|

市場調查報告書

商品編碼

1716689

槍枝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Firearms Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

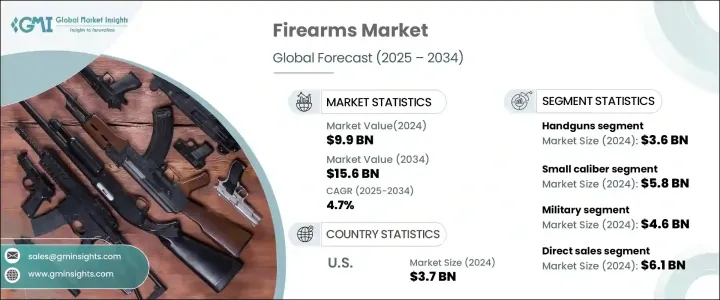

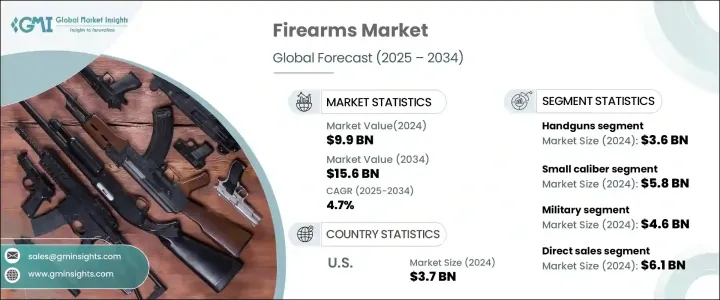

2024 年全球槍械市場價值為 99 億美元,預計 2025 年至 2034 年的複合年成長率為 4.7%。武器生產和出口的成長繼續推動整個產業的需求。由於世界各國政府為國家安全而向先進武器分配了更多的預算,軍事開支的增加對市場成長做出了重大貢獻。這一趨勢為製造商提供了豐厚的機會,使他們能夠專注於生產符合現代防禦要求的先進、高精度槍支。滿足日益成長的民用需求並採用創新技術也可以加強市場,確保未來十年的穩定成長。

槍械是一種機械裝置或攜帶式槍管武器,旨在利用燃燒推進劑產生的氣體膨脹提供動力,以高速發射子彈。市場涵蓋各種各樣的武器,包括手槍、步槍、獵槍、機關槍和衝鋒槍。 2024 年,手槍市場價值為 36 億美元。人們對緊湊型、大容量和可隱藏的手槍的偏好日益成長,導致執法機構擴大採用這種手槍,他們不斷升級現有槍支,採用改進的人體工學和更輕的材料,以提高作戰效率。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 99億美元 |

| 預測值 | 156億美元 |

| 複合年成長率 | 4.7% |

槍枝市場按口徑細分,包括小口徑、中口徑和大口徑槍枝以及霰彈槍口徑。 2024 年小口徑槍佔市場主導地位,估值達 58 億美元。對於用於特定目的的緊湊型高速槍械的需求日益成長,推動了這一領域的需求。小口徑武器因其輕量化設計和更高的精度而被廣泛用於訓練、休閒射擊和軍事應用。執法現代化和軍事進步進一步刺激了這一領域的需求,使小口徑槍支成為全球市場的主導類別。

按最終用戶分類,槍支市場服務於軍隊、執法機構、平民、私人保全公司以及射擊場和俱樂部。 2024 年,軍事部分的價值為 46 億美元。全球致力於透過下一代槍械增強軍事實力,推動了該領域的大幅成長。各國防組織大量訂購槍支顯示了對武器庫進行現代化改造的決心,從而進一步推動了市場擴張。執法機構也不斷增加對升級槍枝的投資,以提高應對能力並確保公共安全。

市場也根據分銷管道進行分類,包括直接銷售和間接銷售。直銷,即製造商透過授權平台直接與客戶互動,佔據了市場主導地位,2024 年的估值為 61 億美元。合法的 D2C 平台允許製造商繞過中間商,提供簡化的採購流程。美國仍然是一個關鍵市場,受平民和安全機構對槍支的強勁需求推動,到 2024 年價值將達到 37 億美元。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 軍事和執法部門對現代化的需求

- 全球武器出口和製造不斷增加

- 狩獵和射擊運動的發展

- 智慧和人工智慧槍械的技術進步

- 地緣政治緊張局勢導致軍事預算增加

- 產業陷阱與挑戰

- 嚴格的槍支法律和監管限制

- 非法武器貿易及走私

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按類型,2021 年至 2034 年

- 主要趨勢

- 手槍

- 手槍

- 左輪手槍

- 步槍

- 半自動步槍

- 栓動步槍

- 突擊步槍

- 狙擊步槍

- 霰彈槍

- 泵動式霰彈槍

- 半自動霰彈槍

- 雙管獵槍

- 單發霰彈槍

- 機關槍

- 衝鋒槍

- 其他

第6章:市場估計與預測:依口徑,2021 年至 2034 年

- 主要趨勢

- 小口徑

- 中口徑

- 大口徑

- 獵槍口徑

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 軍隊

- 執法機構

- 平民

- 私人保全公司

- 射擊場和俱樂部

第8章:市場估計與預測:按配銷通路,2021 年至 2034 年

- 主要趨勢

- 直銷(製造商對消費者)

- 間接銷售(經銷商對消費者)

第9章:市場估計與預測:按地區,2021 年至 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Barrett Headquarters

- Colt CZ Group SE

- FN HERSTAL

- Glock Inc.

- Heckler & Koch

- Kalashnikov Concern JSC

- MOSSBERG & SONS, INC.

- Pietro Beretta Arms Factory SpA

- PTR Industries Inc.

- RemArms LLC.

- Ruger & Co., Inc.

- SIG SAUER

- Smith & Wesson

- Taurus International Manufacturing, Inc.

The Global Firearms Market was valued at USD 9.9 billion in 2024 and is projected to grow at a CAGR of 4.7% from 2025 to 2034. The rising production and export of weapons continue to drive demand across the industry. Increased military spending contributes significantly to market growth, as governments around the world allocate higher budgets toward advanced weapons for national security. This trend presents lucrative opportunities for manufacturers to focus on producing advanced and high-precision firearms that align with modern defense requirements. Catering to the growing civilian demand and adopting innovative technologies can also strengthen the market, ensuring steady growth over the next decade.

Firearms are mechanical devices or portable barreled weapons designed to launch bullets at high velocity, powered by the expansion of gases from burning propellants. The market encompasses a diverse range of weapons, including handguns, rifles, shotguns, machine guns, and submachine guns. In 2024, the handguns market was valued at USD 3.6 billion. The rising preference for compact, high-capacity, and concealable handguns has led to increasing adoption by law enforcement agencies, which continue to upgrade their existing firearms with improved ergonomics and lighter materials to enhance operational efficiency.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.9 Billion |

| Forecast Value | $15.6 Billion |

| CAGR | 4.7% |

The firearms market is segmented by caliber, with categories including small, medium, and large caliber firearms, along with shotgun gauges. Small caliber firearms led the market in 2024 with a valuation of USD 5.8 billion. The growing need for compact, high-velocity firearms for specific purposes is driving demand in this segment. Small caliber weapons are widely used for training, recreational shooting, and military applications due to their lightweight design and improved accuracy. Law enforcement modernization and military advancements have further fueled demand in this segment, making small caliber firearms a dominant category in the global market.

By end user, the firearms market serves military forces, law enforcement agencies, civilians, private security firms, and shooting ranges and clubs. In 2024, the military segment was valued at USD 4.6 billion. The global focus on enhancing military strength through next-generation firearms has contributed to substantial growth in this segment. Bulk orders of firearms by various defense organizations indicate a commitment to modernizing arsenals, further boosting market expansion. Law enforcement agencies are also increasingly investing in upgraded firearms to improve response capabilities and ensure public safety.

The market is also classified by distribution channels, including direct and indirect sales. Direct sales, where manufacturers directly engage with customers through authorized platforms, dominated the market with a valuation of USD 6.1 billion in 2024. Legal D2C platforms allow manufacturers to bypass intermediaries, offering a streamlined purchasing process. The U.S. remains a key market, valued at USD 3.7 billion in 2024, driven by strong demand for firearms among civilians and security agencies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Military and law enforcement demand for modernization

- 3.2.1.2 Increasing export and manufacturing of the weapons across the globe

- 3.2.1.3 Growth of hunting & shooting sports

- 3.2.1.4 Technological advancements in smart & ai-integrated firearms

- 3.2.1.5 Rising military budget amid geopolitical tensions

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent gun laws & regulatory restrictions

- 3.2.2.2 Illegal arms trade & smuggling

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn & Units)

- 5.1 Key trends

- 5.2 Handguns

- 5.2.1 Pistols

- 5.2.2 Revolvers

- 5.3 Rifles

- 5.3.1 Semi-automatic rifles

- 5.3.2 Bolt-action rifles

- 5.3.3 Assault rifles

- 5.3.4 Sniper rifles

- 5.4 Shotguns

- 5.4.1 Pump-action shotguns

- 5.4.2 Semi-automatic shotguns

- 5.4.3 Double-barrel shotguns

- 5.4.4 Single-shot shotguns

- 5.5 Machine guns

- 5.6 Submachine guns

- 5.7 Others

Chapter 6 Market Estimates and Forecast, By Caliber, 2021 – 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 Small caliber

- 6.3 Medium caliber

- 6.4 Large caliber

- 6.5 Shotgun gauges

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn & Units)

- 7.1 Key trends

- 7.2 Military

- 7.3 Law enforcement agencies

- 7.4 Civilians

- 7.5 Private security firms

- 7.6 Shooting ranges and clubs

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 Direct sales (manufacturer to consumer)

- 8.3 Indirect sales (distributors to consumers)

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Barrett Headquarters

- 10.2 Colt CZ Group SE

- 10.3 FN HERSTAL

- 10.4 Glock Inc.

- 10.5 Heckler & Koch

- 10.6 Kalashnikov Concern JSC

- 10.7 MOSSBERG & SONS, INC.

- 10.8 Pietro Beretta Arms Factory SpA

- 10.9 PTR Industries Inc.

- 10.10 RemArms LLC.

- 10.11 Ruger & Co., Inc.

- 10.12 SIG SAUER

- 10.13 Smith & Wesson

- 10.14 Taurus International Manufacturing, Inc.