。

根據應用,市場主要分為汽車、船舶、航空和工業領域,其中汽車領域在 2024 年佔據超過 33.6% 的市場。汽車電子燃料領域正在成長,成為減少 ICE 汽車排放的關鍵策略,特別是在基礎設施或成本障礙阻礙電動車 (EV) 廣泛採用的地區。電子汽油和電子柴油等電子燃料提供了實用的解決方案,使現有的加油站和車輛引擎能夠繼續不間斷地運作。

在美國,電子燃料市場經歷了快速成長,價值從 2022 年的 7 億美元成長到 2024 年的 10 億美元。這一成長主要受到《通貨膨脹削減法案》等舉措的推動,該法案為永續能源技術提供了激勵措施。此外,各公司之間在全國各地的工廠合作生產電子燃料也促進了這一成長,重點是為運輸車隊提供動力並減少對傳統燃料來源的依賴。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 監管格局

- 產業衝擊力

- 成長動力

- 產業陷阱與挑戰

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 戰略儀表板

- 創新與永續發展格局

第5章:市場規模及預測:按再生能源,2021 - 2034 年

- 主要趨勢

- 現場太陽能

- 風

第6章:市場規模及預測:依技術分類,2021 - 2034 年

- 主要趨勢

- 費托合成

- 增強型多普勒雷達系統

- 其他

第7章:市場規模及預測:依產品,2021 - 2034

- 主要趨勢

- 電子汽油

- 電動柴油

- 電子煤油

- 乙醇

- 電子甲醇

- 其他

第 8 章:市場規模與預測:按應用,2021 - 2034 年

- 主要趨勢

- 汽車

- 海洋

- 航空

- 工業的

- 其他

第9章:市場規模及預測:按地區,2021 - 2034

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 荷蘭

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第10章:公司簡介

- Arcadia eFuels

- Archer Daniels Midland

- Ballard Power Systems

- Ceres Power Holding

- Clean Fuels Alliance America

- Climeworks

- Electrochaea

- eFuel Pacific

- ExxonMobil

- FuelCell Energy

- HIF Global

- Infra Synthetic Fuels

- LanzaJet

- Liquid Wind

- MAN Energy Solutions

- Norsk e-Fuel

- Porsche

- Sunfire

The Global E-Fuel Market was valued at USD 7.8 billion in 2024 and is projected to grow at a remarkable CAGR of 32% from 2025 to 2034. This growth can largely be attributed to advancements in renewable energy technologies, increasing environmental awareness, and stricter carbon emission regulations. E-fuels are emerging as a promising solution to overcome the limitations of hydrogen fuel cells and battery electric vehicles (BEVs), offering a viable energy storage option. Governments worldwide are introducing favorable policies and incentives that encourage the development of e-fuels, which is driving investments in related infrastructure.

The rise in environmental concerns, particularly about greenhouse gas emissions from industries like aviation, shipping, and heavy transport, is spurring the demand for alternative energy solutions. These sectors are difficult to decarbonize, making e-fuels a compelling choice. Government regulations and incentives play a crucial role in facilitating e-fuel adoption, with many regions establishing frameworks for integrating renewable fuels into their energy systems.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.8 Billion |

| Forecast Value | $123.2 Billion |

| CAGR | 32% |

Technological advancements and innovations in the e-fuel production process are also contributing to market growth. Improved methods for electrolysis and carbon capture are helping lower production costs and increase the economic viability of e-fuels. The integration of renewable energy sources, such as wind and solar power, into e-fuel production is reducing the carbon footprint and operational expenses, further supporting industry expansion.

The e-fuel market is segmented based on product type, with categories including e-gasoline, e-diesel, e-kerosene, e-methanol, and ethanol. Among these, e-gasoline is gaining popularity, particularly in the automotive sector, as a drop-in fuel for existing internal combustion engine (ICE) vehicles. This growth is driven by the desire to decarbonize the automobile industry without requiring significant changes to the current infrastructure.

By application, the market is primarily divided into automotive, marine, aviation, and industrial sectors, with the automotive sector accounting for over 33.6% of the market share in 2024. The automotive e-fuel segment is growing as a key strategy to reduce emissions from ICE vehicles, especially in regions where the infrastructure or cost barriers hinder the widespread adoption of electric vehicles (EVs). E-fuels like e-gasoline and e-diesel provide a practical solution, enabling existing fuel stations and vehicle engines to continue operating without disruption.

In the U.S., the e-fuel market has seen rapid growth, with values increasing from USD 0.7 billion in 2022 to USD 1 billion in 2024. This growth is largely fueled by initiatives like the Inflation Reduction Act, which provides incentives for sustainable energy technologies. Additionally, partnerships between companies to produce e-fuel in facilities across the country are contributing to this growth, with a focus on powering delivery fleets and reducing reliance on traditional fuel sources.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Renewable Source, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 On-site solar

- 5.3 Wind

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Fischer-tropsch

- 6.3 eRWGS

- 6.4 Others

Chapter 7 Market Size and Forecast, By Product, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 E-Gasoline

- 7.3 E-Diesel

- 7.4 E-Kerosene

- 7.5 Ethanol

- 7.6 E-Methanol

- 7.7 Others

Chapter 8 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Marine

- 8.4 Aviation

- 8.5 Industrial

- 8.6 Others

Chapter 9 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Netherlands

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Middle East & Africa

- 9.5.1 Saudi Arabia

- 9.5.2 UAE

- 9.5.3 South Africa

- 9.6 Latin America

- 9.6.1 Brazil

- 9.6.2 Argentina

Chapter 10 Company Profiles

- 10.1 Arcadia eFuels

- 10.2 Archer Daniels Midland

- 10.3 Ballard Power Systems

- 10.4 Ceres Power Holding

- 10.5 Clean Fuels Alliance America

- 10.6 Climeworks

- 10.7 Electrochaea

- 10.8 eFuel Pacific

- 10.9 ExxonMobil

- 10.10 FuelCell Energy

- 10.11 HIF Global

- 10.12 Infra Synthetic Fuels

- 10.13 LanzaJet

- 10.14 Liquid Wind

- 10.15 MAN Energy Solutions

- 10.16 Norsk e-Fuel

- 10.17 Porsche

- 10.18 Sunfire