|

市場調查報告書

商品編碼

1716678

邊緣人工智慧市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Edge AI Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

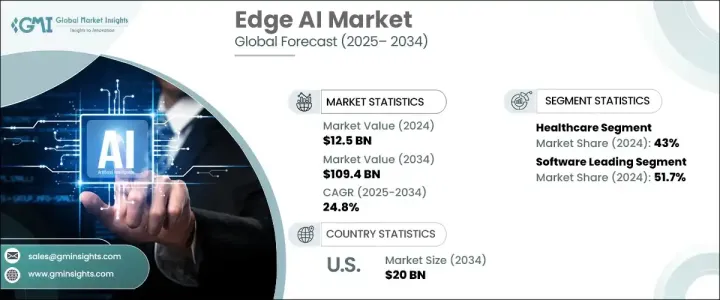

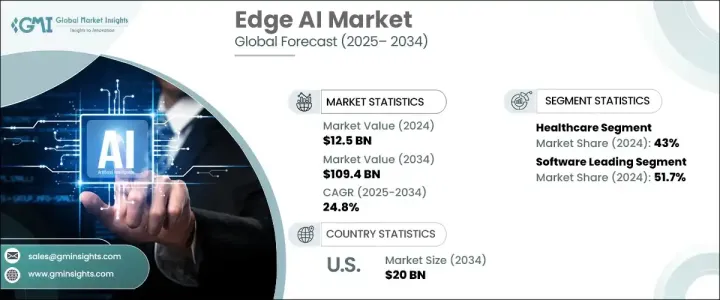

全球邊緣人工智慧市場在 2024 年的價值為 125 億美元,預計在 2025 年至 2034 年期間將以 24.8% 的強勁複合年成長率擴張,這得益於對智慧、分散式運算解決方案的需求的快速成長。隨著各行各業不斷擁抱數位轉型,邊緣人工智慧正在成為一種改變遊戲規則的技術,它使企業能夠直接在源頭處理和分析資料,從而減少延遲、提高安全性並最大限度地減少對雲端基礎設施的依賴。物聯網設備日益普及,加上對 5G 和人工智慧晶片組的投資不斷增加,進一步推動了醫療保健、製造、零售、汽車和電信等關鍵領域對邊緣人工智慧的採用。

企業正在優先考慮能夠實現即時決策和自動化的解決方案,尤其是在產業轉向工業 4.0 和人工智慧驅動的生態系統的情況下。邊緣 AI 解決方案在實現更快洞察、減少營運瓶頸和提供個人化體驗方面發揮著至關重要的作用。對高效、安全地處理邊緣設備產生的海量資料的需求日益成長,這也促使企業大力投資可在設備上運行而無需依賴持續雲連接的人工智慧演算法。此外,人工智慧處理器和專用邊緣人工智慧硬體的進步使得這些解決方案對於各種規模的企業來說更易於存取、更具成本效益且更具可擴展性。隨著資料隱私問題日益嚴重,越來越多的組織開始轉向邊緣人工智慧來確保資料的安全處理和法規遵循,進一步增強了市場的成長。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 125億美元 |

| 預測值 | 1094億美元 |

| 複合年成長率 | 24.8% |

邊緣人工智慧市場涵蓋多個終端產業,包括醫療保健、製造業、銀行和金融服務、政府、零售、電信、運輸和物流。其中,醫療保健在 2024 年佔據全球市場主導地位,佔有 43% 的佔有率,因為邊緣人工智慧將繼續徹底改變病患照護。醫療保健提供者正在使用人工智慧穿戴裝置、遠端監控系統和先進的診斷工具來實現即時患者追蹤、自動醫學影像分析和更快的臨床決策。這些創新不僅改善了患者的治療效果,還簡化了操作並降低了醫療成本。

根據組件,市場細分為軟體、硬體和服務,其中軟體佔 2024 年總市場佔有率的 51.7%。軟體解決方案日益突出,這歸因於它們在部署人工智慧模型、促進即時分析和確保邊緣資料安全方面發揮的關鍵作用。人工智慧軟體框架對於使邊緣設備能夠獨立處理和分析資料、支援人工智慧模型更新以及在不依賴雲端的情況下最佳化系統性能至關重要,可以滿足對即時智慧洞察日益成長的需求。

預計到 2034 年,美國邊緣人工智慧市場規模將達到 200 億美元,這得益於美國在醫療保健、智慧城市和工業自動化領域廣泛採用人工智慧。領先的科技巨頭和半導體公司大力開發人工智慧晶片和邊緣平台,再加上政府推動人工智慧創新和基礎設施現代化的舉措,正在加速成長。 5G、物聯網和雲端邊緣整合的快速發展繼續塑造美國邊緣人工智慧部署的動態生態系統

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 硬體提供者

- 軟體供應商

- 雲端服務供應商

- 託管服務提供者

- 最終用途

- 供應商格局

- 利潤率分析

- 技術與創新格局

- 專利分析

- 重要新聞和舉措

- 案例研究

- 監管格局

- 衝擊力

- 成長動力

- 邊緣設備在各個終端應用領域的採用率不斷提高

- 人工智慧技術投資不斷增加

- 5G網路的普及率不斷提高

- 雲端運算技術的採用激增

- 產業陷阱與挑戰

- 隱私和安全問題

- 互通性問題

- 成長動力

- 成長潛力分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 競爭定位矩陣

- 戰略展望矩陣

第5章:市場估計與預測:依組件,2021 年至 2034 年

- 主要趨勢

- 硬體

- 圖形處理單元 (GPU)

- 專用積體電路(ASIC),

- 中央處理器(CPU)

- 現場可程式閘陣列(FPGA)

- 軟體

- 服務

- 培訓與諮詢

- 支援與維護

- 系統整合與測試

第6章:市場估計與預測:按應用,2021 年至 2034 年

- 主要趨勢

- 視訊監控

- 遠端監控

- 預測性維護

- 其他

第7章:市場估計與預測:依最終用途,2021 年至 2034 年

- 主要趨勢

- 製造業

- 衛生保健

- 英國標準與製造工業聯合會

- 政府

- 零售與電子商務

- 電信

- 運輸與物流

- 其他

第8章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 東南亞

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第9章:公司簡介

- Anagog

- Amazon

- ADLINK

- Clearblade

- Cloudera

- Dell

- Gorilla Technology

- Huawei

- IBM

- Intel

- Microsoft

- MediaTek

- Mavenir System

- Nutanix

- Nvidia

- Synaptics

- Qualcomm

- Veea

- Xilinx

The Global Edge AI Market, valued at USD 12.5 billion in 2024, is projected to expand at a robust CAGR of 24.8% from 2025 to 2034, driven by the rapid surge in demand for intelligent, decentralized computing solutions. As industries continue to embrace digital transformation, edge AI is emerging as a game-changing technology that enables businesses to process and analyze data directly at the source - reducing latency, improving security, and minimizing dependency on cloud infrastructures. The increasing penetration of IoT devices, coupled with growing investments in 5G and AI chipsets, is further fueling the adoption of edge AI across critical sectors, including healthcare, manufacturing, retail, automotive, and telecommunications.

Companies are prioritizing solutions that empower real-time decision-making and automation, particularly as industries shift toward Industry 4.0 and AI-driven ecosystems. Edge AI solutions are playing a crucial role in enabling faster insights, reducing operational bottlenecks, and delivering personalized experiences. The growing need to handle massive amounts of data generated by edge devices efficiently and securely has also prompted enterprises to invest heavily in AI algorithms that can run on-device without relying on continuous cloud connectivity. Moreover, advancements in AI processors and dedicated edge AI hardware are making these solutions more accessible, cost-effective, and scalable for businesses of all sizes. As data privacy concerns escalate, organizations are increasingly turning to edge AI for secure data handling and regulatory compliance, further strengthening market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $12.5 Billion |

| Forecast Value | $109.4 Billion |

| CAGR | 24.8% |

The edge AI market spans several end-use industries, including healthcare, manufacturing, banking and financial services, government, retail, telecommunications, transportation, and logistics. Among these, healthcare dominated the global market with a 43% share in 2024, as AI at the edge continues to revolutionize patient care. Healthcare providers are using AI-powered wearables, remote monitoring systems, and advanced diagnostics tools to enable real-time patient tracking, automated medical image analysis, and faster clinical decision-making. These innovations not only improve patient outcomes but also streamline operations and reduce healthcare costs.

Based on components, the market is segmented into software, hardware, and services, with software accounting for 51.7% of the total market share in 2024. The rising prominence of software solutions is attributed to their critical role in deploying AI models, facilitating real-time analytics, and ensuring data security at the edge. AI software frameworks are essential for enabling edge devices to process and analyze data independently, support AI model updates, and optimize system performance without cloud reliance, addressing the growing need for instant, intelligent insights.

The U.S. edge AI market is anticipated to reach USD 20 billion by 2034, backed by the country's widespread adoption of AI across healthcare, smart cities, and industrial automation. The strong presence of leading tech giants and semiconductor companies developing AI chips and edge platforms, coupled with government initiatives promoting AI innovation and infrastructure modernization, is accelerating growth. Rapid advancements in 5G, IoT, and cloud-edge integration continue to shape a dynamic ecosystem for edge AI deployment in the U.S.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Hardware providers

- 3.1.2 Software providers

- 3.1.3 Cloud service providers

- 3.1.4 Managed service provider

- 3.1.5 End use

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Patent analysis

- 3.6 Key news & initiatives

- 3.7 Case studies

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Increasing adoption of edge devices across various end use verticals

- 3.9.1.2 Growing investment in AI technology

- 3.9.1.3 Growing adoption of 5G network

- 3.9.1.4 Surging adoption of cloud computing technology

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 Privacy and security concerns

- 3.9.2.2 Interoperability issues

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 – 2034 (USD Million)

- 5.1 Key trends

- 5.2 Hardware

- 5.2.1 Graphics Processing Unit (GPU)

- 5.2.2 Application Specific Integrated Circuit (ASIC),

- 5.2.3 Central Processing Unit (CPU)

- 5.2.4 Field-Programmable Gate Array (FPGA)

- 5.3 Software

- 5.4 Service

- 5.4.1 Training & consulting

- 5.4.2 Support & maintenance

- 5.4.3 System integration and testing

Chapter 6 Market Estimates & Forecast, By Application, 2021 – 2034 (USD Million)

- 6.1 Key trends

- 6.2 Video surveillance

- 6.3 Remote monitoring

- 6.4 Predictive maintenance

- 6.5 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021 – 2034 (USD Million)

- 7.1 Key trends

- 7.2 Manufacturing

- 7.3 Healthcare

- 7.4 BSFI

- 7.5 Government

- 7.6 Retail & e-commerce

- 7.7 Telecommunication

- 7.8 Transport & logistics

- 7.9 Others

Chapter 8 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.3.7 Nordics

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Southeast Asia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 MEA

- 8.6.1 UAE

- 8.6.2 South Africa

- 8.6.3 Saudi Arabia

Chapter 9 Company Profiles

- 9.1 Anagog

- 9.2 Amazon

- 9.3 ADLINK

- 9.4 Clearblade

- 9.5 Cloudera

- 9.6 Dell

- 9.7 Google

- 9.8 Gorilla Technology

- 9.9 Huawei

- 9.10 IBM

- 9.11 Intel

- 9.12 Microsoft

- 9.13 MediaTek

- 9.14 Mavenir System

- 9.15 Nutanix

- 9.16 Nvidia

- 9.17 Synaptics

- 9.18 Qualcomm

- 9.19 Veea

- 9.20 Xilinx